Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[The following Information applies to the questions displayed below.) Reba Dixon is a fifth-grade school teacher who carned a salary of $38 400 in 2019.

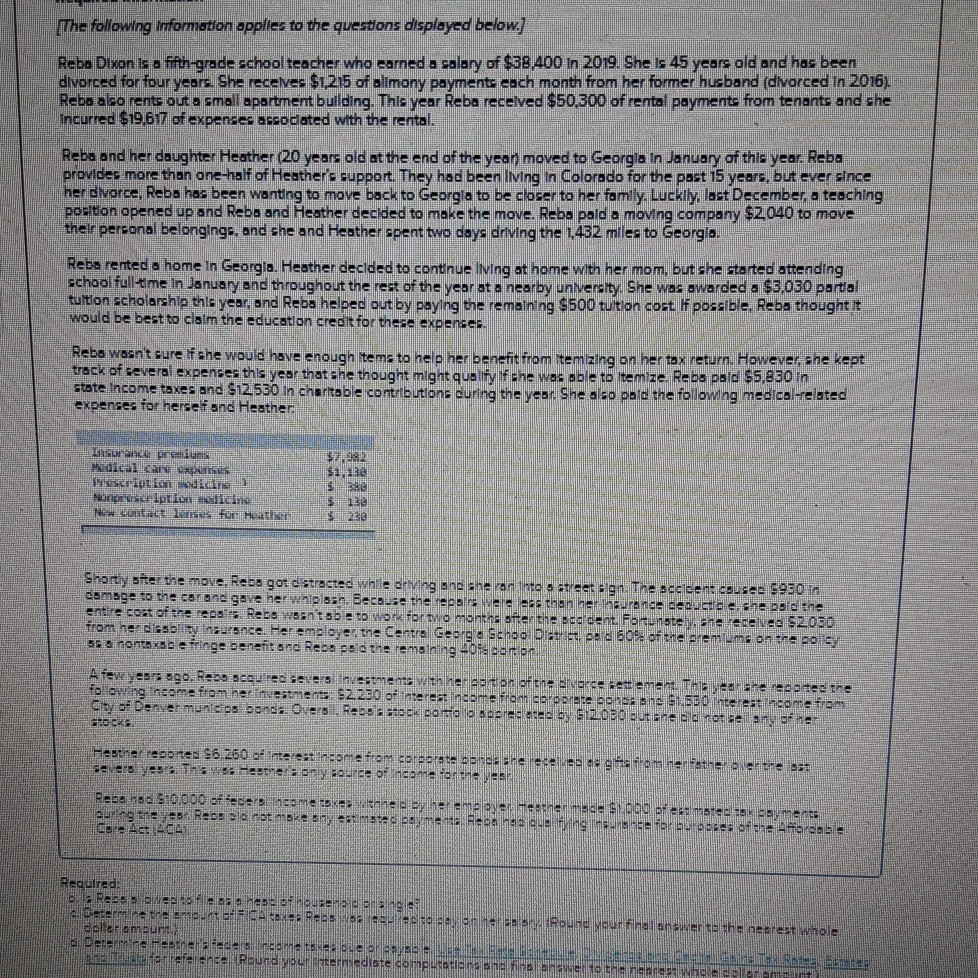

[The following Information applies to the questions displayed below.) Reba Dixon is a fifth-grade school teacher who carned a salary of $38 400 in 2019. She is 45 years old and hos bsen divorced for four years. She receives $1,215 of allmony payments each month from her former husband (divorced in 2016). Reba a to rents out a small apartment building. This year Reba received $50.300 of rental payments from tenants and she Incurred $19.67 of expenses assocated with the rental. Reba and her daughter Heather (20 years old at the end of the yean moved to Georgia in January of this year. Reba provides more than one-half of Heather's support. They had been living in Colorado for the post 15 years, but ever since her divorce, Reba hos been wanting to move back to Georgia to be closer to her family. Luckily, last December a teaching position opened up and Reba and Heather decided to make the move. Reba poldo moving company $2040 to move ther personal belongings, and she and Heather spent two days driving the 1,432 miles to Georgia. Reba rented a home in Georgia. Heather decided to continue living at home with her mom, but she started attending school full time in January and throughout the rest of the year at a nearby university. She was awarded a $3,030 portal tution scholarship this year, and Reba helped out by paying the remaining $500 tuition cost possible. Reba thought it would be best to claim the education credit for these expenses. Reba wasn't sure fshe would have enough items to help her benefit from temizing on her tax return. However, she kept track of several expenses this year that she thought might qualify fshe was able to temize. Reba cold 55.830 in state Income taxes and $12.530 in chartable contributions ouring the year. She a co pale the following medico-related expenses for hersefond Heather $92 31 Lisura pretium Medical Care script.online Norgeselption medicine New contact for Heat Sa Shortiyate the move, Rebo gor distracted while driving and she ran into a street sign. The sccleent cousee 5930 in eamage to the camere gave her whoissh. Because there a aless than her curanee ecducub e che e the entire cost of the 1993 rs Rebs wasn't so e to work for two months after the sce cent Forste merece ve S2050 from her disability insurance. Hereme oyerthe Centre George Schnoo Olcarist. pard 80% of the premiums on the so by 5- anontarse e fringe benefit and Reba eeld the remaining 40 A few years ago. Repo scoured seves investments the soon of the cerce settement. There soortee the following income from her investment: $2.230 of tnterest incerte from corporate eone: 0122 91.580 interest come from City of Denver munte os bonds Overs. Recoch potere des by 9 2030 Utane e drete any of her FEOCKS Heather reported $6.260 of the encome from correta bere edele on este perse 3:1 severs yes. Heathertory source of income torne Rece kod ST0.000 edersincome to the beame behetherme 2000 of ematea de mens angre y Rede se not mean, estimated Payment Peon HD que fa 54 boses oflenz - Actice Required BP Reches House Date aute Peso Round your final answer to the nearest whole deler amount Deine Leather freemetekee BB CREAMS CONSELLER Erreference Round your intermediate computations and in awer to hear here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started