Answered step by step

Verified Expert Solution

Question

1 Approved Answer

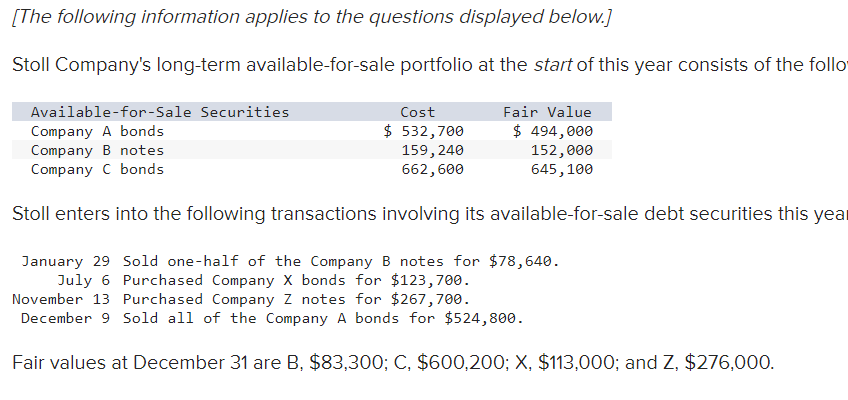

[The following information applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the follo Stoll

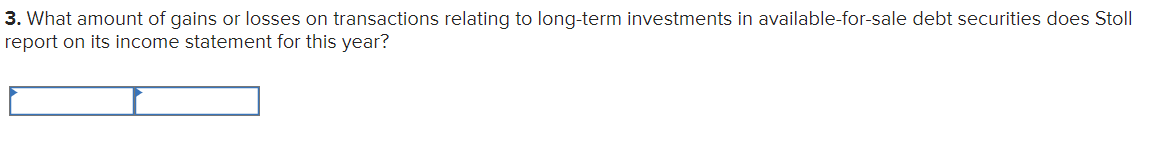

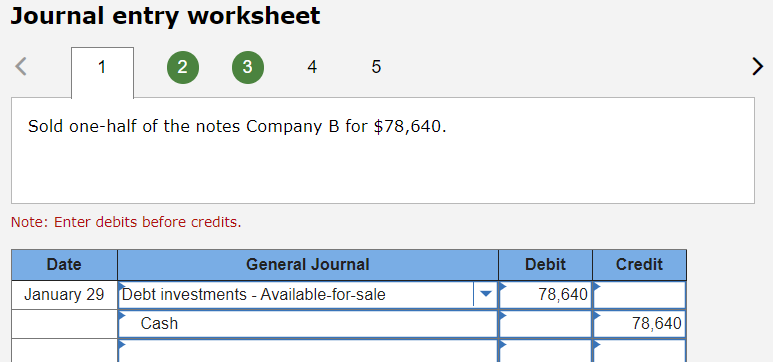

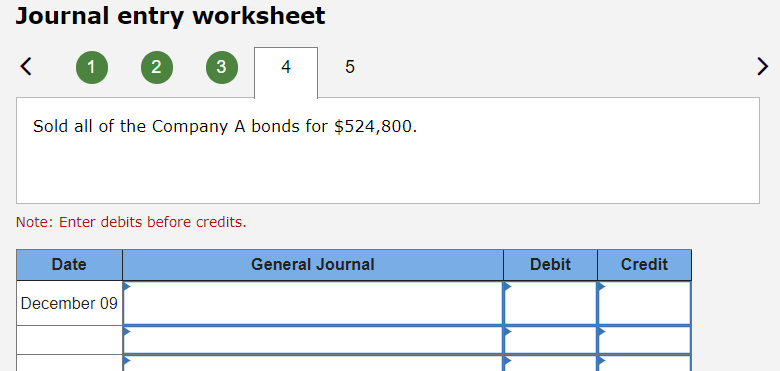

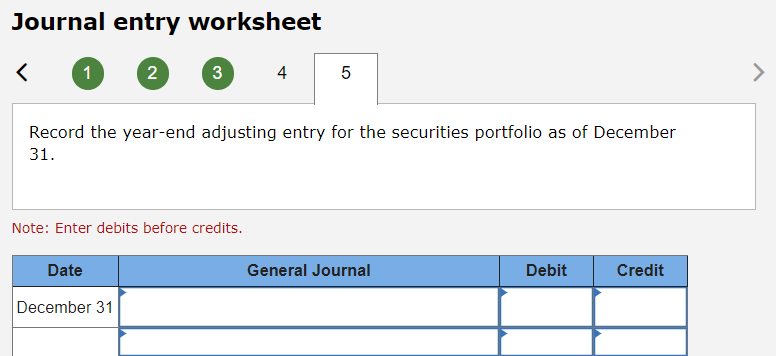

[The following information applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the follo Stoll enters into the following transactions involving its available-for-sale debt securities this yea January 29 Sold one-half of the Company B notes for $78,640. July 6 Purchased Company X bonds for $123,700. November 13 Purchased Company Z notes for $267,700. December 9 Sold all of the Company A bonds for $524,800. Fair values at December 31 are B, $83,300;C,$600,200;X,$113,000; and Z, \$276,000. 3. What amount of gains or losses on transactions relating to long-term investments in available-for-sale debt securities does Stoll report on its income statement for this year? Journal entry worksheet 5 Sold one-half of the notes Company B for $78,640. Note: Enter debits before credits. Journal entry worksheet (1) 2 5 Sold all of the Company A bonds for $524,800. Note: Enter debits before credits. Journal entry worksheet Record the year-end adjusting entry for the securities portfolio as of December 31 . Note: Enter debits before credits

[The following information applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the follo Stoll enters into the following transactions involving its available-for-sale debt securities this yea January 29 Sold one-half of the Company B notes for $78,640. July 6 Purchased Company X bonds for $123,700. November 13 Purchased Company Z notes for $267,700. December 9 Sold all of the Company A bonds for $524,800. Fair values at December 31 are B, $83,300;C,$600,200;X,$113,000; and Z, \$276,000. 3. What amount of gains or losses on transactions relating to long-term investments in available-for-sale debt securities does Stoll report on its income statement for this year? Journal entry worksheet 5 Sold one-half of the notes Company B for $78,640. Note: Enter debits before credits. Journal entry worksheet (1) 2 5 Sold all of the Company A bonds for $524,800. Note: Enter debits before credits. Journal entry worksheet Record the year-end adjusting entry for the securities portfolio as of December 31 . Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started