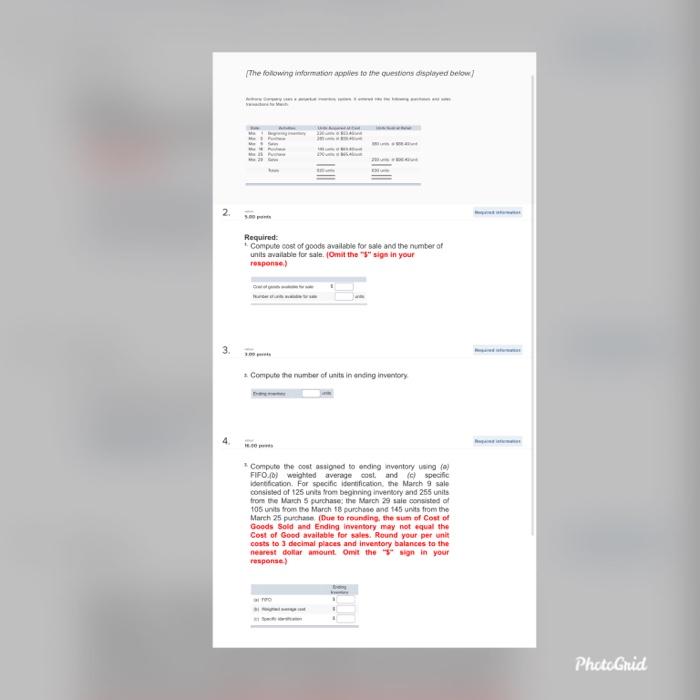

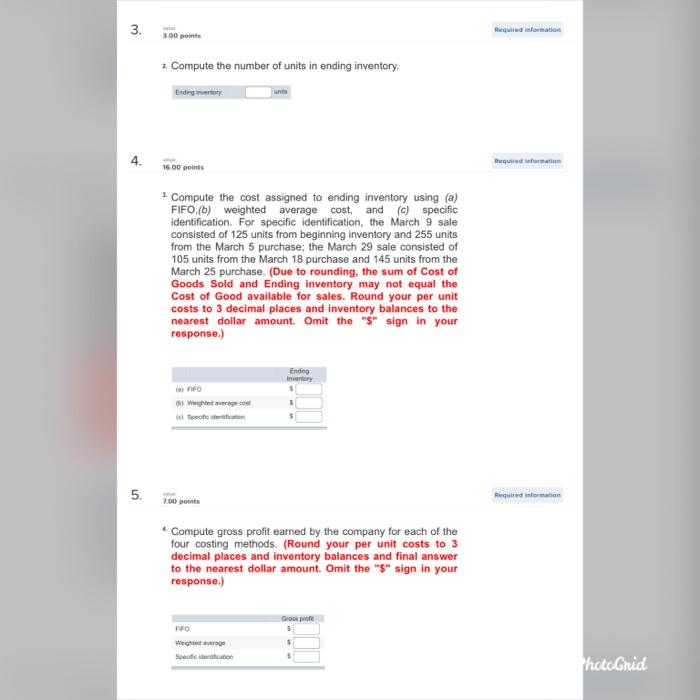

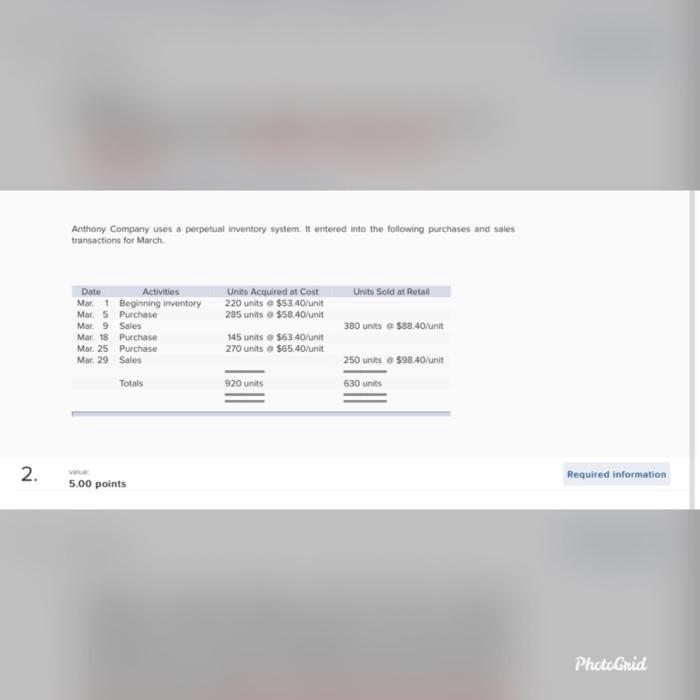

The following information applies to the questions displayed below 2 3.00pm Required: Compute cost of goods available for sale and the number of units available for sale. (Omit the "S" sige in your response) Compute the number of units in ending inventory 4 *Compute the cost assigned to ending inventory using (a) FIFO.pl weighted average cost and specific Identification. For specific identification, the March 9 sale consisted of 125 units from beginning inventory and 255 units from the March 5 purchase the March 29 sale consisted of 106 units from the March 18 purchase and 145 units from the March 25 purchase (Due to rounding the sum of Cost of Goods Sold and Ending Inventory may not equal the Cost of Good available for sale. Round your per unit costs to decimal places and inventory balances to the nearest dolar amount Omit the sign in your response) PhotoGrid 3 3. 3.00 points Ruquired information 2. Compute the number of units in ending inventory. Endeg intory 4. wird man 16.00 points Compute the cost assigned to ending inventory using (a) FIFO,(b) weighted average cost and (c) specific identification. For specific identification, the March 9 sale consisted of 125 units from beginning inventory and 255 units from the March 5 purchase; the March 29 sale consisted of 105 units from the March 18 purchase and 145 units from the March 25 purchase. (Due to rounding, the sum of Cost of Goods Sold and Ending inventory may not equal the Cost of Good available for sales. Round your per unit costs to 3 decimal places and inventory balances to the nearest dollar amount. Omit the "s" sign in your response.) Ending Inventory 5 5 $ a) Weighed teor 5. Required 7.00 points Compute gross profit earned by the company for each of the four costing methods. (Round your per unit costs to 3 decimal places and inventory balances and final answer to the nearest dollar amount. Omit the "S" sign in your response.) Groot FO Weighted average Selfoon 5 hotoGrid Anthony Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March Units Sold at Retail Date Activities Mar1 Beginning inventory Mar. 5 Purchase Mar. 9 Sales Mar. 18 Purchase Mar 25 Purchase Mar 29 Sales Units Acquired at Cost 220 units a $53.40/unit 285 units a $58.40/unit 145 units a $63.40/unit 270 units a $65.40/unit 380 units a $88.40/unit 250 units $98.40/unit 630 units Totals 920 units 2. 5.00 points Required information PhotoGrid