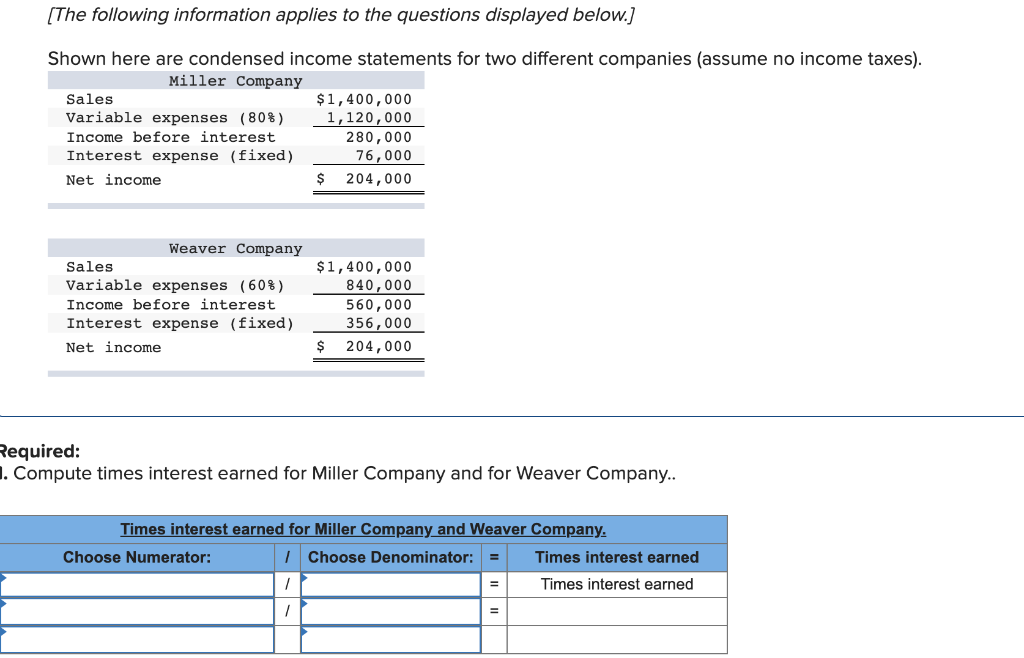

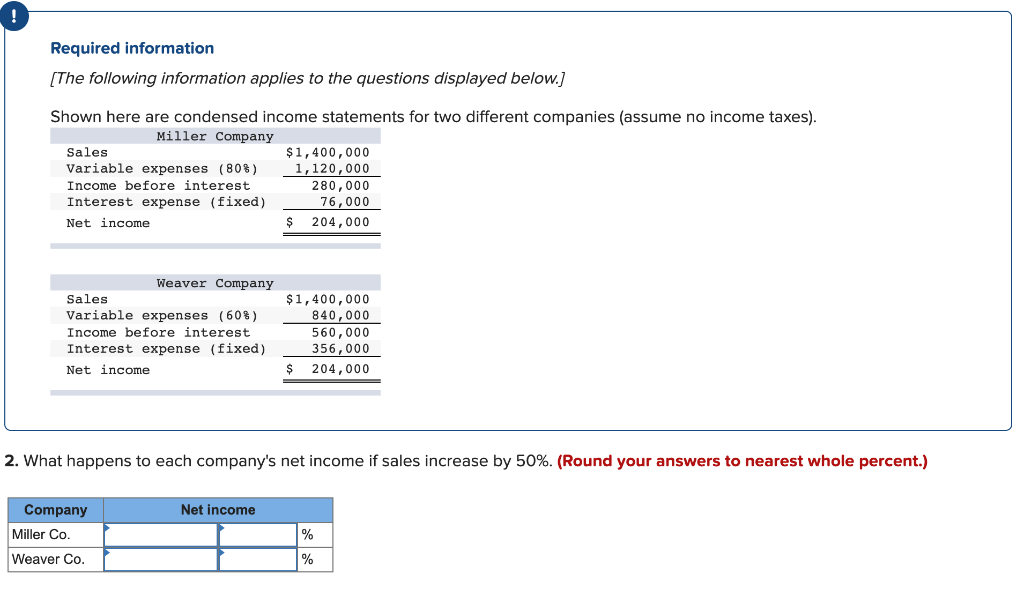

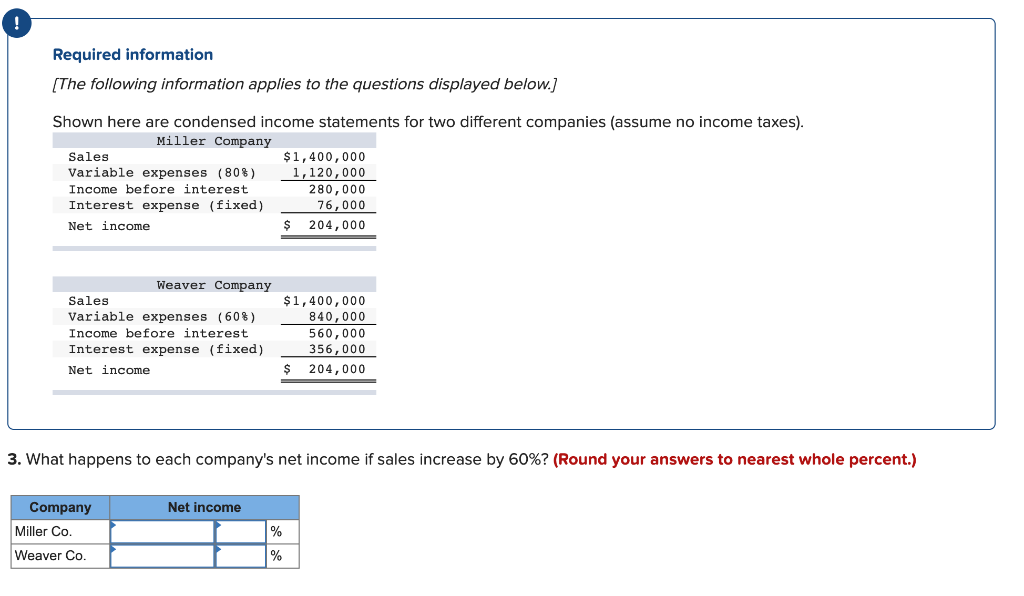

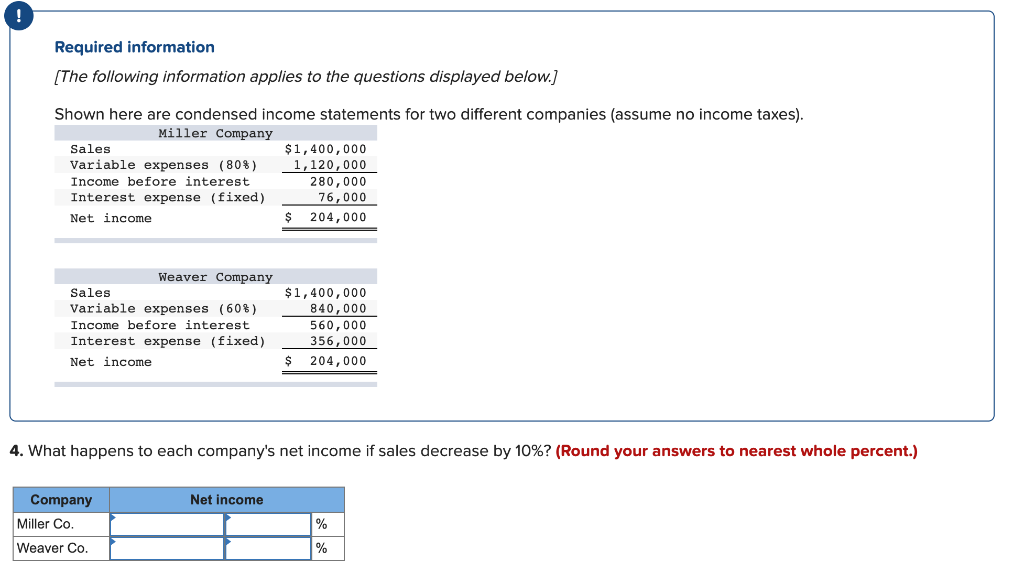

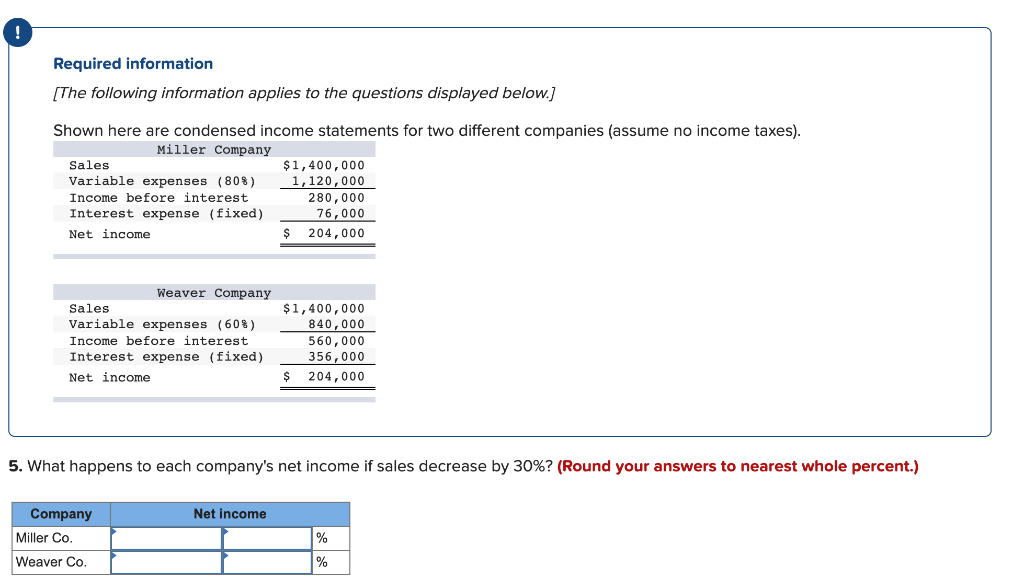

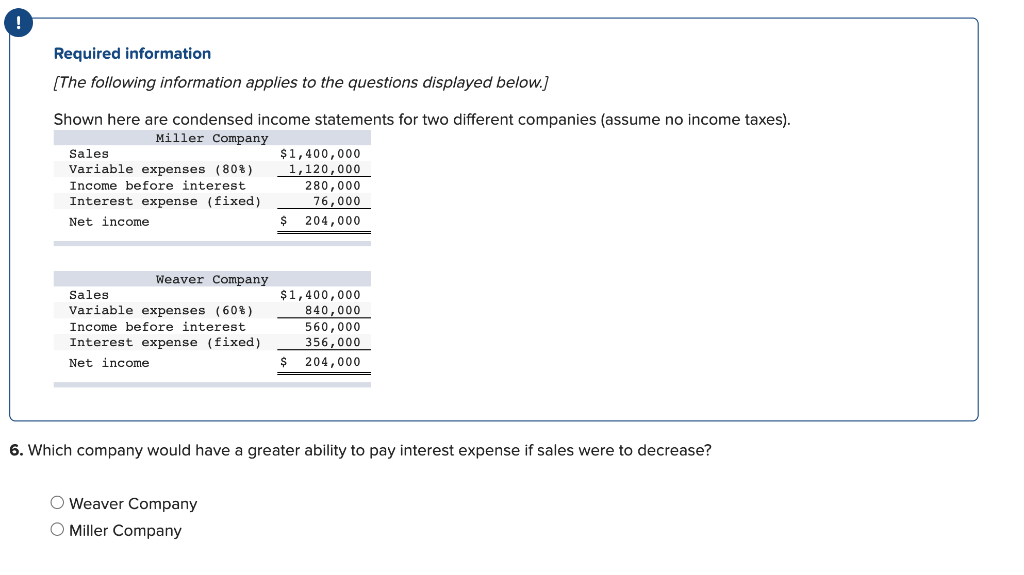

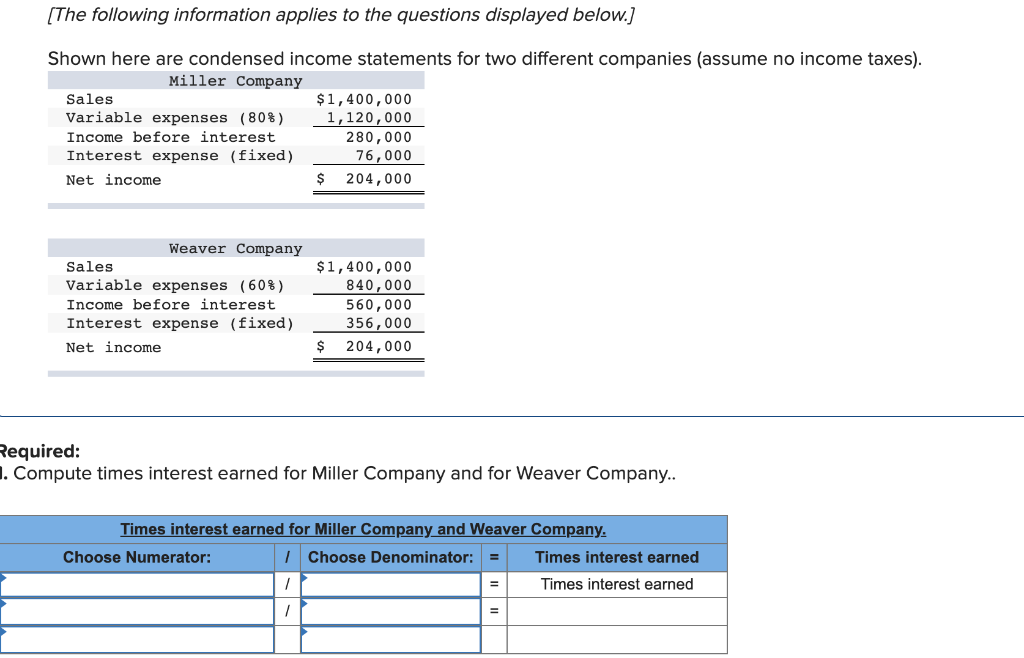

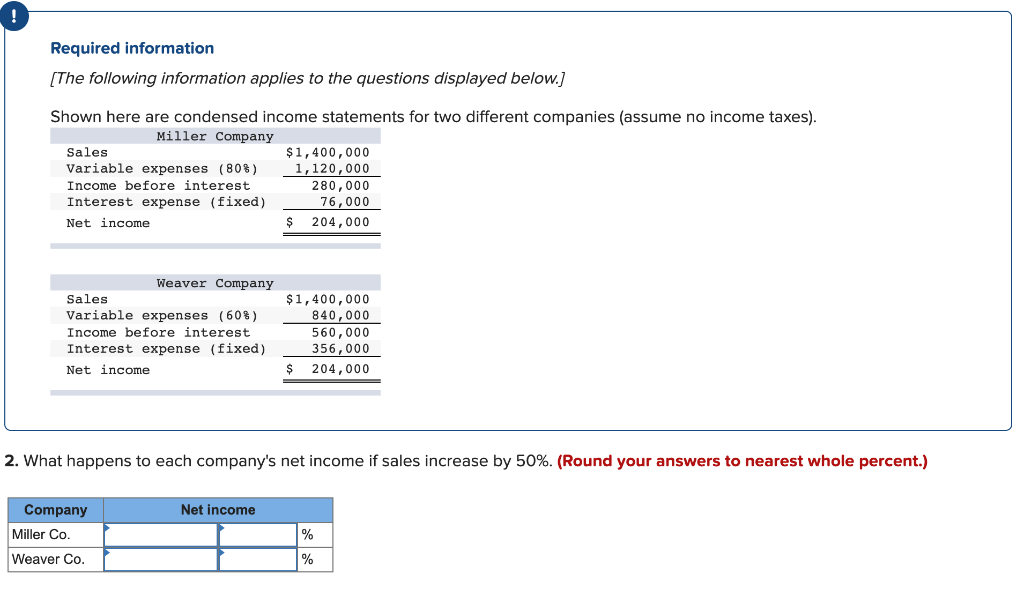

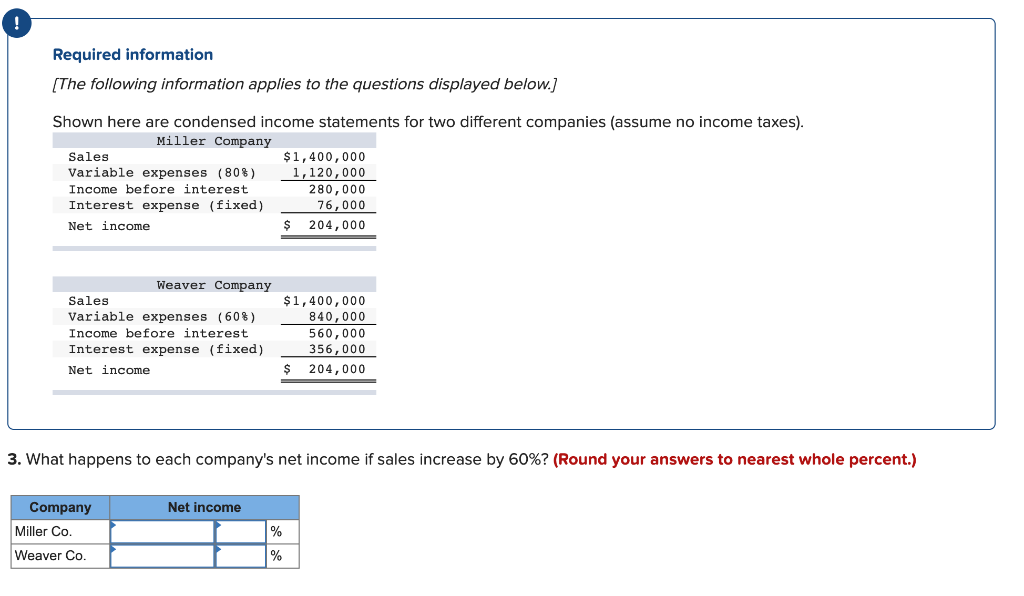

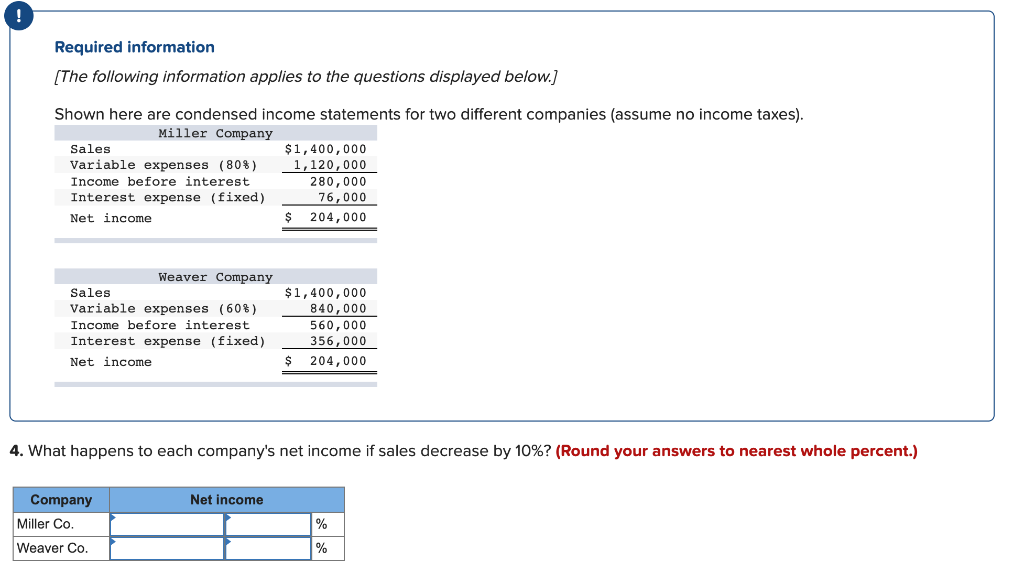

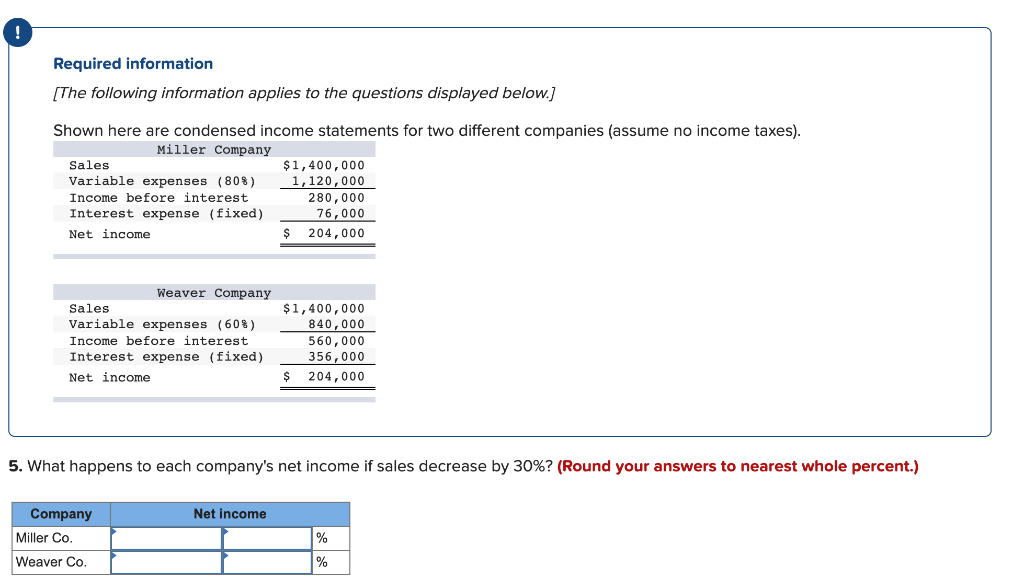

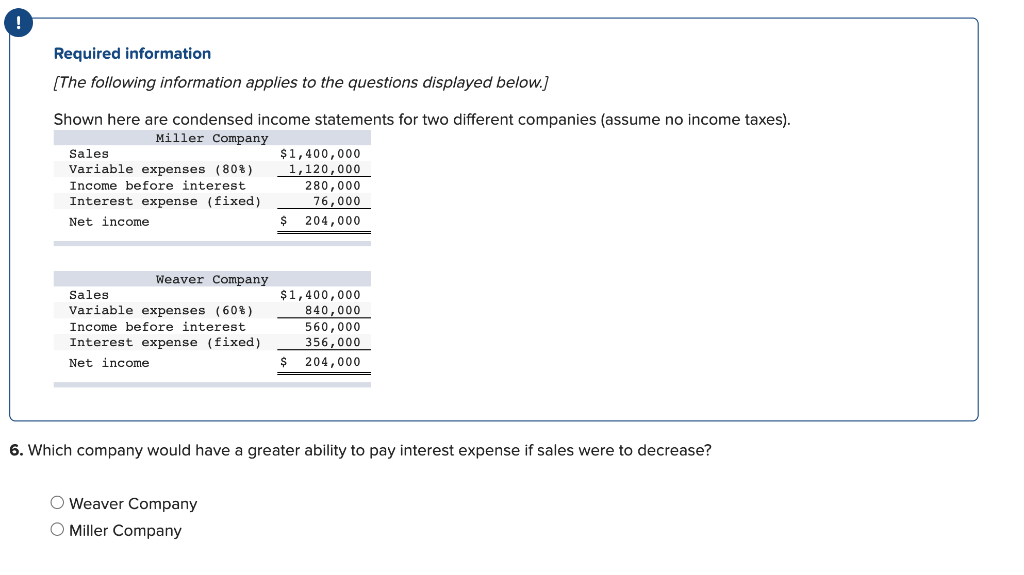

[The following information applies to the questions displayed below.) Shown here are condensed income statements for two different