Answered step by step

Verified Expert Solution

Question

1 Approved Answer

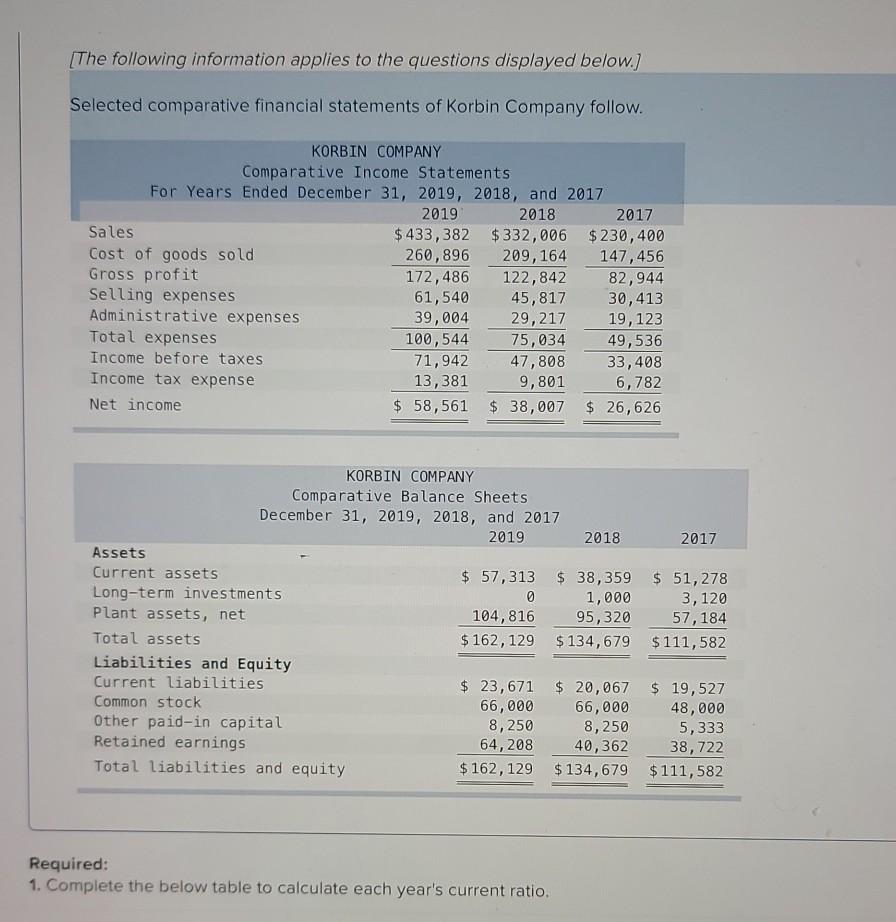

[The following information applies to the questions displayed below.) Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended

