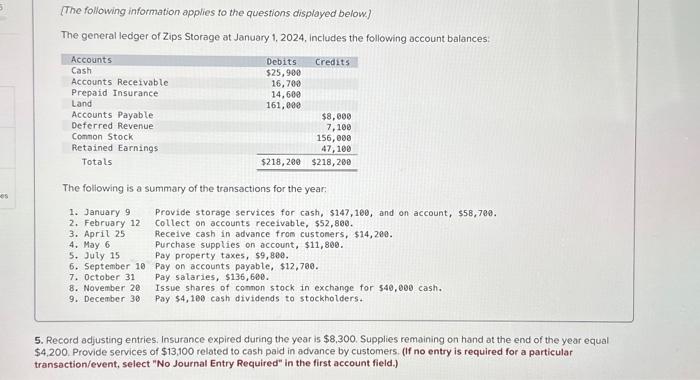

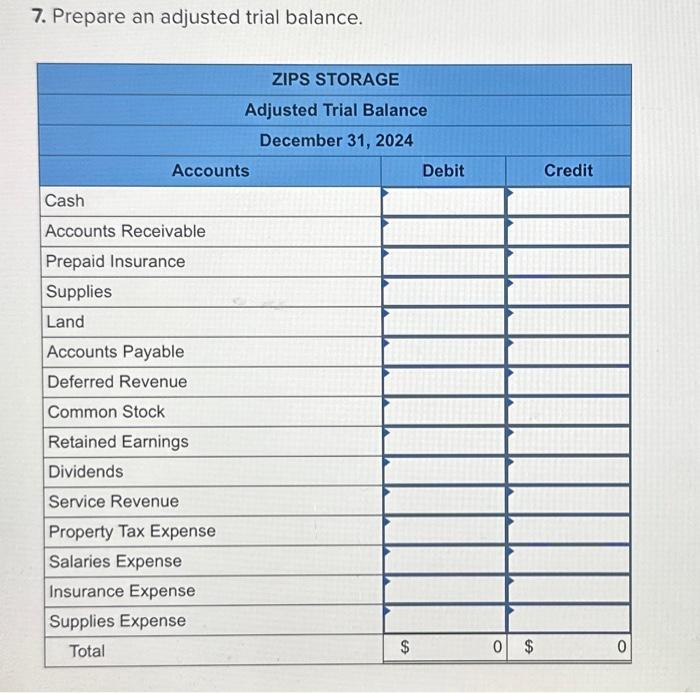

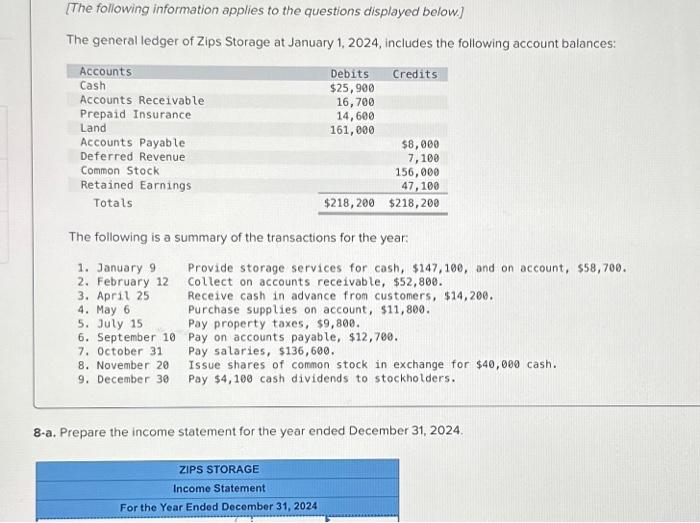

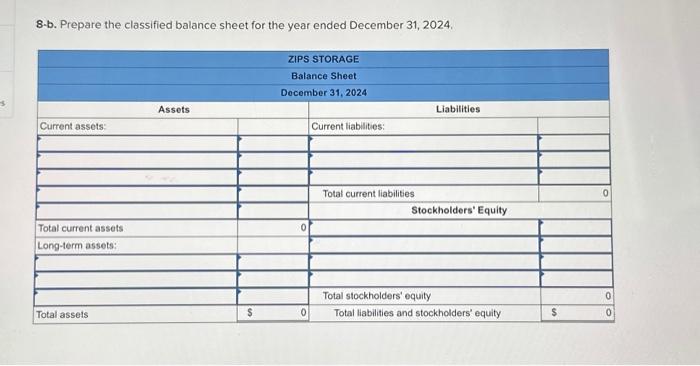

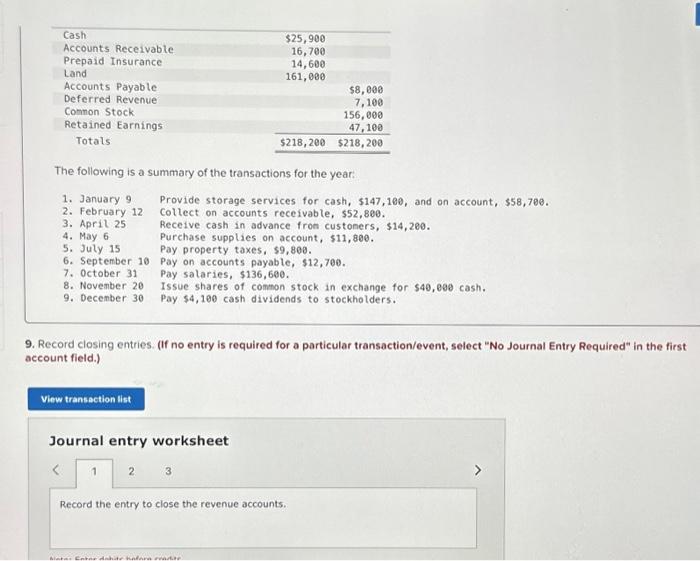

[The following information applies to the questions displayed below] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $147,100, and on account, $58,700. 2. February 12 collect on accounts receivable, $52,800. 3. April 25 Receive cash in advance from customers, $14,200. 4. May 6 Purchase supplies on account, $11,800. 5. July 15 Pay property taxes, $9,800. 6. September 10 Pay on accounts payable, $12,700. 7. October 31 Pay salaries, \$136,600. 8. November 20 Issue shares of common stock in exchange for $40,000 cash. 9. December 30 Pay $4,100 cash dividends to stockholders. 8-a. Prepare the income statement for the year ended December 31, 2024. 7. Prepare an adjusted trial balance. [The following information applies to the questions displayed below] The general ledger of Zips Storage at January 1, 2024, includes the following occount balances: The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. Juty 15 6. September 10 7. October 31 8. November 28 9. Decenber 30 Provide storage services for cash, $147,100, and on account, $58,700. collect on accounts receivable, $52,800. Receive cash in advance from custoners, $14,200. Purchase supplies on account, $11,800. Pay property taxes, $9,800. Pay on accounts payable, $12,700. Pay salaries, $136,600. Issue shares of comnon stock in exchange for $40,000 cash. Pay $4,106 cash dividends to stockholders. 5. Record adjusting entries. Insurance expired during the year is $8,300. Supplies remaining on hand at the end of the year equal $4,200. Provide services of $13,100 related to cash paid in advance by customers. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $147,100, and on account, $58,700. 2. February 12 Collect on accounts receivable, $52,800. 3. April 25 Receive cash in advance fron custoners, \$14,200. 4. May 6 Purchase supplies on account, $11,800. 5. July 15 Pay property taxes, $9,800. 6. Septenber 10 pay on accounts payable, $12,700. 7. October 31 Pay salaries, $136,600. 8. Noventer 20 Issue shares of common stock in exchange for $40,000 cash. 9. December 30 Pay $4,100 cash dividends to stockholders. 9. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) 8-b. Prepare the classified balance sheet for the year ended December 31,2024