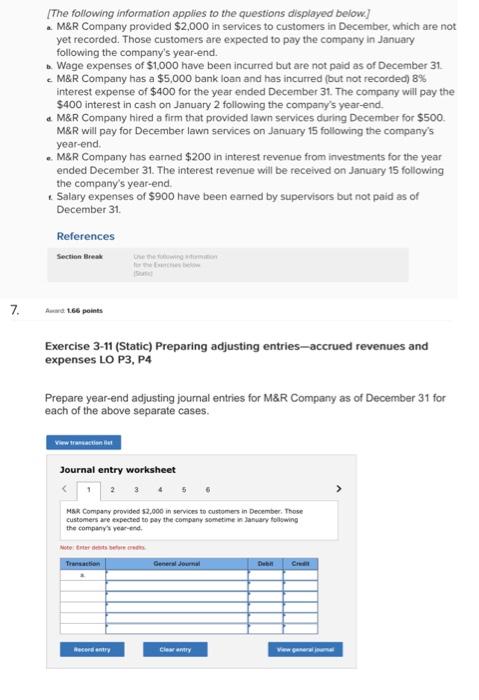

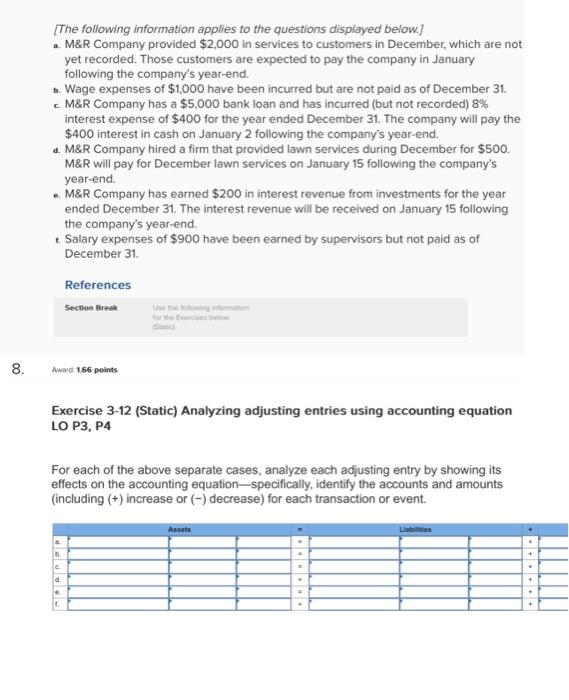

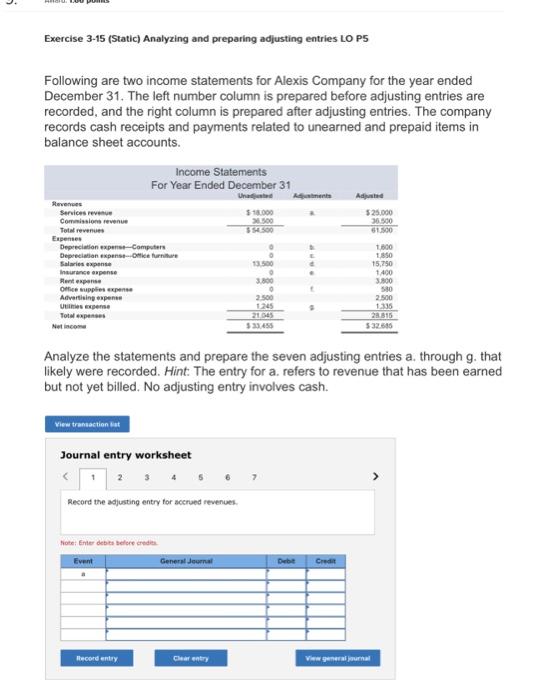

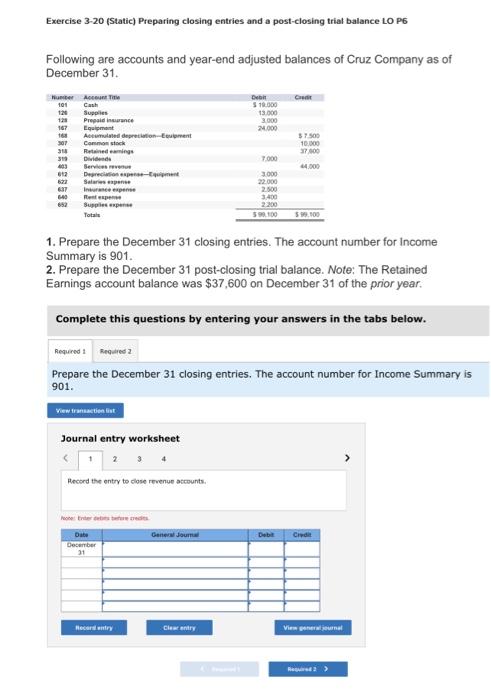

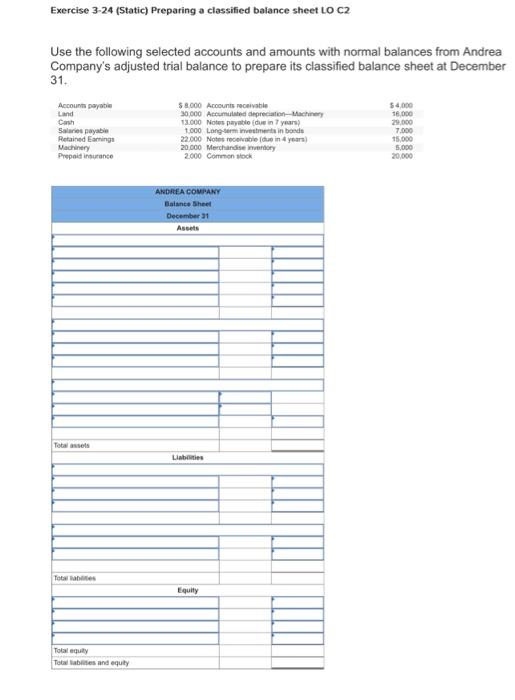

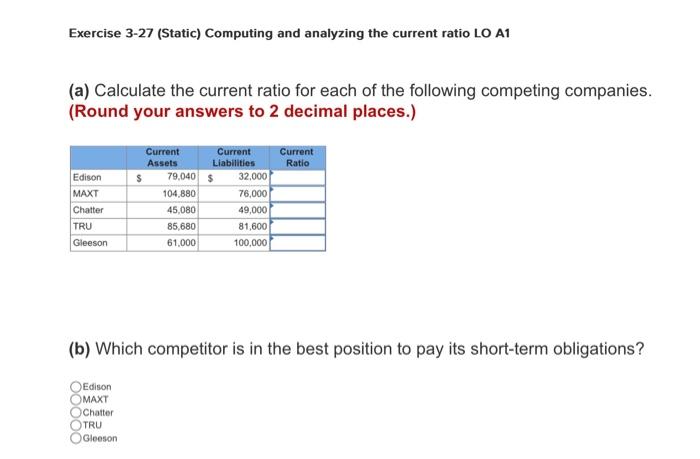

[The following information applies to the questions displayed below.] a. M\&R Company provided $2,000 in services to customers in December, which are not yet recorded. Those customers are expected to pay the company in January following the company's year-end. b. Wage expenses of $1,000 have been incurred but are not paid as of December 31 . c. M\&R Company has a $5,000 bank loan and has incurred (but not recorded) 8% interest expense of $400 for the year ended December 31 . The company will pay the $400 interest in cash on January 2 following the company's year-end. a. M\&R Company hired a firm that provided lawn services during December for $500. M\&R will pay for December lawn services on January 15 following the company's year-end. . M\&R Company has earned $200 in interest revenue from investments for the year ended December 31. The interest revenue will be received on January 15 following the company's year-end. 2. Salary expenses of $900 have been earned by supervisors but not paid as of December 31. References Section Break Anevat 1.66 points Exercise 3-11 (Static) Preparing adjusting entries-accrued revenues and expenses LO P3, P4 Prepare year-end adjusting joumal entries for M\&R Company as of December 31 for each of the above separate cases. Journal entry worksheet 2.34460 Msk Company provided 32,000 in services to customes in December. Those customers are expected to pay the company sometine in Januery tollowing the company's yeer-end. [The following information applies to the questions displayed below.] a. M\&R Company provided $2,000 in services to customers in December, which are not yet recorded. Those customers are expected to pay the company in January following the company's year-end. b. Wage expenses of $1,000 have been incurred but are not paid as of December 31 . c. M\&R Company has a $5,000 bank loan and has incurred (but not recorded) 8% interest expense of $400 for the year ended December 31. The company will pay the $400 interest in cash on January 2 following the company's year-end. a. M\&R Company hired a firm that provided lawn services during December for $500. M\&R will pay for December lawn services on January 15 following the company's