Answered step by step

Verified Expert Solution

Question

1 Approved Answer

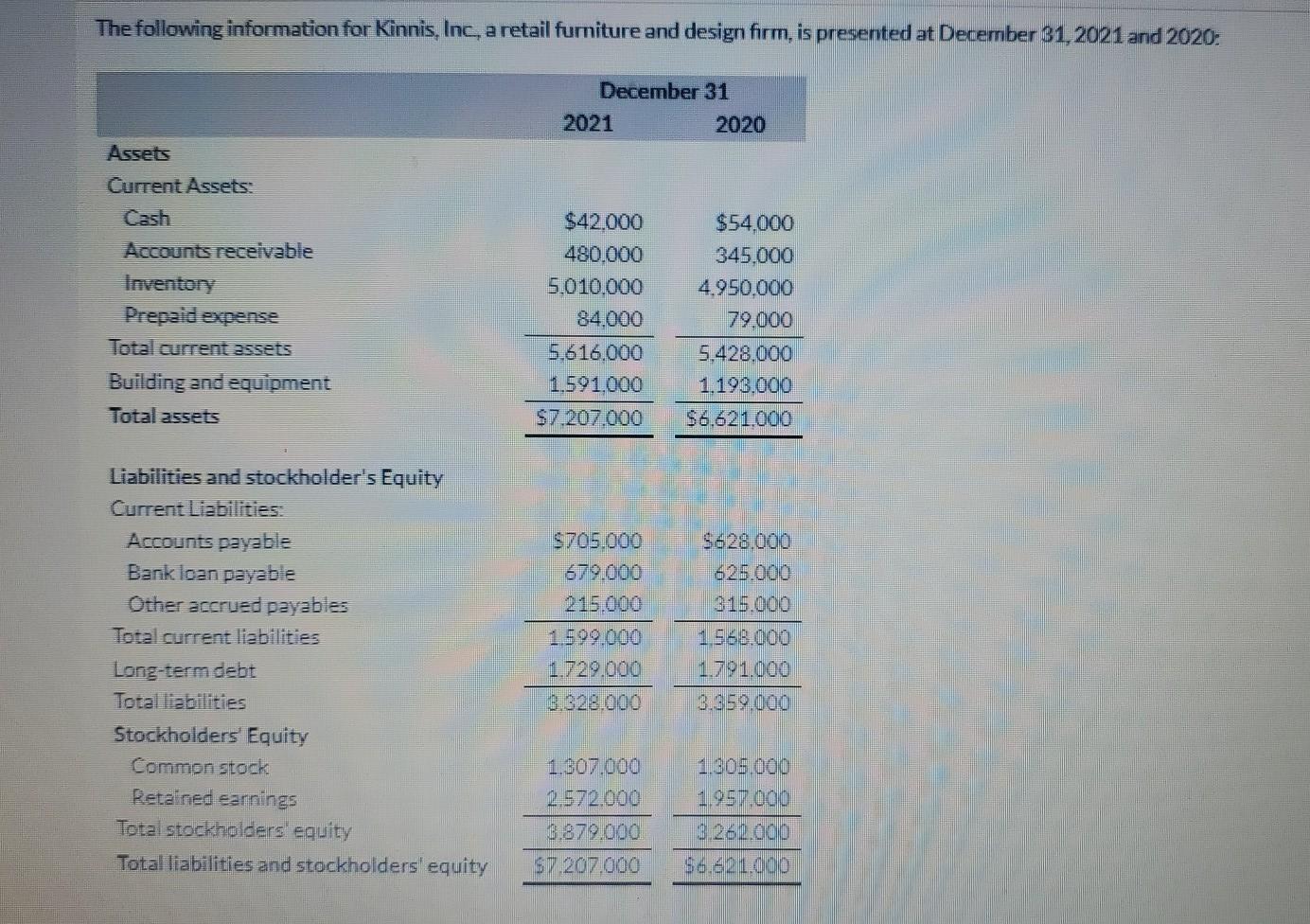

The following information for Kinnis, Inc, a retail furniture and design firm, is presented at December 31, 2021 and 2020: December 31 2021 2020 Assets

