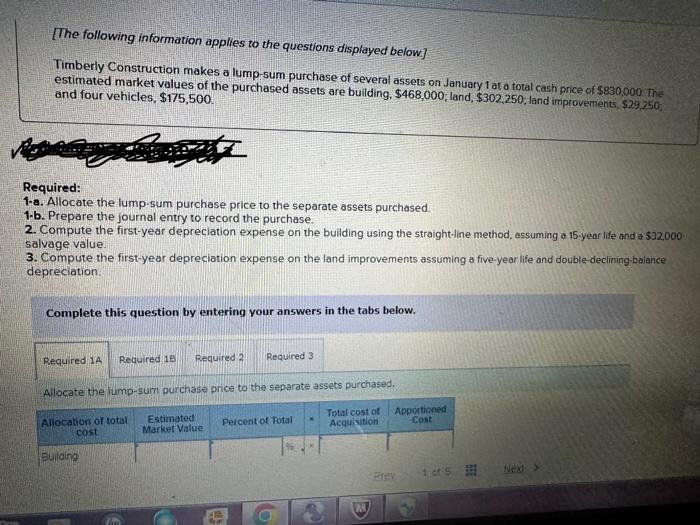

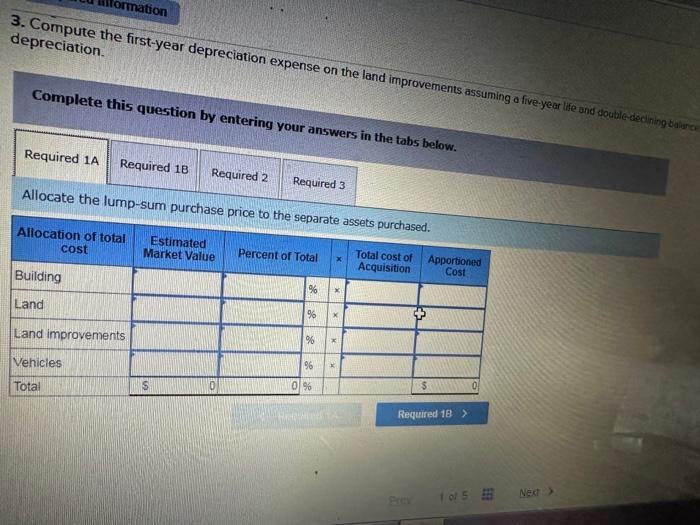

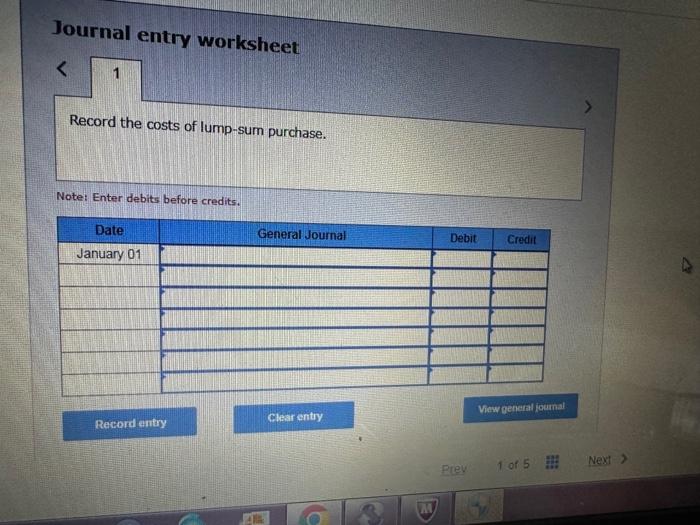

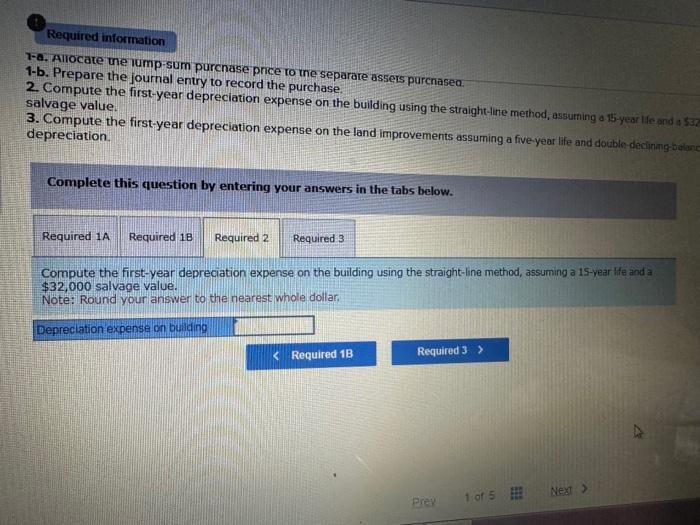

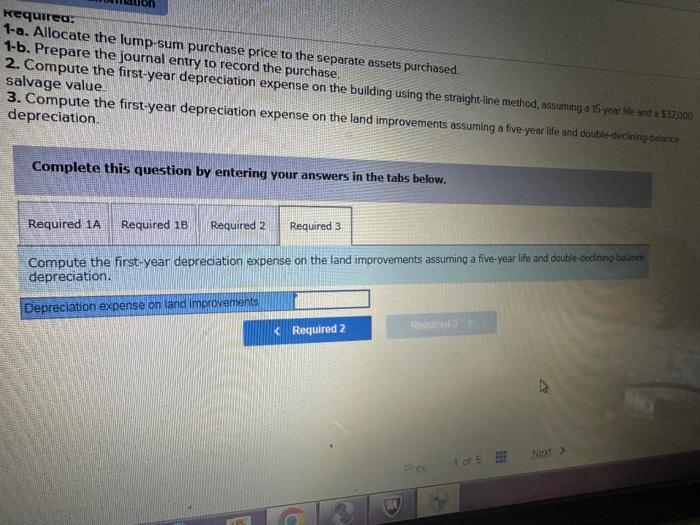

[The following information applies to the questions displayed below] Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $830,000 The estimated market values of the purchased assets are building, $468,000; land, $302,250; land improvements, $29,250; and four vehicles, $175,500 Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $32,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation: Complete this question by entering your answers in the tabs below. Allocate the lump-sum purchase pnce to the separate assets purchased. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and doubiedecining bounce Allocate the lump-sum purchase price to the icnm-. Journal entry worksheet Record the costs of lump-sum purchase. Notet Enter debits before credits. 1-a. Alrocate me tump-sum purcnase price to the separare assers purcnased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming o 15 -year life end a 5 salvage value 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and doable-declinng bahert depreciation. Complete this question by entering your answers in the tabs below. Compute the first-year depreciation expense on the building using the straight-ine method, assuming a 15 --ear lfe and a $32,000 salvage value. Note: Round your answer to the nearest whole dollar. 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute th salvage value. depreciation. Complete this question by entering your answers in the tabs below. Compute the first-year depreciation expense on the land improvements assuming a five-vear life and double-dedining-batarma depreciation