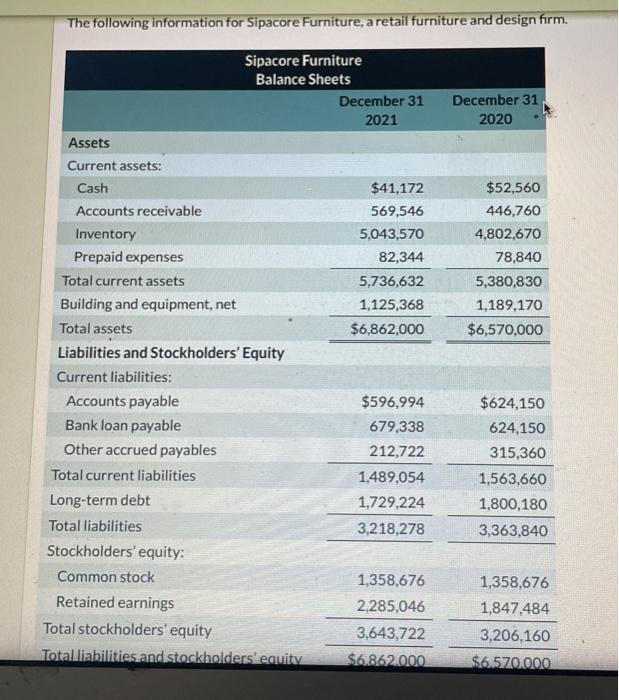

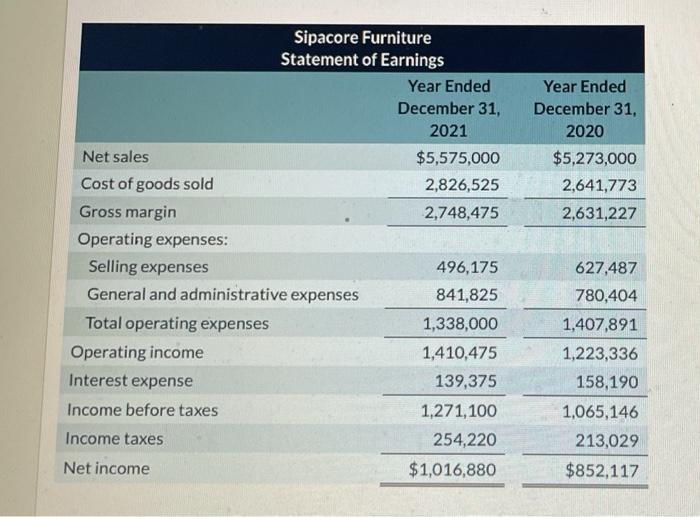

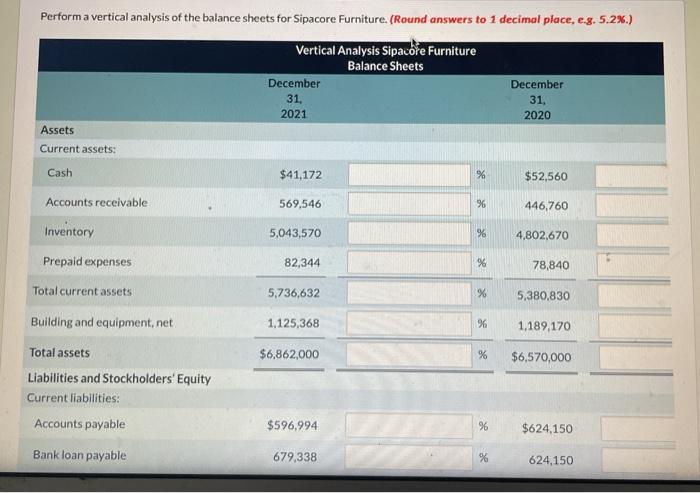

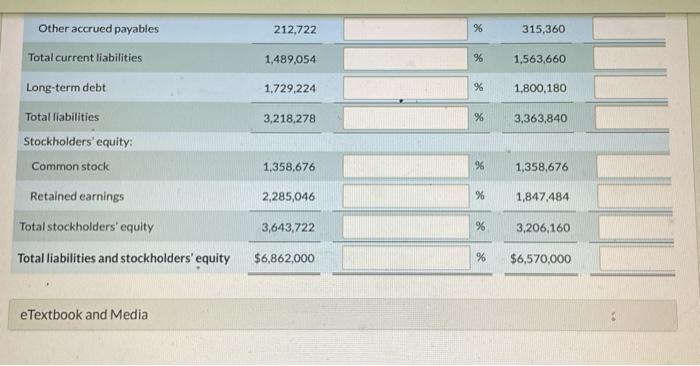

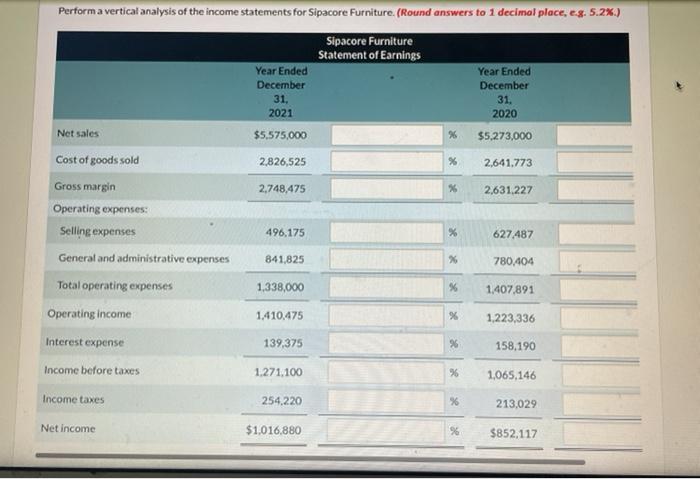

The following information for Sipacore Furniture, a retail furniture and design firm. December 31 2020 $52,560 446,760 4,802,670 78,840 5,380,830 1,189,170 $6,570,000 Sipacore Furniture Balance Sheets December 31 2021 Assets Current assets: Cash $41,172 Accounts receivable 569,546 Inventory 5,043,570 Prepaid expenses 82,344 Total current assets 5,736,632 Building and equipment, net 1,125,368 Total assets $6,862,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $596,994 Bank loan payable 679,338 Other accrued payables 212,722 Total current liabilities 1,489,054 Long-term debt 1,729,224 Total liabilities 3,218,278 Stockholders' equity: Common stock 1,358,676 Retained earnings 2,285,046 Total stockholders' equity 3,643,722 Total liabilities and stockholders' equity $6.862.000 $624,150 624,150 315,360 1,563,660 1,800,180 3,363,840 1,358,676 1,847,484 3,206,160 $6.570.000 Year Ended December 31, 2020 $5,273,000 2,641,773 2,631,227 Sipacore Furniture Statement of Earnings Year Ended December 31, 2021 Net sales $5,575,000 Cost of goods sold 2,826,525 Gross margin 2,748,475 Operating expenses: Selling expenses 496,175 General and administrative expenses 841,825 Total operating expenses 1,338,000 Operating income 1,410,475 Interest expense 139,375 Income before taxes 1,271,100 Income taxes 254,220 Net income $1,016,880 627,487 780,404 1,407,891 1,223,336 158,190 1,065,146 213,029 $852,117 Perform a vertical analysis of the balance sheets for Sipacore Furniture. (Round answers to 1 decimal place, e-3.5.2%.) Vertical Analysis Sipacore Furniture Balance Sheets December 31, 2021 December 31. 