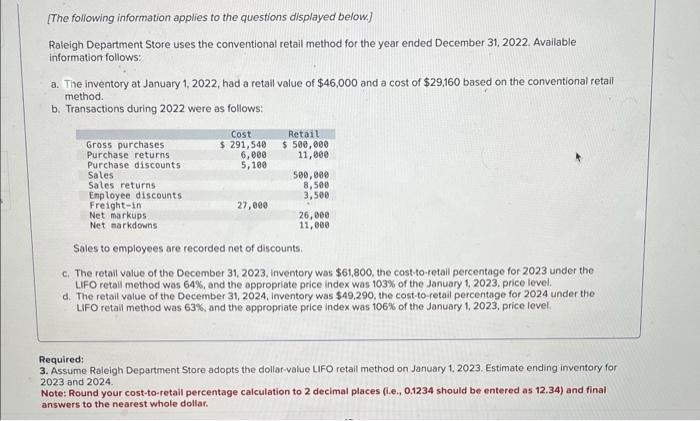

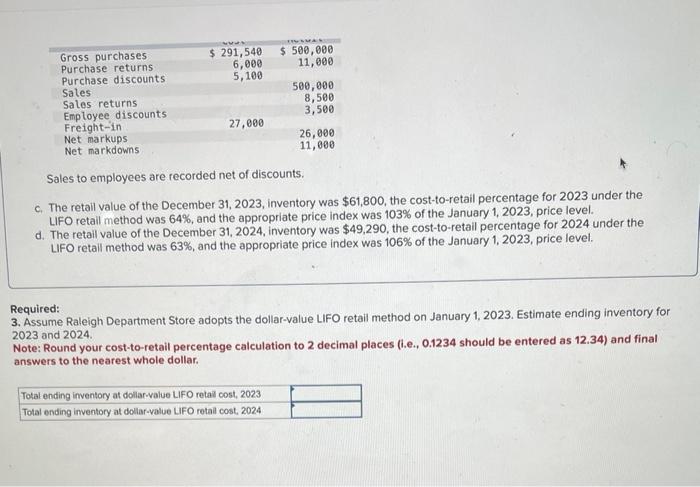

[The following information applies to the questions displayed below.] Raleigh Department Store uses the conventional retail method for the year ended December 31, 2022. Available information follows: a. The inventory at January 1,2022 , had a retail value of $46,000 and a cost of $29,160 based on the conventional retail method. b. Transactions during 2022 were as follows: Sales to employees are recorded net of discounts: c. The retail value of the December 31, 2023, inventory was $61,800, the cost-to-retall percentage for 2023 under the LIFO retall method was 64%, and the appropriate price index was 103% of the January 1, 2023, price level. d. The retail value of the December 31, 2024, inventory was $49,290, the cost-to-retail percentage for 2024 under the LFO retall method was 63%, and the appropriate price index was 106% of the January 1, 2023. price level. Required: 3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2023. Estimate ending inventory for 2023 and 2024. Note: Round your cost-to-retail percentage calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34) and final answers to the nearest whole dollar. Sales to employees are recorded net of discounts. c. The retail value of the December 31,2023 , inventory was $61,800, the cost-to-retail percentage for 2023 under the LIFO retail method was 64%, and the appropriate price index was 103% of the January 1,2023 , price level. d. The retail value of the December 31, 2024, inventory was $49,290, the cost-to-retail percentage for 2024 under the LFO retall method was 63%, and the appropriate price index was 106% of the January 1,2023 , price level. Required: 3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2023. Estimate ending inventory for 2023 and 2024. Note: Round your cost-to-retail percentage calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34) and final answers to the nearest whole dollar. [The following information applies to the questions displayed below.] Raleigh Department Store uses the conventional retail method for the year ended December 31, 2022. Available information follows: a. The inventory at January 1,2022 , had a retail value of $46,000 and a cost of $29,160 based on the conventional retail method. b. Transactions during 2022 were as follows: Sales to employees are recorded net of discounts: c. The retail value of the December 31, 2023, inventory was $61,800, the cost-to-retall percentage for 2023 under the LIFO retall method was 64%, and the appropriate price index was 103% of the January 1, 2023, price level. d. The retail value of the December 31, 2024, inventory was $49,290, the cost-to-retail percentage for 2024 under the LFO retall method was 63%, and the appropriate price index was 106% of the January 1, 2023. price level. Required: 3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2023. Estimate ending inventory for 2023 and 2024. Note: Round your cost-to-retail percentage calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34) and final answers to the nearest whole dollar. Sales to employees are recorded net of discounts. c. The retail value of the December 31,2023 , inventory was $61,800, the cost-to-retail percentage for 2023 under the LIFO retail method was 64%, and the appropriate price index was 103% of the January 1,2023 , price level. d. The retail value of the December 31, 2024, inventory was $49,290, the cost-to-retail percentage for 2024 under the LFO retall method was 63%, and the appropriate price index was 106% of the January 1,2023 , price level. Required: 3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2023. Estimate ending inventory for 2023 and 2024. Note: Round your cost-to-retail percentage calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34) and final answers to the nearest whole dollar