Answered step by step

Verified Expert Solution

Question

1 Approved Answer

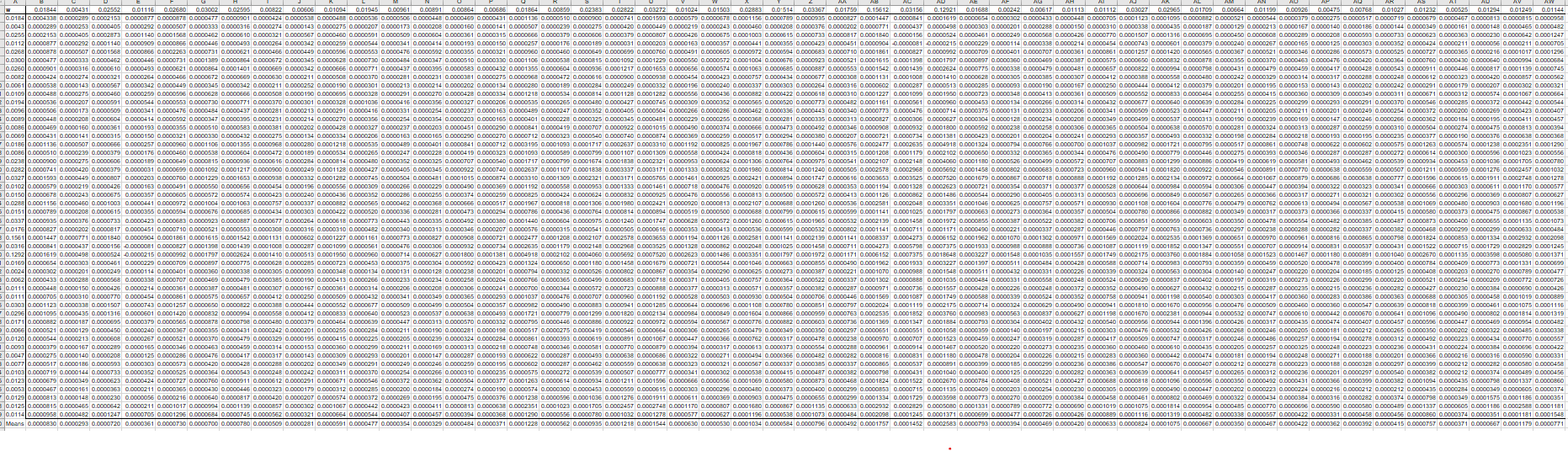

Need some help with the following deliverable, I have everything that I would need to calculate: Suppose you would have invested $ 1 into each

Need some help with the following deliverable, I have everything that I would need to calculate:

Suppose you would have invested $ into each strategy at the end of March and rebalanced your portfolio monthly until How much would your investment be worth at the end of Ignore transaction costs, taxes, etc., and construct a plot that shows the evolution of the values of the two investments over time.

For context as how to solve this, I have the following figures: daily & monthly returns for different industries, daily variances from the past days, beginning inverse variances month end trading day a covariance matrix, weighted returns returns for each of the industries on the last trading day of each month, a portfolio return sheet that contains weighted covariances see screenshot TRC SSE, mean, vol, std ev num not sure what this means, followed directions of my professor risk contribution, result parts and result.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started