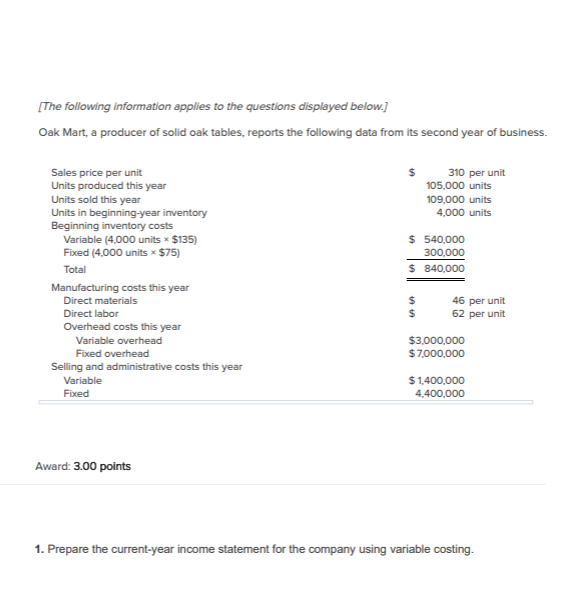

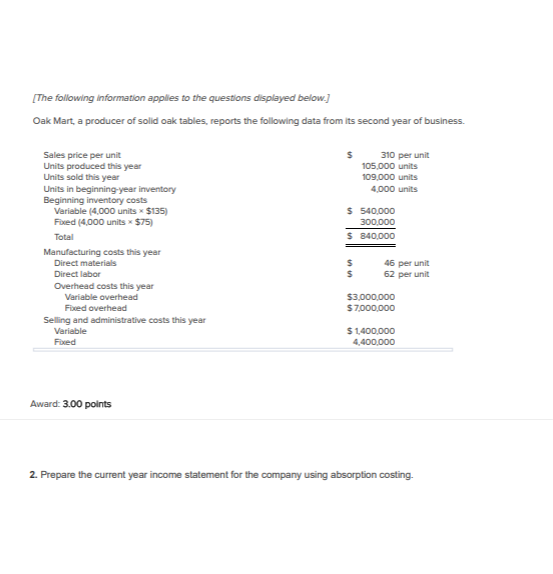

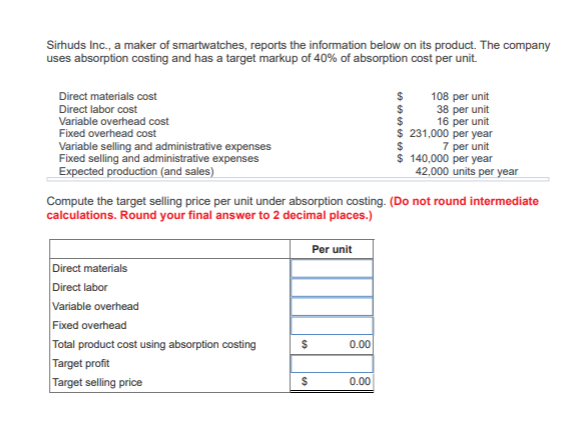

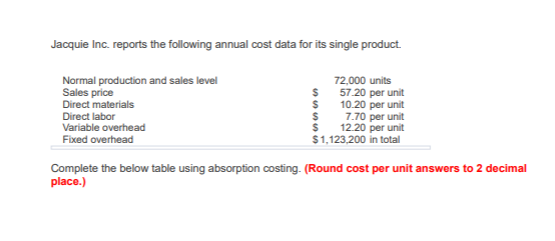

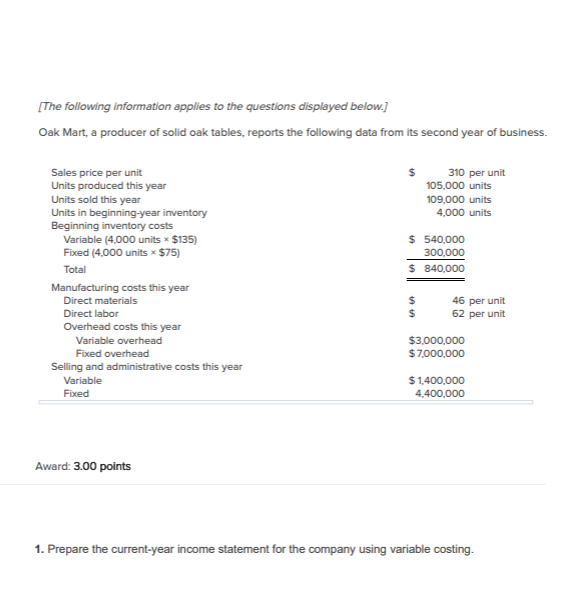

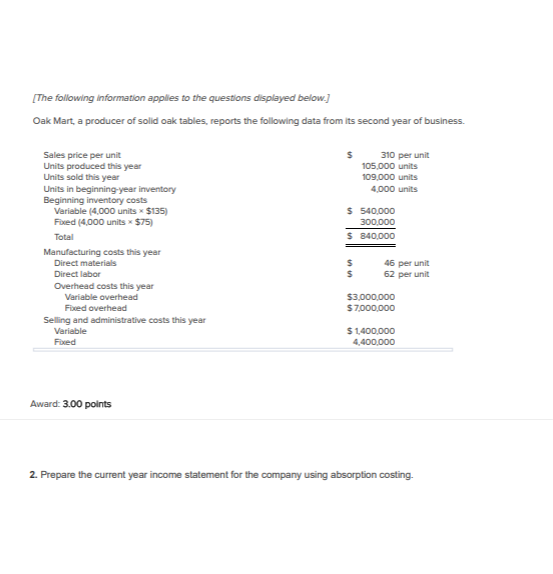

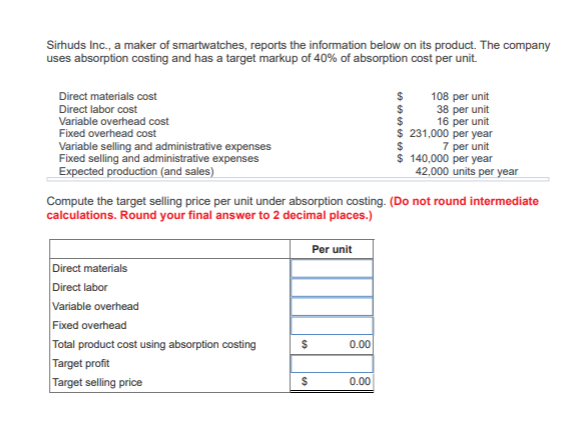

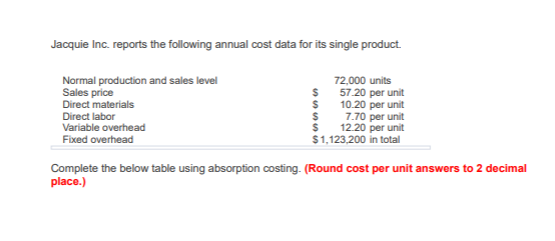

The following information applies to the questions displayed below. Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. $ 310 per unit 105.000 units 109,000 units 4,000 units $ 540,000 300,000 $ 840,000 Sales price per unit Units produced this year Units sold this year Units in beginning-year inventory Beginning inventory costs Variable (4,000 units $135) Fixed (4.000 units * $75) Total Manufacturing costs this year Direct materials Direct labor Overhead costs this year Variable overhead Fixed overhead Selling and administrative costs this year Variable Fixed 46 per unit 62 per unit $ $3,000,000 $7,000,000 $ 1.400.000 4,400,000 Award: 3.00 points 1. Prepare the current-year income statement for the company using variable costing. The following information applies to the questions displayed below.) Oak Mart, a producer of solid oak tables, reports the following data from its second year of business Sales price per unit Units produced this year Units sold this year Units in beginning year inventory Beginning inventory costs Variable (4,000 units $135) Fixed (4,000 units $75) 310 per unit 105,000 units 109,000 units 4,000 units $540,000 300,000 $ 840,000 