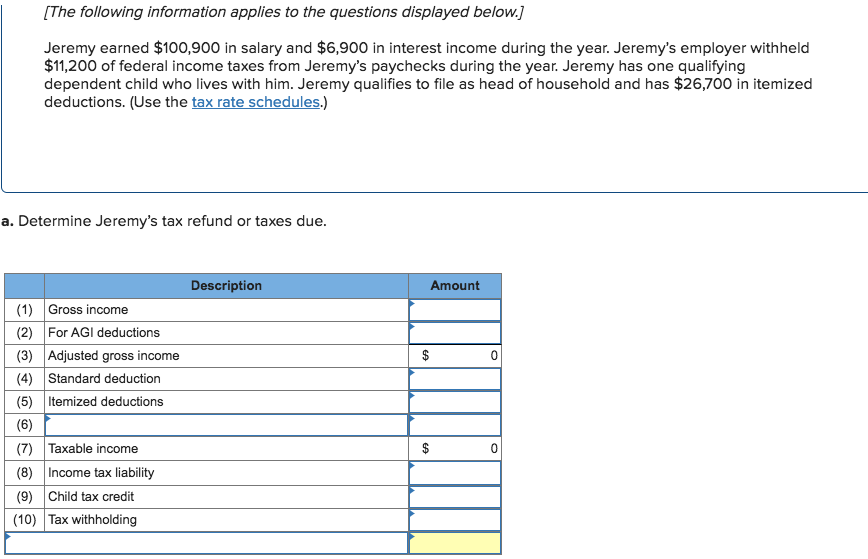

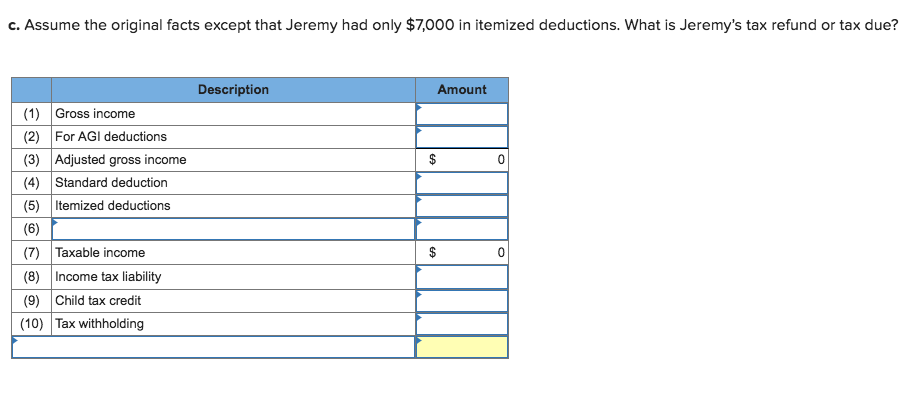

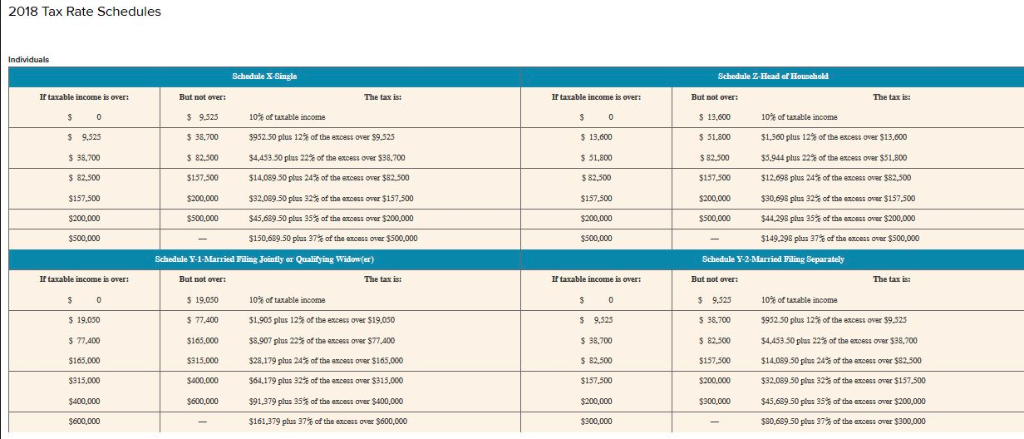

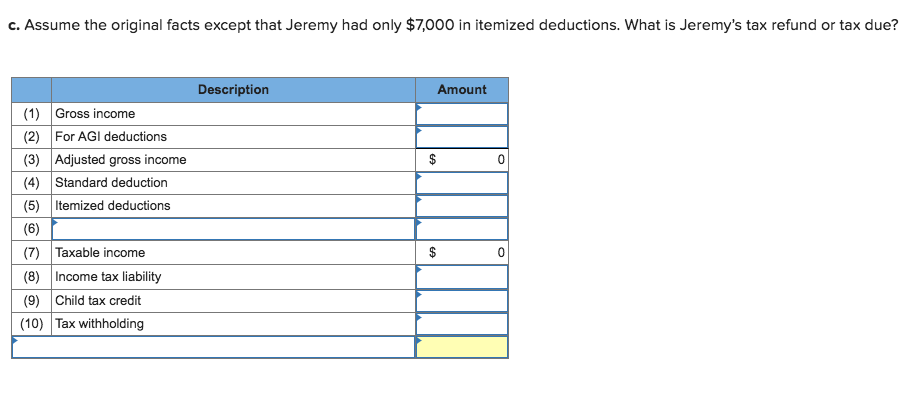

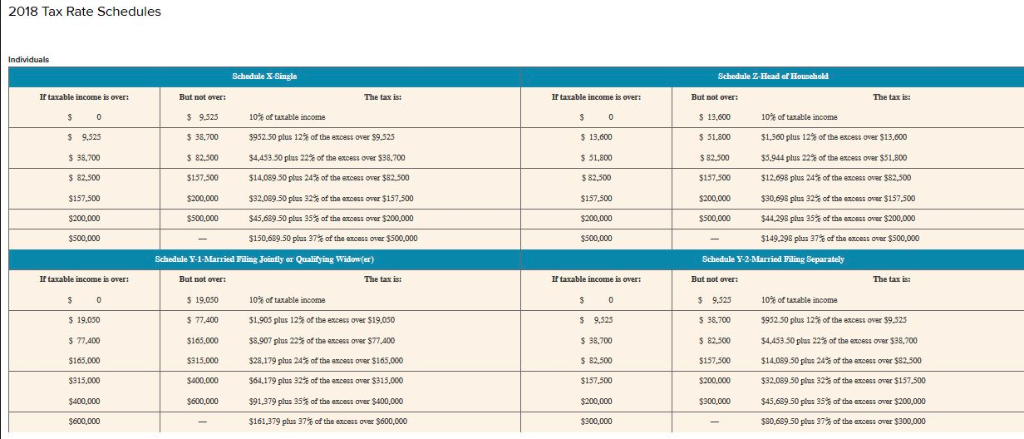

The following information applies to the questions displayed below. Jeremy earned $100,900 in salary and $6,900 in interest income during the year. Jeremy's employer withheld $11,200 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child who lives with him. Jeremy qualifies to file as head of household and has $26,700 in itemized deductions. (Use the tax rate schedules.) a. Determine Jeremy's tax refund or taxes due Description Amount (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (7 Taxable income (8) Income tax liability (9)Child tax credit (10) Tax withholding c. Assume the original facts except that Jeremy had only $7,000 in itemized deductions. What is Jeremy's tax refund or tax due? Description Amount (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (7) Taxable income (8) Income tax liability (9)Child tax credit (10) Tax withholding 2018 Tax Rate Schedules Schedule X Single Schedule Z-Head of Household If tarable income is over: But not over: The tax is If tarable income is over: But pot over: 13,600 51,800 $ 82.500 157.500 $200,000 $500,000 The tar i $ 9.525 S 38,700 S 82,500 157,500 100,000 9.525 38,700 S 82,500 $157.500 10% of taxable income $952.50 plus 12% of the ence" over 30,525 $4,453 50 plus 22% of the eneess