Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[The following information applies to the questions displayed below.] RayLok Incorporated has invented a secret process to improve light intensity and, as a result, manufactures

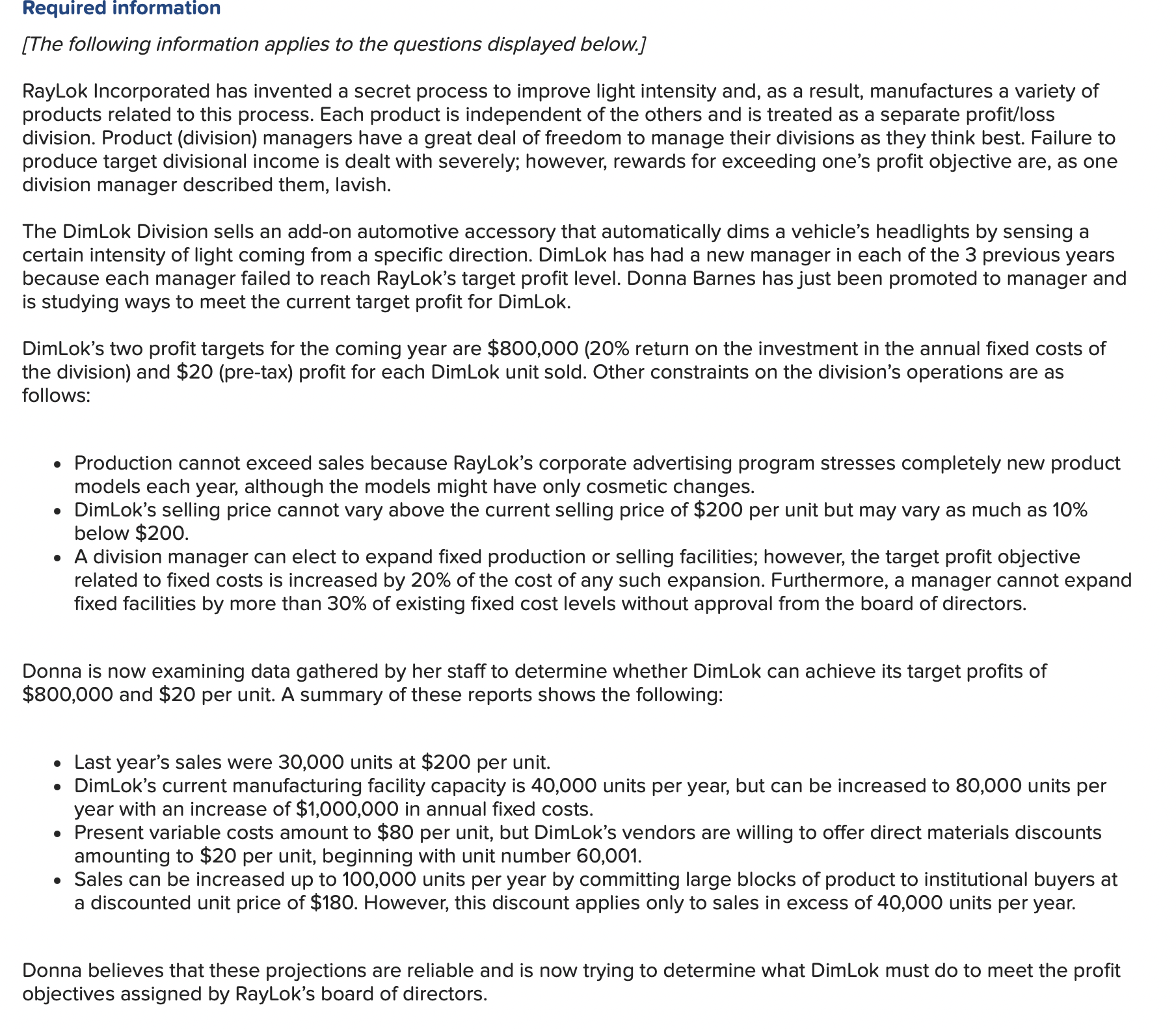

[The following information applies to the questions displayed below.] RayLok Incorporated has invented a secret process to improve light intensity and, as a result, manufactures a variety of products related to this process. Each product is independent of the others and is treated as a separate profit/loss division. Product (division) managers have a great deal of freedom to manage their divisions as they think best. Failure to produce target divisional income is dealt with severely; however, rewards for exceeding one's profit objective are, as one division manager described them, lavish. The DimLok Division sells an add-on automotive accessory that automatically dims a vehicle's headlights by sensing a certain intensity of light coming from a specific direction. DimLok has had a new manager in each of the 3 previous years because each manager failed to reach RayLok's target profit level. Donna Barnes has just been promoted to manager and is studying ways to meet the current target profit for DimLok. DimLok's two profit targets for the coming year are $800,000(20% return on the investment in the annual fixed costs of the division) and $20 (pre-tax) profit for each DimLok unit sold. Other constraints on the division's operations are as follows: - Production cannot exceed sales because RayLok's corporate advertising program stresses completely new product models each year, although the models might have only cosmetic changes. - DimLok's selling price cannot vary above the current selling price of $200 per unit but may vary as much as 10% below $200. - A division manager can elect to expand fixed production or selling facilities; however, the target profit objective related to fixed costs is increased by 20% of the cost of any such expansion. Furthermore, a manager cannot expand fixed facilities by more than 30% of existing fixed cost levels without approval from the board of directors. Donna is now examining data gathered by her staff to determine whether DimLok can achieve its target profits of $800,000 and $20 per unit. A summary of these reports shows the following: - Last year's sales were 30,000 units at $200 per unit. - DimLok's current manufacturing facility capacity is 40,000 units per year, but can be increased to 80,000 units per year with an increase of $1,000,000 in annual fixed costs. - Present variable costs amount to $80 per unit, but DimLok's vendors are willing to offer direct materials discounts amounting to $20 per unit, beginning with unit number 60,001. - Sales can be increased up to 100,000 units per year by committing large blocks of product to institutional buyers at a discounted unit price of $180. However, this discount applies only to sales in excess of 40,000 units per year. Donna believes that these projections are reliable and is now trying to determine what DimLok must do to meet the profit objectives assigned by RayLok's board of directors. Required: 1. Determine the dollar amount of DimLok's present annual fixed costs per year. 2. Determine the number of units that DimLok must sell to achieve both profit objectives. Be sure to consider all constraints in determining your answer. 3. Without regard to your answer in requirement 2 , assume that Donna decides to sell 40,000 units at $200 per unit and 24,000 units at $180 per unit. (a) Prepare a budgeted income statement (contribution format) for DimLok showing budgeted operating income. (b) Would this projected operating income meet the stated profit objectives

