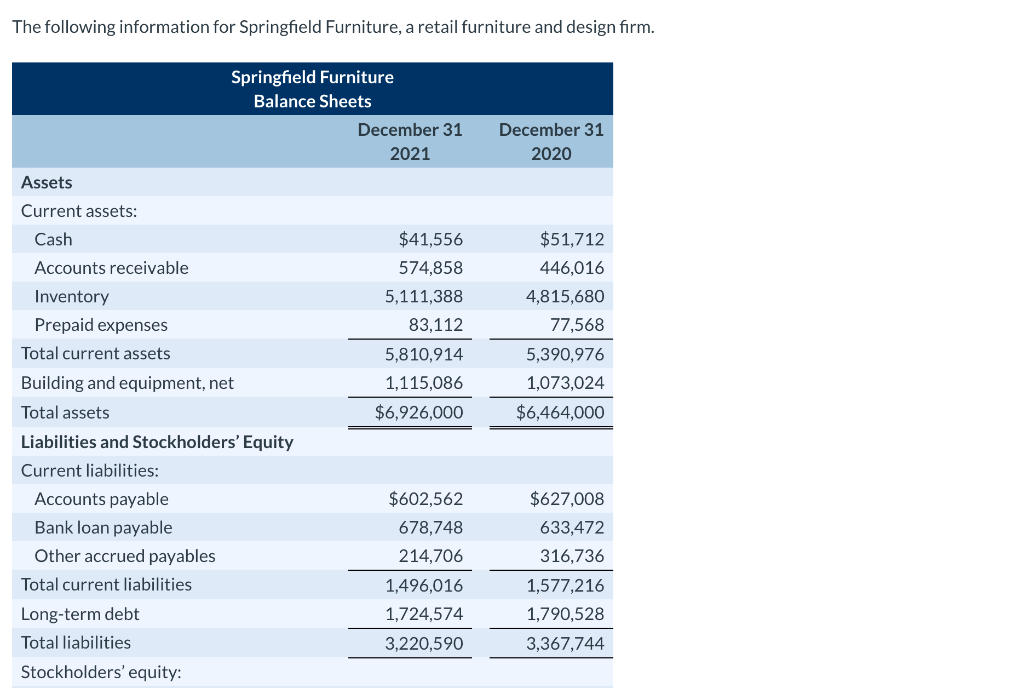

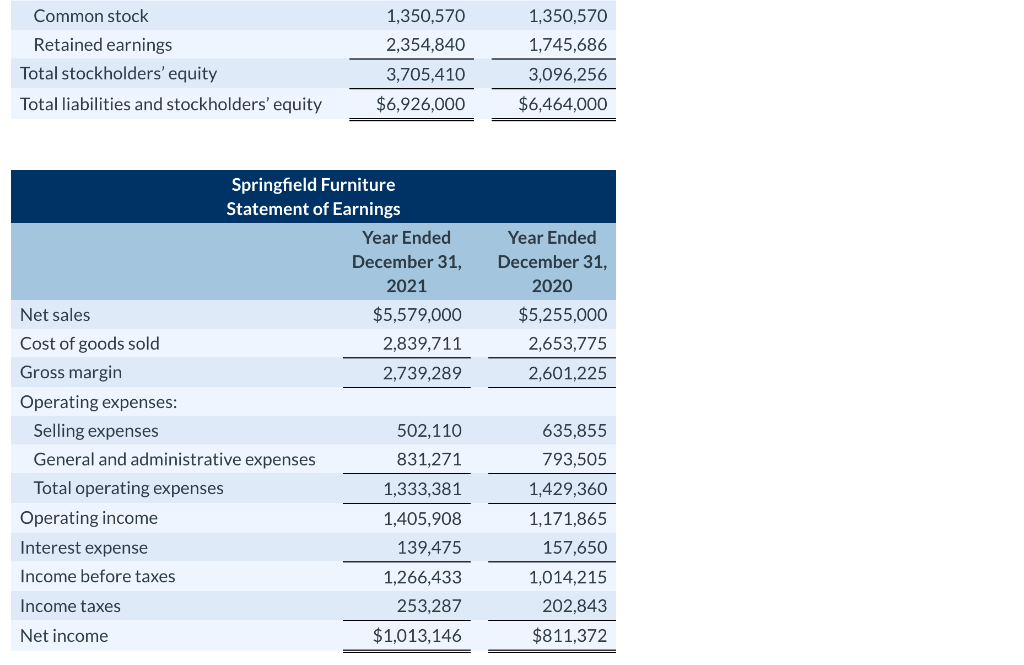

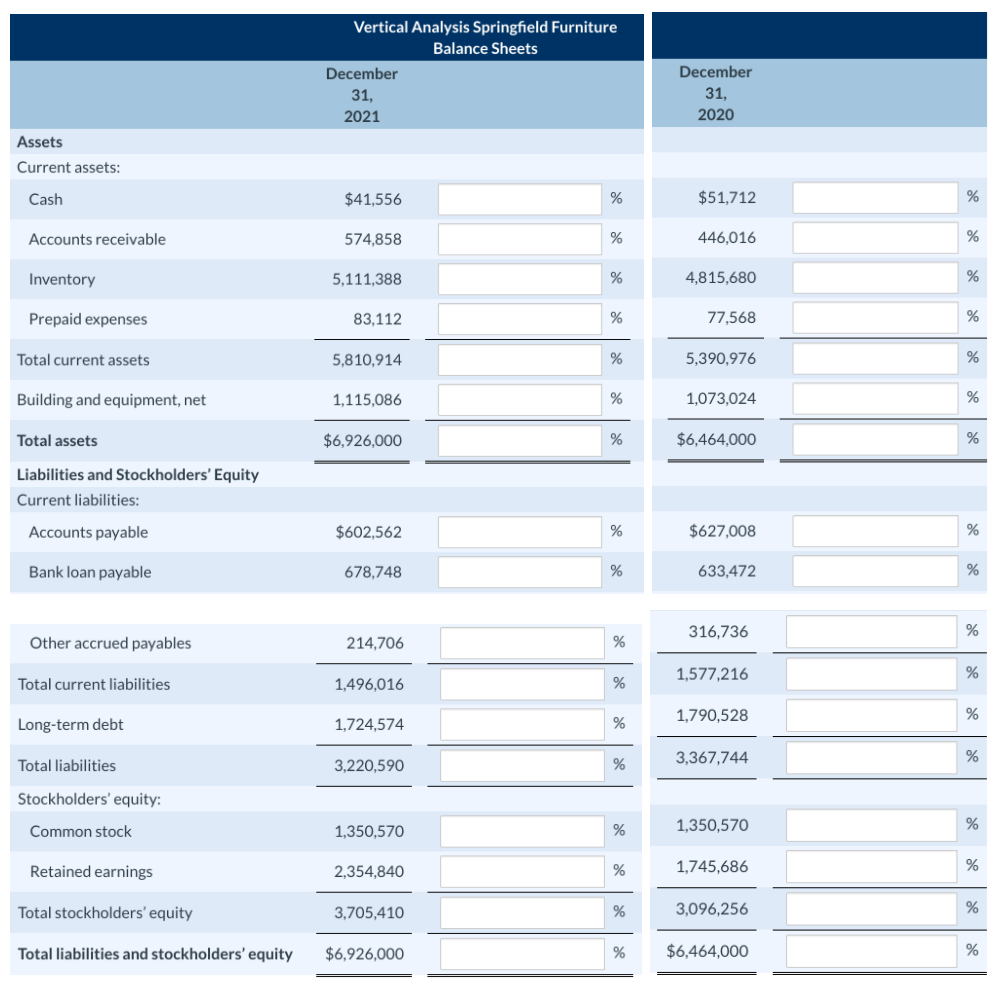

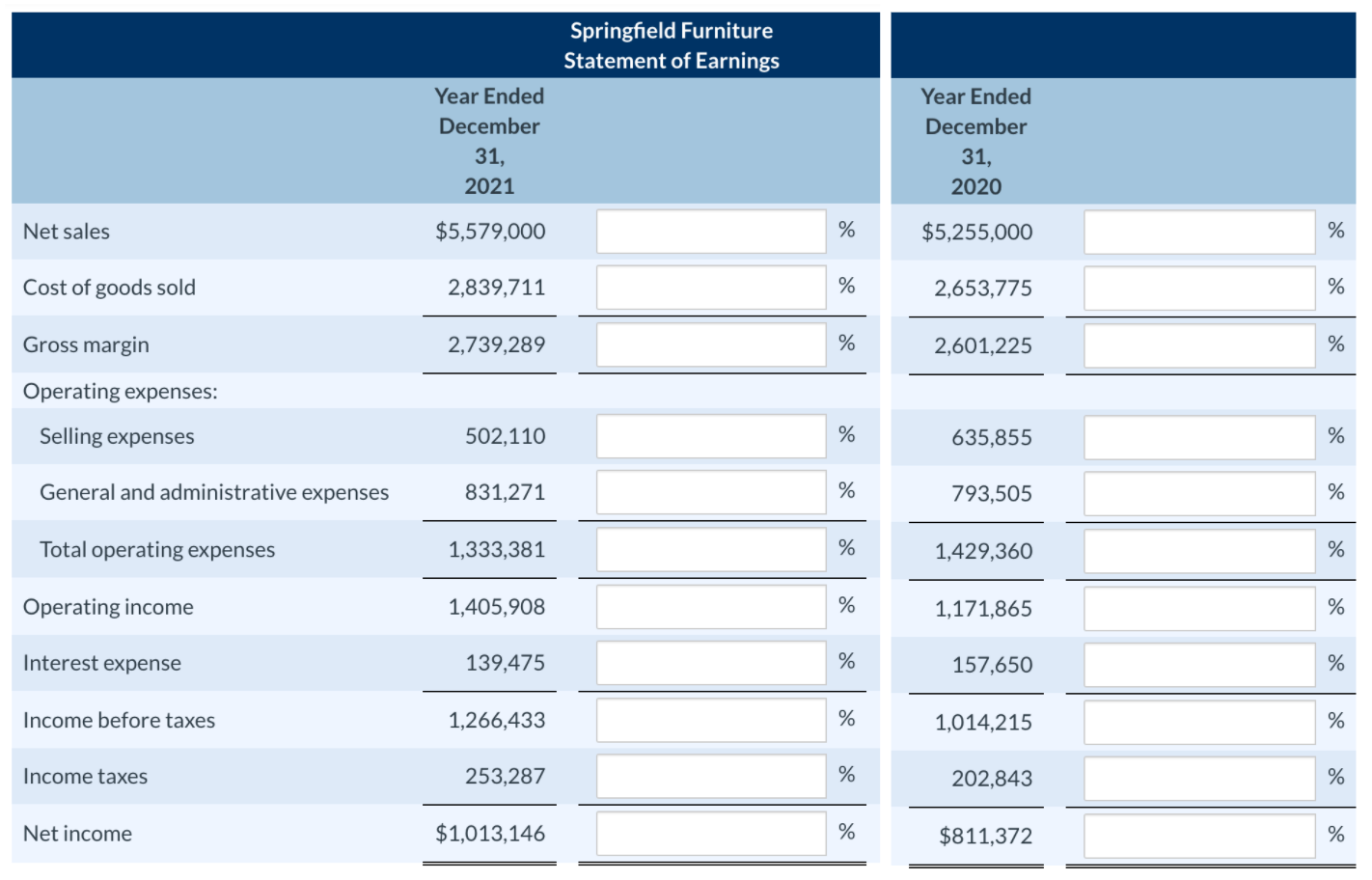