Total $ 46 per unit 62 per unit Manufacturing costs this year Direct materials Direct labor Overhead costs this year Variable overhead Food overhead Selling and administrative costs this year Variable Fixed $3,000,000 $7,000,000 $1400,000 4.400,000 Award: 3.00 points 2. Prepare the current year income statement for the company using absorption costing Sirhuds Inc., a maker of smartwatches, reports the information below on its product. The company uses absorption costing and has a target markup of 40% of absorption cost per unit. Direct materials cost Direct labor cost Variable overhead cost Fixed overhead cost Variable selling and administrative expenses Fixed selling and administrative expenses Expected production (and sales) $ 108 per unit 38 per unit 16 per unit $ 231,000 per year 7 per unit $ 140,000 per year 42,000 units per year Compute the target selling price per unit under absorption costing. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Per unit Direct materials Direct labor Variable overhead Fixed overhead Total product cost using absorption costing Target profit Target selling price 0.00 Jacquie Inc. reports the following annual cost data for its single product. Normal production and sales level Sales price Direct materials Direct labor Variable overhead Fixed overhead 72,000 units $ 57 20 per unit $ 10.20 per unit $ 7.70 per unit $ 12.20 per unit $1,123,200 in total Complete the below table using absorption costing. (Round cost per unit answers to 2 decimal place.)