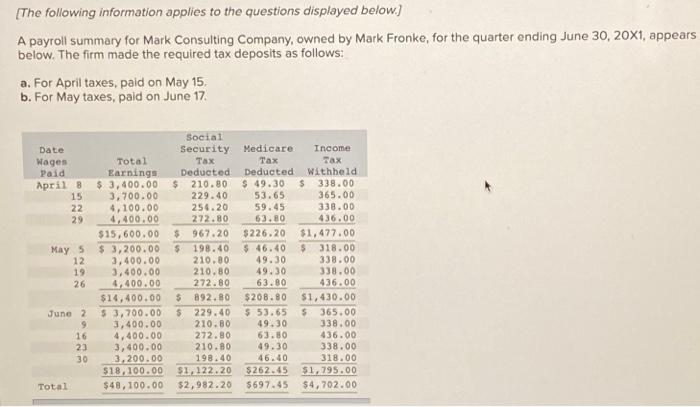

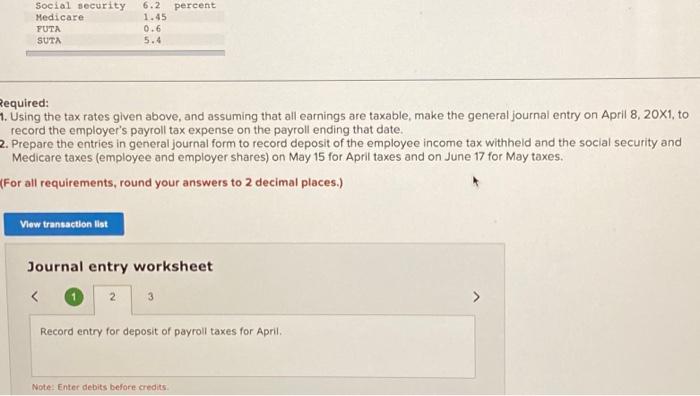

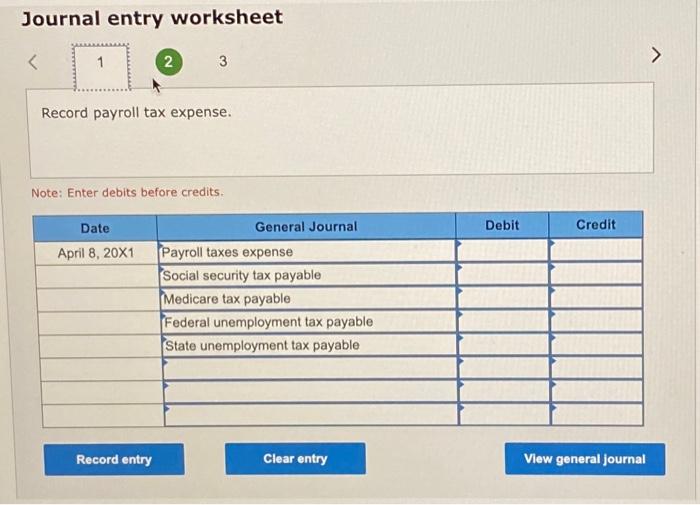

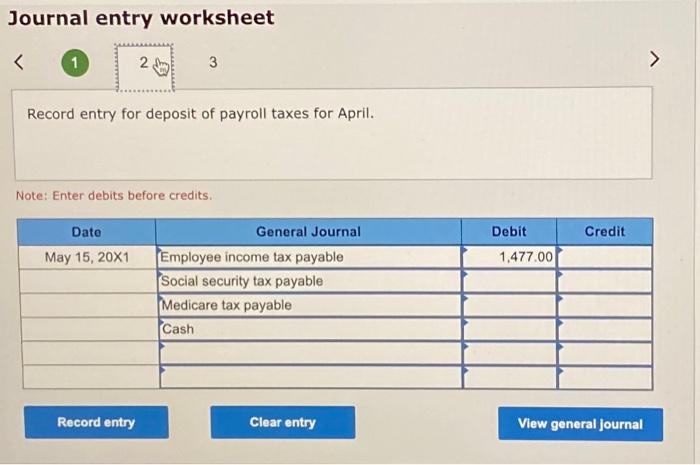

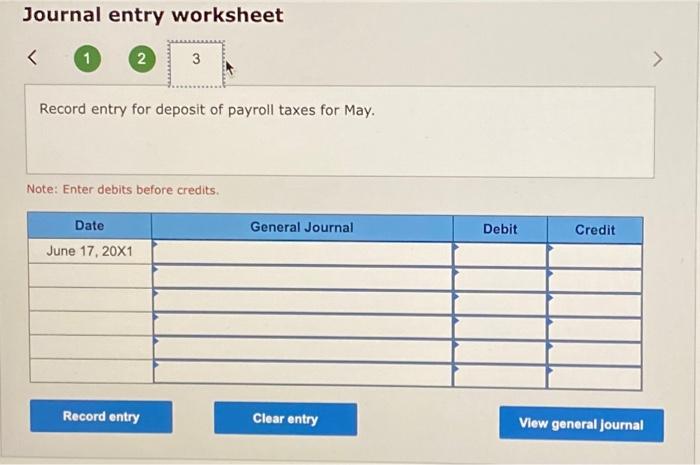

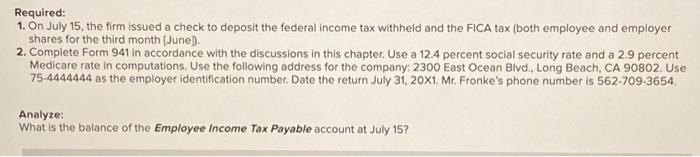

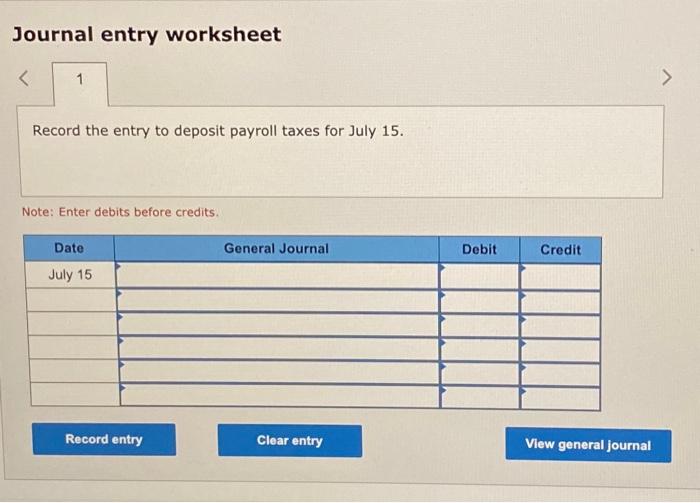

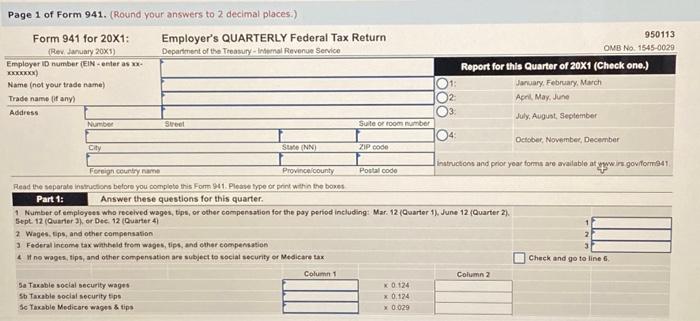

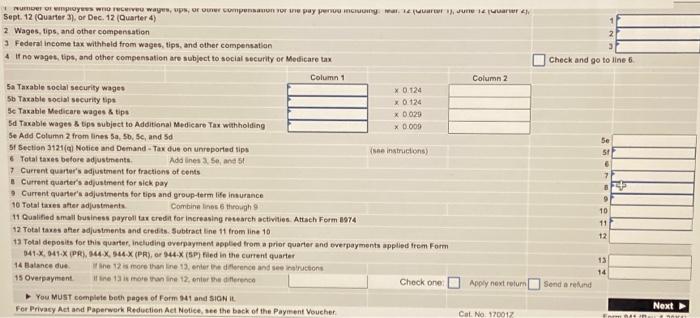

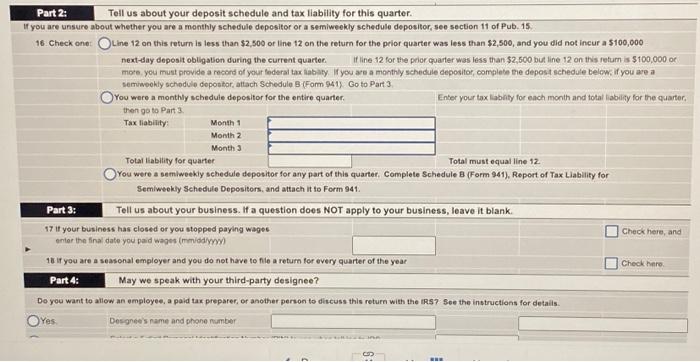

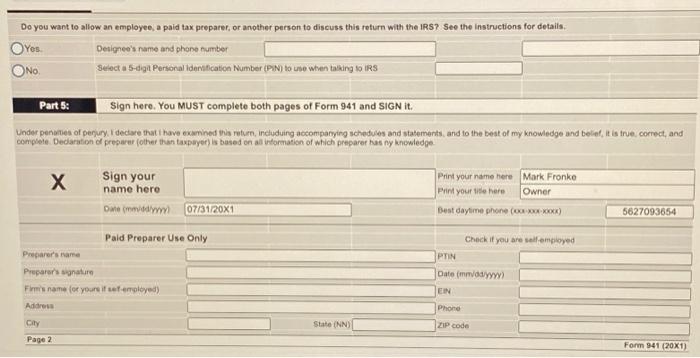

[The following information applies to the questions displayed below.] A payroll summary for Mark Consulting Company, owned by Mark Fronke, for the quarter ending June 30, 20X1, appears below. The firm made the required tax deposits as follows: a. For April taxes, paid on May 15. b. For May taxes, paid on June 17. equired: Using the tax rates given above, and assuming that all earnings are taxable, make the general journal entry on April 8, 20X1, to record the employer's payroll tax expense on the payroll ending that date. . Prepare the entries in general journal form to record deposit of the employee income tax withheld and the social security and Medicare taxes (employee and employer shares) on May 15 for April taxes and on June 17 for May taxes. For all requirements, round your answers to 2 decimal places.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record entry for deposit of payroll taxes for April. Note: Enter debits before credits. Journal entry worksheet Record entry for deposit of payroll taxes for May. Note: Enter debits before credits. Required: 1. On July 15, the firm issued a check to deposit the federal income tax withheld and the FiCA tax (both employee and employer shares for the third month [June]). 2. Complete Form 941 in accordance with the discussions in this chapter. Use a 12.4 percent social security rate and a 2.9 percent Medicare rate in computations. Use the following address for the company: 2300 East Ocean Blvd., Long Beach, CA 90802. Use 75-4444444 as the employer identification number. Date the return July 31, 20X1. Mr. Fronke's phone number is 5627093654. Analyze: What is the balance of the Employee Income Tax Payable account at July 15 ? Journal entry worksheet Record the entry to deposit payroll taxes for July 15. Note: Enter debits before credits. Page 1 of Form 941. (Round your answers to 2 decimal places.) Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 2 Wages, tips, and other compensation 3 Federal income tax withheld from wages, tips, and other compensatian 4 If no wapet, tips, and other compensation are subject to social security of Medicare tax Sa Taxable soclal security wages Sb Taxable social security tipt Sc Taxable Medicare wages s tipt Sd Taxable wages 8 Eps subject to Additional Medicare Tax witholding Se Add Cotumn 2 from lines 5a,5b,Sc; and 5d Sf Sectlon 1121 (q) Notice and Demand - Tax due on unreported tipu Column 1 Add lines 3.50, and 5 ! 7 Current quarter's adjustment for fractions of cents e. Current quarter's adjustment for sick pay 9. Current quarter's adjustments for tips and group-term life insurance 10 Total taves after adjustments. Combine lines 6 throwh 9 11 Qualified small business payrell tax creda for increasing netearch activities. Atrach Form 697 12 Total taxes afer adjustments and credits. Subtract tine 11 from line 10 13. Tolal deposits for this quarter, ineluding overpaytnent applifd from a prior quarter and everpayments applied frem Form 041x,041(PR),944,544 (PR), or 944 (SP) fied in the curtent quarter 14 Batance due. I I the 12 is more than line 12 , enter Be difecence and see intructions 15 Overpayment. If tre 13 is moie than ine 12, enier be diflerence Check one: Apply next return Send a rekund You MUst complete beth pages of Form 941 and SicN it. Fer Privacy Act aed Paperwerk Reductien Act Netice, see the back of the Paym ent Voucher. \begin{tabular}{l|l} Part 2: & Tell us about your deposit schedule and tax liability for this quarter. \end{tabular} If you are unsure about whether you are a monthly schedule depesitor or a semiweekly schedule depositor, see section 11 of Pub. 15 . 