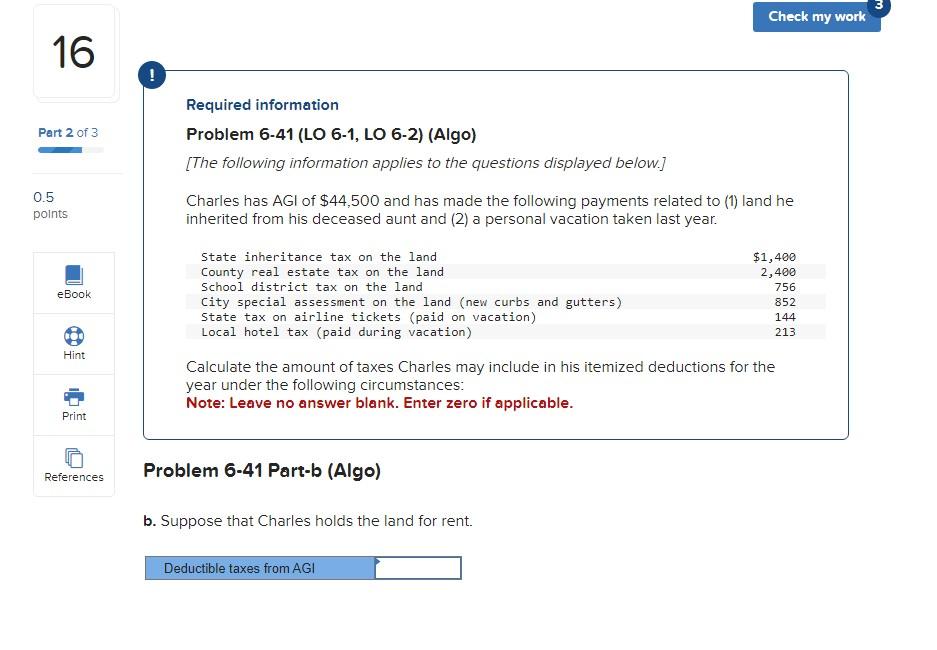

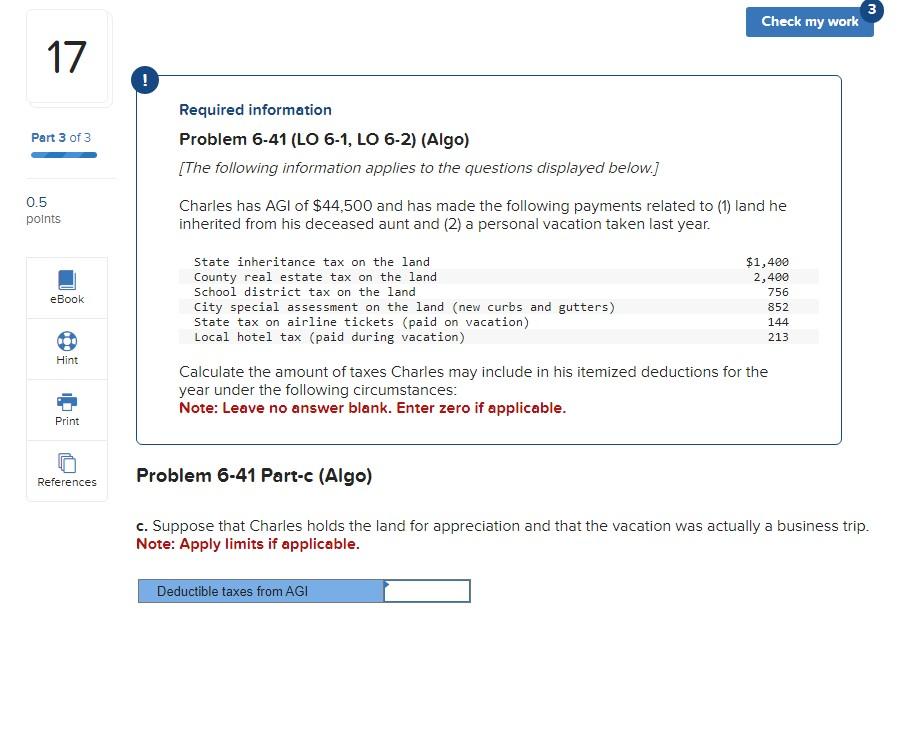

[The following information applies to the questions displayed below.] Charles has AGI of $44,500 and has made the following payments related to (1) land he inherited from his deceased aunt and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. Problem 6-41 Part-b (Algo) b. Suppose that Charles holds the land for rent. Problem 6-41 (LO 6-1, LO 6-2) (Algo) [The following information applies to the questions displayed below.] Charles has AGI of $44,500 and has made the following payments related to (1) land he inherited from his deceased aunt and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. Problem 6-41 Part-c (Algo) c. Suppose that Charles holds the land for appreciation and that the vacation was actually a business trip. Note: Apply limits if applicable. [The following information applies to the questions displayed below.] Charles has AGI of $44,500 and has made the following payments related to (1) land he inherited from his deceased aunt and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. Problem 6-41 Part-b (Algo) b. Suppose that Charles holds the land for rent. Problem 6-41 (LO 6-1, LO 6-2) (Algo) [The following information applies to the questions displayed below.] Charles has AGI of $44,500 and has made the following payments related to (1) land he inherited from his deceased aunt and (2) a personal vacation taken last year. Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances: Note: Leave no answer blank. Enter zero if applicable. Problem 6-41 Part-c (Algo) c. Suppose that Charles holds the land for appreciation and that the vacation was actually a business trip. Note: Apply limits if applicable