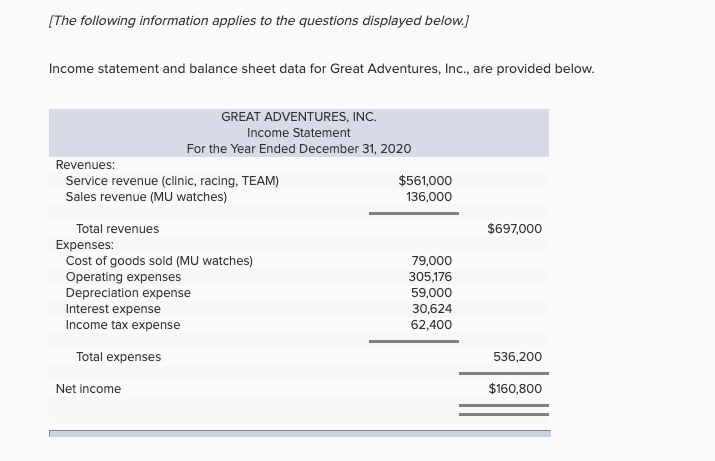

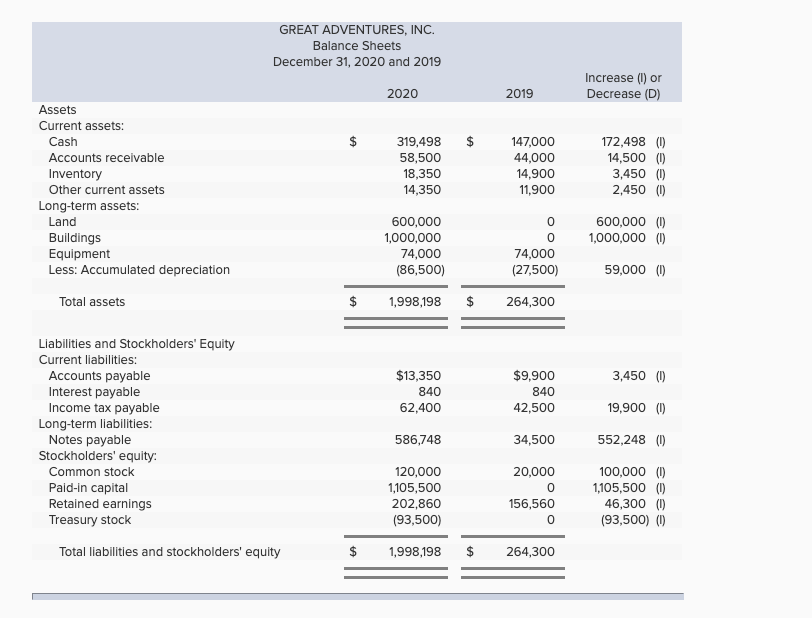

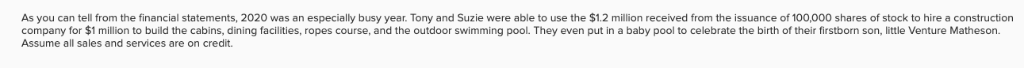

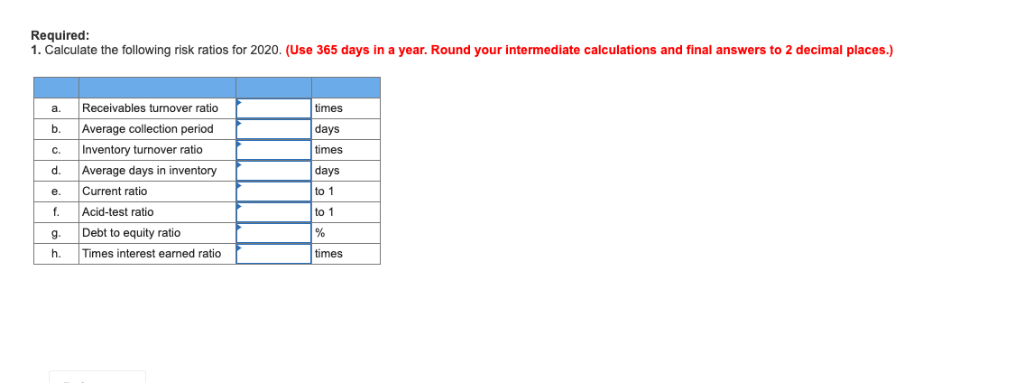

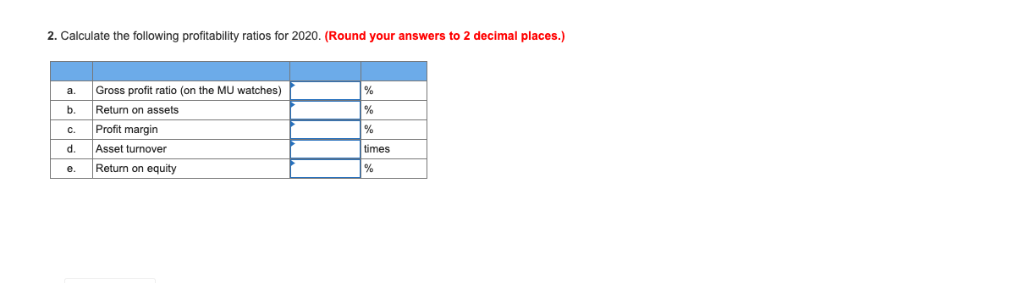

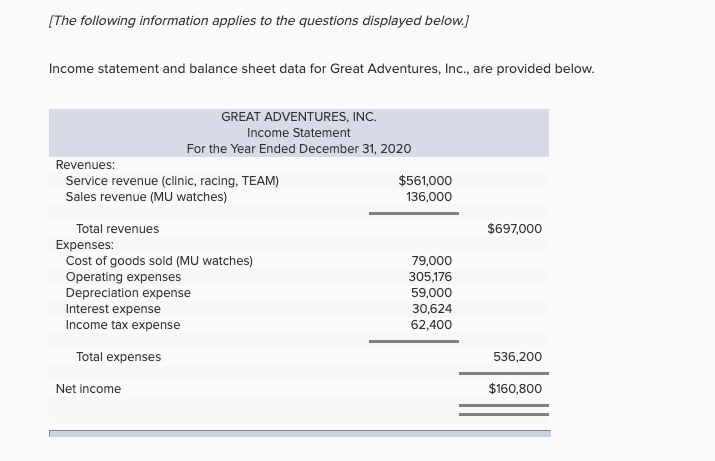

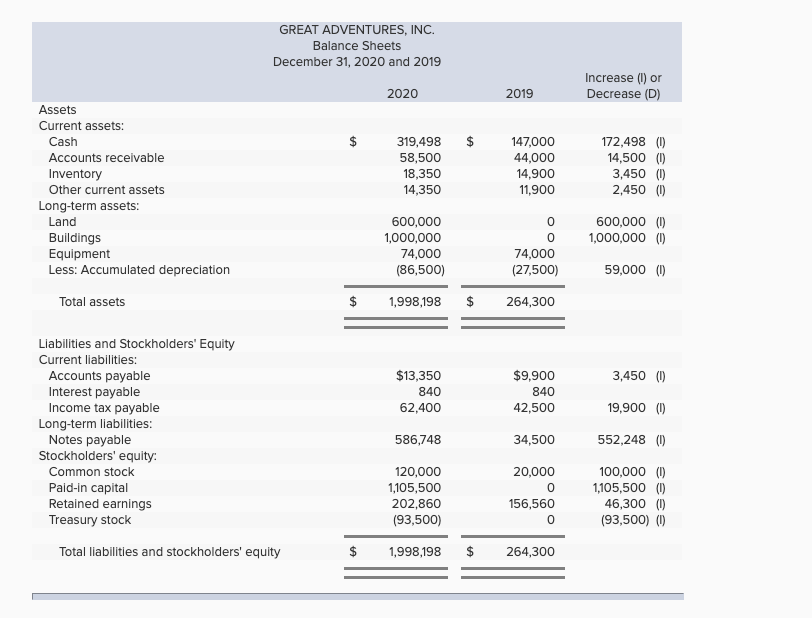

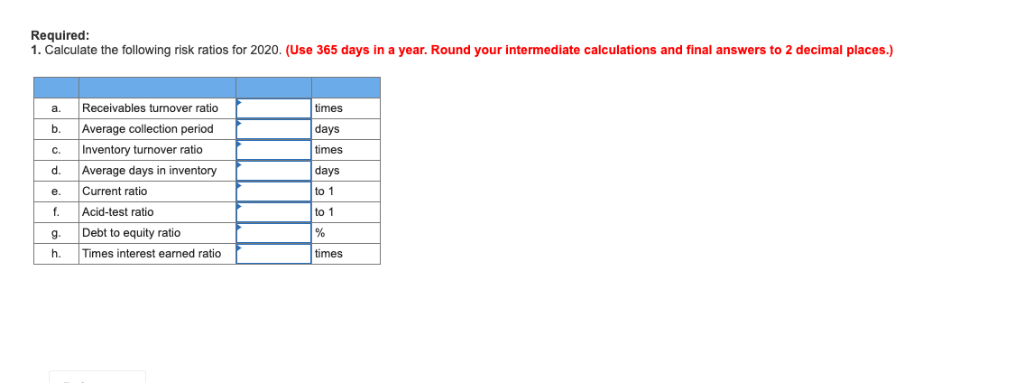

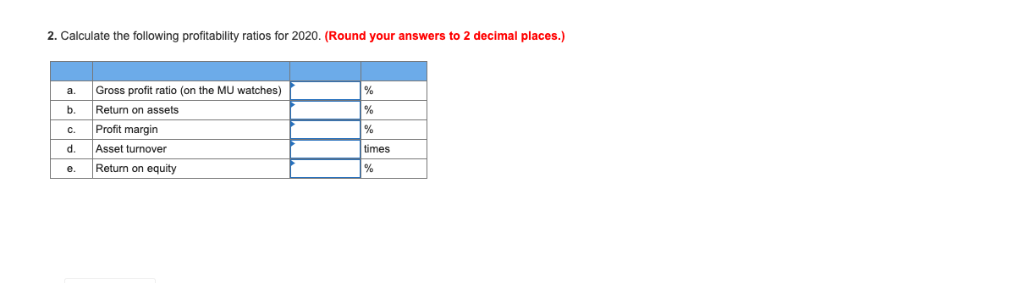

[The following information applies to the questions displayed below.] Income statement and balance sheet data for Great Adventures, Inc., are provided below. GREAT ADVENTURES, INC. Income Statement For the Year Ended December 31, 2020 Revenues: Service revenue (clinic, racing, TEAM) Sales revenue (MU watches) $561,000 136,000 Total revenues $697,000 Expenses: 79,000 Cost of goods sold (MU watches) Operating expenses Depreciation expense 305,176 59,000 30,624 Interest expense Income tax expense 62,400 Total expenses 536,200 $160,800 Net income