Answered step by step

Verified Expert Solution

Question

1 Approved Answer

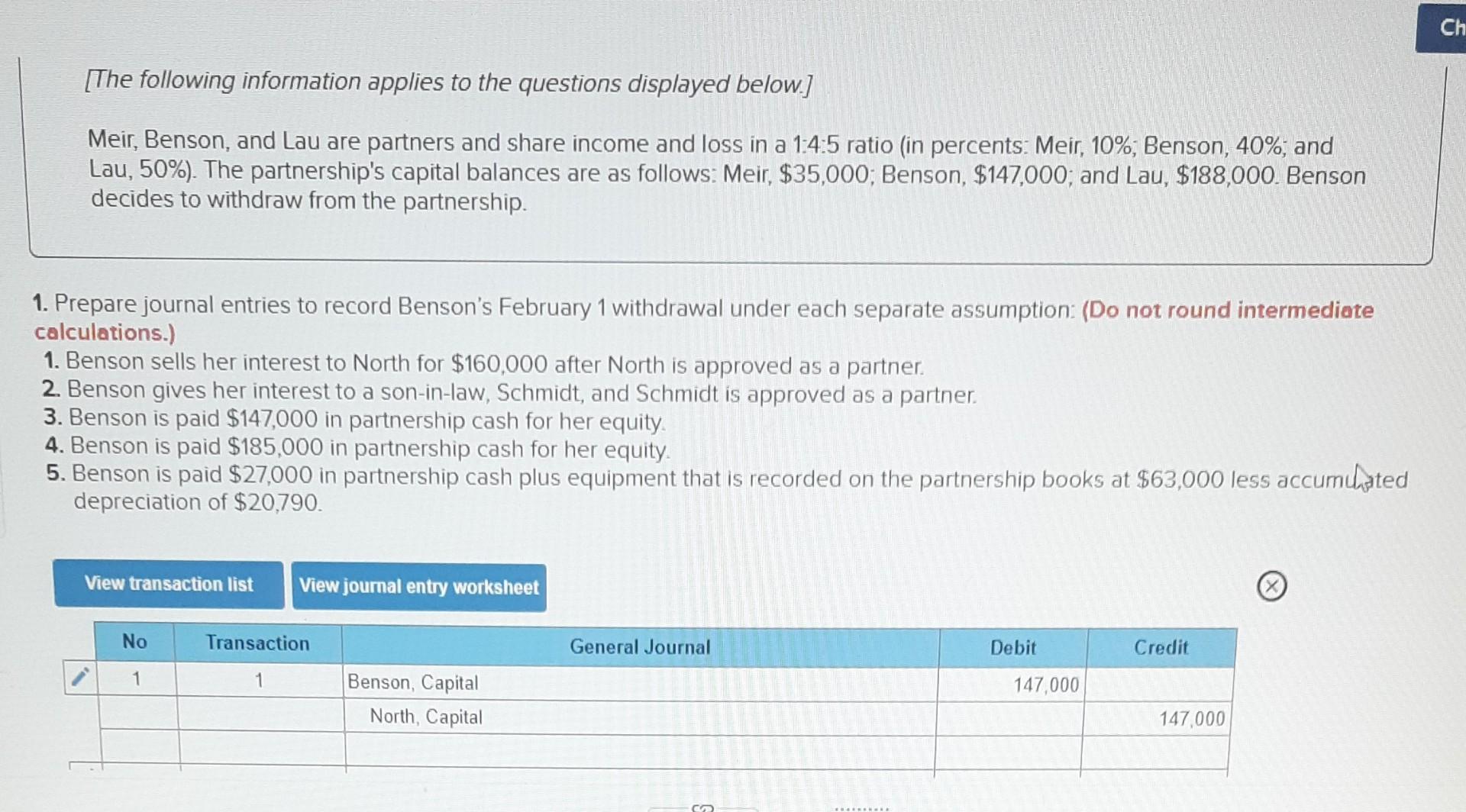

[The following information applies to the questions displayed below.] Meir, Benson, and Lau are partners and share income and loss in a 1:4:5 ratio (in

