Question

[The following information applies to the questions displayed below.] A recent annual report for FedEx included the following note: Property and Equipment Expenditures for major

[The following information applies to the questions displayed below.]

| A recent annual report for FedEx included the following note: |

| Property and Equipment |

| Expenditures for major additions, improvements, flight equipment modifications, and certain equipment overhaul costs are capitalized when such costs are determined to extend the useful life of the asset or are part of the cost of acquiring the asset. Maintenance and repairs are charged to expense as incurred . . . |

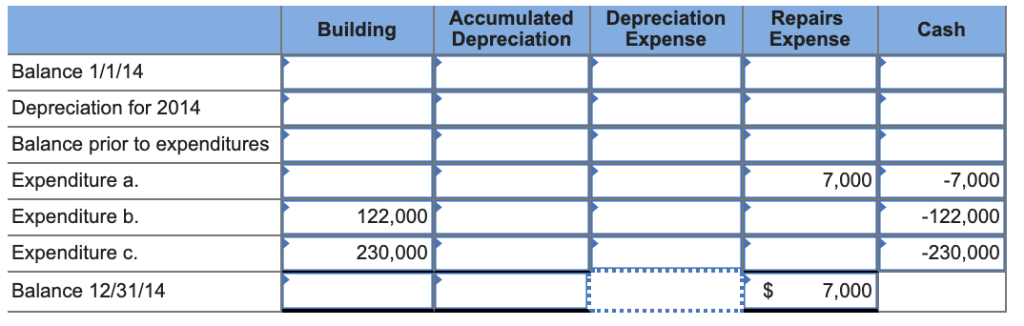

| Assume that FedEx made extensive repairs on an existing building and added a new wing. The building is a garage and repair facility for delivery trucks that serve the Denver area. The existing building originally cost $950,000, and by the end of 2013 (10 years), it was half depreciated on the basis of a 20-year estimated useful life and no residual value. Assume straight-line depreciation was used. During 2014, the following expenditures related to the building were made: |

| a. | Ordinary repairs and maintenance expenditures for the year, $7,000 cash. |

| b. | Extensive and major repairs to the roof of the building, $122,000 cash. These repairs were completed on December 31, 2014. |

| c. | The new wing was completed on December 31, 2014, at a cash cost of $230,000. |

| 1. | Applying the policies of FedEx, complete the following, indicating the effects for the preceding expenditures. Indicate the effect positive value for increase, negative value for decrease, and zero for a net effect of zero. |

| 2. | What was the book value of the building on December 31, 2014? |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started