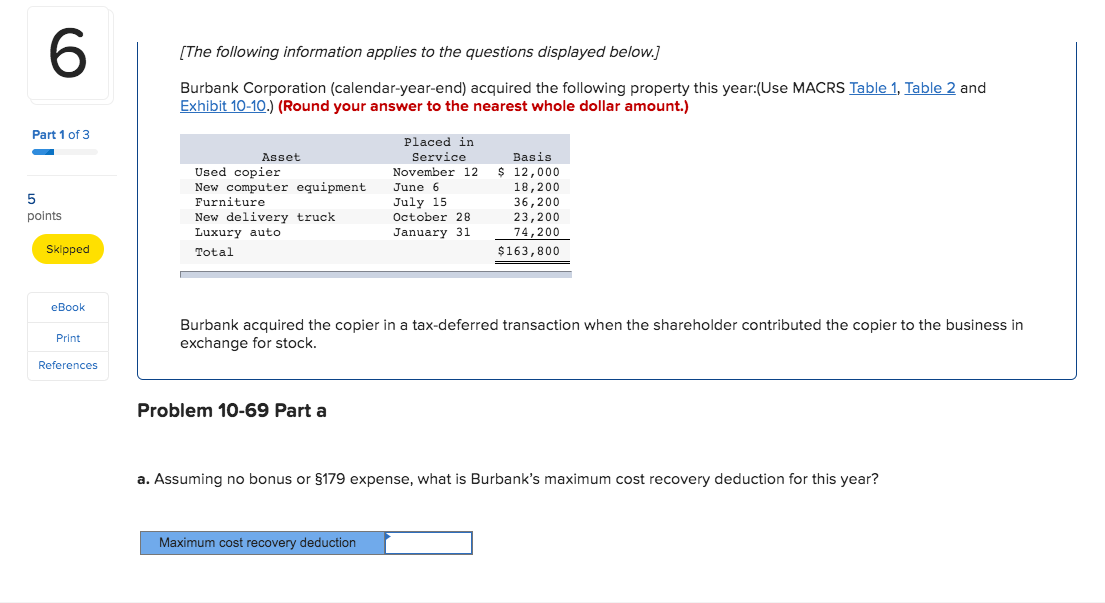

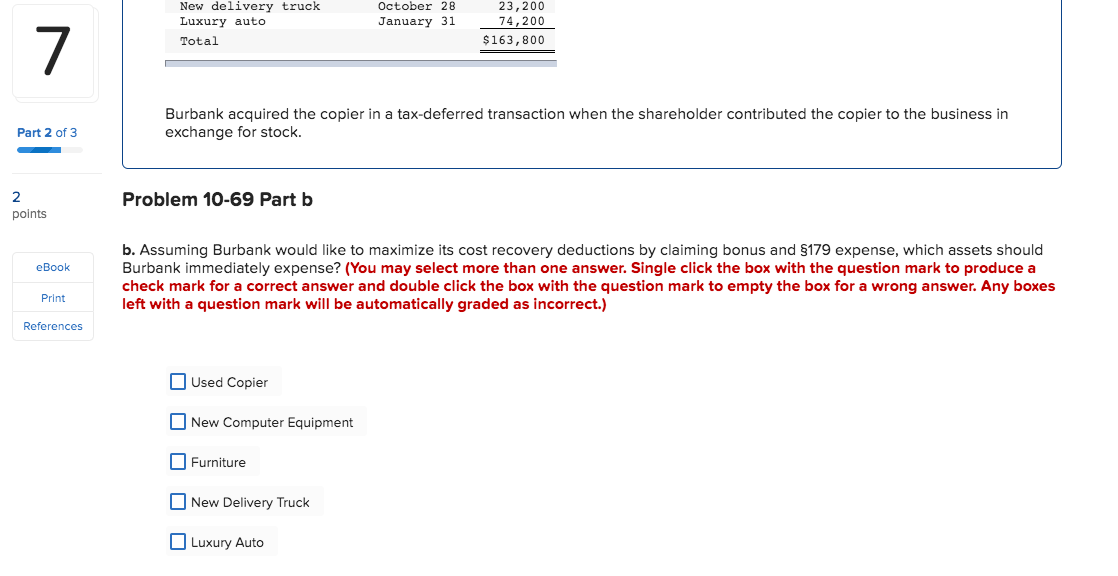

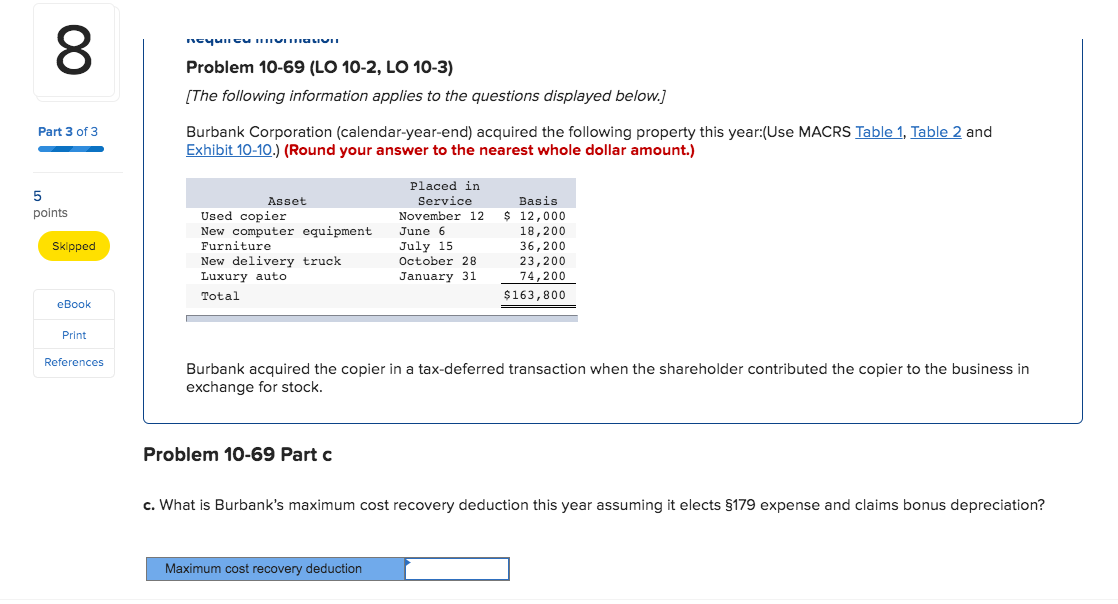

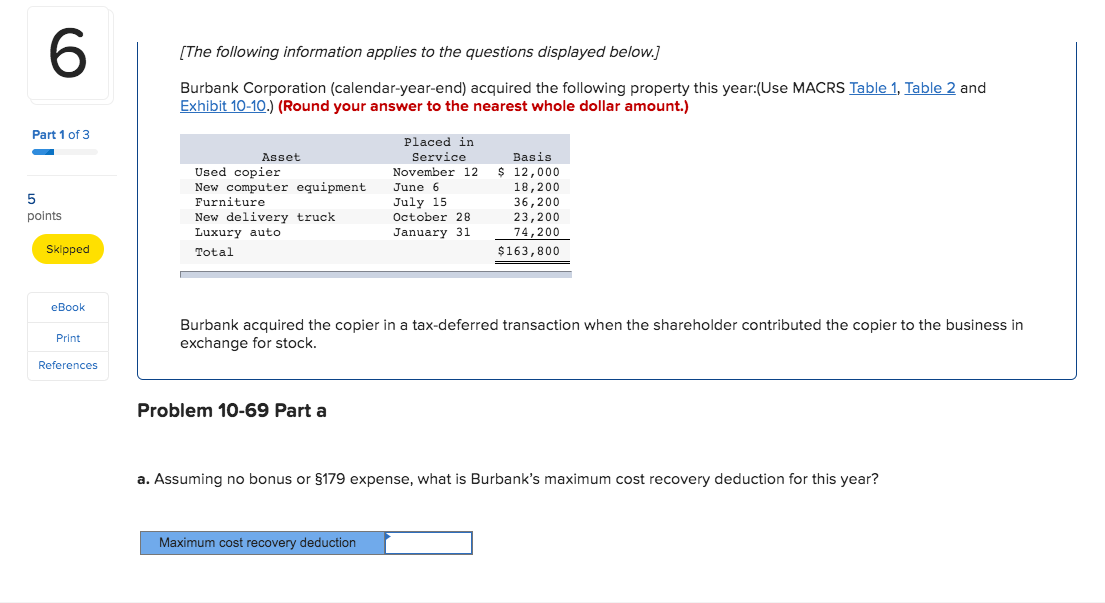

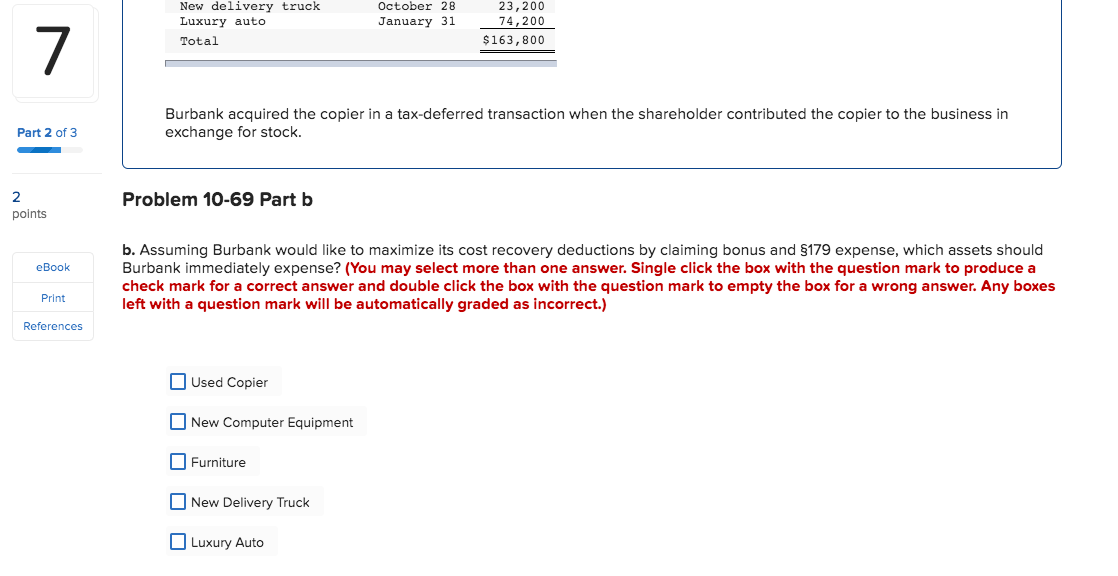

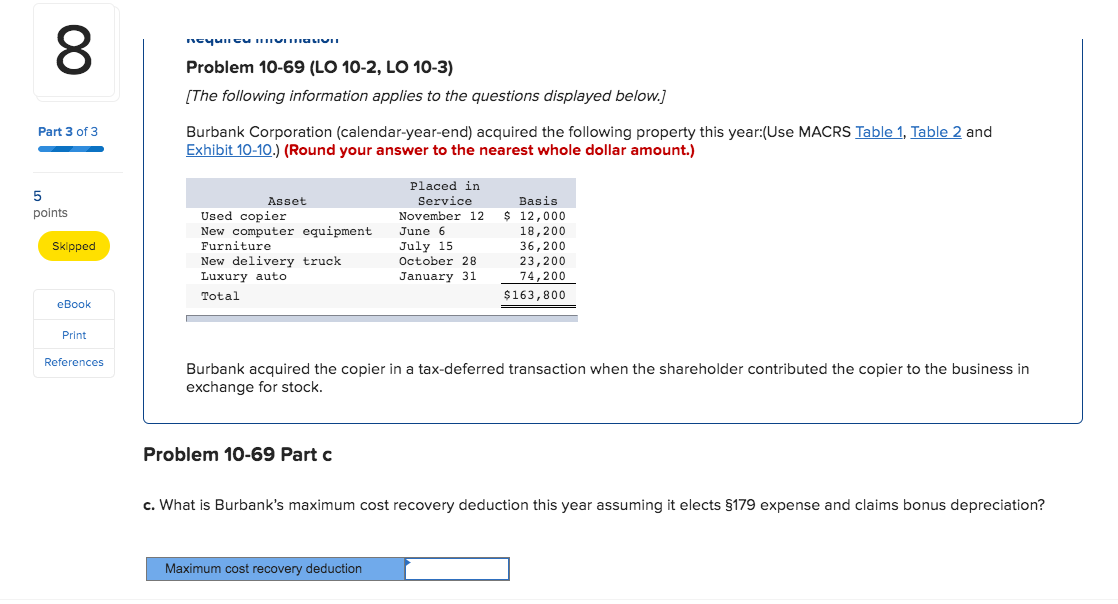

(The following information applies to the questions displayed below.) Burbank Corporation (calendar-year-end) acquired the following property this year:(Use MACRS Table 1, Table 2 and Exhibit 10-10.) (Round your answer to the nearest whole dollar amount.) Part 1 of 3 Asset Used copier New computer equipment Furniture New delivery truck Luxury auto Total Placed in Service November 12 June 6 July 15 October 28 January 31 Basis $ 12,000 18,200 36,200 23,200 74,200 $ 163,800 points 74,20 Skipped eBook Print Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. References Problem 10-69 Part a a. Assuming no bonus or $179 expense, what is Burbank's maximum cost recovery deduction for this year? Maximum cost recovery deduction New delivery truck Luxury auto Total October 28 January 31 23,200 74,200 $ 163,800 Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. Part 2 of 3 Problem 10-69 Part b points eBook b. Assuming Burbank would like to maximize its cost recovery deductions by claiming bonus and $179 expense, which assets should Burbank immediately expense? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Print References Used Copier New Computer Equipment Furniture New Delivery Truck Luxury Auto FCYUCU HIVIOLIUI Problem 10-69 (LO 10-2, LO 10-3) [The following information applies to the questions displayed below.) Part 3 of 3 Burbank Corporation (calendar-year-end) acquired the following property this year:(Use MACRS Table 1, Table 2 and Exhibit 10-10.) (Round your answer to the nearest whole dollar amount.) points Placed in Service November 12 June 6 July 15 October 28 January 31 Asset Used copier New computer equipment Furniture New delivery truck Luxury auto Total Skipped Basis $ 12,000 18,200 36,200 23,200 74,200 $ 163,800 eBook Print References Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. Problem 10-69 Part c. What is Burbank's maximum cost recovery deduction this year assuming it elects $179 expense and claims bonus depreciation? Maximum cost recovery deduction (The following information applies to the questions displayed below.) Burbank Corporation (calendar-year-end) acquired the following property this year:(Use MACRS Table 1, Table 2 and Exhibit 10-10.) (Round your answer to the nearest whole dollar amount.) Part 1 of 3 Asset Used copier New computer equipment Furniture New delivery truck Luxury auto Total Placed in Service November 12 June 6 July 15 October 28 January 31 Basis $ 12,000 18,200 36,200 23,200 74,200 $ 163,800 points 74,20 Skipped eBook Print Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. References Problem 10-69 Part a a. Assuming no bonus or $179 expense, what is Burbank's maximum cost recovery deduction for this year? Maximum cost recovery deduction New delivery truck Luxury auto Total October 28 January 31 23,200 74,200 $ 163,800 Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. Part 2 of 3 Problem 10-69 Part b points eBook b. Assuming Burbank would like to maximize its cost recovery deductions by claiming bonus and $179 expense, which assets should Burbank immediately expense? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Print References Used Copier New Computer Equipment Furniture New Delivery Truck Luxury Auto FCYUCU HIVIOLIUI Problem 10-69 (LO 10-2, LO 10-3) [The following information applies to the questions displayed below.) Part 3 of 3 Burbank Corporation (calendar-year-end) acquired the following property this year:(Use MACRS Table 1, Table 2 and Exhibit 10-10.) (Round your answer to the nearest whole dollar amount.) points Placed in Service November 12 June 6 July 15 October 28 January 31 Asset Used copier New computer equipment Furniture New delivery truck Luxury auto Total Skipped Basis $ 12,000 18,200 36,200 23,200 74,200 $ 163,800 eBook Print References Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. Problem 10-69 Part c. What is Burbank's maximum cost recovery deduction this year assuming it elects $179 expense and claims bonus depreciation? Maximum cost recovery deduction