[The following information applies to the questions displayed below.] RayLok Incorporated has invented a secret process to improve light intensity and, as a result, manufactures a variety of products related to this process. Each product is independent of the others and is treated as a separate profit/loss division. Product (division) managers have a great deal of freedom to manage their divisions as they think best. Failure to produce target divisional income is dealt with severely; however, rewards for exceeding one's profit objective are, as one division manager described them, lavish. The DimLok Division sells an add-on automotive accessory that automatically dims a vehicle's headlights by sensing a certain intensity of light coming from a specific direction. DimLok has had a new manager in each of the 3 previous years because each manager failed to reach RayLok's target profit level. Donna Barnes has just been promoted to manager and is studying ways to meet the current target profit for DimLok. DimLok's two profit targets for the coming year are $800,000(20% return on the investment in the annual fixed costs of the division) and $20 (pre-tax) profit for each DimLok unit sold. Other constraints on the division's operations are as follows: - Production cannot exceed sales because RayLok's corporate advertising program stresses completely new product models each year, although the models might have only cosmetic changes. - DimLok's selling price cannot vary above the current selling price of $200 per unit but may vary as much as 10% below $200. - A division manager can elect to expand fixed production or selling facilities; however, the target profit objective related to fixed costs is increased by 20% of the cost of any such expansion. Furthermore, a manager cannot expand fixed facilities by more than 30% of existing fixed cost levels without approval from the board of directors. Donna is now examining data gathered by her staff to determine whether DimLok can achieve its target profits of $800,000 and $20 per unit. A summary of these reports shows the following: - Last year's sales were 30,000 units at $200 per unit. - DimLok's current manufacturing facility capacity is 40,000 units per year, but can be increased to 80,000 units per year with an increase of $1,000,000 in annual fixed costs. - Present variable costs amount to $80 per unit, but DimLok's vendors are willing to offer direct materials discounts amounting to $20 per unit, beginning with unit number 60,001. - Sales can be increased up to 100,000 units per year by committing large blocks of product to institutional buyers at a discounted unit price of $180. However, this discount applies only to sales in excess of 40,000 units per year. Donna believes that these projections are reliable and is now trying to determine what DimLok must do to meet the profit objectives assigned by RayLok's board of directors. Required: 1. Determine the dollar amount of DimLok's present annual fixed costs per year. 2. Determine the number of units that DimLok must sell to achieve both profit objectives. Be sure to consider all constraints in determining your answer. 3. Without regard to your answer in requirement 2 , assume that Donna decides to sell 40,000 units at $200 per unit and 24,000 units at $180 per unit. (a) Prepare a budgeted income statement (contribution format) for DimLok showing budgeted operating income. (b) Would this projected operating income meet the stated profit objectives Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started