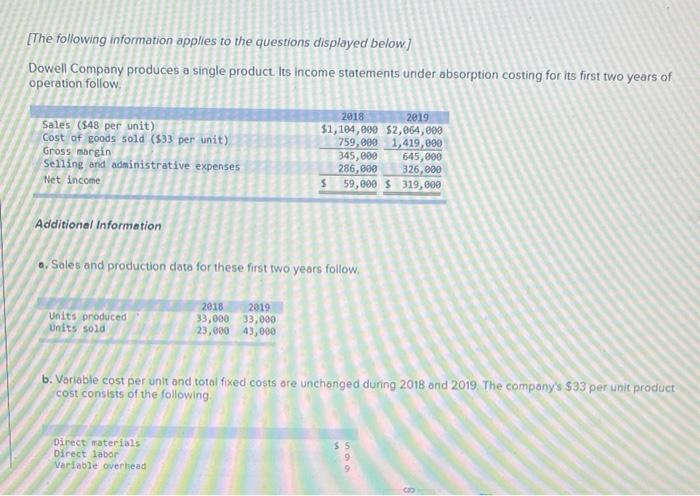

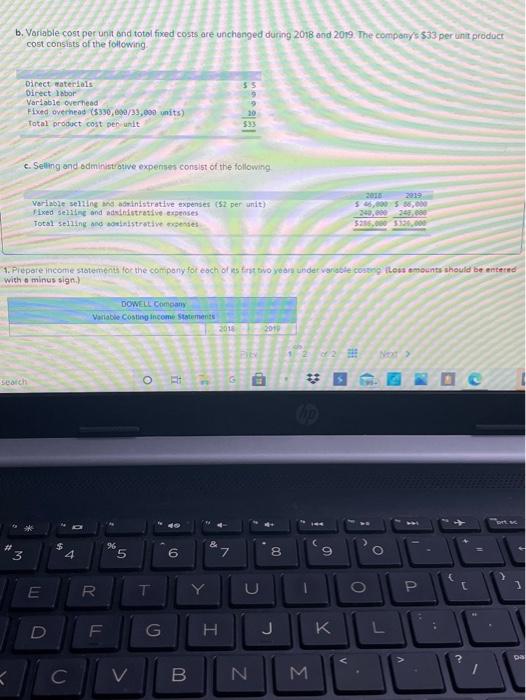

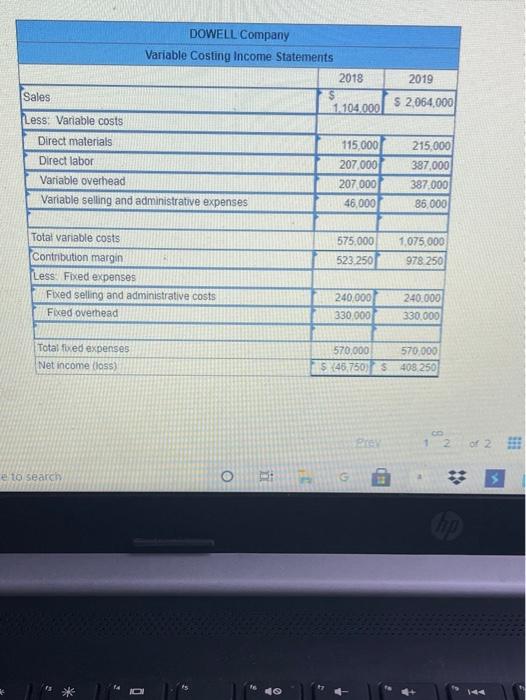

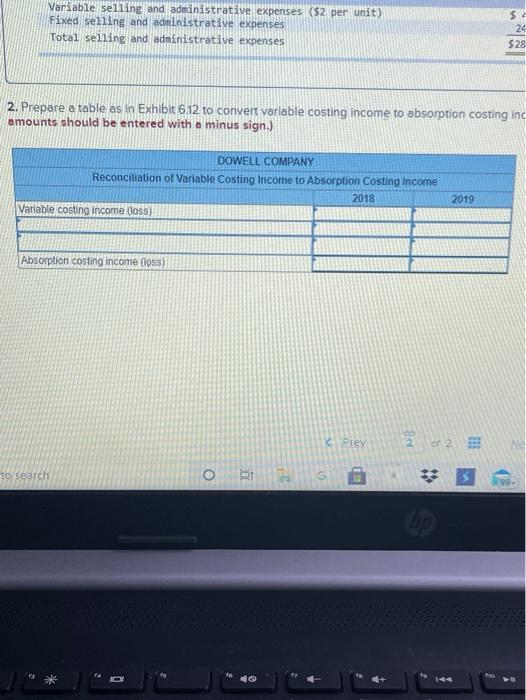

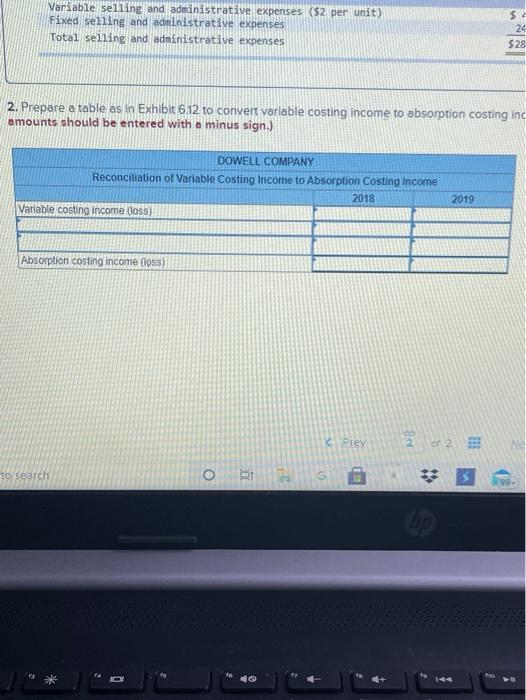

[The following information applies to the questions displayed below) Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow Sales (548 per unit) Cost of goods sold (533 per unit) Gross margin Selling and administrative expenses Net income 2018 2019 $1,184,000 $2,064,000 759,800 1,419,000 345,000 645,000 286,000 326,000 $ 59,000 S 319,000 Additional Information a. Sales and production data for these first two years follow, Units produced Units sold 2018 2019 33,000 33,000 23,000 43,000 b. Variable cost per unit and total fixed costs are unchanged during 2018 and 2019. The company's $33 per unit product cost consists of the following Direct materials Direct labor Variable overhead b. Variable cost per unit and total fixed costs are unchanged during 2018 and 2019. The company's 533 per unit product cost consists of the following Direct waterials Direct labor Variable overhead Fixed overhead ($330,600/33,000 units) Total product cost per unit 55 9 9 30 533 e. Selling and administrative experimen consist of the following Variable selling ministrative expenses (52 per unit) Fixed setting and distrative expenses Total selline anoninistrative reset 