16. Check one: Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you did not incur a $100,000 next-day deposit obligation during the current quarter. If line 12 for the prior quarter was less than $2,500 bul line 12 on this feturn is $100,000 or more, you must provide a record of your foderal tax labaty. If you ase a monthly schedule cepositor, complete me depost schedule below, if you are a semimookly schodule depostor, attach Schedule B (Form 941). Go to Part 3 You were a monthly schedule depositor for the entire quarter. Enter your tax liablity for each month and total liability for the quarter, then go to Part 3 Tax liabinity: Month 1 Month 2 Month 3 Total liability for quarter Total must equal line 12. You were a semiweekly schedule depositor for any part of this quarter, Complete Schedule B (Form 941 ), Report of Tax Liability for Semiweokly Schedule Depositors, and attach it to Form 941. Part 3: Tell us about your business. If a question does NOT apply to your business, leave it blank. 17 if your business has closed or you stopped paying wages enter the final date you paid wages (mmidd/mmy) 16 if you are a seasonal employer and you do not have to file a return for every quarter of the year Check here, and Check here. Part 4: May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRs? See the instructions for detalis. Yes: Desgree's name and phone number Do you want to allow an employee, a paid tax preparer, or another person to discuss this refurn with the IRS? See the instructions for details. Yes. Detignee's name and phone number Seloct a 5-digit Personal ldensfication Number (PAN) to use when taking to IRS Part 5: Sign here. You MUST complete both pages of Form 941 and SIGN it. Under penases of peryury. Idectare that have examined this return, includuing actomparying schedules and statements, and to the best of my knowledge and belief, it is inve. correct, and complete. Dedaration of presarer (other than taxpyyer) is based on al intormation of which preparer hus ny knewledpe. Sign your name here