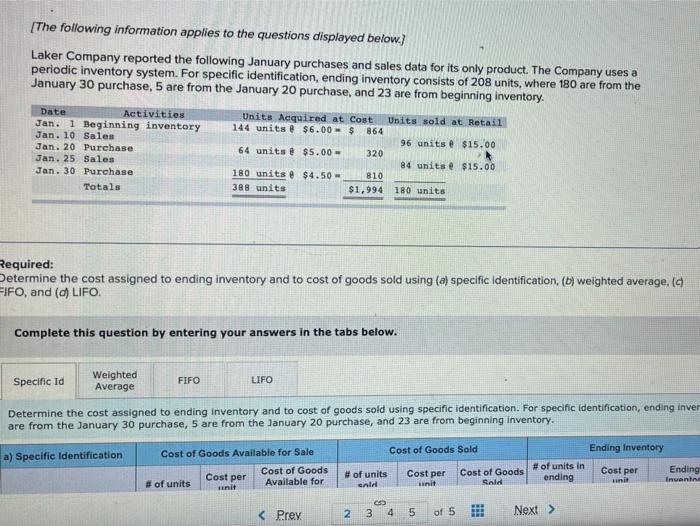

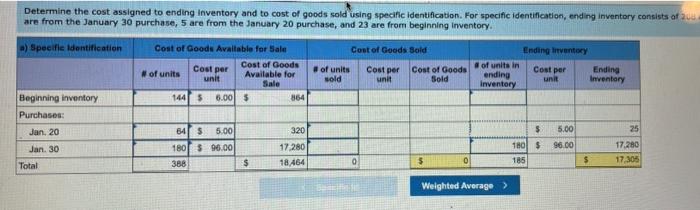

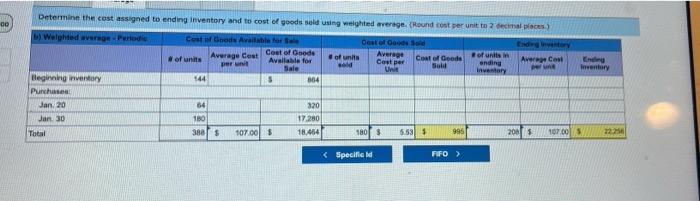

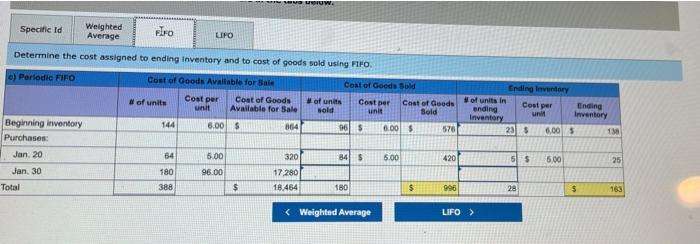

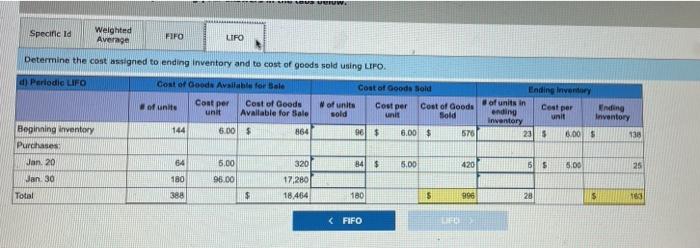

[The following information applies to the questions displayed below.) Laker Company reported the following January purchases and sales data for its only product. The Company uses a periodic inventory system. For specific identification, ending inventory consists of 208 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 23 are from beginning inventory. Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Jan. 20 Purchase Jan. 25 Sales Jan. 30 Purchase Totals Units Acquired at Cost Units sold at Retail 144 units @ $6.00 - $ 864 96 units @ $15.00 64 units @ $5.00 - 320 84 units e $15.00 180 units @ $4.50 810 388 units $1,994 180 units Required: Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average. (c FIFO, and () LIFO. Complete this question by entering your answers in the tabs below. Specific Id Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using specific identification. For specific identification, ending inver are from the January 30 purchase, 5 are from the January 20 purchase, and 23 are from beginning Inventory. Cost of Goods Available for Sale Cost of Goods Sold a) Specific Identification Ending Inventory Cost per Cost of Goods Available for Cost per # of units end Cost of Goods Sold # of units in ending Cost per unit Ending Invent # of units unit tinit Determine the cost assigned to ending Inventory and to cost of goods sold using specific identification. For specific identification, ending inventory consists of 2 are from the January 30 purchase, 5 are from the January 20 purchase, and 23 are from beginning inventory. Specifice Identification Cost of Goods Available for Sale Cost per Cost of Goods # of units unit Available for Sale 144 5 6.00 5 864 Cost of Goods Sold Ending Inventory of units Cost per Cost of Goode of units in Ending sold unit ending Sold unit Inventory Inventory Cost per Beginning inventory Purchases: Jan. 20 $ 5.00 25 84 5 5.00 180 S 96.00 388 320 17.280 18.464 Jan. 30 Total 96.00 17.280 180 $ 185 $ 0 0 $ 17.305 Weighted Average > 00 Eng Inventory Determine the cost assigned to ending inventory and to cost of goods sold using weighted average (Round cont per unit to 2 decimal places b) Weighted avere Purladie Contenede Available for Castell de bord Endlestory Coat of Goode Average Cest of units Average of units of units Available for Cost per Cont of Goods Avere Cast pert ending Sale Une Sold Inventory Beginning inventory 144 5 064 Purchase Jan, 20 64 320 Jan 30 130 17.280 Total 3805 10700 5 18.454 180 6.535 996 20 5 107.00 2220 Sw. Specific Id Weighted Average FIFO LIPO Determine the cost assigned to ending Inventory and to cost of goods sold using FIFO e) Periodic FIFO Cost of Goods Available for Sale Cost per Cost of Goods of units unit Available for Sale 144 8.00 364 Coat of Goods Bold Ending Inventory of units Cost per Cost of Goods of units in Cost per wold Ending unit ending Sold unit Inventory Inventory 965 6.00 $ 570 225 6.00 5 138 Beginning inventory Purchases: Jan. 20 Jan, 30 Total 14 84 5 5.00 420 5 s 5.00 25 5.00 96.00 180 388 320 17.280 18.464 $ 180 $ 996 28 $ 163 UW. Specific Id Weighted Average FIFO LIFO Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. d) Periodic LIFO Cont of Goods Available for Sale Cost of Goods of units unit Available for Sale Cost per Cost of Goods Sold Ending Inventory W of units Cost per Cost of Goode of units in Cest per King sold unit Sold endir unit Inventory Inventory 90$ 6.00 $ 570 235 6.00 $ 938 144 6.00 $ 164 Beginning inventory Purchases Jan. 20 320 84 $ 5.00 420 65 16.00 25 64 180 388 5,00 95.00 Jan 30 17,280 18.464 Total $ 180 $ 996 28 5 10