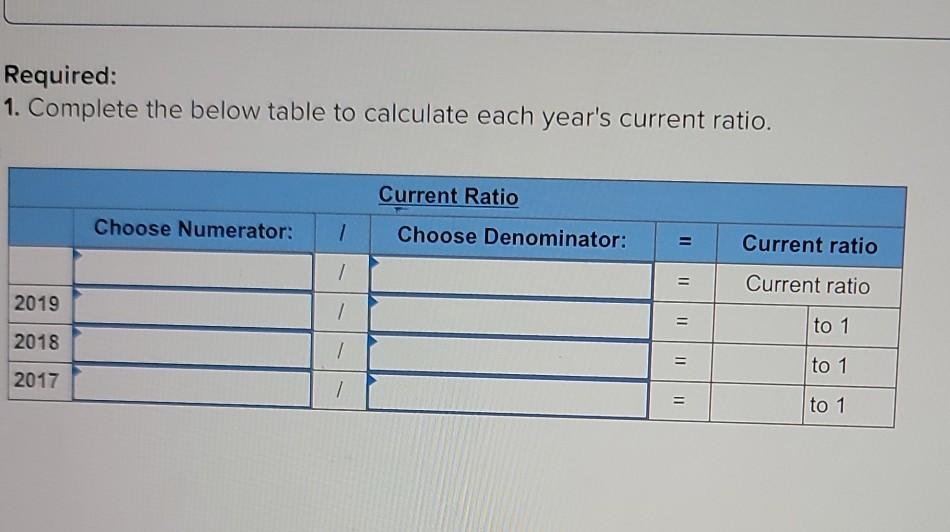

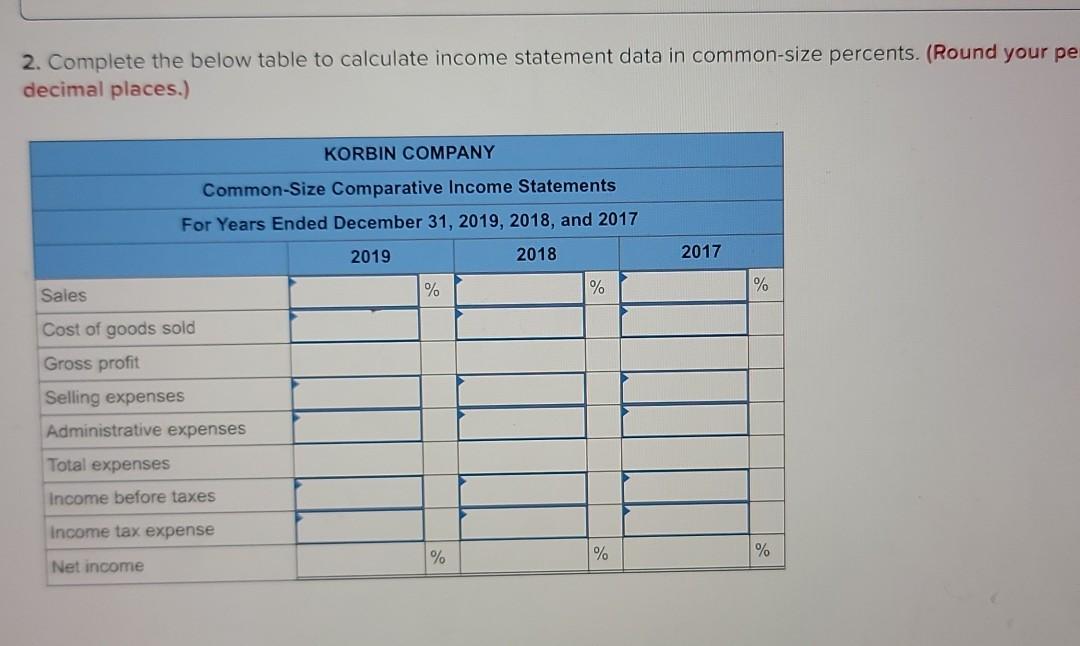

[The following information applies to the questions displayed below.) Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales $ 433,382 $332,006 $230,400 Cost of goods sold 260,896 209,164 147,456 Gross profit 172,486 122,842 82,944 Selling expenses 61,540 45,817 30,413 Administrative expenses 39,004 29,217 19,123 Total expenses 100,544 75,034 49,536 Income before taxes 71,942 47,808 33,408 Income tax expense 13,381 9,801 6,782 Net income $ 58,561 $ 38,007 $ 26,626 KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 2018 2017 Assets Current assets $ 57,313 $ 38,359 $ 51,278 Long-term investments 0 1,000 3,120 Plant assets, net 104,816 95,320 57,184 Total assets $ 162, 129 $134,679 $ 111,582 Liabilities and Equity Current liabilities $ 23,671 $ 20,067 $ 19,527 Common stock 66,000 66,000 48,000 Other paid-in capital 8,250 8,250 5,333 Retained earnings 64,208 40,362 38,722 Total liabilities and equity $ 162,129 $ 134,679 $ 111,582 Required: 1. Complete the below table to calculate each year's current ratio. Required: 1. Complete the below table to calculate each year's current ratio. Current Ratio Choose Numerator: 7 Choose Denominator: Current ratio 1 = Current ratio 2019 7 to 1 2018 / to 1 2017 / to 1 2. Complete the below table to calculate income statement data in common-size percents. (Round your pe decimal places.) KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 % % Sales % Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense % % % Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started