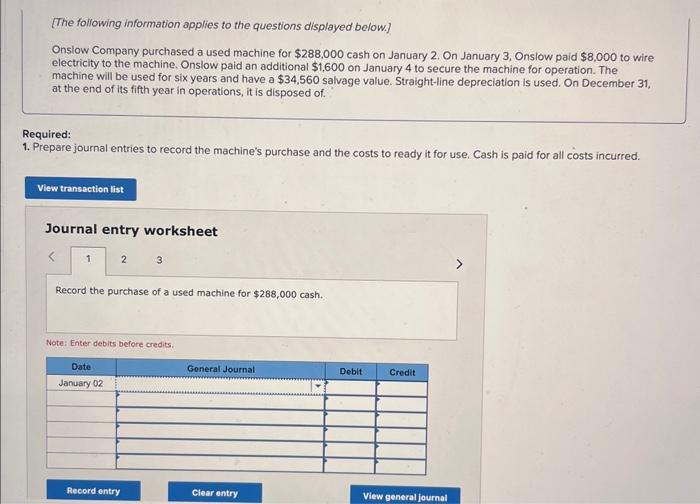

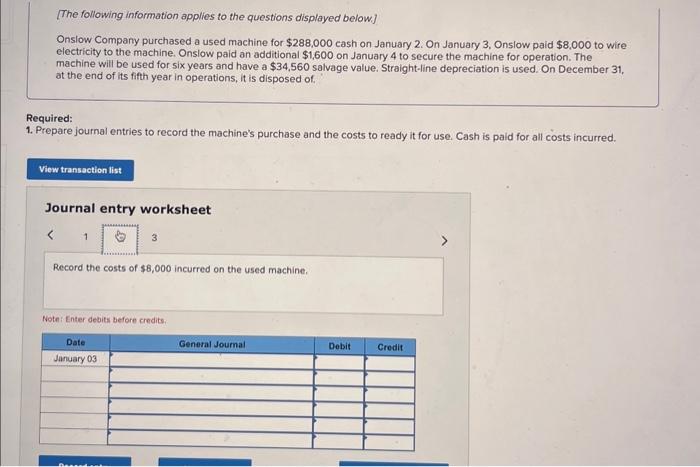

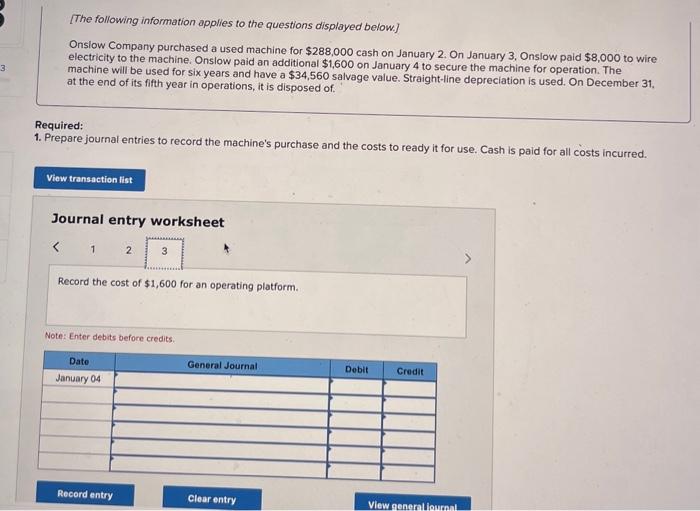

[The following information applies to the questions displayed below.] Onslow Company purchased a used machine for $288,000 cash on January 2 . On January 3, Onslow paid $8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for six years and have a $34,560 salvage value. Straight-line depreciation is used. On December 31 , at the end of its fifth year in operations, it is disposed of. required: Prepare journal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred. Journal entry worksheet Record the purchase of a used machine for $288,000 cash. Note: Enter debits before credits. [The following information applies to the questions displayed below] Onslow Company purchased a used machine for $288,000 cash on January 2 . On January 3, Onslow paid $8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for six years and have a $34,560 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. Required: Prepare joumal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred. Journal entry worksheet Record the costs of $8,000 incurred on the used machine. Fotef Enter debits before credits. [The following information applies to the questions displayed below] Onslow Company purchased a used machine for $288,000 cash on January 2, On January 3, Onslow paid $8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for six years and have a $34,560 salvage value. Straight-line depreciation is used. On December 31. at the end of its fifth year in operations, it is disposed of. Required: Prepare journal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred. Journal entry worksheet Record the cost of $1,600 for an operating platform. Note: Enter debits befoce credits