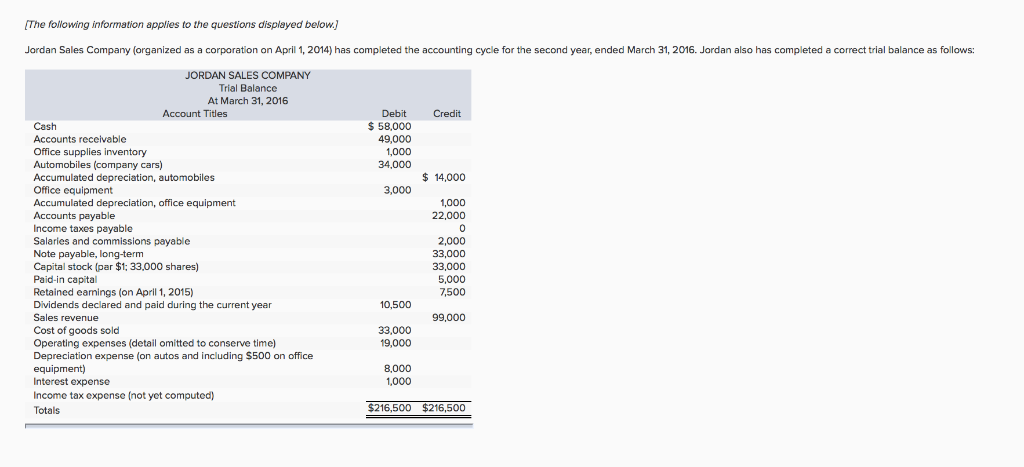

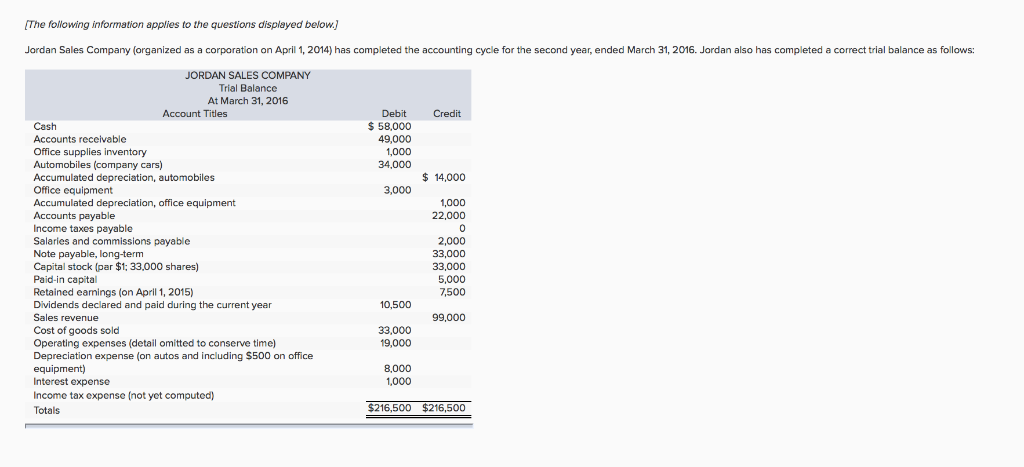

The following information applies to the questions displayed below Jordan Sales Company (organized as a corporation on April 1, 2014) has completed the accounting cycle for the second year, ended March 31, 2016. Jordan also has completed a correct trial balance as follows: JORDAN SALES COMPANY Trial Balance At March 31, 2016 Debit 58,000 49,000 1,000 34,000 Credit Accounts reccivable Office supplies inventory Automobiles (company cars) Accumulated depreciation, automobiles Office equipment Accumulated depreciatian, office equipment Accounts payable Income taxes payable Salaries and commissions payable Note payable, long-term Capital stock (par $1: 33,000 shares) Paid-in capital Retained eamings (on April 1, 2015) Dividends declared and paid during the current year Sales revenue Cost of goods sold Operating expenses (detail omitted to conserve time) Depreciation expense (on autos and including S500 on office equipment) Interest expense Income tax expense (not yet computed) Totals $14,000 3,000 1,000 2,000 33,000 5,000 7,500 10,500 33,000 19,000 8,000 1,000 $216,500 $216,500 b. Classified balance sheet at the end of the reporting year, March 31, 2016. Include (1 income taxes for the current year in Income Taxes payable and (2) dividends in Retained eamings. (Amounts to be deducted should be indicated by a minus sign.) Balance Sheet The following information applies to the questions displayed below Jordan Sales Company (organized as a corporation on April 1, 2014) has completed the accounting cycle for the second year, ended March 31, 2016. Jordan also has completed a correct trial balance as follows: JORDAN SALES COMPANY Trial Balance At March 31, 2016 Debit 58,000 49,000 1,000 34,000 Credit Accounts reccivable Office supplies inventory Automobiles (company cars) Accumulated depreciation, automobiles Office equipment Accumulated depreciatian, office equipment Accounts payable Income taxes payable Salaries and commissions payable Note payable, long-term Capital stock (par $1: 33,000 shares) Paid-in capital Retained eamings (on April 1, 2015) Dividends declared and paid during the current year Sales revenue Cost of goods sold Operating expenses (detail omitted to conserve time) Depreciation expense (on autos and including S500 on office equipment) Interest expense Income tax expense (not yet computed) Totals $14,000 3,000 1,000 2,000 33,000 5,000 7,500 10,500 33,000 19,000 8,000 1,000 $216,500 $216,500 b. Classified balance sheet at the end of the reporting year, March 31, 2016. Include (1 income taxes for the current year in Income Taxes payable and (2) dividends in Retained eamings. (Amounts to be deducted should be indicated by a minus sign.) Balance Sheet