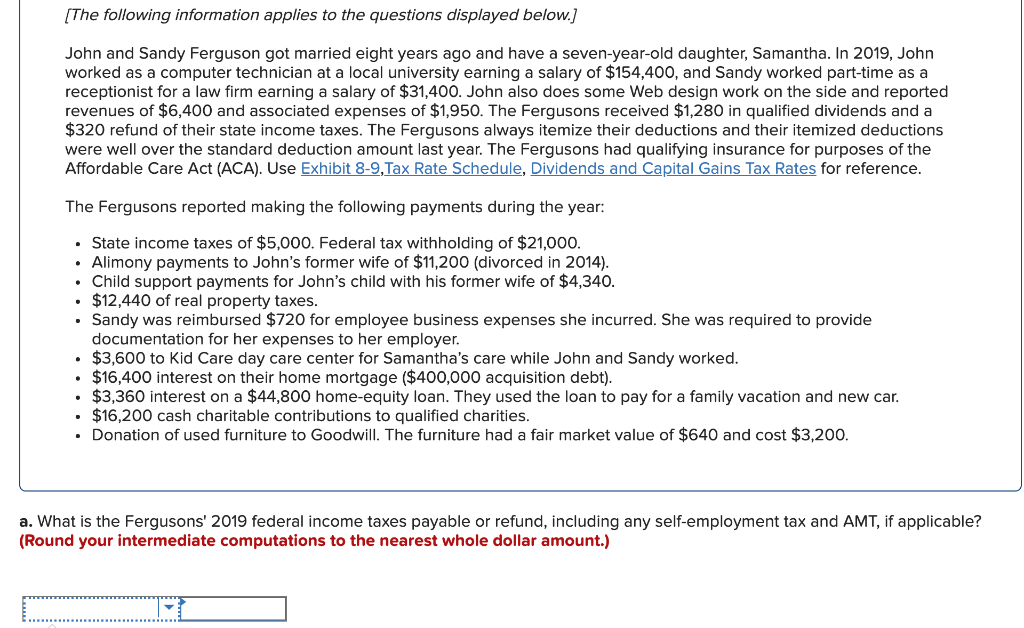

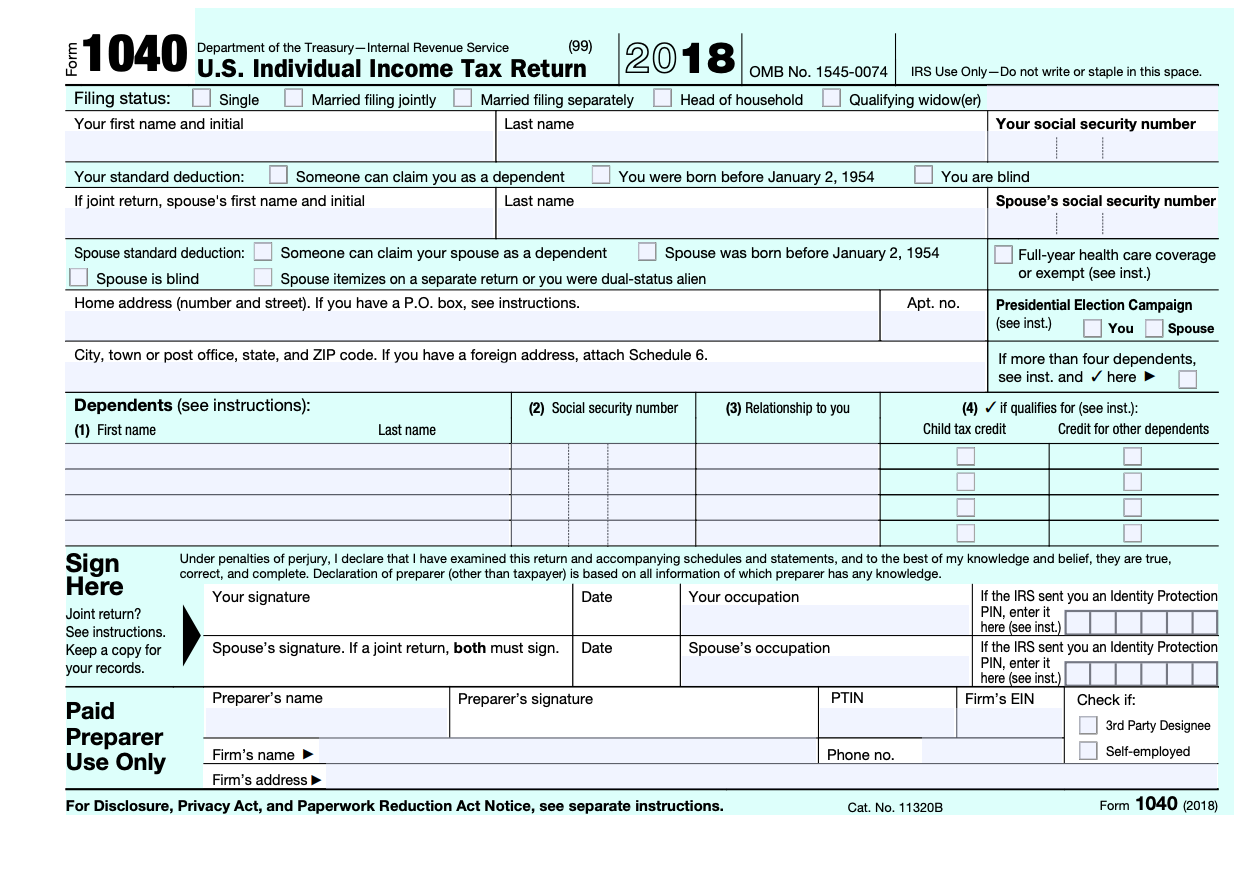

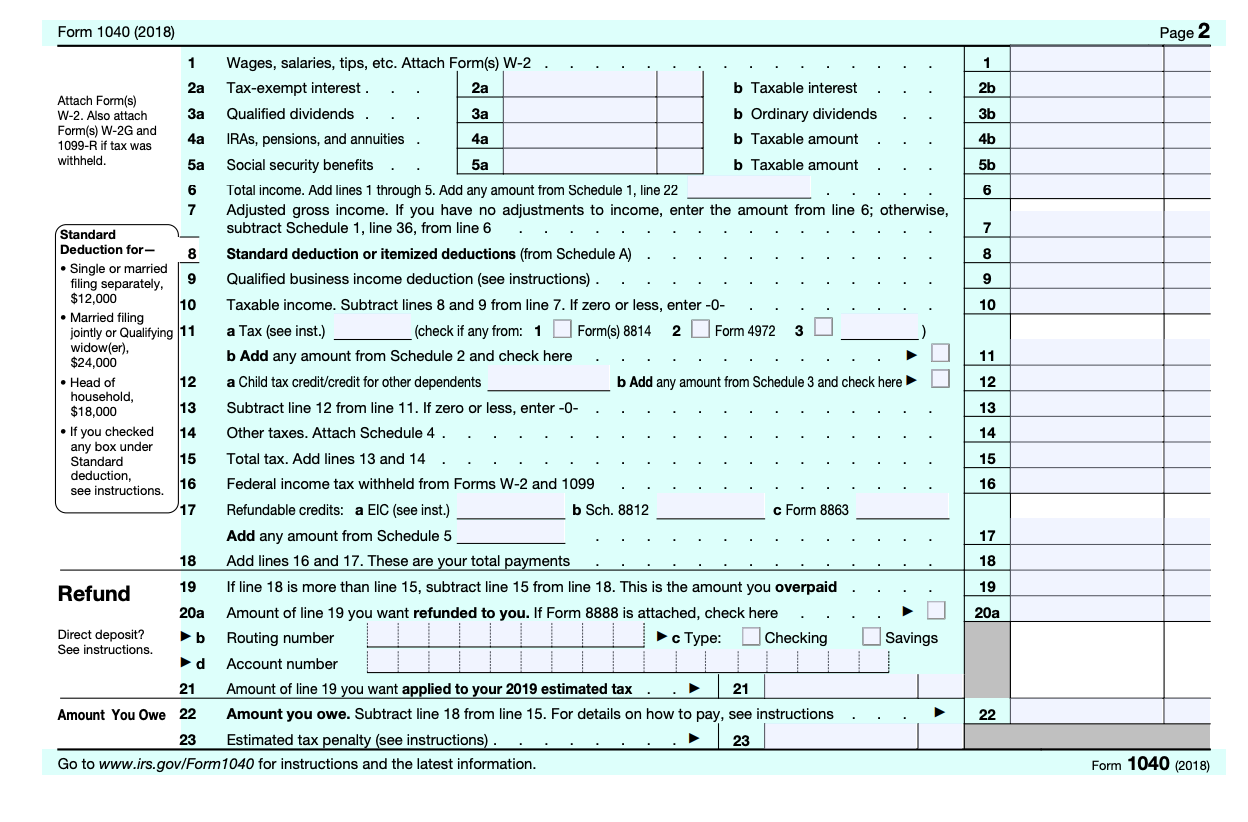

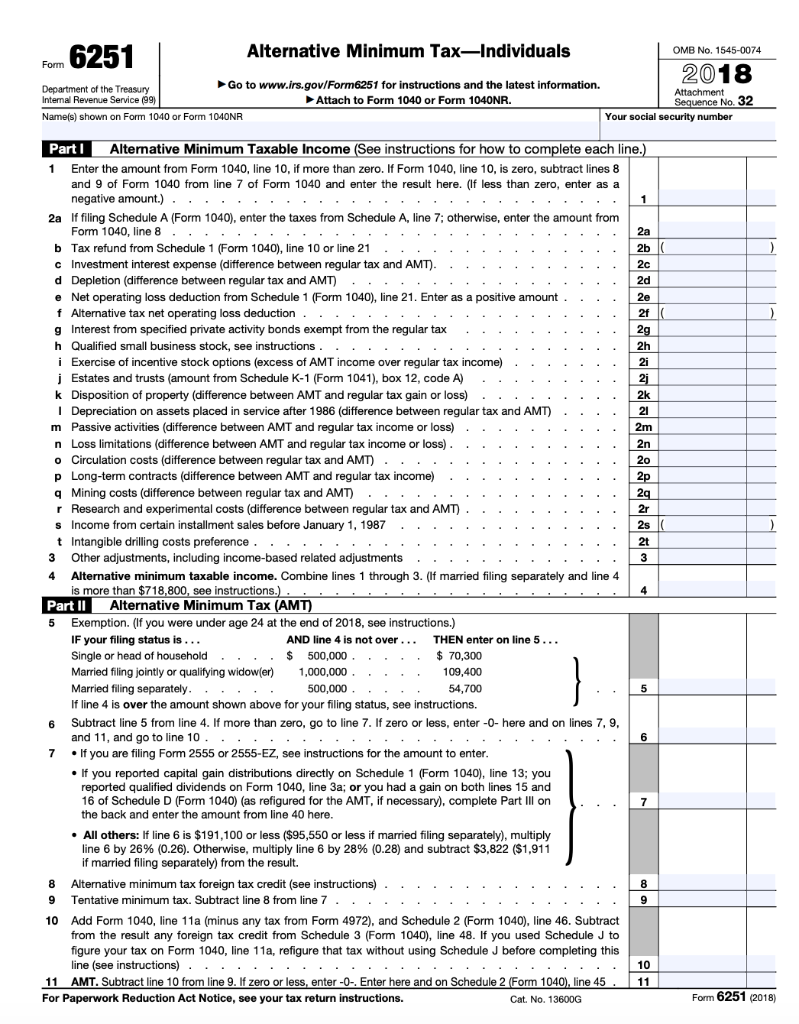

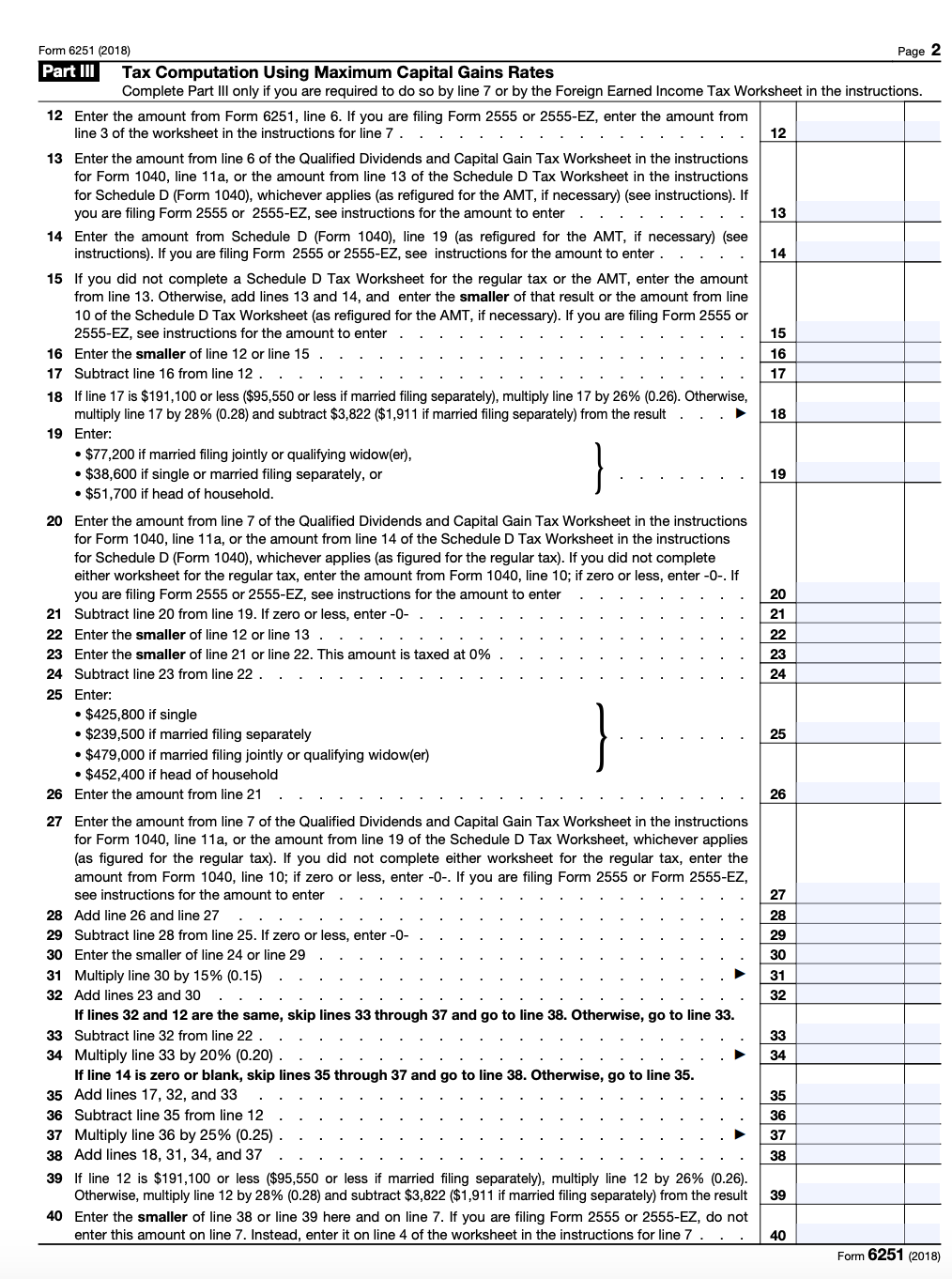

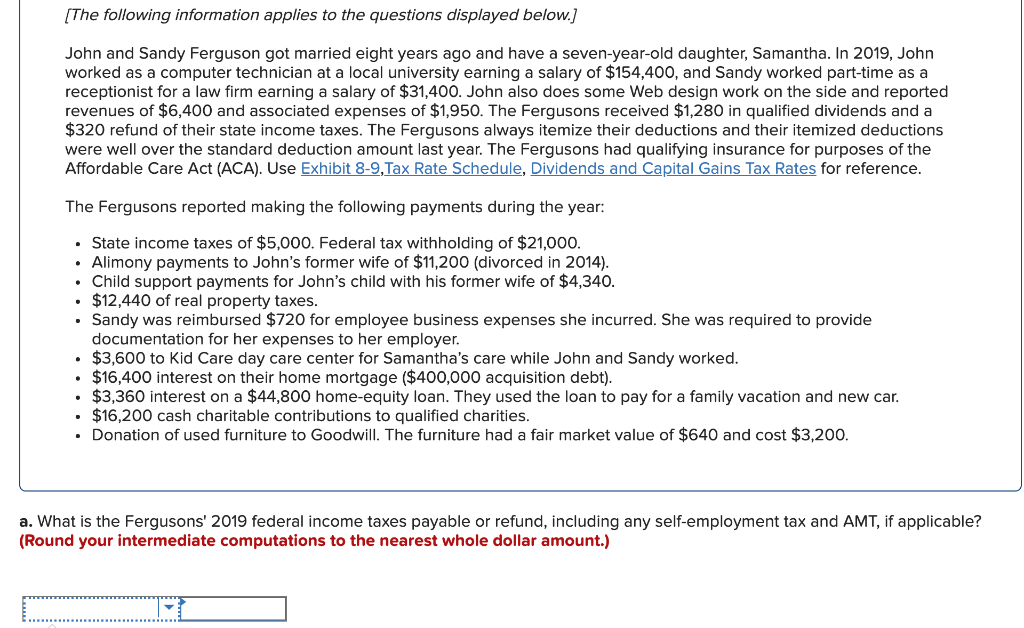

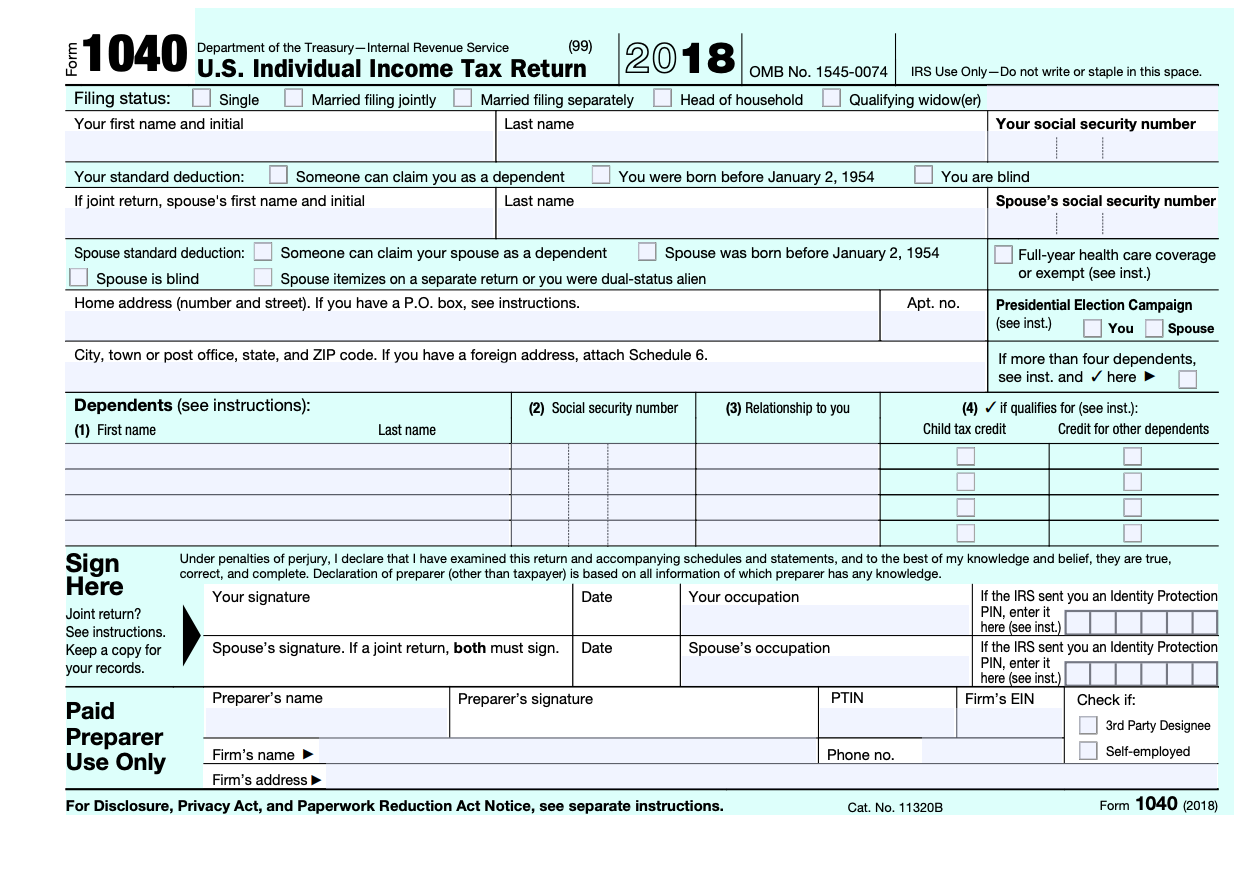

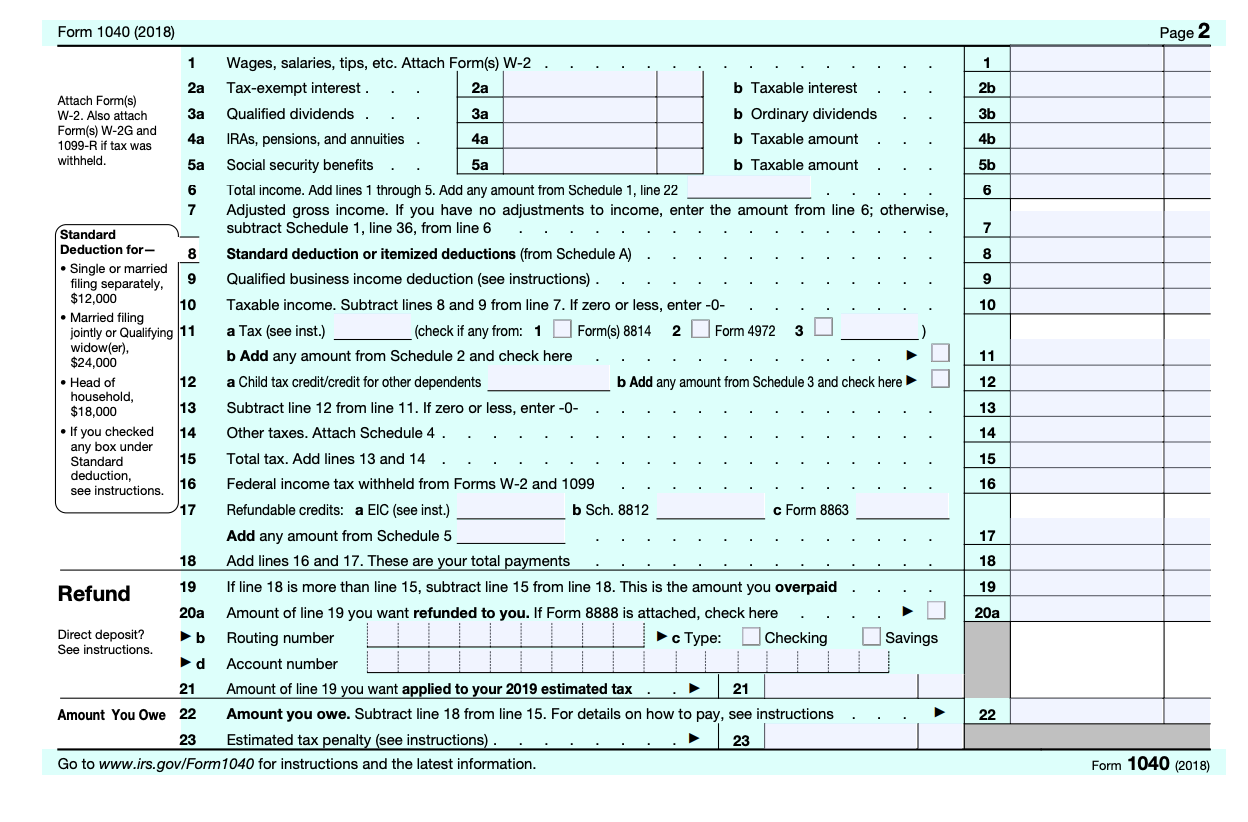

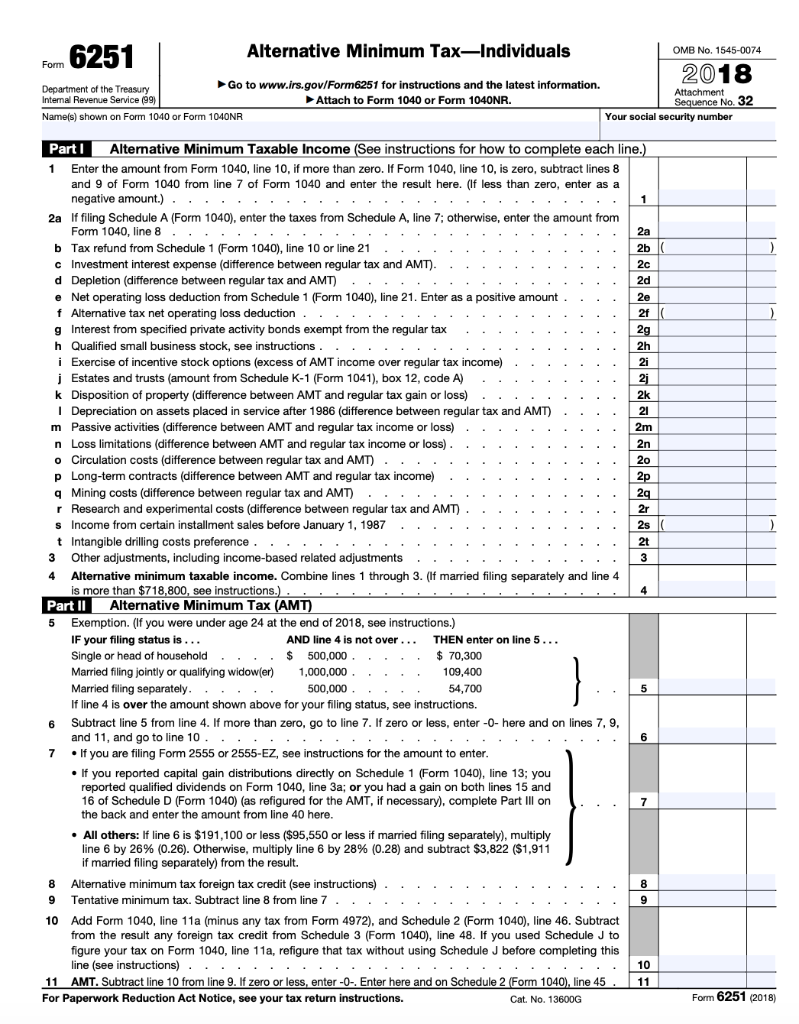

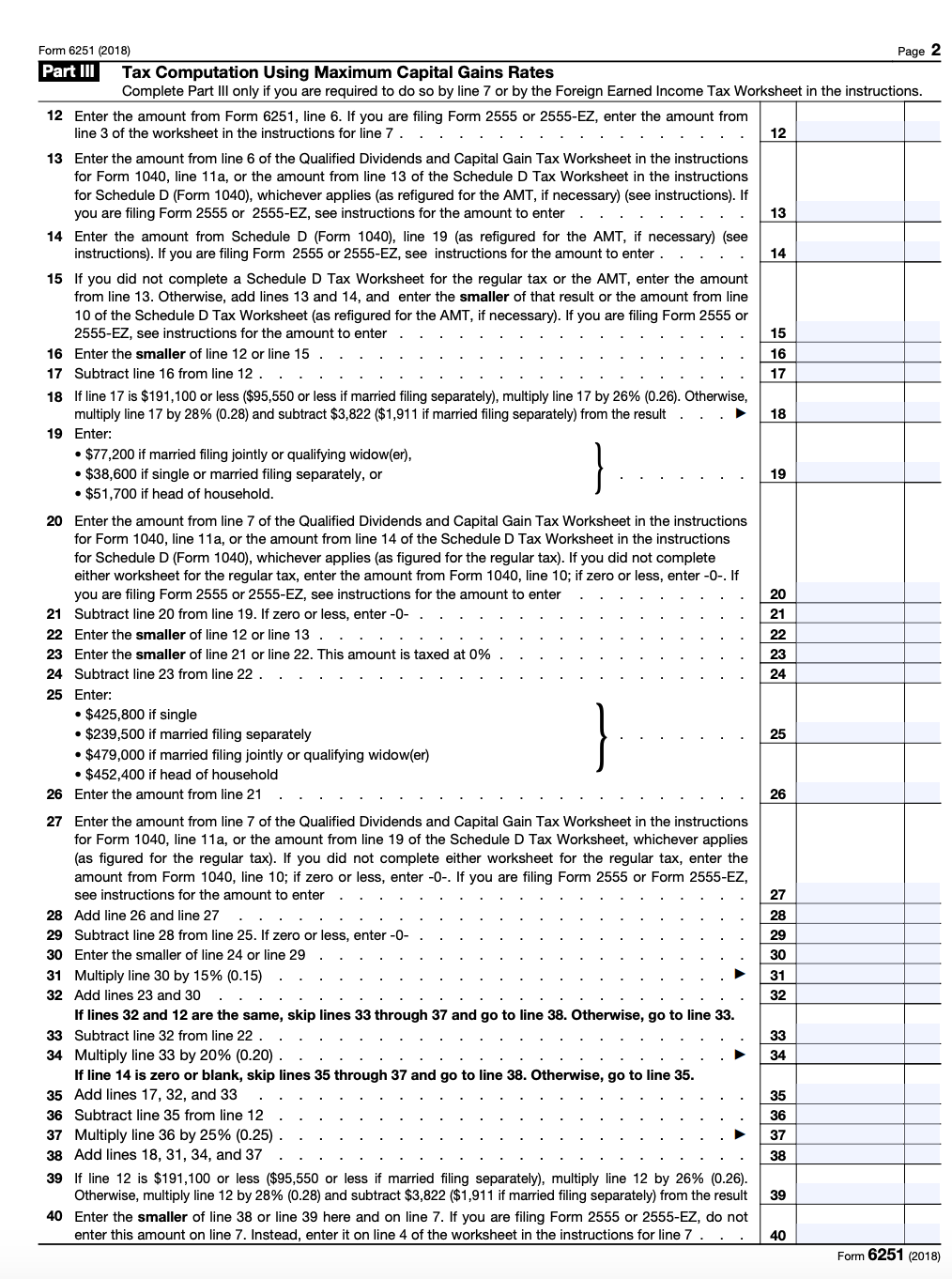

[The following information applies to the questions displayed below. John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2019, John worked as a computer technician at a local university earning a salary of $154,400, and Sandy worked part-time as a receptionist for a law firm earning a salary of $31,400. John also does some Web design work on the side and reported revenues of $6,400 and associated expenses of $1,950. The Fergusons received $1,280 in qualified dividends and a $320 refund of their state income taxes. The Fergusons always itemize their deductions and their itemized deductions were well over the standard deduction amount last year. The Fergusons had qualifying insurance for purposes of the Affordable Care Act (ACA). Use Exhibit 8-9, Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. The Fergusons reported making the following payments during the year: State income taxes of $5,000. Federal tax withholding of $21,000. Alimony payments to John's former wife of $11,200 (divorced in 2014). Child support payments for John's child with his former wife of $4,340. $12,440 of real property taxes. Sandy was reimbursed $720 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. $16,400 interest on their home mortgage ($400,000 acquisition debt). $3,360 interest on a $44,800 home-equity loan. They used the loan to pay for a family vacation and new car. $16,200 