2018 2019 55,000 5 30,000 340.00 20.00 525.0 5390.000 1. Prepare income statements for the company for each of its first to ye bra under variatie coseng flous amounts should be entered with a minus sign) DOWELL Coman Variable Costing income Statement 2013 2018 22 > Search 43 Tomas 96 X # 3 $ 4 5 6 7 00 9 O C R. E T Y P o D F G . J K L Da C V B N M 1 DOWELL Company Variable Costing Income Statements 2018 2019 Sales 11.104.000 $ 2,064,000 Less: Variable costs Direct materials Direct labor Variable overhead Variable selling and administrative expenses 115.000 207.000 207 000 46.000 215.000 387.000 387.000 86.000 575.000 1.075.000 978 250 523 250 Total variable costs Contribution margin Less Fixed expenses Fixed selling and administrative costs Fixed overhead 240.000 240.000 330.000 330.000 Total fixed expenses Net income doss) 570,000 $ 46.750) 5 570 000 408 250 Pre to search O ta Variable selling and administrative expenses ($2 per unit) Fixed selling and administrative expenses Total selling and administrative expenses $28 2. Prepare a table as in Exhibit 612 to convert variable costing income to absorption costing in amounts should be entered with a minus sign.) DOWELL COMPANY Reconciliation of Variable Costing Income to Absorption Costing Income 2018 Variable costing income (loss) 2019 Absorption costing income (oss) Sey 32 Ne to search O ** O