Answered step by step

Verified Expert Solution

Question

1 Approved Answer

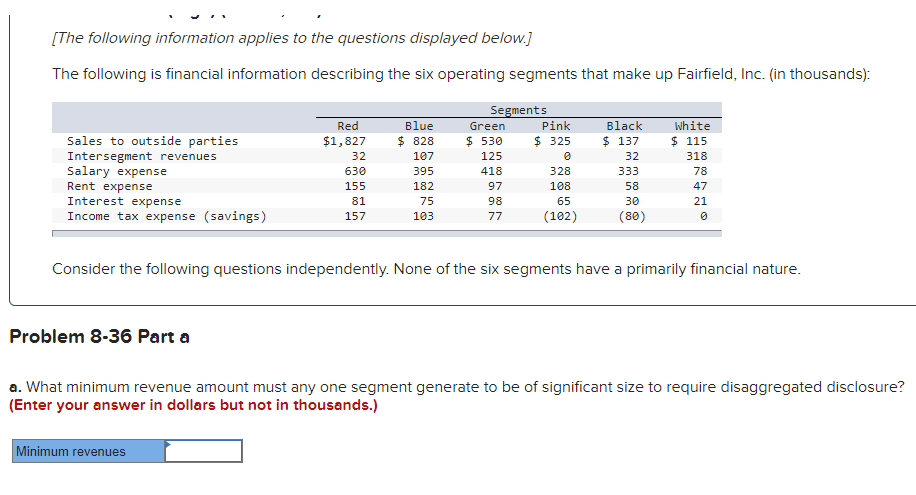

[The following information applies to the questions displayed below.] The following is financial information describing the six operating segments that make up Fairfield, Inc. (in