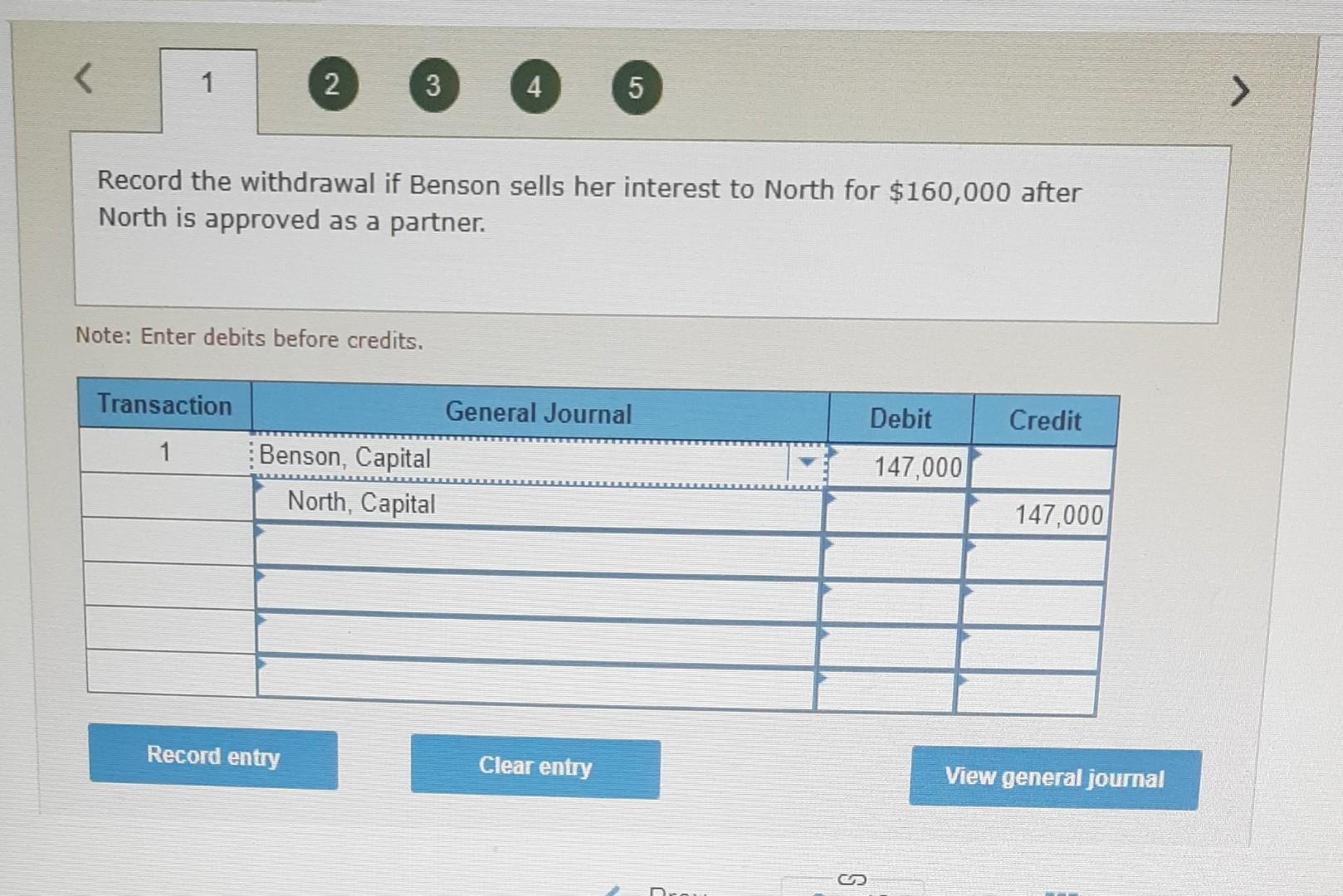

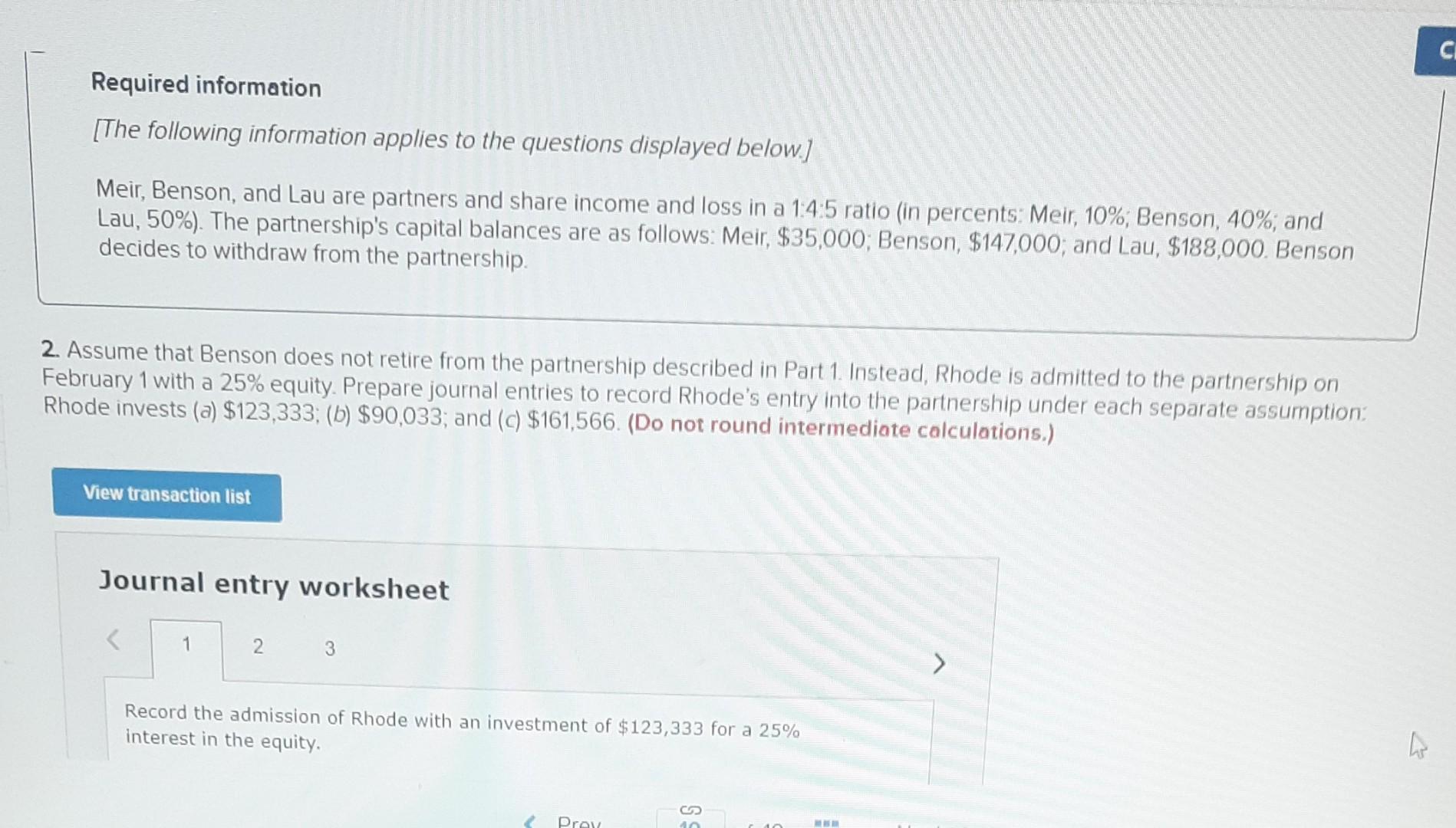

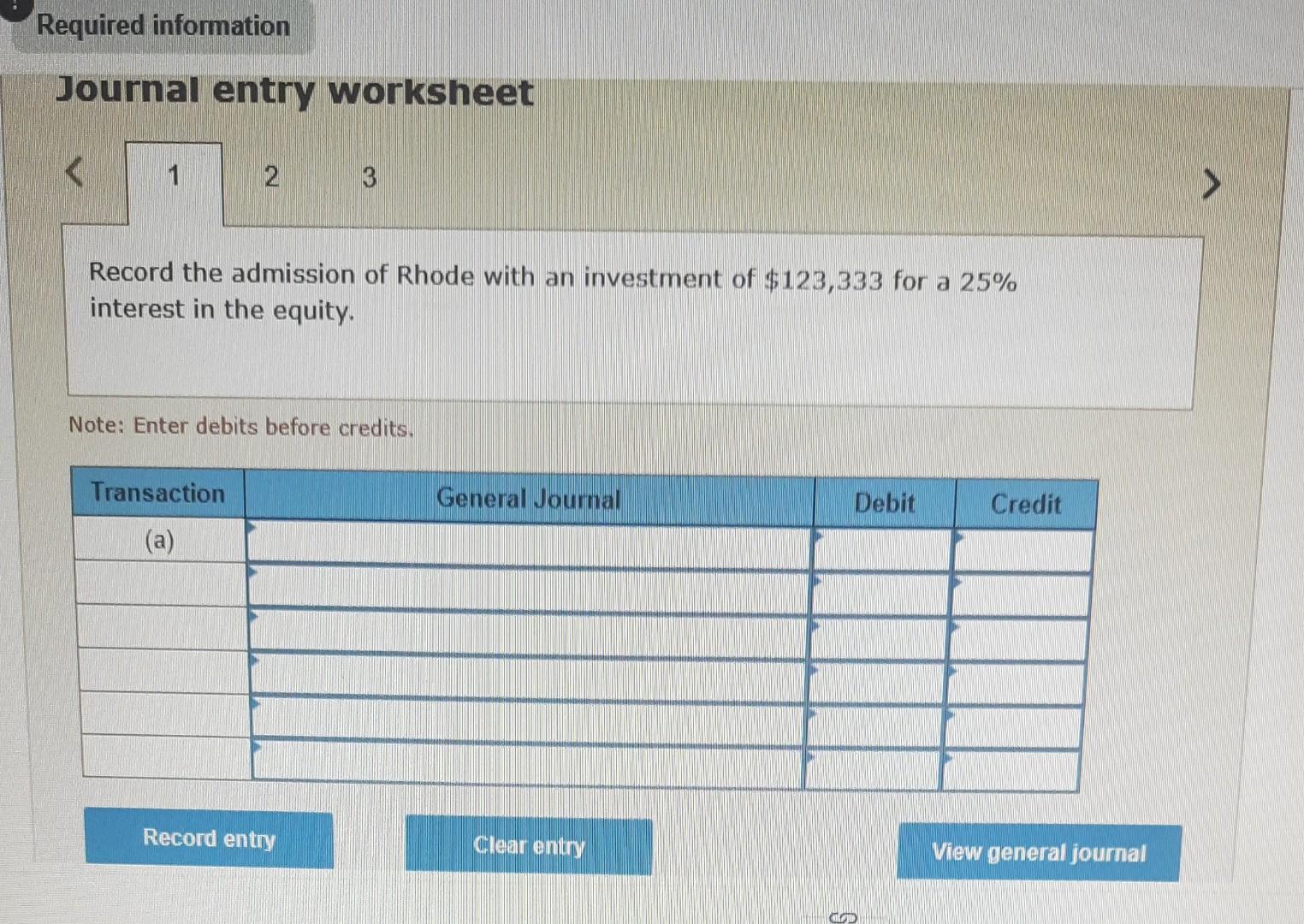

[The following information applies to the questions displayed below.] Meir, Benson, and Lau are partners and share income and loss in a 1:4:5 ratio (in percents: Meir, 10\%; Benson, 40\%; and Lau, 50% ). The partnership's capital balances are as follows: Meir, $35,000; Benson, $147,000; and Lau, $188,000. Benson decides to withdraw from the partnership. 1. Prepare journal entries to record Benson's February 1 withdrawal under each separate assumption: (Do not round intermediate calculations.) 1. Benson sells her interest to North for $160,000 after North is approved as a partner. 2. Benson gives her interest to a son-in-law, Schmidt, and Schmidt is approved as a partner. 3. Benson is paid $147,000 in partnership cash for her equity. 4. Benson is paid $185,000 in partnership cash for her equity. 5. Benson is paid $27,000 in partnership cash plus equipment that is recorded on the partnership books at $63,000 less accumuhsted depreciation of $20,790. Record the withdrawal if Benson sells her interest to North for $160,000 after North is approved as a partner. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Meir, Benson, and Lau are partners and share income and loss in a 1:4:5 ratio (in percents: Meir, 10\%; Benson, 40\%; and Lau, 50% ). The partnership's capital balances are as follows: Meir, $35,000; Benson, $147,000; and Lau, \$188,000. Benson decides to withdraw from the partnership. 2. Assume that Benson does not retire from the partnership described in Part 1. Instead, Rhode is admitted to the partnership on February 1 with a 25% equity. Prepare journal entries to record Rhode's entry into the partnership under each separate assumption: Rhode invests (a) $123,333;(b)$90,033; and (c)$161,566. (Do not round intermediate calculations.) Journal entry worksheet Record the admission of Rhode with an investment of $123,333 for a 25% interest in the equity. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started