year-end. . M\&R Company has earned $200 in interest revenue from investments for the year ended December 31. The interest revenue will be received on January 15 following the company's year-end. t. Salary expenses of $900 have been earned by supervisors but not paid as of December 31. References Awiod 1.66 points Exercise 3-12 (Static) Analyzing adjusting entries using accounting equation LO P3, P4 For each of the above separate cases, analyze each adjusting entry by showing its effects on the accounting equation-specifically, identify the accounts and amounts (including (+) increase or () decrease) for each transaction or event. Exercise 3-15 (Static) Analyzing and preparing adjusting entries LO P5 Following are two income statements for Alexis Company for the year ended December 31. The left number column is prepared before adjusting entries are recorded, and the right column is prepared after adjusting entries. The company records cash receipts and payments related to unearned and prepaid items in balance sheet accounts. Analyze the statements and prepare the seven adjusting entries a. through g. that likely were recorded. Hint: The entry for a. refers to revenue that has been earned but not yet billed. No adjusting entry involves cash. Exercise 3-20 (Static) Preparing closing entries and a post-closing trial balance LO P6 Following are accounts and year-end adjusted balances of Cruz Company as of December 31 . 1. Prepare the December 31 closing entries. The account number for Income Summary is 901. 2. Prepare the December 31 post-closing trial balance. Note: The Retained Earnings account balance was $37,600 on December 31 of the prior year. Complete this questions by entering your answers in the tabs below. Prepare the December 31 closing entries. The account number for Income Summary is 901. Journal entry worksheet Pecord the entry to close revenue accounts. Nosoe friter tefits tatue meste. Exercise 3-24 (Static) Preparing a classified balance sheet LO C2 Use the following selected accounts and amounts with normal balances from Andrea Company's adjusted trial balance to prepare its classified balance sheet at December 31. Exercise 3-27 (Static) Computing and analyzing the current ratio LO A1 (a) Calculate the current ratio for each of the following competing companies. (Round your answers to 2 decimal places.) (b) Which competitor is in the best position to pay its short-term obligations? EdisonMAXTChatterTRUBeeson