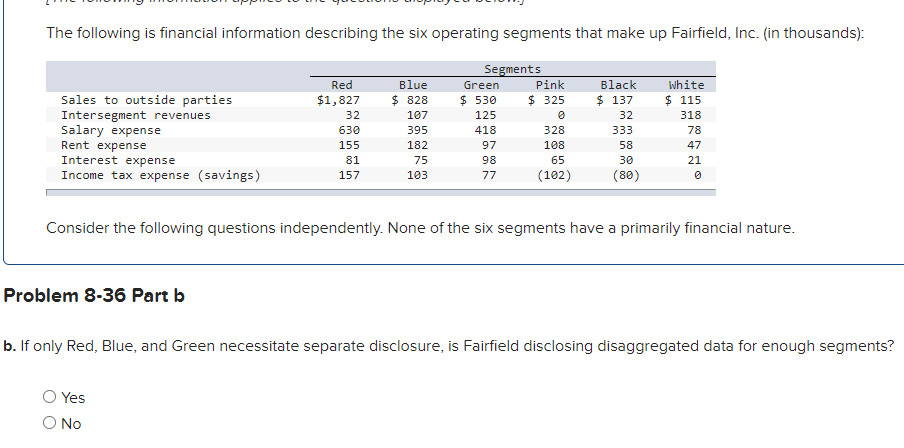

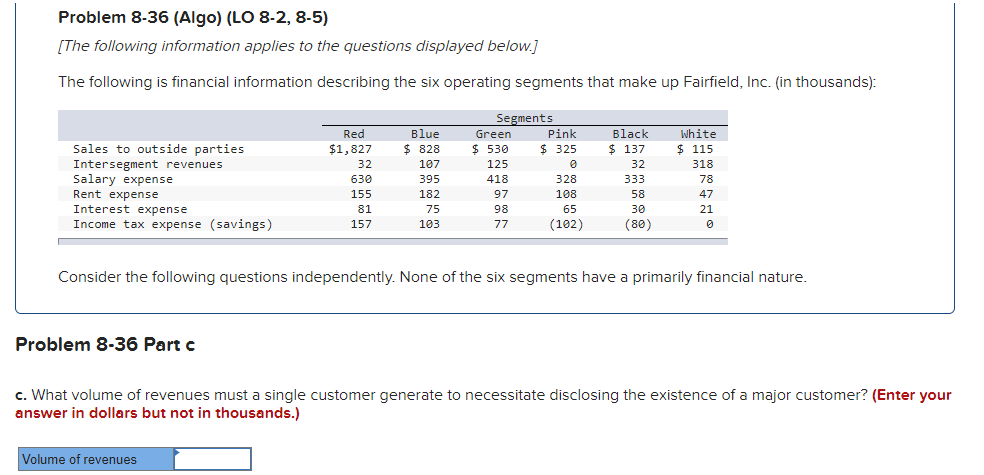

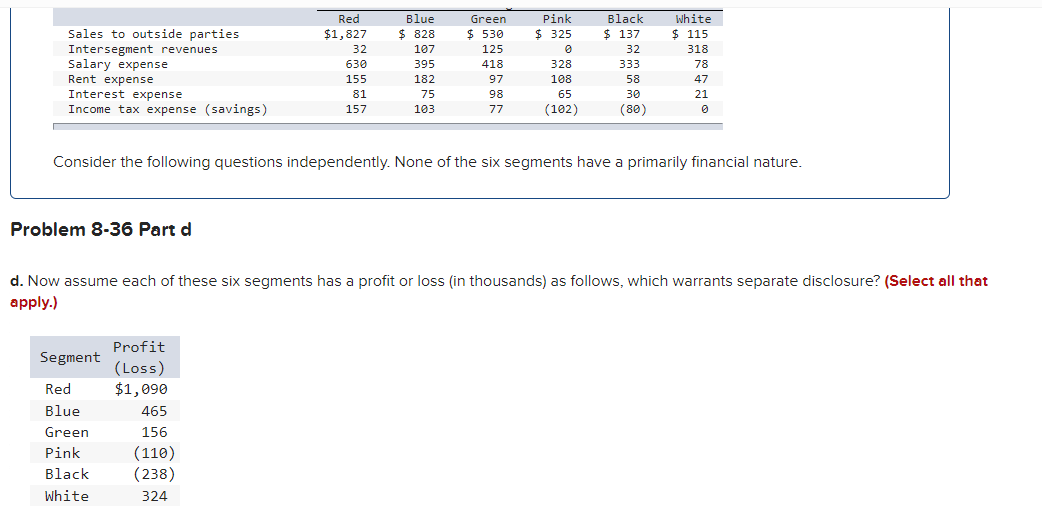

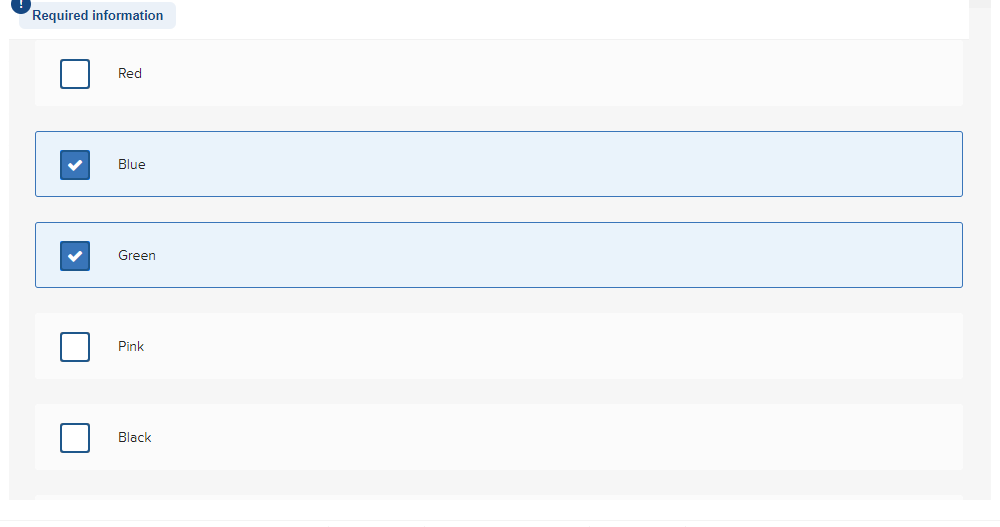

[The following information applies to the questions displayed below.] The following is financial information describing the six operating segments that make up Fairfield, Inc. (in thousands): Consider the following questions independently. None of the six segments have a primarily financial nature. Problem 8-36 Part a What minimum revenue amount must any one segment generate to be of significant size to require disaggregated disclosure? Enter your answer in dollars but not in thousands.) The following is financial information describing the six operating segments that make up Fairfield, Inc. (in thousands): Consider the following questions independently. None of the six segments have a primarily financial nature. Droblem 8-36 Part b o. If only Red, Blue, and Green necessitate separate disclosure, is Fairfield disclosing disaggregated data for enough segments? Yes No Problem 8-36 (Algo) (LO 8-2, 8-5) [The following information applies to the questions displayed below.] The following is financial information describing the six operating segments that make up Fairfield, Inc. (in thousands): Consider the following questions independently. None of the six segments have a primarily financial nature. roblem 8-36 Part c What volume of revenues must a single customer generate to necessitate disclosing the existence of a major customer? (Enter your nswer in dollars but not in thousands.) Consider the following questions independently. None of the six segments have a primarily financial nature. Problem 8-36 Part d d. Now assume each of these six segments has a profit or loss (in thousands) as follows, which warrants separate disclosure? (Select all that apply.) Red Blue Green Pink Black

[The following information applies to the questions displayed below.] The following is financial information describing the six operating segments that make up Fairfield, Inc. (in thousands): Consider the following questions independently. None of the six segments have a primarily financial nature. Problem 8-36 Part a What minimum revenue amount must any one segment generate to be of significant size to require disaggregated disclosure? Enter your answer in dollars but not in thousands.) The following is financial information describing the six operating segments that make up Fairfield, Inc. (in thousands): Consider the following questions independently. None of the six segments have a primarily financial nature. Droblem 8-36 Part b o. If only Red, Blue, and Green necessitate separate disclosure, is Fairfield disclosing disaggregated data for enough segments? Yes No Problem 8-36 (Algo) (LO 8-2, 8-5) [The following information applies to the questions displayed below.] The following is financial information describing the six operating segments that make up Fairfield, Inc. (in thousands): Consider the following questions independently. None of the six segments have a primarily financial nature. roblem 8-36 Part c What volume of revenues must a single customer generate to necessitate disclosing the existence of a major customer? (Enter your nswer in dollars but not in thousands.) Consider the following questions independently. None of the six segments have a primarily financial nature. Problem 8-36 Part d d. Now assume each of these six segments has a profit or loss (in thousands) as follows, which warrants separate disclosure? (Select all that apply.) Red Blue Green Pink Black Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started