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $640 and cost $3,200. a. What is the Fergusons' 2019 federal income taxes payable or refund, including any self-employment tax and AMT, if applicable? (Round your intermediate computations to the nearest whole dollar amount.) 1040 2018 Department of the Treasury-Internal Revenue Service (99) U.S. Individual Income Tax Return Filing status: Single Married filing jointly Married filing separately Your first name and initial Last name OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Head of household Qualifying widow(er) Your social security number You were born before January 2, 1954 Your standard deduction: Someone can claim you as a dependent If joint return, spouse's first name and initial Last name You are blind Spouse's social security number Spouse standard deduction: Someone can claim your spouse as a dependent Spouse was born before January 2, 1954 Spouse is blind Spouse itemizes on a separate return or you were dual-status alien Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Full-year health care coverage or exempt (see inst.) Presidential Election Campaign (see inst.) You Spouse City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6. If more than four dependents, see inst. and here Dependents (see instructions): (1) First name (2) Social security number (3) Relationship to you (4) Vif qualifies for (see inst.): Child tax credit Credit for other dependents Last name Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation If the IRS sent you an Identity Protection Joint return? PIN, enter it here (see inst.) See instructions. Spouse's signature. If a joint return, both must sign. Date Keep a copy for Spouse's occupation If the IRS sent you an Identity Protection PIN, enter it your records. here (see