Question

The following information applies to the questions displayed below.] Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In

The following information applies to the questions displayed below.]

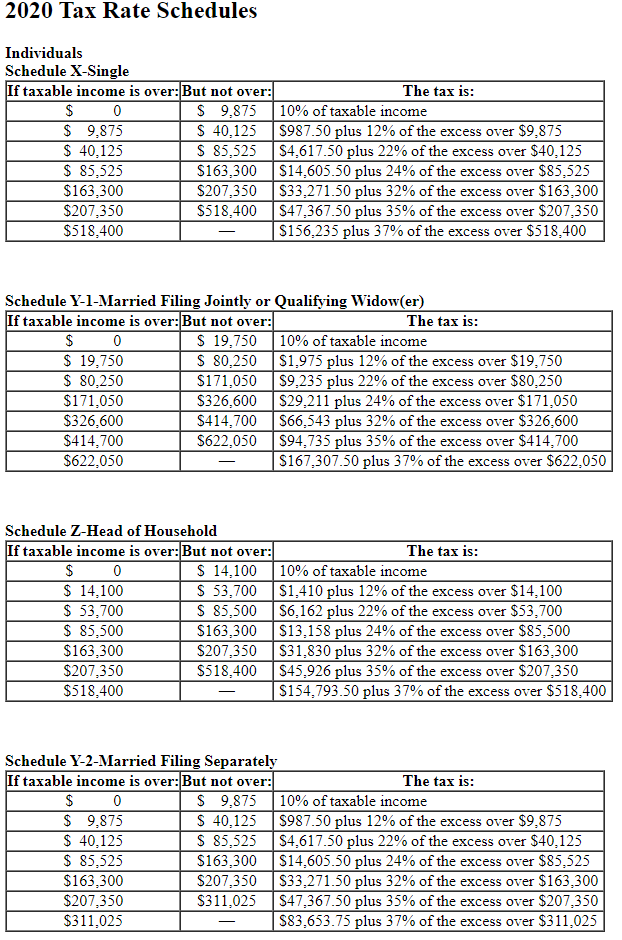

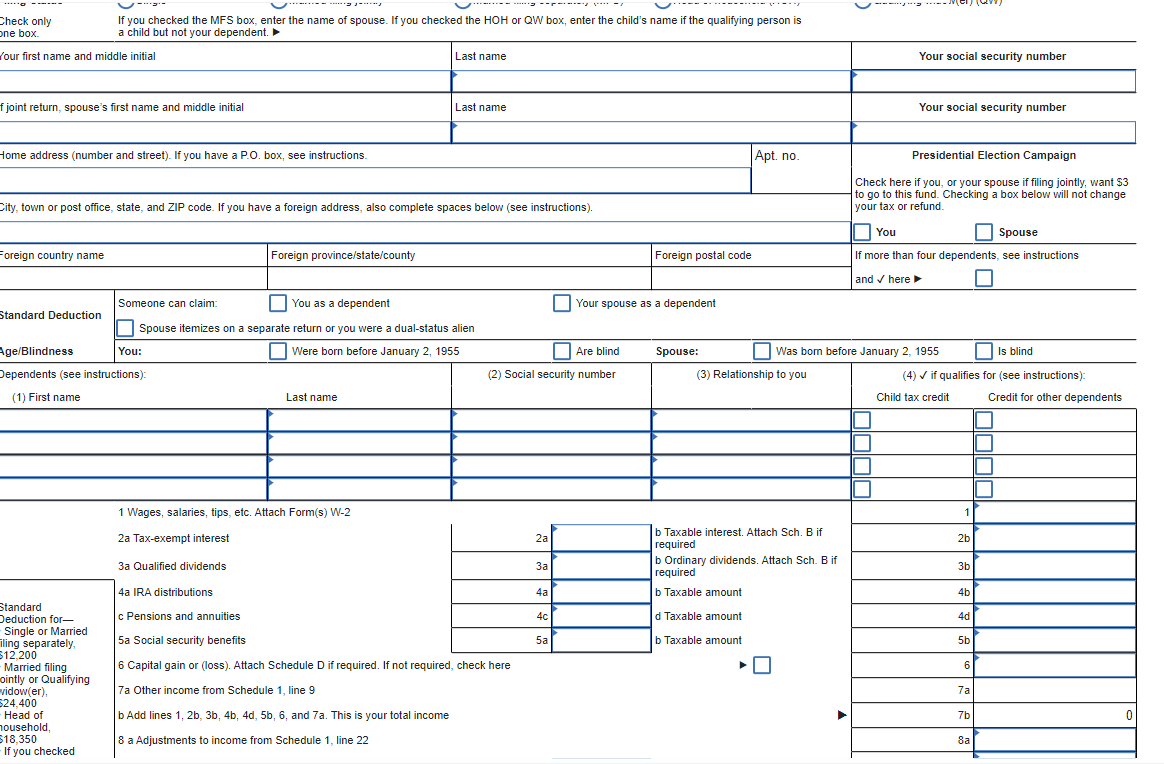

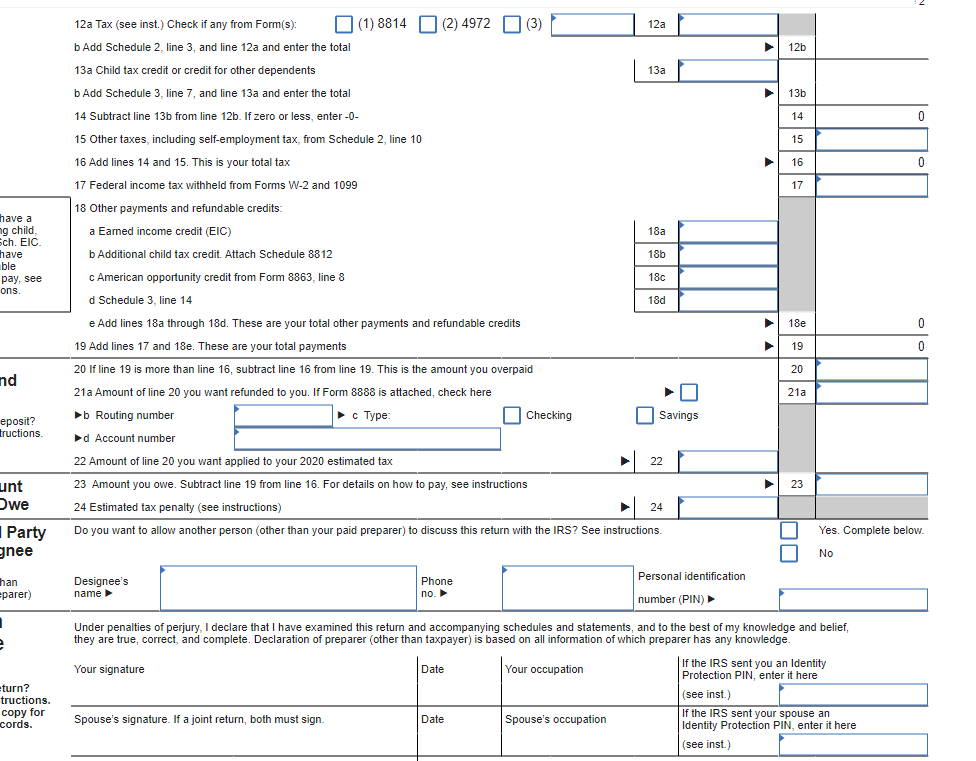

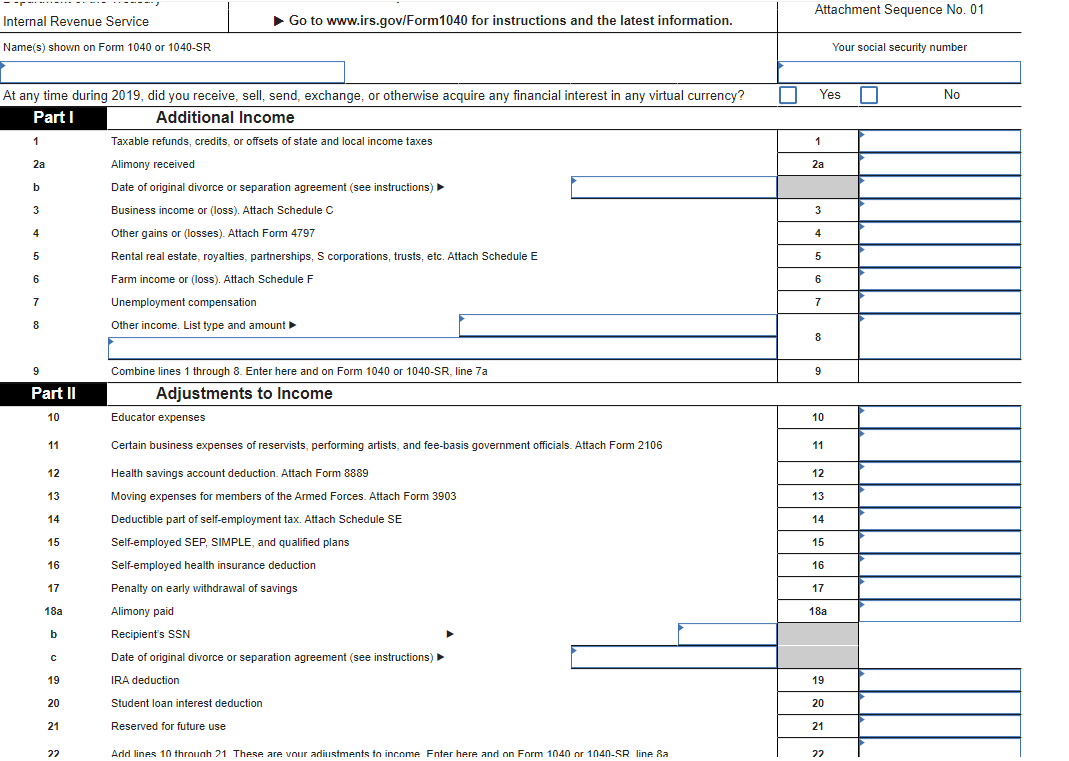

Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to an individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2005). Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire year. Thus, Marc and Michelle are allowed to claim a $2,000 child tax credit for Matthew. Marc and Michelle paid $6,000 of expenditures that qualify as itemized deductions and they had a total of $3,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules.)