over $38.700 $14.08950 ptus 24% of the eteess over S82.500 $32,099.50 plus 32% of the tee" over $157,500 $45,68950 plus 35% of the mess over S20000 $150,539.50 plus 37% of the ances: over $500,000 13,600 51,800 $ 82.500 157,500 200,000 10% of taxable income $1,360 plus 12% of the excess over $13,000 $3.944 plus 22%ofthe excess over$51.800 $12,098 plus 24% of the excess over $82.500 $30,698 plus 32% of tha anten oner $157,500 $44,296 plus 35% of tha ancea nr $200,000 $149.296 plus 37% of tha oooo" o or $500,000 $500,000 Schedule Y-1-Married Filing Jointly or Qualiying Widon(er) Schedule Y-2-Married Filing Separately If tatable income is over The tax is But not over: 19.050 s 77,400 $165.000 315,000 If tatable income is over But pot over The tar is 10% of taxable income $1.905 plus 12% of the excess over $19.050 $8.907 plus 22% of the eness over $77,400 $28.179 plus 24% of the ance" over $165,000 $64,179 plus 32% of the ance" over $315,000 $91,379 plus 35% of the once" over $400,000 $161,379 plus 37% ofthe ence" over $600,000 $ 9.525 S 38,700 82.500 157,500 $200,000 $300,000 $ 9.525 S 38,700 S82,500 157500 10% of taxable income 3952.50 plus 12% of the excess over 39325 $4,453 50 plus 22% of the emess oper S38.700 $14,089.50 plus 24% of the eccess over S82.500 $32,0 89.50 plus 32% of the men oser $157,500 $45,609.50 plus 99% of the toess over $200,000 sa,609.50 plus 37% of the ocess over $300,000 19.050 77.400 315,000 $400,000 600,000 $300,000