inst.) Preparer's signature PTIN Preparer's name Firm's EIN Check if: Paid 3rd Party Designee Preparer Firm's name Self-employed Phone no. Use Only Firm's address For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2018) Page 2 1 2b 3b 4b 5b 6 7 8 9 $12,000 10 11 12 Form 1040 (2018) 1 Wages, salaries, tips, etc. Attach Form(s) W-2 2a Tax-exempt interest. 2a b Taxable interest Attach Form(s) W-2. Also attach Qualified dividends. b Ordinary dividends Form(s) W-2G and 4a 4a IRAs, pensions, and annuities 1099-R if tax was b Taxable amount withheld. 5a Social security benefits 5a b Taxable amount 6 Total income. Add lines 1 through 5. Add any amount from Schedule 1, line 22 7 Adjusted gross income. If you have no adjustments to income, enter the amount from line 6; otherwise, Standard subtract Schedule 1, line 36, from line 6 Deduction for- 8 Standard deduction or itemized deductions (from Schedule A) Single or married filing separately, 9 Qualified business income deduction (see instructions) 10 Taxable income. Subtract lines 8 and 9 from line 7. If zero or less, enter-O- Married filing jointly or Qualifying 11 a Tax (see inst.) (check if any from: 1 Form(s) 8814 2 Form 4972 3 widow(er), $24,000 b Add any amount from Schedule 2 and check here Head of 112 a Child tax credit/credit for other dependents b Add any amount from Schedule 3 and check here household, 13 Subtract line 12 from line 11. If zero or less, enter -0- If you checked 14 Other taxes. Attach Schedule 4. any box under Standard 15 Total tax. Add lines 13 and 14 deduction, 16 Federal income tax withheld from Forms W-2 and 1099 see instructions. 