Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information concerns the adjusting entries to be recorded on November 30, 2023, for Rail ink's year just ended. a. The Office Supplles account

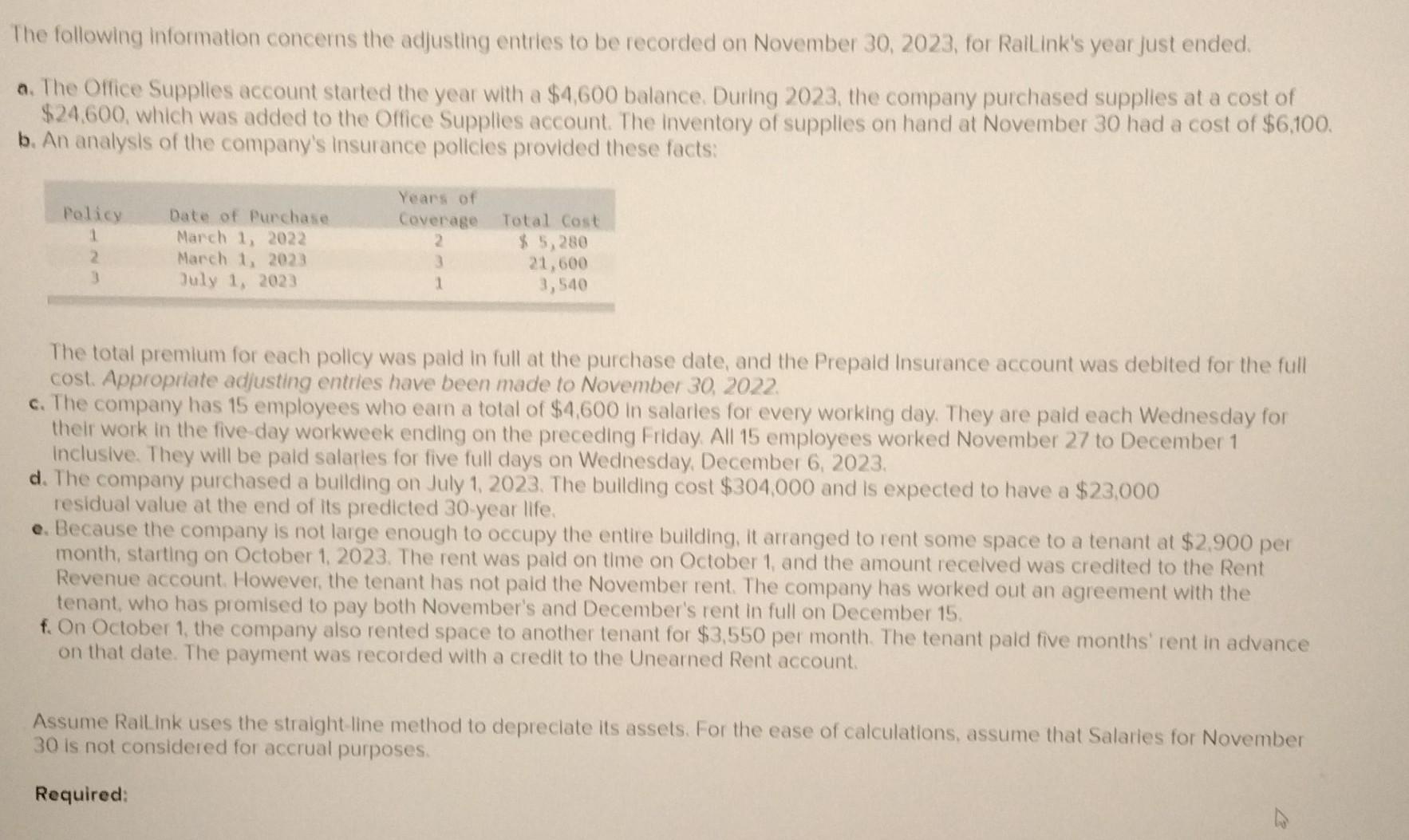

The following information concerns the adjusting entries to be recorded on November 30, 2023, for Rail ink's year just ended. a. The Office Supplles account started the year with a $4,600 balance. During 2023, the company purchased supplies at a cost of $24,600, which was added to the Office Supplies account. The inventory of supplles on hand at November 30 had a cost of $6,100. b. An analysis of the company's insurance policles provided these facts: The total premium for each pollcy was pald in full at the purchase date, and the Prepaid Insurance account was debited for the full cost. Appropriate adjusting entries have been made to November 30, 2022. c. The company has 15 employees who earn a total of $4,600 in salarles for every working day. They are paid each Wednesday for their work in the five-day workweek ending on the preceding Friday. All 15 employees worked November 27 to December 1 Inclusive. They will be paid salaries for five full days on Wednesday. December 6, 2023. d. The company purchased a bullding on July 1, 2023. The bullding cost $304,000 and is expected to have a $23,000 residual value at the end of its predicted 30 -year life. e. Because the company is not large enough to occupy the entire building, it arranged to rent some space to a tenant at $2,900 per month, starting on October 1, 2023. The rent was paid on time on October 1, and the amount recelved was credited to the Rent Revenue account. However, the tenant has not paid the November rent. The company has worked out an agreement with the tenant, who has promised to pay both November's and December's rent in full on December 15. f. On October 1, the company also rented space to another tenant for $3,550 per month. The tenant paid five months' rent in advance on that date. The payment was recorded with a credit to the Unearned Rent account. Assume Railink uses the straight-line method to depreciate its assets. For the ease of calculations, assume that Salaries for November 30 is not considered for accrual purposes. The following information concerns the adjusting entries to be recorded on November 30, 2023, for Rail ink's year just ended. a. The Office Supplles account started the year with a $4,600 balance. During 2023, the company purchased supplies at a cost of $24,600, which was added to the Office Supplies account. The inventory of supplles on hand at November 30 had a cost of $6,100. b. An analysis of the company's insurance policles provided these facts: The total premium for each pollcy was pald in full at the purchase date, and the Prepaid Insurance account was debited for the full cost. Appropriate adjusting entries have been made to November 30, 2022. c. The company has 15 employees who earn a total of $4,600 in salarles for every working day. They are paid each Wednesday for their work in the five-day workweek ending on the preceding Friday. All 15 employees worked November 27 to December 1 Inclusive. They will be paid salaries for five full days on Wednesday. December 6, 2023. d. The company purchased a bullding on July 1, 2023. The bullding cost $304,000 and is expected to have a $23,000 residual value at the end of its predicted 30 -year life. e. Because the company is not large enough to occupy the entire building, it arranged to rent some space to a tenant at $2,900 per month, starting on October 1, 2023. The rent was paid on time on October 1, and the amount recelved was credited to the Rent Revenue account. However, the tenant has not paid the November rent. The company has worked out an agreement with the tenant, who has promised to pay both November's and December's rent in full on December 15. f. On October 1, the company also rented space to another tenant for $3,550 per month. The tenant paid five months' rent in advance on that date. The payment was recorded with a credit to the Unearned Rent account. Assume Railink uses the straight-line method to depreciate its assets. For the ease of calculations, assume that Salaries for November 30 is not considered for accrual purposes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started