2020 Assets Current assets: Cash $41,172 % $52,560 Accounts receivable 569,546 %6 446,760 Inventory 5,043,570 % 4,802,670 Prepaid expenses 82,344 % 78,840 Total current assets 5,736,632 9 5,380,830 Building and equipment, net 1,125,368 %6 1.189.170 $6,862,000 % $6,570,000 Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable $596,994 % $624,150 Bank loan payable 679,338 % 624,150 212,722 % 315,360 1,489,054 % 1,563,660 1,729,224 %6 1,800,180 3,218,278 % 3,363,840 Other accrued payables Total current liabilities Long-term debt Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 1,358,676 96 1,358,676 2,285,046 1,847,484 3,643,722 % 3,206,160 $6,862,000 % $6,570,000 e Textbook and Media Performa vertical analysis of the income statements for Sipacore Furniture. (Round answers to 1 decimal place, c.8.5.2%) Sipacore Furniture Statement of Earnings Year Ended Year Ended December 31. 31. December 2021 2020 $5,575,000 96 $5,273,000 2,826,525 2,641.773 2,748,475 % 2,631.227 496.175 % 627,487 Net sales Cost of goods sold Gross margin Operating expenses: Selling expenses General and administrative expenses Total operating expenses Operating income Interest expense Income before taxes 841,825 X 780,404 1,338,000 % 1.407,891 1,410,475 % 1,223,336 139,375 % 158.190 1,271,100 26 1,065,146 Income taxes 254.220 %6 213.029 Net income $1,016,880 % $852,117