17 Refundable credits: a EIC (see inst.) b Sch. 8812 c Form 8863 Add any amount from Schedule 5 18 Add lines 16 and 17. These are your total payments 19 Refund If line 18 is more than line 15, subtract line 15 from line 18. This is the amount you overpaid 20a Amount of line 19 you want refunded to you. If Form 8888 is attached, check here Direct deposit? b Routing number c Type: Checking Savings See instructions. d Account number 21 Amount of line 19 you want applied to your 2019 estimated tax 21 Amount You Owe 22 Amount you owe. Subtract line 18 from line 15. For details on how to pay, see instructions 23 Estimated tax penalty (see instructions) 23 Go to www.irs.gov/Form 1040 for instructions and the latest information. $18,000 13 14 15 16 17 18 19 20a 22 Form 1040 (2018) 6251 Alternative Minimum Tax-Individuals OMB No. 1545-0074 Form Department of the Treasury Go to www.irs.gov/Form 6251 for instructions and the latest information. Attachment Internal Revenue Service (99) Attach to Form 1040 or Form 1040NR. Sequence No. 32 Name(s) shown on Form 1040 or Form 1040NR Your social security number 2018 2k 2p 2 21 25 Part 1 Alternative Minimum Taxable income (See instructions for how to complete each line.) 1 Enter the amount from Form 1040, line 10, if more than zero. If Form 1040, line 10, is zero, subtract lines 8 and 9 of Form 1040 from line 7 of Form 1040 and enter the result here. (If less than zero, enter as a negative amount.). 1 2a If filing Schedule A (Form 1040), enter the taxes from Schedule A, line 7; otherwise, enter the amount from Form 1040, line 8 2a Form meo b Tax refund from Schedule 1 (Form 1040), line 10 or line 21 2b c Investment interest expense (difference between regular tax and AMT). 