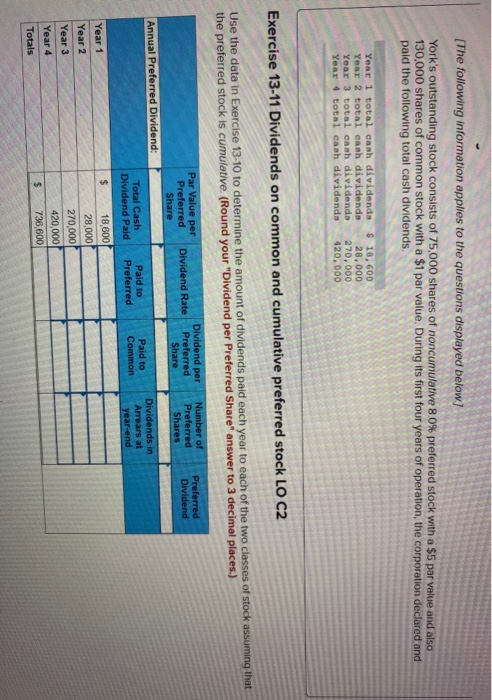

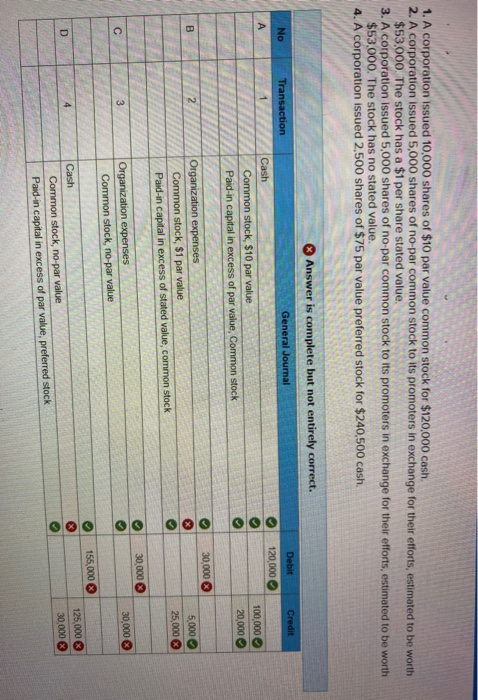

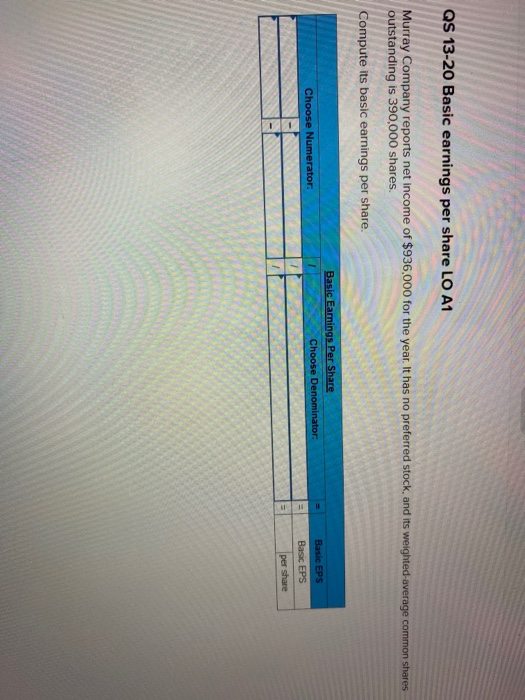

[The following information applies to the questions displayed below) York's outstanding stock consists of 75,000 shares of noncumulative 8.0% preferred stock with a $5 par value and also 130,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends. Year 1 total cash dividends Year 2 total cash dividenda Year 3 total cash dividenda Year 4 total cash dividenda $ 10, 600 28,000 270,000 420,000 Exercise 13-11 Dividends on common and cumulative preferred stock LO C2 Use the data in Exercise 13-10 to determine the amount of dividends paid each year to each of the two classes of stock assuming that the preferred stock is cumulative, (Round your "Dividend per Preferred Share" answer to 3 decimal places.) Par Value per Preferred Share Dividend per Preferred Share Dividend Rate Number of Preferred Shares Preferred Dividend Annual Preferred Dividend: Total Cash Dividend Paid Paid to Preferred Paid to Common Dividends in Arrears at year-end $ Year 1 Year 2 Year 3 Year 4 Totals 18,600 28,000 270,000 420,000 736,600 $ 1. A corporation issued 10,000 shares of $10 par value common stock for $120,000 cash, 2. A corporation issued 5,000 shares of no-par common stock to its promoters in exchange for their efforts, estimated to be worth $53,000. The stock has a $1 per share stated value. 3. A corporation issued 5,000 shares of no par common stock to its promoters in exchange for their efforts, estimated to be worth $53,000. The stock has no stated value. 4. A corporation issued 2,500 shares of $75 par value preferred stock for $240,500 cash. Answer is complete but not entirely correct. Credit No Transaction Debit 120,000 A General Journal Cash Common stock, $10 par value Paid-in capital in excess of par value, Common stock DIO 100,000 20,000 OC 30,000 B 2 Organization expenses Common stock, $1 par value Paid-in capital in excess of stated value, common stock 5,000 25,000 0 30,000 30,000 > 3 Organization expenses Common stock, no-par value 155,000 D 125.000 30,000 X Cash Common stock, no par value Paid-in capital in excess of par value, preferred stock QS 13-20 Basic earnings per share LO A1 Murray Company reports net income of $936,000 for the year. It has no preferred stock, and its weighted average common shares outstanding is 390,000 shares. Compute its basic earnings per share. Basic Earnings Per Share Choose Denominator: Choose Numerator: Basic EPS Basic EPS per share