GREAT ADVENTURES, INC Balance Sheets December 31, 2020 and 2019 Increase () or Decrease (D) 2020 2019 Assets Current assets: Cash 319,498 147,000 172,498 () 14,500 () 3,450 ( 2,450 ( 44,000 14,900 11,900 Accounts receivable 58,500 18,350 14,350 Inventory Other current assets Long-term assets 600,000 () 1,000,000 (I) Land 600,000 C Buildings Equipment Less: Accumulated depreciation 1,000,000 C 74,000 74,000 (27,500) 59,000 () (86,500) $ Total assets $ 264,300 1,998,198 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity $13,350 $9,900 3,450 () 840 840 19,900 () 62,400 42,500 552,248 ( 586,748 34,500 120,000 1,105,500 202,860 100,000 (I) Common stock 20,000 Paid-in capital 1,105,500 () 46,300 () (93,500) (I) C Retained earnings Treasury stock 156,560 (93,500) C 1,998,198 $ 264,300 Total liabilities and stockholders' equity especially busy year. Tony and Suzie were able to use the $1.2 million received from the issuance of 100,000 shares of stock to hire a construction As you can tell from the financial statements, 2020 was a dining facilities, ropes course, and the outdoor swimming pool. They even put in a baby pool to celebrate the birth of their firstborn son, little Venture on Assume all sales and services are on credit. Required: 1. Calculate the following risk ratios for 2020. (Use 365 days in a year. Round your intermediate calculations and final answers to 2 decimal places.) times Receivables turnover ratio a Average collection period b days Inventory turnover ratio times Average days in inventory days to 1 Current ratio e f. Acid-test ratio to 1 Debt to equity ratio % g times Times interest earned ratio o 2 decimal places.) Calculate the following profitability ratios for 2020. (Round your answers Gross profit ratio (on the MU watches) % a Return on assets b % Profit margin C d Asset turnover times Return on equity %