Question

The following information for 2018 relates to Purple Corp, a calendar year, accrual method taxpayer. Net Income per books (after-tax) $250,000 Federal income tax per

The following information for 2018 relates to Purple Corp, a calendar year, accrual method taxpayer.

Net Income per books (after-tax) $250,000 Federal income tax per books 122,250 Depreciation (amount deducted on GAAP financial statements) 145,000 Depreciation (amount calculated for tax purposes under MACRS) 130,000 Fine for Speeding tickets 6,250 Amortization (GAAP) 0 Amortization (Tax) 10,750 Country Club Dues 11,000 Accrued Vacation not deducted on 12/31/17 Return 15,000 Accrued Vacation @ 12/31/18 (7,500 paid by 3/15/19) 25,000 Allowance for Bad Debts on Balance Sheet @ 12/31/17 13,200 Allowance for Bad Debts on Balance Sheet @ 12/31/18 15,750

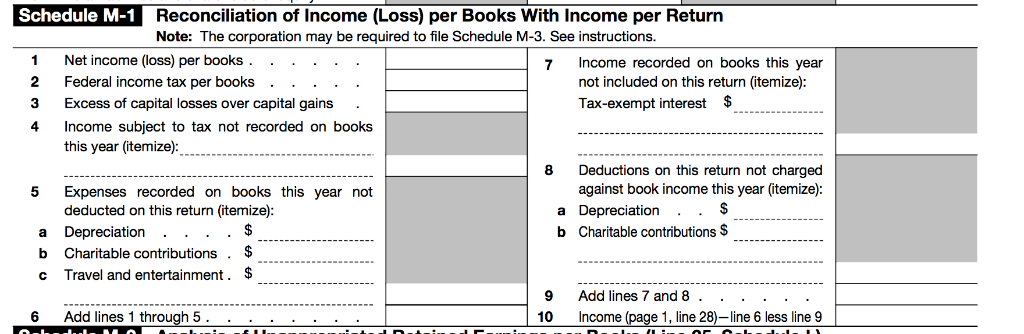

Based on the above information, use Schedule M-1 (on page 5 of Form 1120) for Purple Corp. and upload the Schedule M-1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started