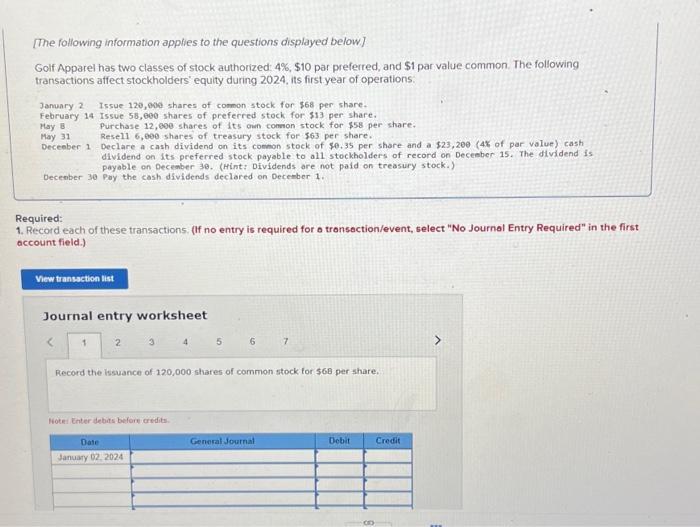

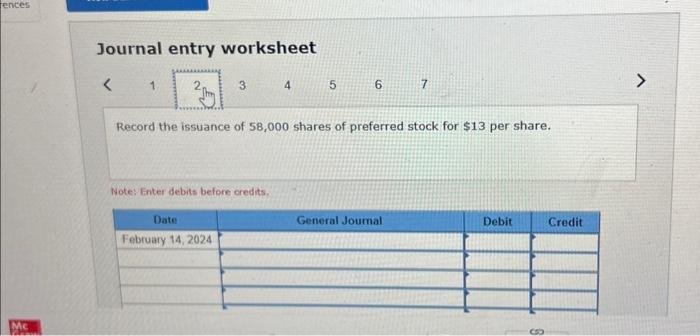

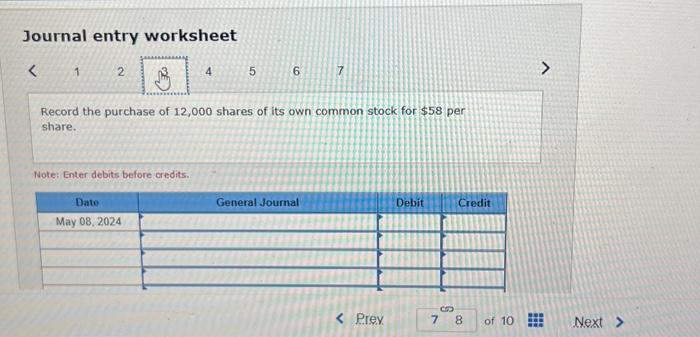

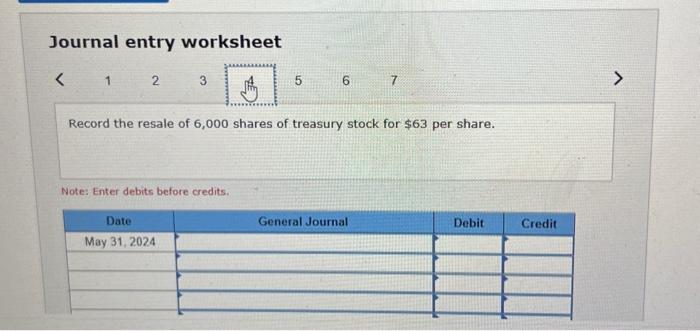

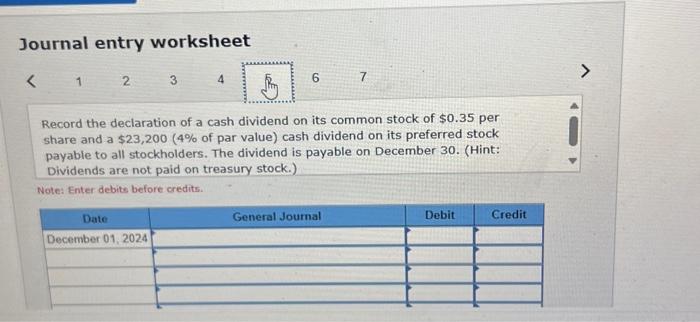

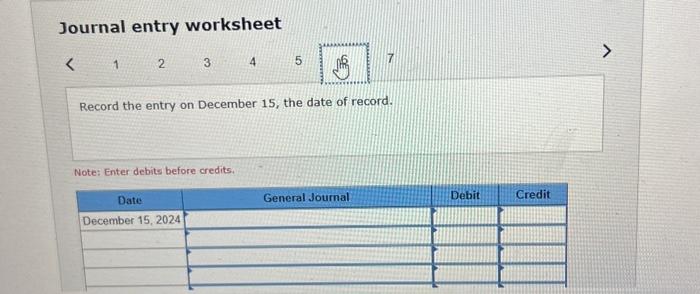

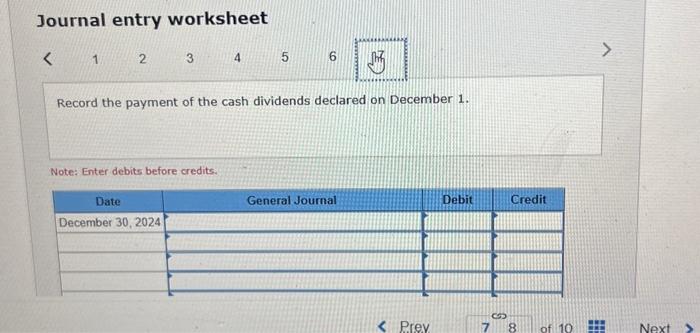

[The following information applies to the questions displayed below] Golf Apparel has two classes of stock authorized 4%,$10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first. year of operations. January 2 Issue 120 , 000 shares of common stock for $68 per share. February 14 Issue 58,000 shares of preferred stock for $13 per share. Hay is Purchase 12 , 900 shores of its own comon stock for $58 per share. May 31 Rese11 6,000 shares of treasury stock for $63 per share. Deceaber 1 Declare a cash dividend on its comon stock of $0,35 per share and a $23,200 (46 of par value) cash dividend on its preferred stock payable to all stockholders of recond on Deceaber 15 . The dividend is payable on Decenber 30 . (Hint: Dividends are not paid on treasury stock.) December 30 Poy the cash dividends declared on December 1. Required: 1. Record each of these transactions. (If no entry is required for o tronsection/event, select "No Journol Entry Required" in the first account field.) Journal entry worksheet 234567 Record the issuance of 120,000 shares of common stock for $68 per share, Hotei Enter debats before credits. Journal entry worksheet Record the issuance of 58,000 shares of preferred stock for $13 per share. Note: Enter debits before oredits. Journal entry worksheet Record the purchase of 12,000 shares of its own common stock for $58 per share. Note: Enter debits before credits. Journal entry worksheet Record the resale of 6,000 shares of treasury stock for $63 per share. Note: Enter debits before credits. Journal entry worksheet Record the declaration of a cash dividend on its common stock of $0.35 per share and a $23,200 ( 4% of par value) cash dividend on its preferred stock payable to all stockholders. The dividend is payable on December 30 . (Hint: Dividends are not paid on treasury stock.) Note: Enter debits before credits. Journal entry worksheet Record the entry on December 15 , the date of record. Note: Enter debits before credits. Journal entry worksheet Record the payment of the cash dividends declared on December 1. Note: Enter debits before credits