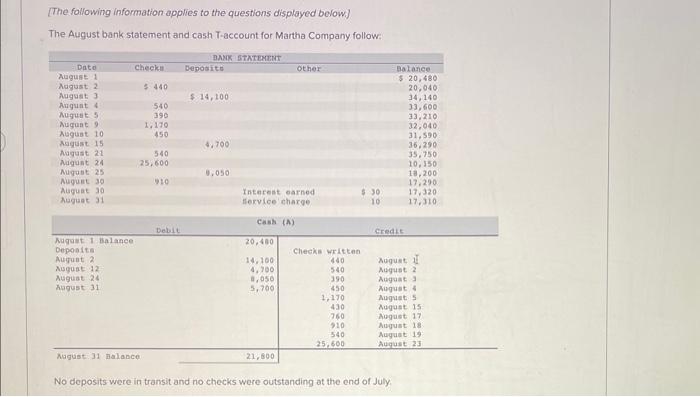

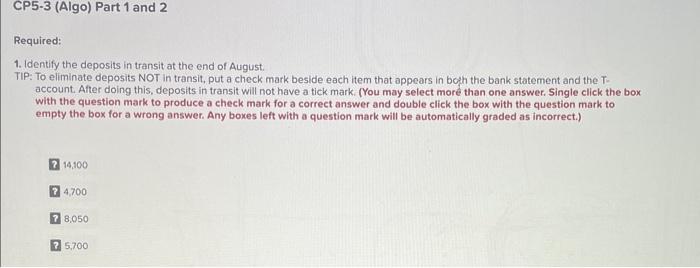

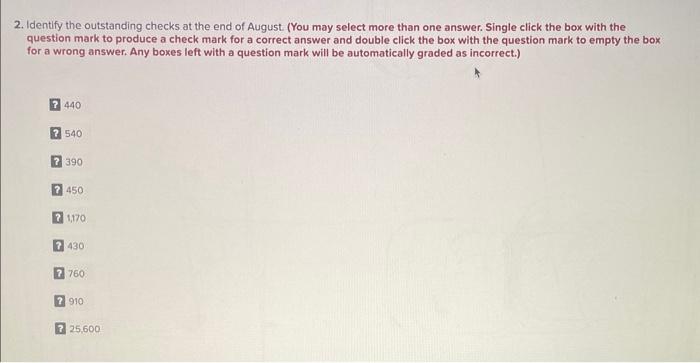

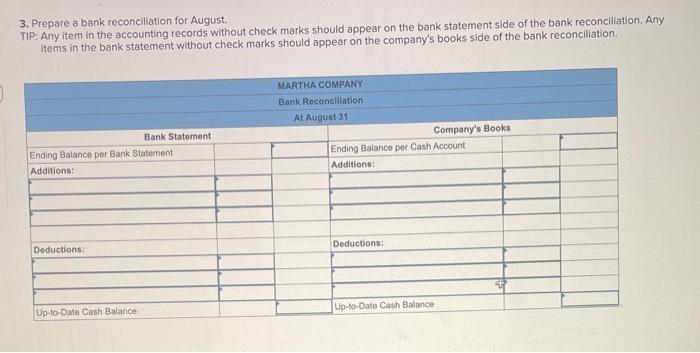

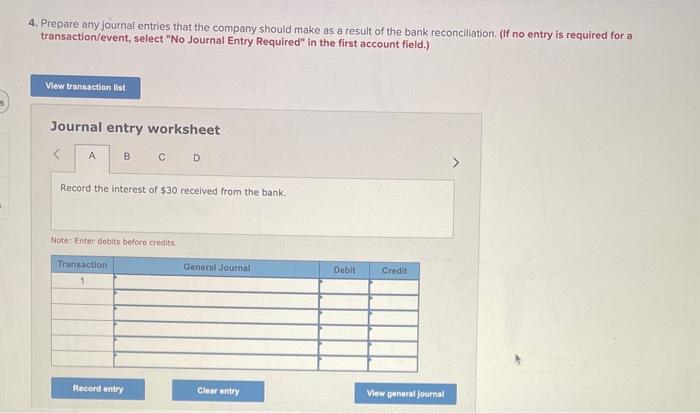

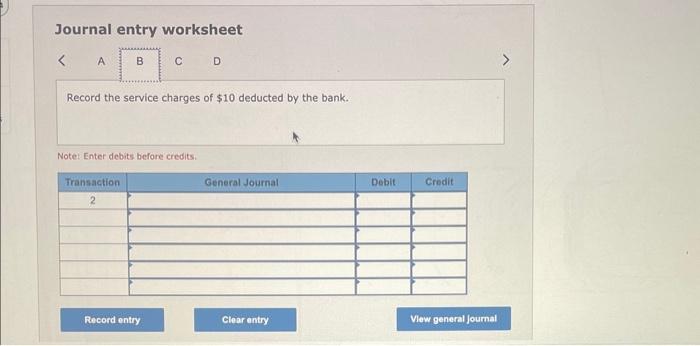

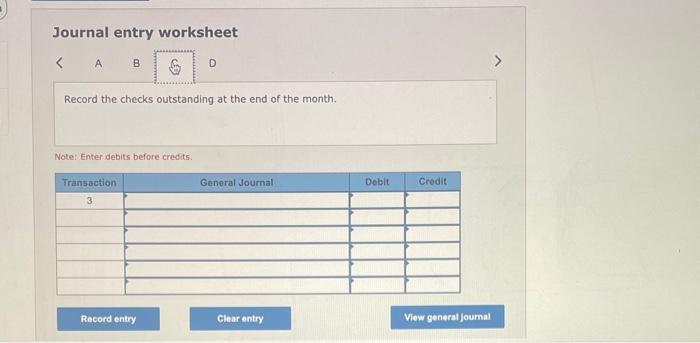

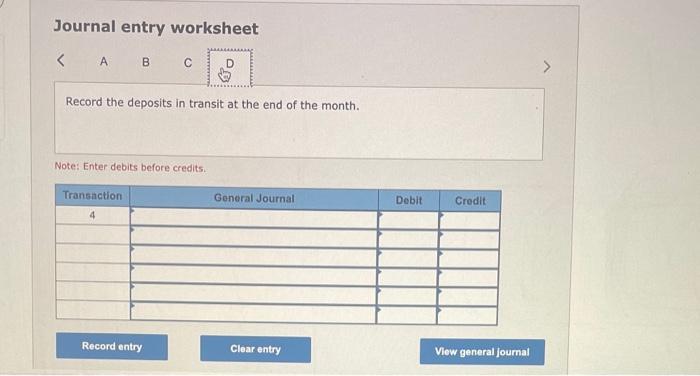

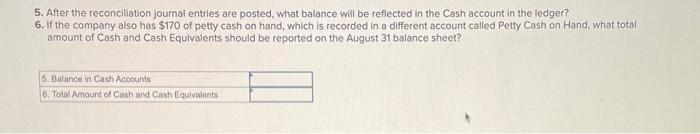

[The following information applies to the questions displayed bolow] The August bank statement and cash T-account for Martha Company follow: No deposits were in transit and no checks were outstanding at the end of July. 1. Identify the deposits in transit at the end of August. TIP: To eliminate deposits NOT in transit, put a check mark beside each item that appears in both the bank statement and the Taccount. After doing this, deposits in transit will not have a tick mark. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) 14,100 4,700 8,050 5,700 2. Identify the outstanding checks at the end of August. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) 440 540 390 450 1,770 430 760 910 ? 25,600 3. Prepare a bank reconciliation for August. TIP: Any item in the accounting records without check marks should appear on the bank statement side of the bank reconciliation. Any items in the bank statement without check marks should appear on the company's books side of the bank reconcillation. 4. Prepare any journal entries that the company should make as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the interest of $30 received from the bank. Note: Enter debits before redits. Journal entry worksheet Record the service charges of $10 deducted by the bank. Note: Enter debits before credits: Journal entry worksheet Record the checks outstanding at the end of the month. Note: Enter debits before credits. Journal entry worksheet Record the deposits in transit at the end of the month. Note: Enter debits before credits. 5. After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger? 6. If the company also has $170 of petty cash on hand, which is recorded in a different account called Petty Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the August 31 balance sheet