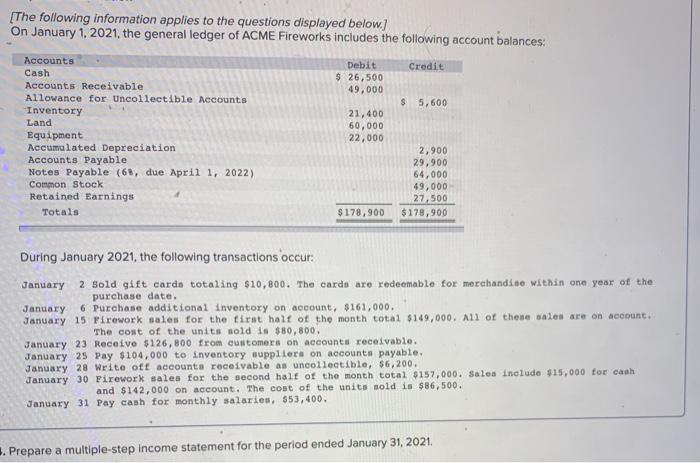

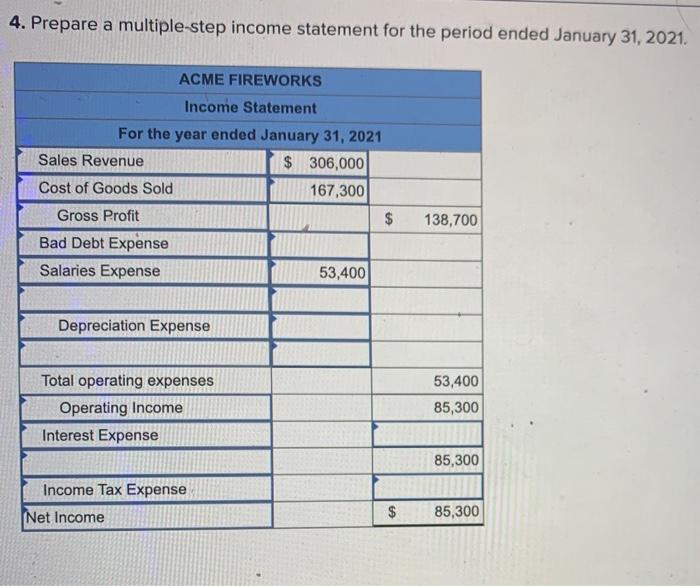

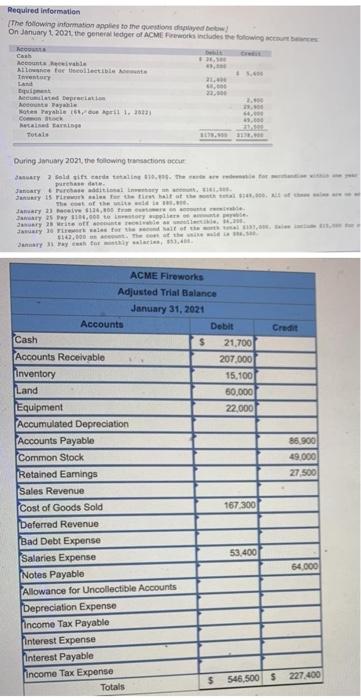

[The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: Credit Debit $ 26,500 49,000 $ 5,600 Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Equipment Accumulated Depreciation Accounts Payable Notes Payable (68, due April 1, 2022) Common Stock Retained Earnings Totals 21,400 60,000 22,000 2,900 29,900 64,000 49,000 27.500 $178,900 $178,900 During January 2021, the following transactions occur: January 2 Sold gift cards totaling $10,800. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $161,000. January 15 Firework sales for the first halt of the month total $149,000. All of these sales are on account. The cont of the units sold is $80,800. January 23 Receive $126,800 from customers on accounts receivable. January 25 Pay $104,000 to inventory suppliers on accounts payable, January 28 Write oft accounts receivable as uncollectible, $6,200. January 30 Pirework sales for the second half of the month total $157,000. Sales include $15,000 for cash and $142,000 on account. The cost of the units sold is $86,500. January 31 Pay cash for monthly salaries, $53,400. 3. Prepare a multiple-step Income statement for the period ended January 31, 2021. 4. Prepare a multiple-step income statement for the period ended January 31, 2021. ACME FIREWORKS Income Statement For the year ended January 31, 2021 Sales Revenue $ 306,000 Cost of Goods Sold 167,300 Gross Profit $ Bad Debt Expense Salaries Expense 53,400 138,700 Depreciation Expense Total operating expenses Operating Income Interest Expense 53,400 85,300 85,300 Income Tax Expense Net Income $ 85,300 Required information [The following information applies to the questioned be On January 1 2021 the general ledger of ACME works includes the flowing the . 2. . Accountivo Alle for collectie Theory LA punt Memprint Ae Noten alle 16. 1. 2013) con Total . . During January 2021, the following transactions com AUTY > Solat it card attinete pred Jatory proti ARTY 15 that at the 1.100 The of the JA 3 124,5 Pay. January 3 written ay naturale 10. The Jy who was ACME Fireworks Adjusted Trial Balance January 31, 2021 Accounts Debit Credit Cash $ 21,700 Accounts Receivable 207.000 Inventory 15.100 Land 50.000 Equipment 22.000 (Accumulated Depreciation Accounts Payable 86 900 Common Stock 49.000 Retained Earnings 27.500 Sales Revenue Cost of Goods Sold 167300 Deferred Revenue Bad Debt Expense Salaries Expense 53.400 64.000 Notes Payable 'Allowance for Uncollectible Accounts Depreciation Expense Income Tax Payable Pinterest Expense Interest Payable income Tax Expense 546,500S 227 400 Totals $