2c d Depletion (difference between regular tax and AMT) 2d e Net operating loss deduction from Schedule 1 (Form 1040), line 21. Enter as a positive amount 2e f Alternative tax net operating loss deduction 2f g Interest from specified private activity bonds exempt from the regular tax 29 h Qualified small business stock, see instructions 2h i Exercise of incentive stock options (excess of AMT income over regular tax income) 2i Estates and trusts (amount from Schedule K-1 (Form 1041), box 12, code A) 2j k Disposition of property (difference between AMT and regular tax gain or loss) | Depreciation on assets placed in service after 1986 (difference between regular tax and AMT) 21 m Passive activities (difference between AMT and regular tax income or loss) 2m n Loss limitations (difference between AMT and regular tax income or loss). 2n o Circulation costs (difference between regular tax and AMT) 20 p Long-term contracts (difference between AMT and regular tax income) Mining costs (difference between regular tax and AMT). 20 29. r Research and experimental costs (difference between regular tax and AMT) s Income from certain installment sales before January 1, 1987 t Intangible drilling costs preference 2t 3 Other adjustments, including income-based related adjustments 3 4 Alternative minimum taxable income. Combine lines 1 through 3. (If married filing separately and line 4 is more than $718,800, see instructions.) Alternative Minimum Tax (AMT) 5 Exemption. (If you were under age 24 at the end of 2018, see instructions.) IF your filing status is... AND line 4 is not over... THEN enter on line 5... Single or head of household $ 500,000 $ 70,300 Married filing jointly or qualifying widow(er) 1,000,000 109,400 Married filing separately. 500,000 54,700 If line 4 is over the amount shown above for your filing status, see instructions. 6 Subtract line 5 from line 4. If more than zero, go to line 7. If zero or less, enter-O- here and on lines 7, 9, and 11, and go to line 10.. 