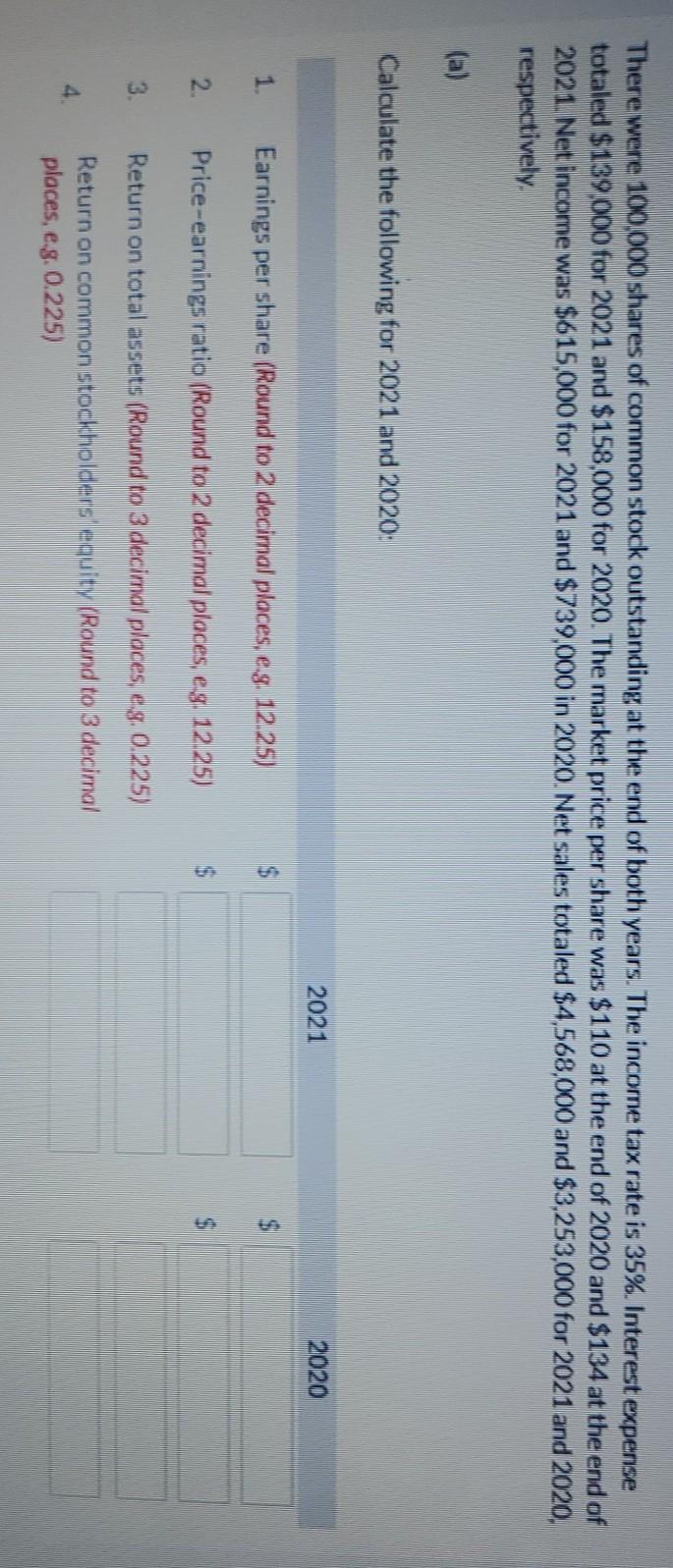

The following information for Kinnis, Inc, a retail furniture and design firm, is presented at December 31, 2021 and 2020: December 31 2021 2020 Assets Current Assets: Cash Accounts receivable Inventory Prepaid expense Total current assets Building and equipment Total assets $42.000 480.000 5.010.000 84.000 5.616.000 1.591.000 $7.207.000 $54.000 345.000 4,950.000 79,000 5.428.000 1.190.000 $6.621.000 Liabilities and stockholder's Equity Current Liabilities: Accounts payable Bank loan payable Other accrued payables Total current liabilities Long-term debt Total liabilities Stockholders Equity Common stock Retained earnings Total stockholders equity Total liabilities and stockholders' equity $705.000 679.000 215.000 1 599.000 1.729.000 3.328.000 $628.000 625.000 315.000 1 568.000 1.701.000 3.350 000 1.807.000 2.572.000 1.805.000 1.957.000 3.262.000 $6.621.000 3.879.000 $7.207.000 There were 100.000 shares of common stock outstanding at the end of both years. The income tax rate is 35%. Interest expense totaled $139 000 for 2021 and $158,000 for 2020. The market price per share was $110 at the end of 2020 and $134 at the end of 2021 Net income was $615,000 for 2021 and $739,000 in 2020. Net sales totaled $4,568,000 and $3,253,000 for 2021 and 2020, respectively a) Calculate the following for 2021 and 2020: 2021 2020 1. Earnings per share (Round to 2 decimal places, eg 12 25) 2. Price-earnings ratio (Round to 2 decimal places eg. 1225) $ 3 Return on total assets (Round to 3 decimal places eg 0225) 4. Return on common stockholders equity (Round to 3 decimal places, e.g. 0.225)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started