Answered step by step

Verified Expert Solution

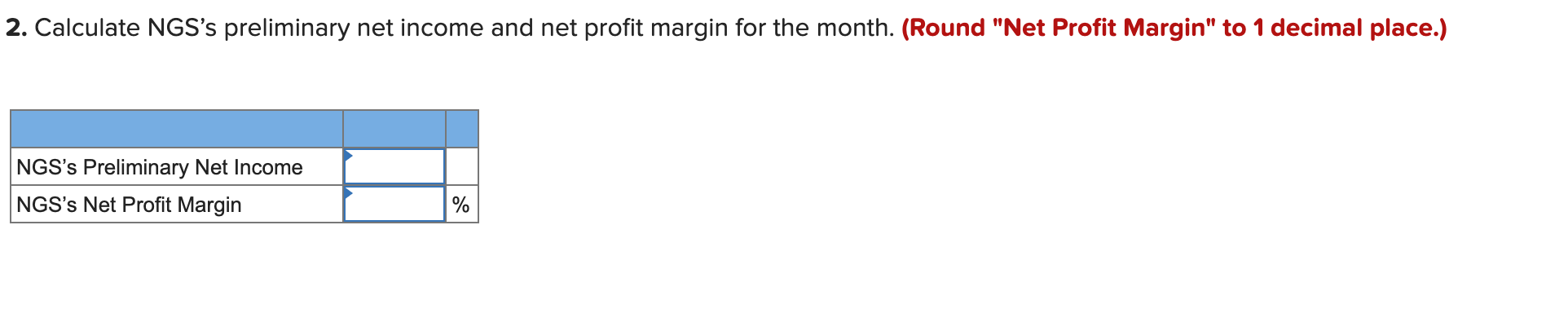

Question

1 Approved Answer

[The following information applies to the questions displayed below.] Starting in May, Nicole has decided that she has everything she needs to open her doors

[The following information applies to the questions displayed below.]

Starting in May, Nicole has decided that she has everything she needs to open her doors to customers. To keep up with competition, Nicole has added gift certificates and has started to advertise her company more to keep her business going in the long term. Here is a sample of some transactions that occurred in the month of May at Nicoles Getaway Spa (NGS).

| May | 1 | Paid $2,950 cash for an insurance policy that covers the period from June 1 until May 31 next year. | ||

| May | 4 | Ordered five new massage tables from Spa Supplies Unlimited for $245 each for future delivery. | ||

| May | 7 | Provided $795 of spa services to customers on account. | ||

| May | 10 | Received spa supplies purchased for $960 on account to use at Nicoles Getaway Spa. | ||

| May | 13 | Received a bill for $48 for running an advertisement in the newspaper in May. The bill was paid in cash. | ||

| May | 16 | Paid one-quarter of the amount owed from May 10. | ||

| May | 19 | Customers paid $1,650 cash for NGS gift cards. No gift cards have been used. | ||

| May | 20 | Obtained financing from the bank by signing a $6,000 two-year note payable. The $6,000 cash was deposited in NGS's bank account | ||

| May | 22 | Received two of the massage tables ordered on May 4 and paid for the two tables in cash. | ||

| May | 25 | Paid $490 cash for utility bills for services received and billed in May. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started