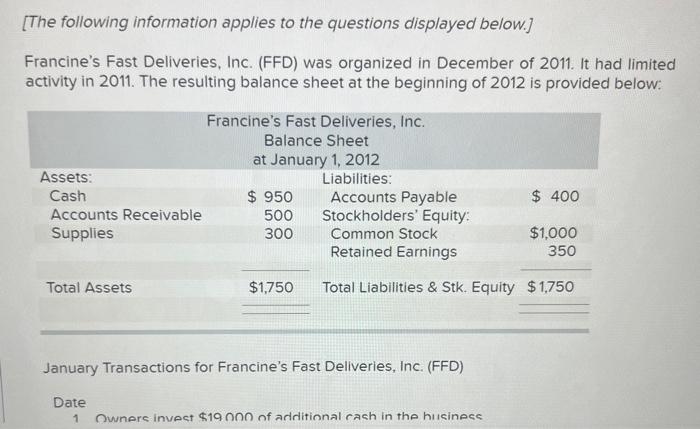

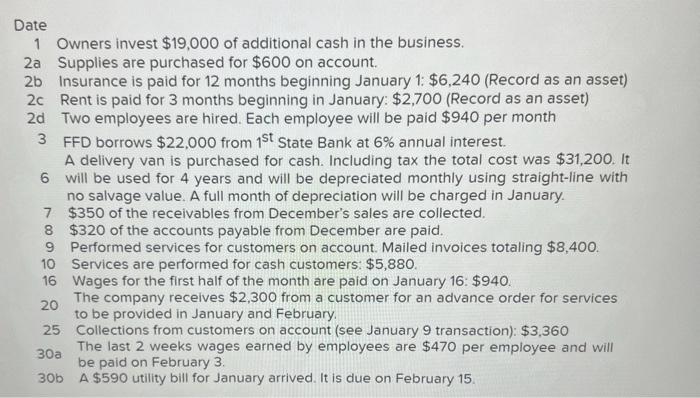

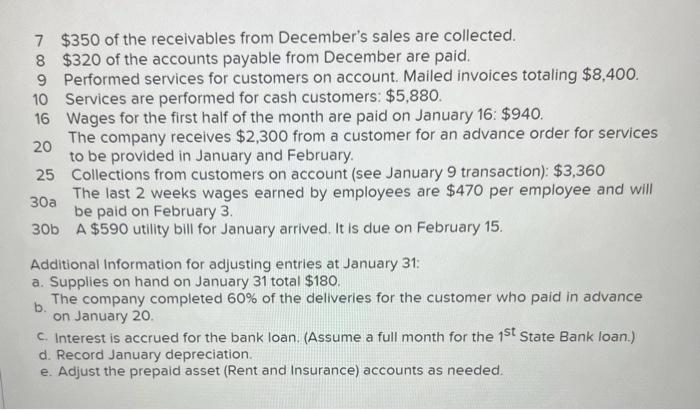

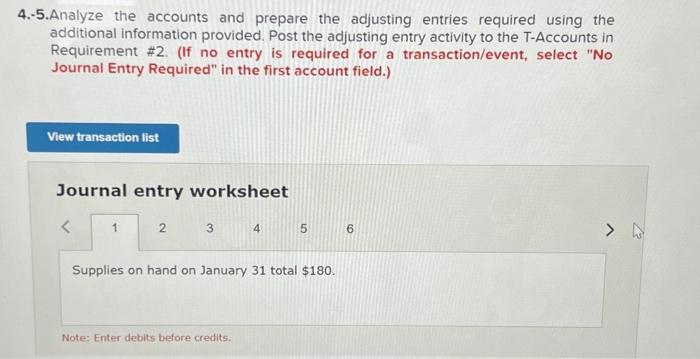

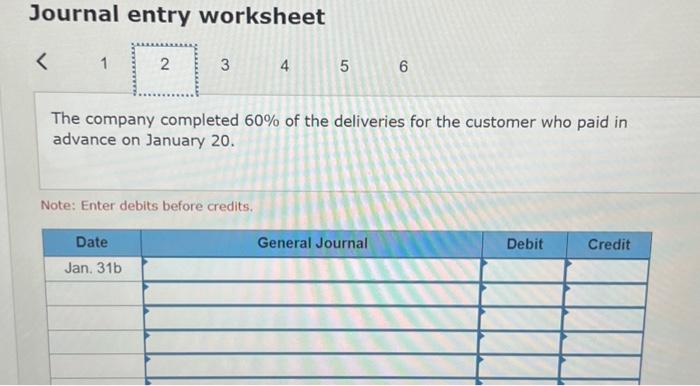

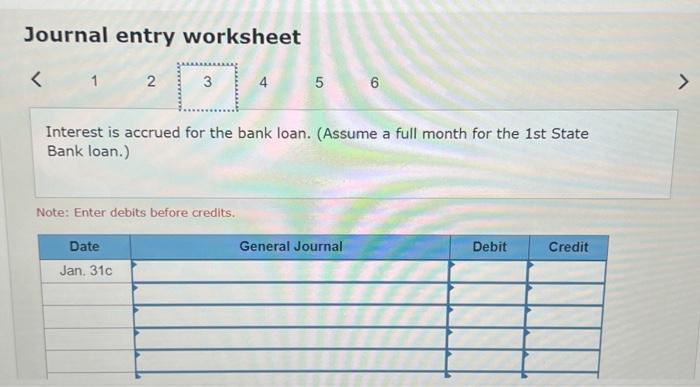

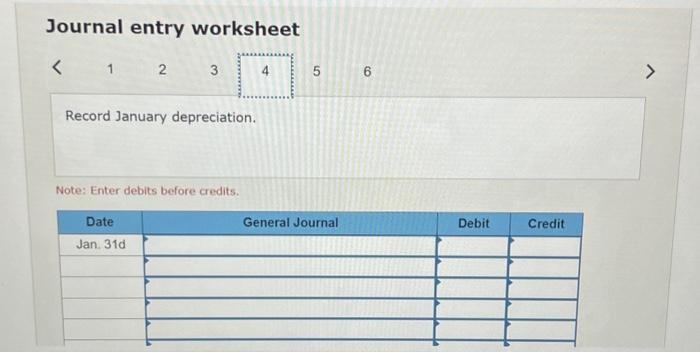

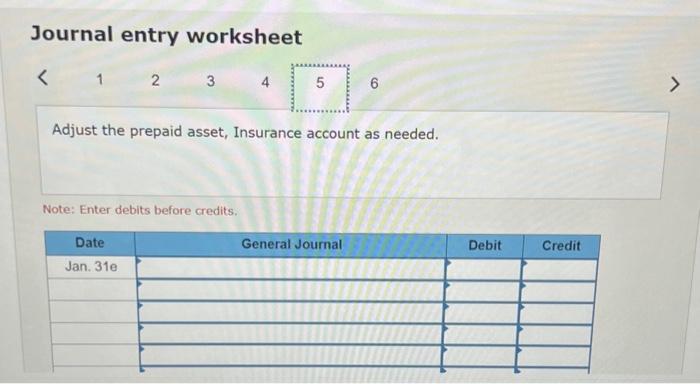

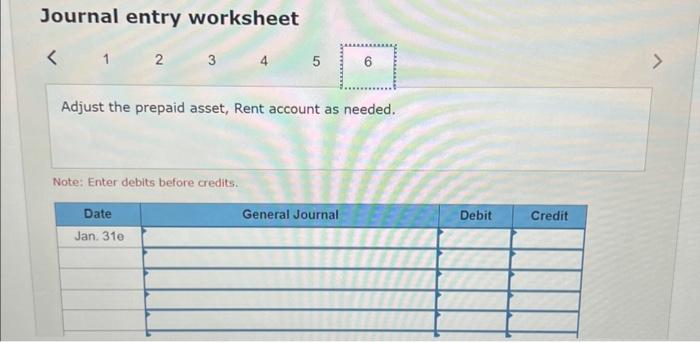

[The following information applies to the questions displayed below.] Francine's Fast Deliveries, Inc. (FFD) was organized in December of 2011. It had limited activity in 2011. The resulting balance sheet at the beginning of 2012 is provided below: January Transactions for Francine's Fast Deliveries, Inc. (FFD) Date 1 Dumpre invest \$19 nn nf adritional cash in the hissinese Date 1 Owners invest $19,000 of additional cash in the business. 2a Supplies are purchased for $600 on account. 2b Insurance is paid for 12 months beginning January 1:$6,240 (Record as an asset) 2c Rent is paid for 3 months beginning in January: $2,700 (Record as an asset) 2d Two employees are hired. Each employee will be paid $940 per month 3 FFD borrows $22,000 from 1st State Bank at 6% annual interest. A delivery van is purchased for cash. Including tax the total cost was $31,200. It 6 will be used for 4 years and will be depreciated monthly using straight-line with no salvage value. A full month of depreciation will be charged in January. 7$350 of the receivables from December's sales are collected. 8 \$320 of the accounts payable from December are paid. 9 Performed services for customers on account. Mailed invoices totaling $8,400. 10 Services are performed for cash customers: $5,880. 16 Wages for the first half of the month are paid on January 16: $940. 20 The company receives $2,300 from a customer for an advance order for services to be provided in January and February. 25 Collections from customers on account (see January 9 transaction): $3,360 30a The last 2 weeks wages earned by employees are $470 per employee and will be paid on February 3. 