companies (assume no income taxes). Miller Company Sales $1,400,000 Variable expenses (80%) 1,120,000 Income before interest 280,000 Interest expense (fixed) 76,000 Net income $ 204,000 Weaver Company Sales Variable expenses (60%) Income before interest Interest expense (fixed) Net income $1,400,000 840,000 560,000 356,000 $ 204,000 Required: 1. Compute times interest earned for Miller Company and for Weaver Company.. Times interest earned for Miller Company and Weaver Company. Choose Numerator: 1 Choose Denominator: Times interest earned / Times interest earned 1 Required information [The following information applies to the questions displayed below.) Shown here are condensed income statements for two different companies (assume no income taxes). Miller Company Sales $1,400,000 Variable expenses (80%) 1,120,000 Income before interest 280,000 Interest expense (fixed) 76,000 Net income $ 204,000 Weaver Company Sales Variable expenses (60%) Income before interest Interest expense (fixed) Net income $1,400,000 840,000 560,000 356,000 $ 204,000 2. What happens to each company's net income if sales increase by 50%. (Round your answers to nearest whole percent.) Net income Company Miller Co. Weaver Co. % % Required information [The following information applies to the questions displayed below.] Shown here are condensed income statements for two different companies (assume no income taxes). Miller Company Sales $1,400,000 Variable expenses (80%) 1,120,000 Income before interest 280,000 Interest expense (fixed) 76,000 Net income $ 204,000 Weaver Company Sales Variable expenses (60%) Income before interest Interest expense (fixed) Net income $1,400,000 840,000 560,000 356,000 $ 204,000 3. What happens to each company's net income if sales increase by 60%? (Round your answers to nearest whole percent.) Net income Company Miller Co. Weaver Co. % % Required information (The following information applies to the questions displayed below.) Shown here are condensed income statements for two different companies (assume no income taxes). Miller Company Sales $1,400,000 Variable expenses (808) 1,120,000 Income before interest 280,000 Interest expense (fixed) 76,000 Net income $ 204,000 Weaver Company Sales Variable expenses (60%) Income before interest Interest expense (fixed) Net income $1,400,000 840,000 560,000 356,000 204,000 4. What happens to each company's net income if sales decrease by 10%? (Round your answers to nearest whole percent.) Net income Company Miller Co. Weaver Co. % % Required information [The following information applies to the questions displayed below.] Shown here are condensed income statements for two different companies (assume no income taxes). Miller Company Sales $1,400,000 Variable expenses (808) 1,120,000 Income before interest 280,000 Interest expense (fixed) 76,000 Net income $ 204,000 Weaver Company Sales Variable expenses (608) Income before interest Interest expense (fixed) Net income $1,400,000 840,000 560,000 356,000 $ 204,000 5. What happens to each company's net income if sales decrease by 30%? (Round your answers to nearest whole percent.) Net income Company Miller Co. Weaver Co. % % Required information (The following information applies to the questions displayed below.) Shown here are condensed income statements for two different companies (assume no income taxes). Miller Company Sales $1,400,000 Variable expenses (809) 1,120,000 Income before interest 280,000 Interest expense (fixed) 76,000 Net income 204,000 S Weaver Company Sales Variable expenses (60%) Income before interest Interest expense (fixed) Net income $1,400,000 840,000 560,000 356,000 $ 204,000 6. Which company would have a greater ability to pay interest expense if sales were to decrease? O Weaver Company O Miller Company