Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION FOUR Baharini Company has Sh.200 million in total net assets at the end of 2022. It plans to increase its production machinery in the

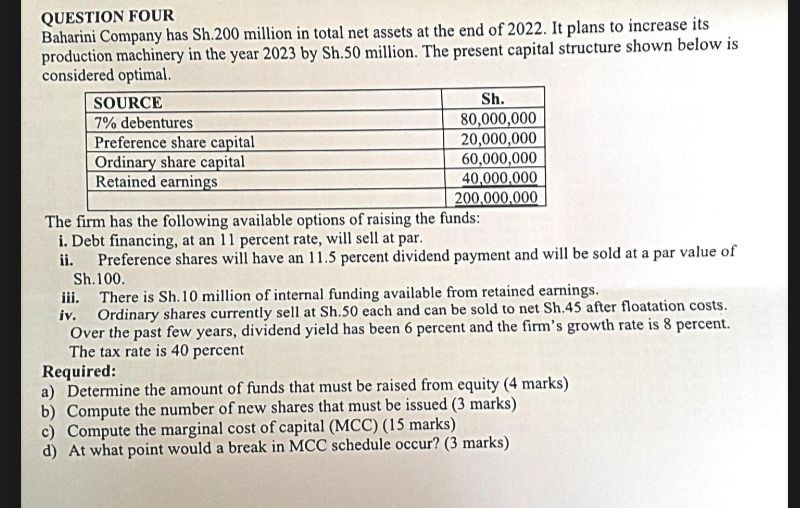

QUESTION FOUR Baharini Company has Sh.200 million in total net assets at the end of 2022. It plans to increase its production machinery in the year 2023 by Sh. 50 million. The present capital structure shown below is considered optimal. The firm has the following available options of raising the funds: i. Debt financing, at an 11 percent rate, will sell at par. ii. Preference shares will have an 11.5 percent dividend payment and will be sold at a par value of Sh. 100. iii. There is Sh. 10 million of internal funding available from retained earnings. iv. Ordinary shares currently sell at Sh.50 each and can be sold to net Sh. 45 after floatation costs. Over the past few years, dividend yield has been 6 percent and the firm's growth rate is 8 percent. The tax rate is 40 percent Required: a) Determine the amount of funds that must be raised from equity ( 4 marks) b) Compute the number of new shares that must be issued ( 3 marks) c) Compute the marginal cost of capital (MCC) (15 marks) d) At what point would a break in MCC schedule occur

QUESTION FOUR Baharini Company has Sh.200 million in total net assets at the end of 2022. It plans to increase its production machinery in the year 2023 by Sh. 50 million. The present capital structure shown below is considered optimal. The firm has the following available options of raising the funds: i. Debt financing, at an 11 percent rate, will sell at par. ii. Preference shares will have an 11.5 percent dividend payment and will be sold at a par value of Sh. 100. iii. There is Sh. 10 million of internal funding available from retained earnings. iv. Ordinary shares currently sell at Sh.50 each and can be sold to net Sh. 45 after floatation costs. Over the past few years, dividend yield has been 6 percent and the firm's growth rate is 8 percent. The tax rate is 40 percent Required: a) Determine the amount of funds that must be raised from equity ( 4 marks) b) Compute the number of new shares that must be issued ( 3 marks) c) Compute the marginal cost of capital (MCC) (15 marks) d) At what point would a break in MCC schedule occur Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started