6 7 If you are filing Form 2555 or 2555-EZ, see instructions for the amount to enter. If you reported capital gain distributions directly on Schedule 1 (Form 1040), line 13; you reported qualified dividends on Form 1040, line 3a; or you had a gain on both lines 15 and 16 of Schedule D (Form 1040) (as refigured for the AMT, if necessary), complete Part III on 7 the back and enter the amount from line 40 here. . All others: If line 6 is $191,100 or less ($95,550 or less if married filing separately), multiply line 6 by 26% (0.26). Otherwise, multiply line 6 by 28% (0.28) and subtract $3,822 ($1,911 if married filing separately) from the result. 8 Alternative minimum tax foreign tax credit (see instructions) Tentative minimum tax. Subtract line 8 from line 7.. 9 10 Add Form 1040, line 11a (minus any tax from Form 4972), and Schedule 2 (Form 1040), line 46. Subtract from the result any foreign tax credit from Schedule 3 (Form 1040), line 48. If you used Schedule J to figure your tax on Form 1040, line 11a, refigure that tax without using Schedule J before completing this line (see instructions) ........................... 10 11 AMT. Subtract line 10 from line 9. If zero or less, enter-O-. Enter here and on Schedule 2 (Form 1040), line 45 11 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 13600G 4 Part II 5 8 Form 6251 (2018) Form 6251 (2018) Page 2 Part III Tax Computation Using Maximum Capital Gains Rates Complete Part III only if you are required to do so by line 7 or by the Foreign Earned Income Tax Worksheet in the instructions. 12 Enter the amount from Form 6251, line 6. If you are filing Form 2555 or 2555-Ez, enter the amount from line 3 of the worksheet in the instructions for line 7. 