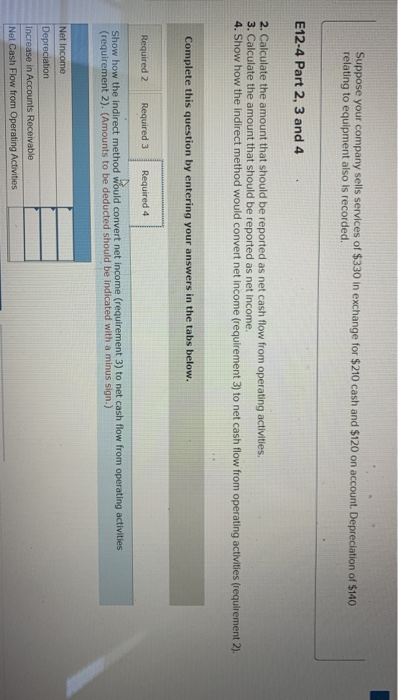

(The following information applies to the questions displayed below.) Suppose your company sells services of $330 in exchange for $210 cash and $120 on account. Depreciation of $140 relating to equipment also is recorded. E12-4 Part 2, 3 and 4 2. Calculate the amount that should be reported as net cash flow from operating activities. 3. Calculate the amount that should be reported as net income. 4. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2). Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required 4 Calculate the amount that should be reported as net cash flow from operating activities. Required 2 Required 3 > (The following information applies to the questions displayed below.) Suppose your company sells services of $330 in exchange for $210 cash and $120 on account. Depreciation of $140 relating to equipment also is recorded. E12-4 Part 2, 3 and 4 2. Calculate the amount that should be reported as net cash flow from operating activities. 3. Calculate the amount that should be reported as net income. 4. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2). Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required 4 Calculate the amount that should be reported as net income. Net Income (Required 2 Required 4 > Suppose your company sells services of $330 in exchange for $210 cash and $120 on account. Depreciation of $140 relating to equipment also is recorded. E12-4 Part 2, 3 and 4 2. Calculate the amount that should be reported as net cash flow from operating activities 3. Calculate the amount that should be reported as net income. 4. Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2). Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required 4 Show how the indirect method would convert net income (requirement 3) to net cash flow from operating activities (requirement 2). (Amounts to be deducted should be indicated with a minus sign.) Net Income Depreciation Increase in Accounts Receivable Net Cash Flow from Operating Activities