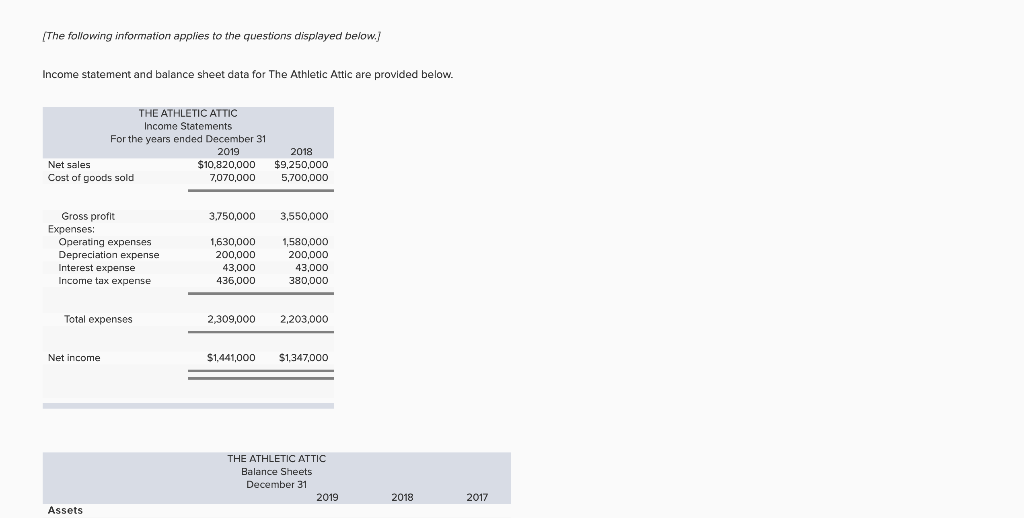

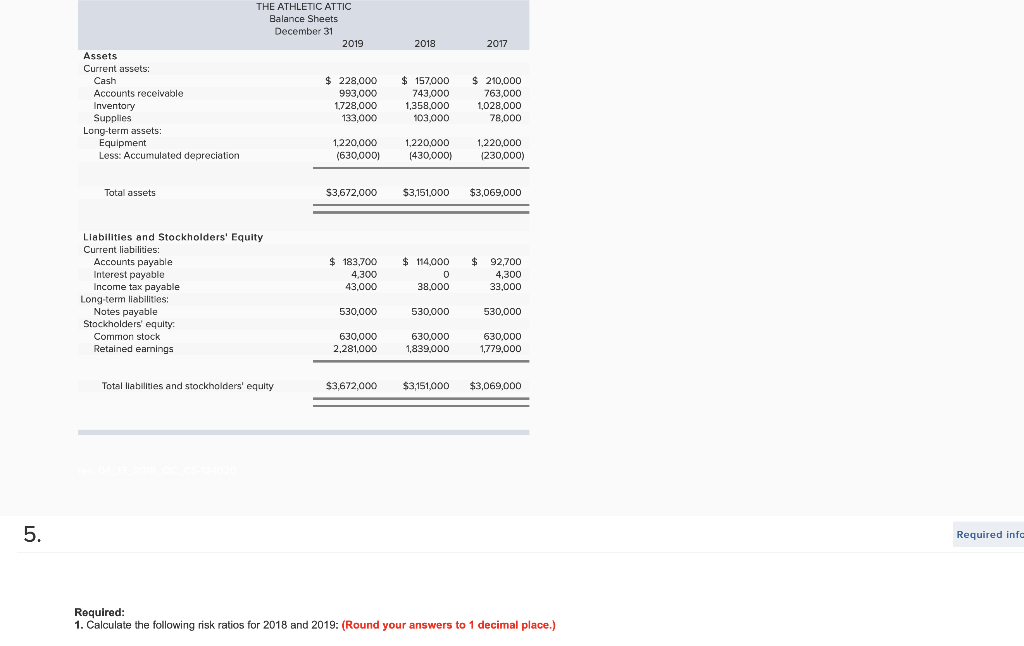

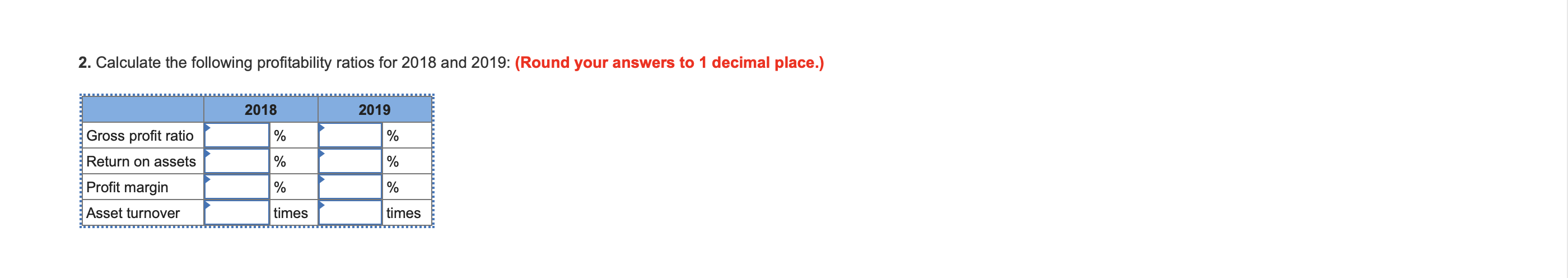

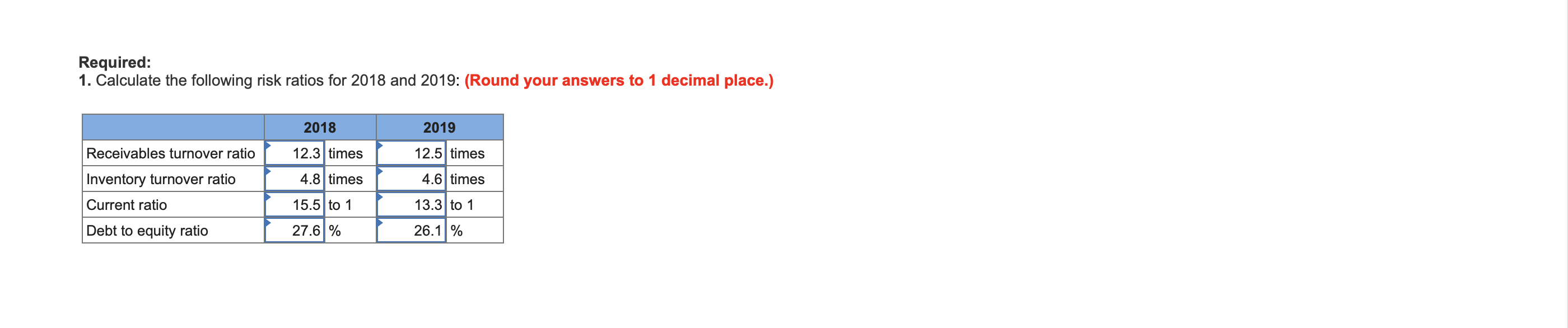

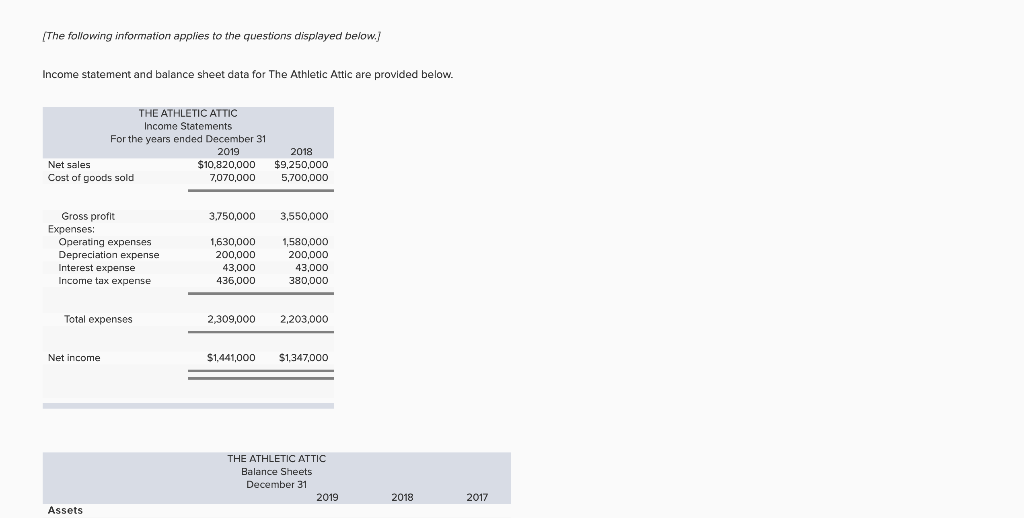

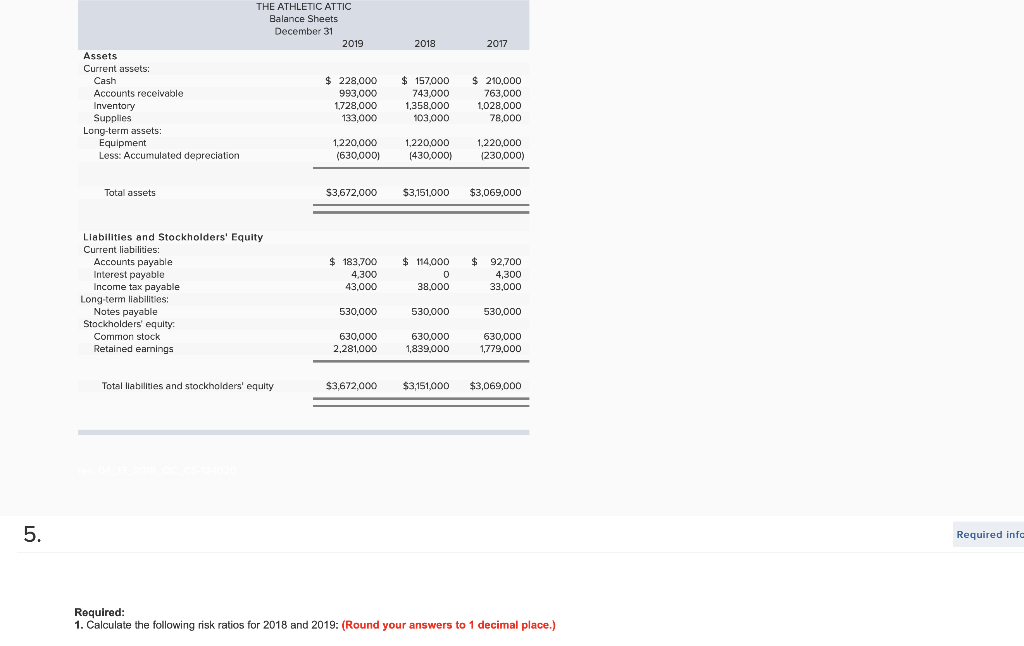

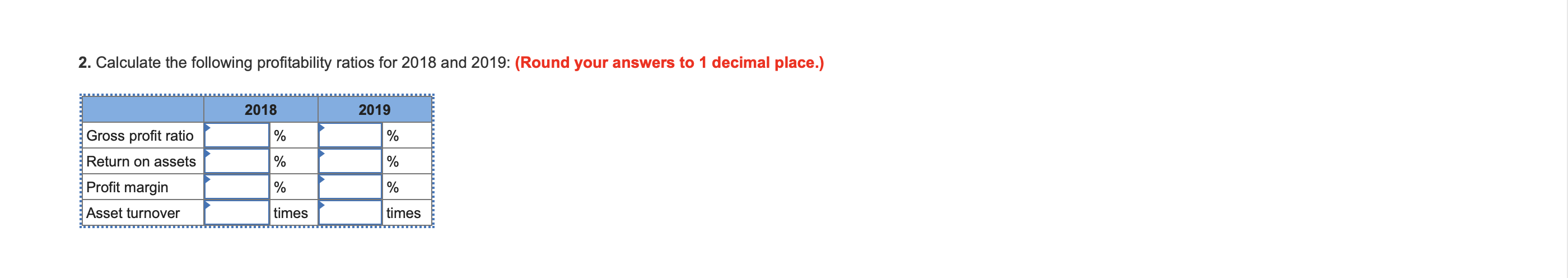

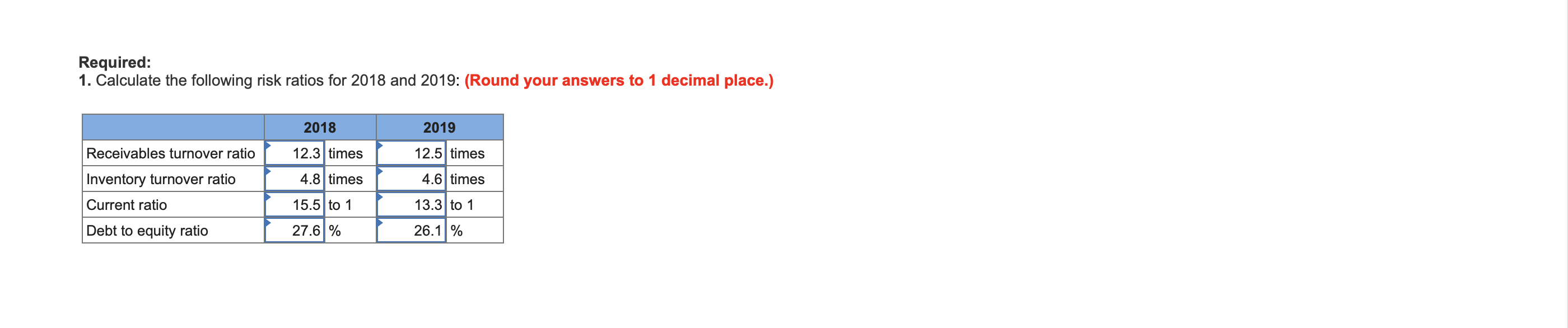

[The following information applies to the questions displayed below.) Income statement and balance sheet data for The Athletic Attic are provided below. THE ATHLETIC ATTIC Income Statements For the years ended December 31 