12 13 Enter the amount from line 6 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 11a, or the amount from line 13 of the Schedule D Tax Worksheet in the instructions for Schedule D (Form 1040), whichever applies (as refigured for the AMT, if necessary) (see instructions). If you are filing Form 2555 or 2555-EZ, see instructions for the amount to enter. 13 14 Enter the amount from Schedule D (Form 1040), line 19 (as refigured for the AMT, if necessary) (see instructions). If you are filing Form 2555 or 2555-EZ, see instructions for the amount to enter. 14 15 If you did not complete a Schedule D Tax Worksheet for the regular tax or the AMT, enter the amount from line 13. Otherwise, add lines 13 and 14, and enter the smaller of that result or the amount from line 10 of the Schedule D Tax Worksheet (as refigured for the AMT, if necessary). If you are filing Form 2555 or 2555-EZ, see instructions for the amount to enter 15 16 Enter the smaller of line 12 or line 15. 16 17 Subtract line 16 from line 12. 17 18 If line 17 is $191,100 or less ($95,550 or less if married filing separately), multiply line 17 by 26% (0.26). Otherwise, multiply line 17 by 28% (0.28) and subtract $3,822 ($1,911 if married filing separately) from the result 18 19 Enter: $77,200 if married filing jointly or qualifying widow(er), $38,600 if single or married filing separately, or 19 $51,700 if head of household. 20 Enter the amount from line 7 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 11a, or the amount from line 14 of the Schedule D Tax Worksheet in the instructions for Schedule D (Form 1040), whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040, line 10; if zero or less, enter-O-. If you are filing Form 2555 or 2555-EZ, see instructions for the amount to enter 20 21 Subtract line 20 from line 19. If zero or less, enter-O- 21 22 Enter the smaller of line 12 or line 13 22 23 Enter the smaller of line 21 or line 22. This amount is taxed at 0% 23 24 Subtract line 23 from line 22. 