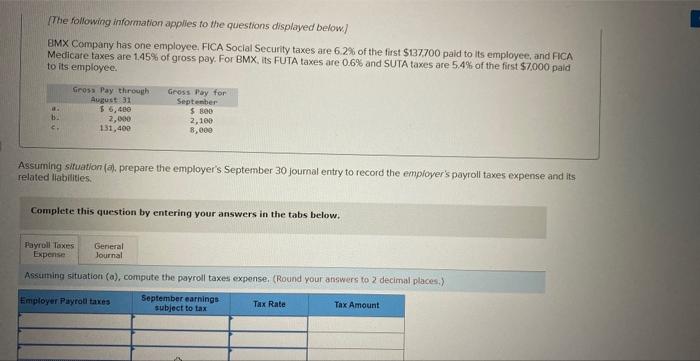

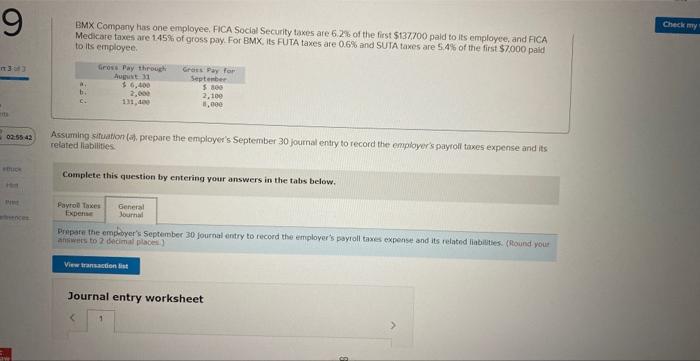

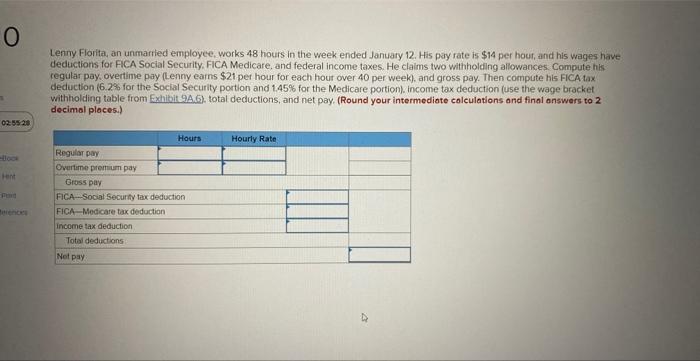

[The following information applies to the questions displayed below] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137700 paid to lits employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7.000 paid to its employee. Assuming situation (a), prepare the employer's September 30 joumal entry to record the empioyer's payroll taxes expense and its related liabilities. Complete this question by entering your answers in the tabs below. Assuming situation (a), compute the payroll taxes expense, (Round your answers to 2 decimal places,) BMX Company has one employee. FICA Social Security taxes are 6.2% of the first 5137700 paid to its employere, and FiCA Mediare taxes are 145% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first 37000 palid to its employee. ssiming situation (ah, prepare the employer's September 30 journal entry to record the empioyer's payroll tixes expense and its alated liabilities? Complete this question by entering your answers in the tabs below. Prepare the emphyer's September 30 fournal entry to record the employer's payroll taxes expense and its related liabilites. (Round rous Journal entry worksheet Lenny Florita, an unmarried employee, works 48 hours in the week ended January 12 . His pay rate is $14 per hout, and his wages have deductions for FICA Social Security. FICA Medicare, and federal income taxes. He claims two withholding allowances, Compute his regular pay overtime pay (Lenny earns $21 per hour for each hour over 40 per week), and gross pay. Then compute his FICA tax deduction (6.2\% for the Social Security portion and 1.45% for the Medicare portion). income tax deduction (use the wage bracket withholding table from Exhibit 9A,6, total deductions, and net pay. (Round your intermediate colculations and final onswers to 2 decimal ploces.) [The following information applies to the questions displayed below] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137700 paid to lits employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7.000 paid to its employee. Assuming situation (a), prepare the employer's September 30 joumal entry to record the empioyer's payroll taxes expense and its related liabilities. Complete this question by entering your answers in the tabs below. Assuming situation (a), compute the payroll taxes expense, (Round your answers to 2 decimal places,) BMX Company has one employee. FICA Social Security taxes are 6.2% of the first 5137700 paid to its employere, and FiCA Mediare taxes are 145% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first 37000 palid to its employee. ssiming situation (ah, prepare the employer's September 30 journal entry to record the empioyer's payroll tixes expense and its alated liabilities? Complete this question by entering your answers in the tabs below. Prepare the emphyer's September 30 fournal entry to record the employer's payroll taxes expense and its related liabilites. (Round rous Journal entry worksheet Lenny Florita, an unmarried employee, works 48 hours in the week ended January 12 . His pay rate is $14 per hout, and his wages have deductions for FICA Social Security. FICA Medicare, and federal income taxes. He claims two withholding allowances, Compute his regular pay overtime pay (Lenny earns $21 per hour for each hour over 40 per week), and gross pay. Then compute his FICA tax deduction (6.2\% for the Social Security portion and 1.45% for the Medicare portion). income tax deduction (use the wage bracket withholding table from Exhibit 9A,6, total deductions, and net pay. (Round your intermediate colculations and final onswers to 2 decimal ploces.)