Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[The following information applies to the questions displayed below.] Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. May 11 Sydney accepts

[The following information applies to the questions displayed below.]

Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions.

| May 11 | Sydney accepts delivery of $40,000 of merchandise it purchases for resale from Troy: invoice dated May 11, terms 3/10, n/90, FOB shipping point. The goods cost Troy $30,000. Sydney pays $345 cash to Express Shipping for delivery charges on the merchandise. |

|---|---|

| May 12 | Sydney returns $1,400 of the $40,000 of goods to Troy, who receives them the same day and restores them to its inventory. The returned goods had cost Troy $1,050. |

| May 20 | Sydney pays Troy for the amount owed. Troy receives the cash immediately. |

(Both Sydney and Troy use a perpetual inventory system and the net method.)

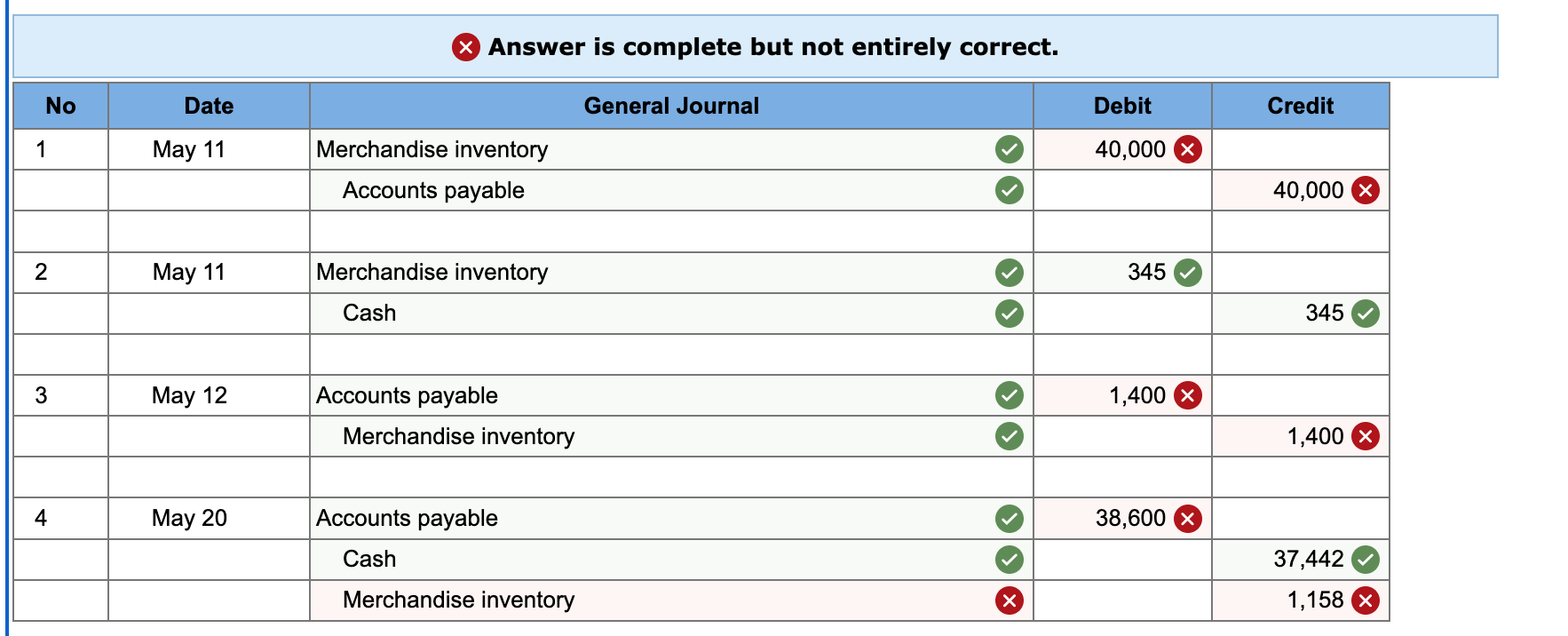

1. Prepare journal entries that Sydney Retailing (buyer) records for these three transactions.

Answer is complete but not entirely correct. \begin{tabular}{|c|c|c|c|c|c|} \hline No & Date & \multicolumn{2}{|c|}{ General Journal } & Debit & Credit \\ \hline \multirow[t]{2}{*}{1} & May 11 & Merchandise inventory & 2 & 40,000 & \\ \hline & & Accounts payable & 2 & & 40,000 \\ \hline \multirow[t]{2}{*}{2} & May 11 & Merchandise inventory & 0 & 345 & \\ \hline & & Cash & & & 345 \\ \hline \multirow[t]{2}{*}{3} & May 12 & Accounts payable & & 1,400 & \\ \hline & & Merchandise inventory & 2 & & 1,400 \\ \hline \multirow[t]{3}{*}{4} & May 20 & Accounts payable & & 38,600 & \\ \hline & & Cash & & & 37,442 \\ \hline & & Merchandise inventory & & & 1,158 \\ \hline \end{tabular}

Answer is complete but not entirely correct. \begin{tabular}{|c|c|c|c|c|c|} \hline No & Date & \multicolumn{2}{|c|}{ General Journal } & Debit & Credit \\ \hline \multirow[t]{2}{*}{1} & May 11 & Merchandise inventory & 2 & 40,000 & \\ \hline & & Accounts payable & 2 & & 40,000 \\ \hline \multirow[t]{2}{*}{2} & May 11 & Merchandise inventory & 0 & 345 & \\ \hline & & Cash & & & 345 \\ \hline \multirow[t]{2}{*}{3} & May 12 & Accounts payable & & 1,400 & \\ \hline & & Merchandise inventory & 2 & & 1,400 \\ \hline \multirow[t]{3}{*}{4} & May 20 & Accounts payable & & 38,600 & \\ \hline & & Cash & & & 37,442 \\ \hline & & Merchandise inventory & & & 1,158 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started