Complete Marc and Michelles Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form available). Marc and Michelles address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: Marc Taxpayer: 111-22-3333 Michelle Taxpayer: 222-33-4444 Matthew Taxpayer: 333-44-5555 Prior Spouse 111-11-1111 (Input all the values as positive numbers. Enter any non-financial information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Do not skip rows, while entering in Deductions section of Form 1040 PG1. The refundable portion of the Child Tax Credit is $1,400. Use 2020 tax laws and 2019 tax form. ) Neither Marc nor Michelle wish to contribute to the Presidential Election Campaign fund.

2020 Tax Rate Schedules Individuals Srhadnlo X_Sinalo Srhadulo V_1_Marriad Filina .Tointlv or Oualifvina Widnw(ar) If you checked the MFS box, enter the name of spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person is a child but not your dependent. 12 a Tax (see inst.) Check if any from Form(s): (1) 8814 (2) 4972 (3) b Add Schedule 2 , line 3 , and line 12 and enter the total 13 a Child tax credit or credit for other dependents b Add Schedule 3 , line 7 , and line 13 and enter the total 14 Subtract line 13b from line 12b. If zero or less, enter -0 - 15 Other taxes, including self-employment tax, from Schedule 2, line 10 16 Add lines 14 and 15. This is your total tax 17 Federal income tax withheld from Forms W-2 and 1099 18 Other payments and refundable credits: a Earned income credit (EIC) b Additional child tax credit. Attach Schedule 8812 c American opportunity credit from Form 8863 , line 8 d Schedule 3 , line 14 e Add lines 18 a through 18d. These are your total other payments and refundable credits 19 Add lines 17 and 18e. These are your total payments 20 If line 19 is more than line 16 , subtract line 16 from line 19 . This is the amount you overpaid 21 amount of line 20 you want refunded to you. If Form 8888 is attached, check here b Routing number 22 Amount of line 20 you want applied to your 2020 estimated tax 23 Amount you owe. Subtract line 19 from line 16 . For details on how to pay, see instructions 24 Estimated tax penalty (see instructions) Do you want to allow another person (other than your paid preparer) to discuss this return with the IRS? See instructions. Yes. Complete below. gnee No Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. \begin{tabular}{l|l|l|} \hline Internal Revenue Service & Go to www.irs.gov/Form1040 for instructions and the latest information. \\ \hline Name(s) shown on Form 1040 or 1040 SR \\ \hline \end{tabular} At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Part I Additional Income 12ab345Taxablerefunds,credits,oroffsetsofstateandlocalincometaxesAlimonyreceivedDateoforiginaldivorceorseparationagreement(seeinstructions)Businessincomeor(loss).AttachScheduleCOthergainsor(losses).AttachForm4797Rentalrealestate,royalties,partnerships,Scorporations,trusts,etc.AttachScheduleE 6 Farm income or (loss). Attach Schedule F 7 Unemployment compensation 8 9 Combine lines 1 through 8 . Enter here and on Form 1040 or 1040SR, line 7 a \begin{tabular}{|c|c|c|} \hline \multirow{2}{*}{} & 1 & \\ \cline { 2 - 3 } & 2a & \\ \hline & & \\ \hline \multirow{5}{*}{} & 3 & \\ \hline & 4 & \\ \hline & 5 & \\ \hline & 6 & \\ \hline & 7 & \\ \hline & 8 & \\ \hline & 9 & \\ \hline \end{tabular} Part II Adjustments to Income 10 Educator expenses 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 12 Health savings account deduction. Attach Form 8889 13 Moving expenses for members of the Armed Forces. Attach Form 3903 14 Deductible part of self-employment tax. Attach Schedule SE 15 Self-employed SEP, SIMPLE, and qualified plans 16 Self-employed health insurance deduction 17 Penalty on early withdrawal of savings 18a Alimony paid b Recipient's SSN c Date of original divorce or separation agreement (see instructions) - 19 IRA deduction 20 Student loan interest deduction 21 Reserved for future use 22 Add lines 10 through 21 These are vour adiustments to inconme Fnter here and on Form 1040 or 1040SR line 8a \begin{tabular}{|l|l|} \hline 10 & \\ \hline 11 & \\ \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & \\ \hline 18a & \\ \hline & \\ \hline & \\ \hline 19 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started