24 25 Enter: $425,800 if single $239,500 if married filing separately 25 $479,000 if married filing jointly or qualifying widow(er) $452,400 if head of household 26 Enter the amount from line 21 26 27 Enter the amount from line 7 of the Qualified Dividends and Capital Gai Worksheet nstructions for Form 1040, line 11a, or the amount from line 19 of the Schedule D Tax Worksheet, whichever applies (as figured for the regular tax). If you did not complete either worksheet for the regular tax, enter the amount from Form 1040, line 10; if zero or less, enter -O-. If you are filing Form 2555 or Form 2555-EZ, see instructions for the amount to enter 27 28 Add line 26 and line 27 28 29 Subtract line 28 from line 25. If zero or less, enter-O- 29 30 Enter the smaller of line 24 or line 29 30 31 Multiply line 30 by 15% (0.15) 31 32 Add lines 23 and 30 32 If lines 32 and 12 are the same, skip lines 33 through 37 and go to line 38. Otherwise, go to line 33. 33 Subtract line 32 from line 22. 33 34 Multiply line 33 by 20% (0.20) 34 If line 14 is zero or blank, skip lines 35 through 37 and go to line 38. Otherwise, go to line 35. 35 Add lines 17, 32, and 33 35 36 Subtract line 35 from line 12 36 37 Multiply line 36 by 25% (0.25) 37 38 Add lines 18, 31, 34, and 37 38 39 If line 12 is $191,100 or less ($95,550 or less if married filing separately), multiply line 12 by 26% (0.26). Otherwise, multiply line 12 by 28% (0.28) and subtract $3,822 ($1,911 if married filing separately) from the result 39 40 Enter the smaller of line 38 or line 39 here and on line 7. If you are filing Form 2555 or 2555-EZ, do not enter this amount on line 7. Instead, enter it on line 4 of the worksheet in the instructions for line 7. 40 Form 6251 (2018) }