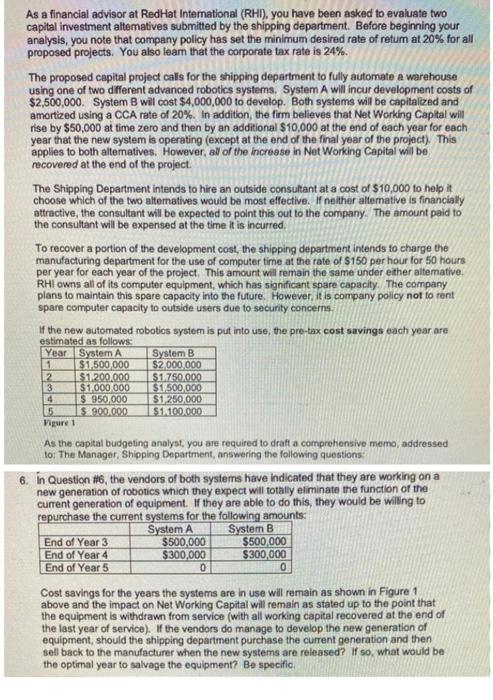

if vendors do manage to develop new generation of equipment, should the shipping department purchase the current generation and then sell back to the manufacturer when the new systems are released? if so, what would be the optimal year to salvage the equipment? be specific

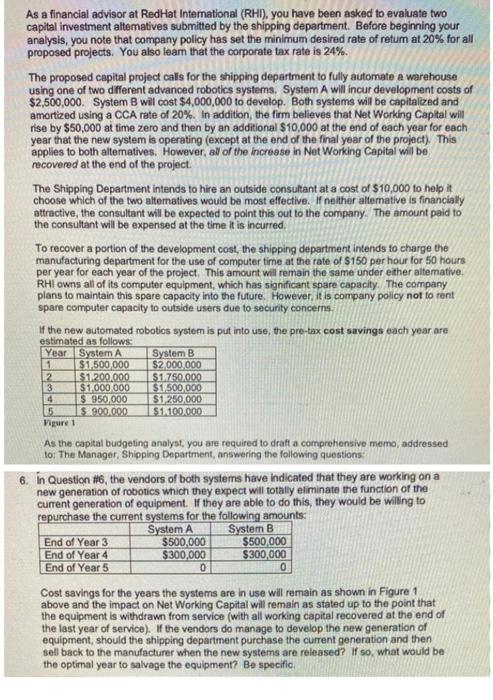

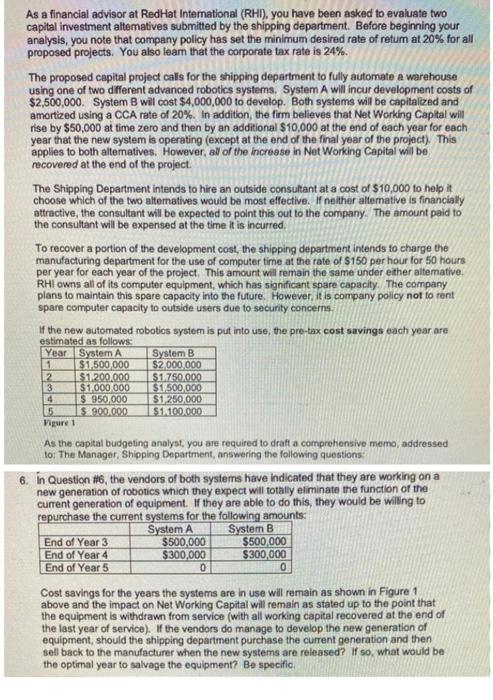

As a financial advisor at RedHat Intemational (RHI), you have been asked to evaluate two capital investment altematives submitted by the shipping department. Before beginning your analysis, you note that company policy has set the minimum desired rate of retum at 20% for all proposed projects. You also leam that the corporate tax rate is 24%. The proposed capital project calls for the shipping department to fully automate a warehouse using one of two diferent advanced robotics systems. System A will incur development costs of $2,500,000. System B wil cost \$4,000,000 to develop. Both systems will be capitalized and amortized using a CCA rate of 20\%. In addition, the firm believes that Nat Working Cap Aal will rise by $50,000 at time zero and then by an additional $10,000 at the end of each year for each year that the new system is operating (except at the end of the final year of the project). This applies to both altematives. However, aN of the increase in Net Working Capital will be recovered at the end of the project. The Shipping Department intends to hire an outside consultant at a cost of $10,000 to help it choose which of the two altematives would be most effective. If nelther altemative is financially attractive, the consultant will be expected to point this out to the company. The amount paid to the consultant will be expensed at the time it is incurred. To recover a portion of the development cost, the shipping department intends to charge the manufacturing department for the use of computer time at the rate of $150 per hour for 50 hours per year for each year of the project. This amount will remain the same under eather altemative. RHI owns all of its computer equipment, which has significant spare capacity. The company plans to maintain this spare capacity into the future. However, it is company policy not to rent spare computer capacity to outside users due to security concerns. If the new automated robotics system is put into use, the pre-tax cost savings each year are estimated as follows: As the capital budgeting analyst, you are required to draft a comprehensive memo, addressed to: The Manager, Shipping Department, answering the following questions: 6. In Question #6, the vendors of both systems have indicated that they are working on a new generation of robotics which they expect will totally eliminate the function of the current generation of equipment. If they are able to do this, they would be willing to renurchase the current svitems for the following amounts: Cost savings for the years the systems are in use will remain as shown in Figure 1 above and the impact on Net Working Capital will remain as stated up to the point that the equipment is withdrawn from service (with all working capital recovered at the end of the last year of service). If the vendors do manage to develop the new generation of equipment, should the shipping department purchase the current generation and then sell back to the manufacturer when the new systems are released? If so, what would be the optimal year to salvage the equipment? Be specific