2019 Net sales $10,820,000 Cost of goods sold 7,070,000 2018 $9,250,000 5,700,000 3,750,000 3,550,000 Gross profit Expenses: Operating expenses Depreciation expense Interest expense Income tax expense 1,630,000 200,000 43,000 436,000 1,580,000 200,000 43,000 380,000 Total expenses 2,309,000 2,203,000 Net income $1,441,000 $1,347,000 THE ATHLETIC ATTIC Balance Sheets December 31 2019 2018 2017 Assets Asset THE ATHLETIC ATTIC Balance Sheets December 31 2019 2018 2017 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Less: Accumulated depreciation $ 228,000 993,000 1,728,000 133,000 $ 157,000 743,000 1,358,000 103,000 $ 210,000 763,000 1,028,000 78,000 1,220,000 (630,000) 1,220,000 (430,000) 1,220,000 1230,000) Total assets $3,672,000 $3,151,000 $3,069,000 $ 183,700 4,300 43,000 $ 114,000 0 38,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity Common stock Retained earnings $ 92,700 4,300 33,000 530,000 530,000 530,000 630,000 2,281,000 630,000 1.839,000 630,000 1,779,000 Total liabilities and stockholders' equity $3,672,000 $3,151,000 $3,069,000 5. Required infc Required: 1. Calculate the following risk ratios for 2018 and 2019: (Round your answers to 1 decimal place.) 2. Calculate the following profitability ratios for 2018 and 2019: (Round your answers to 1 decimal place.) 2018 2019 Gross profit ratio % % Return on assets % % Profit margin % % Asset turnover times times Required: 1. Calculate the following risk ratios for 2018 and 2019: (Round your answers to 1 decimal place.) 2018 2019 Receivables turnover ratio 12.3 times 12.5 times 4.8 times 4.6 times Inventory turnover ratio Current ratio Debt to equity ratio 15.5 to 1 13.3 to 1 27.6% 26.1%