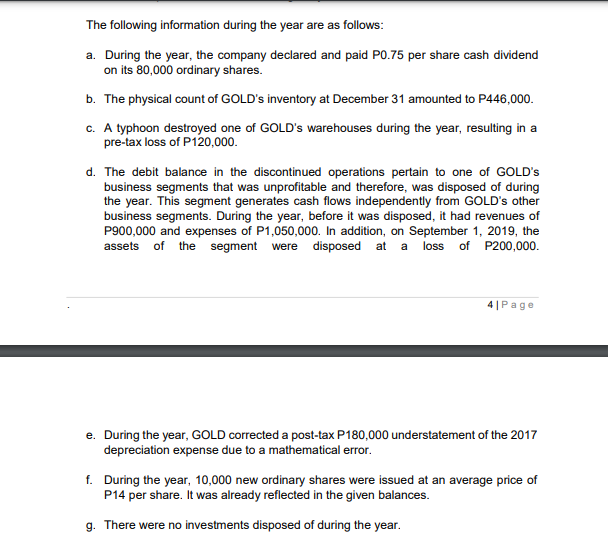

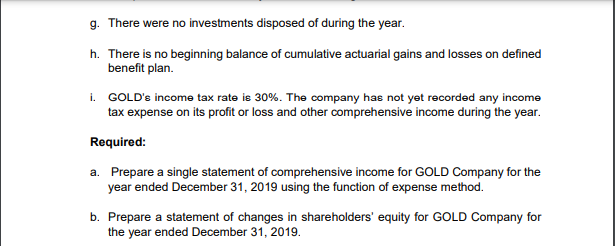

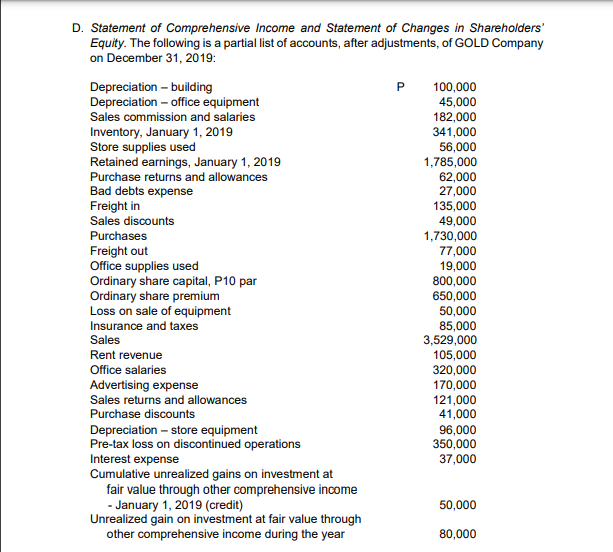

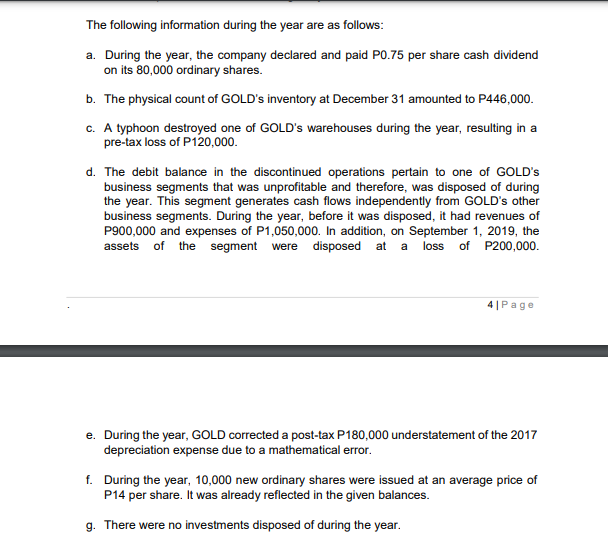

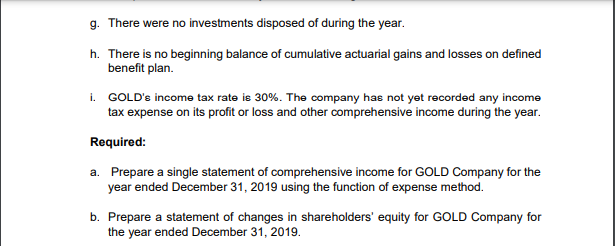

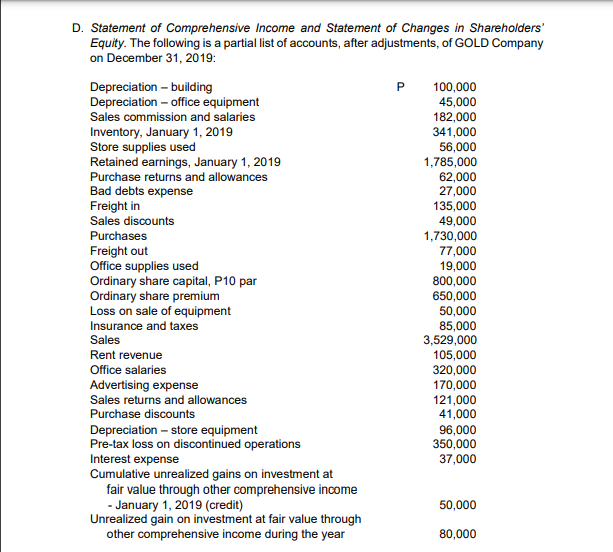

The following information during the year are as follows: a. During the year, the company declared and paid P0.75 per share cash dividend on its 80,000 ordinary shares. b. The physical count of GOLD's inventory at December 31 amounted to P446,000. C. A typhoon destroyed one of GOLD's warehouses during the year, resulting in a pre-tax loss of P120,000. d. The debit balance in the discontinued operations pertain to one of GOLD's business segments that was unprofitable and therefore, was disposed of during the year. This segment generates cash flows independently from GOLD's other business segments. During the year, before it was disposed, it had revenues of P900,000 and expenses of P1,050,000. In addition, on ptember 1, 2019, the assets of the segment were disposed at a loss of P200,000 41 Page e. During the year, GOLD corrected a post-tax P180,000 understatement of the 2017 depreciation expense due to a mathematical error. f. During the year, 10,000 new ordinary shares were issued at an average price of P14 per share. It was already reflected in the given balances. g. There were no investments disposed of during the year. g. There were no investments disposed of during the year. h. There is no beginning balance of cumulative actuarial gains and losses on defined benefit plan. I. GOLD's income tax rate is 30%. The