30bA$590 utility bill for January arrived. It is due on February 15. 7$350 of the receivables from December's sales are collected. 8$320 of the accounts payable from December are paid. 9 Performed services for customers on account. Mailed invoices totaling $8,400. 10 Services are performed for cash customers: $5,880. 16 Wages for the first half of the month are paid on January 16: $940. 20 The company receives $2,300 from a customer for an advance order for services to be provided in January and February. 25 Collections from customers on account (see January 9 transaction): $3,360 30 a The last 2 weeks wages earned by employees are $470 per employee and will be paid on February 3. 30 b A $590 utility bill for January arrived, It is due on February 15. Additional Information for adjusting entries at January 31: a. Supplies on hand on January 31 total $180. b. The company completed 60% of the deliveries for the customer who paid in advance on January 20. c. Interest is accrued for the bank loan. (Assume a full month for the 1st State Bank loan.) d. Record January depreciation. e. Adjust the prepaid asset (Rent and Insurance) accounts as needed. 4.-5. Analyze the accounts and prepare the adjusting entries required using the additional information provided. Post the adjusting entry activity to the T-Accounts in Requirement \#2. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 23456 Journal entry worksheet The company completed 60% of the deliveries for the customer who paid in advance on January 20. Note: Enter debits before credits. Journal entry worksheet Interest is accrued for the bank loan. (Assume a full month for the 1st State Bank loan.) Note: Enter debits before credits. Journal entry worksheet Journal entry worksheet Adjust the prepaid asset, Insurance account as needed. Note: Enter debits before credits. Journal entry worksheet