company has not yet recorded any income tax expense on its profit or loss and other comprehensive income during the year. Required: a. Prepare a single statement of comprehensive income for GOLD Company for the year ended December 31, 2019 using the function of expense method. b. Prepare a statement of changes in shareholders' equity for GOLD Company for the year ended December 31, 2019. D. Statement of Comprehensive Income and Statement of Changes in Shareholders' Equity. The following is a partial list of accounts, after adjustments, of GOLD Company on December 31, 2019: Depreciation - building P 100,000 Depreciation - office equipment 45,000 Sales commission and salaries 182,000 Inventory, January 1, 2019 341,000 Store supplies used 56,000 Retained earnings, January 1, 2019 1,785,000 Purchase returns and allowances 62,000 Bad debts expense 27,000 Freight in 135,000 Sales discounts 49,000 Purchases 1,730,000 Freight out 77,000 Office supplies used 19,000 Ordinary share capital, P10 par 800,000 Ordinary share premium 650,000 Loss on sale of equipment 50,000 Insurance and taxes 85,000 Sales 3,529,000 Rent revenue 105,000 Office salaries 320,000 Advertising expense 170,000 Sales returns and allowances 121,000 Purchase discounts 41,000 Depreciation - store equipment 96,000 Pre-tax loss on discontinued operations 350,000 Interest expense 37,000 Cumulative unrealized gains on investment at fair value through other comprehensive income - January 1, 2019 (credit) 50,000 Unrealized gain on investment at fair value through other comprehensive income during the year 80,000