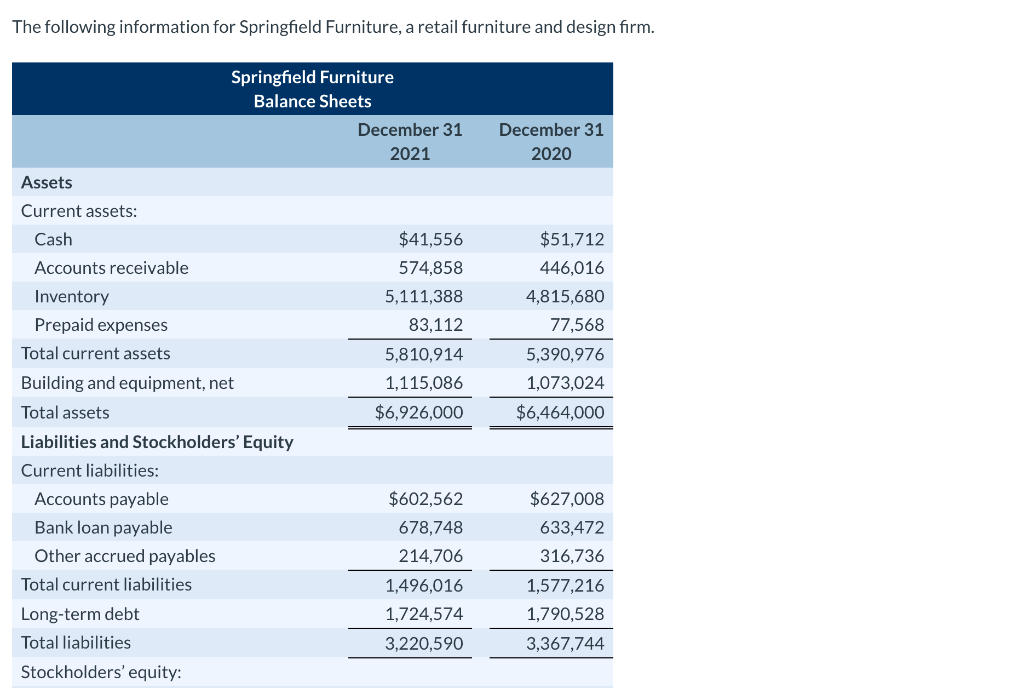

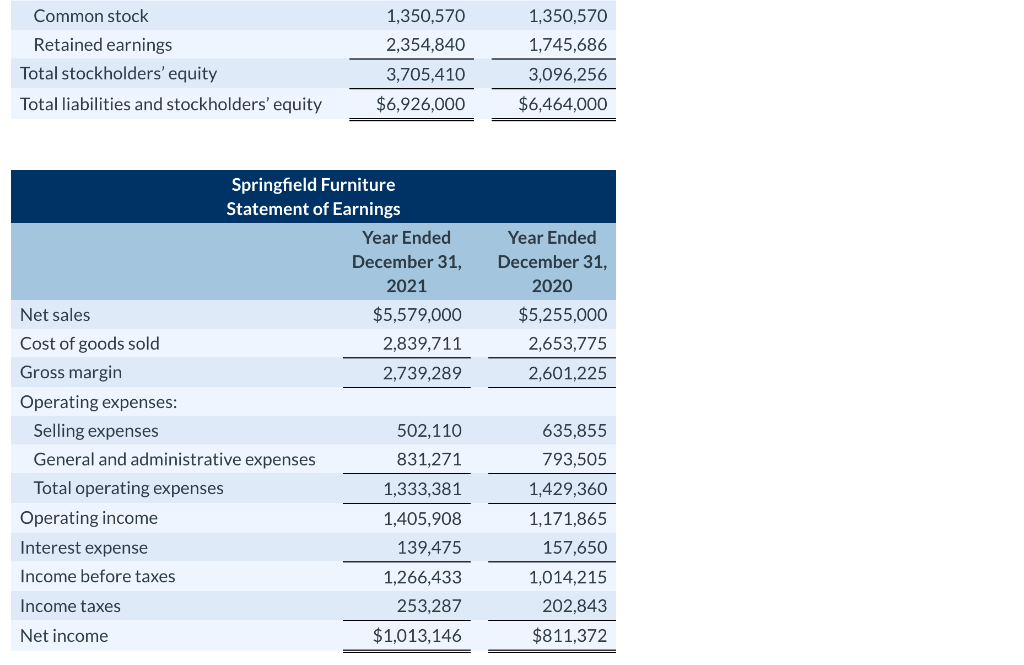

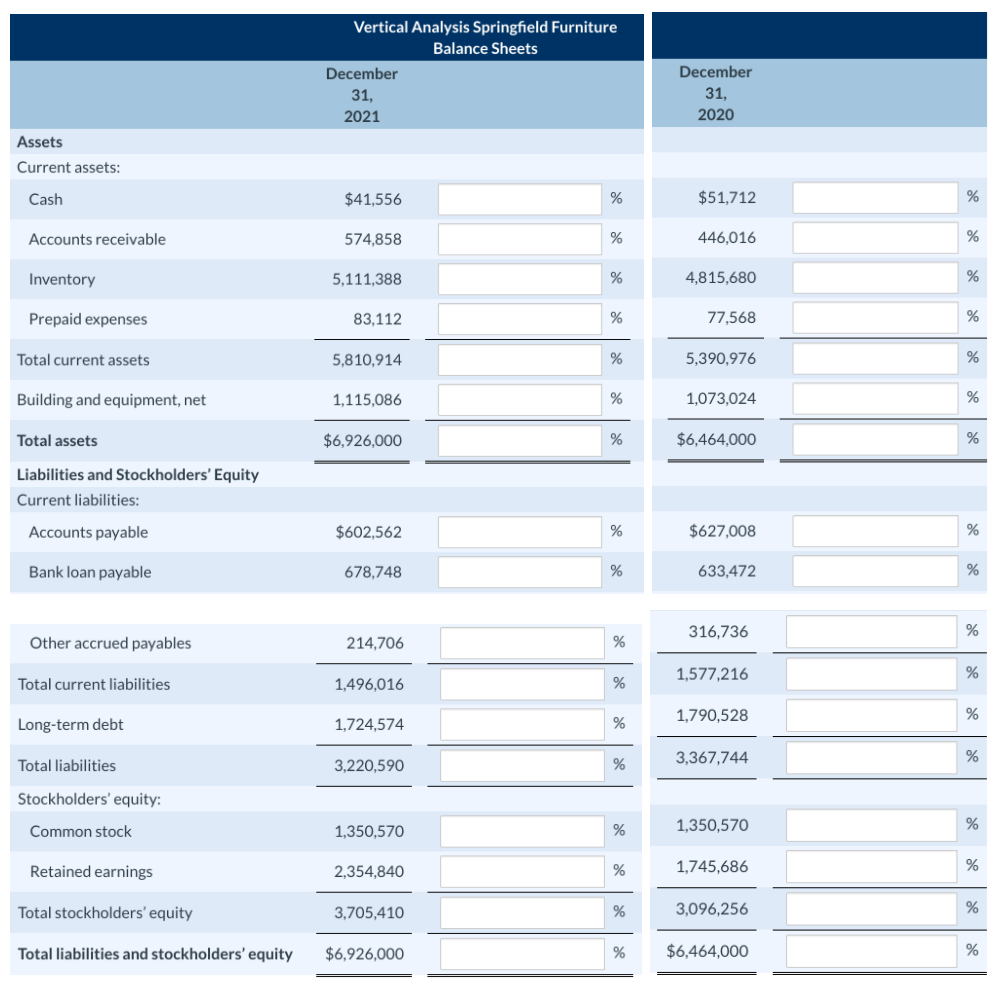

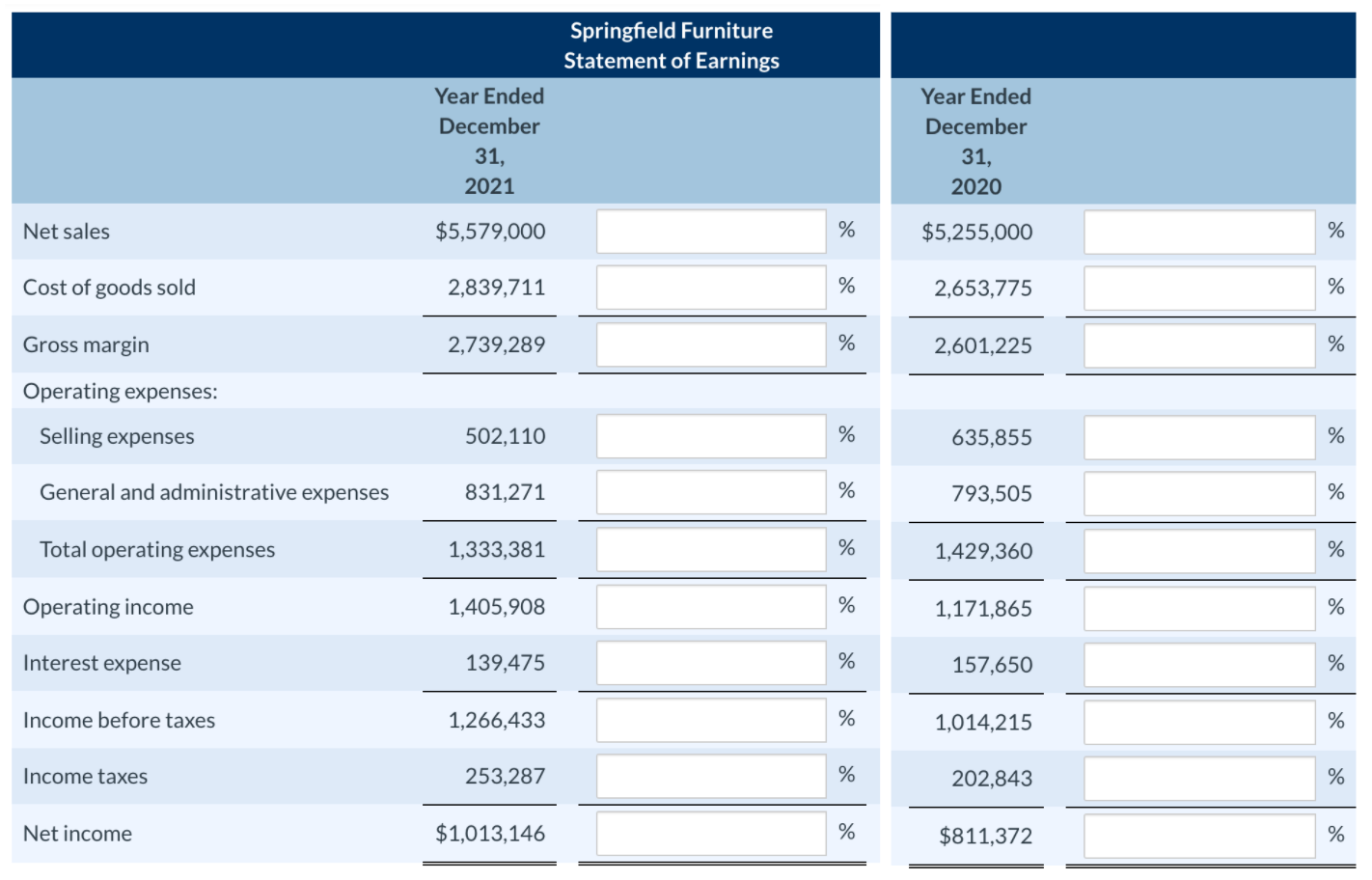

The following information for Springfield Furniture, a retail furniture and design firm. December 31 2020 Springfield Furniture Balance Sheets December 31 2021 Assets Current assets: Cash $41,556 Accounts receivable 574,858 Inventory 5,111,388 Prepaid expenses 83,112 Total current assets 5,810,914 Building and equipment, net 1,115,086 Total assets $6,926,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $602,562 Bank loan payable 678,748 Other accrued payables 214,706 Total current liabilities 1,496,016 Long-term debt 1,724,574 Total liabilities 3,220,590 Stockholders' equity: $51,712 446,016 4,815,680 77,568 5,390,976 1,073,024 $6,464,000 $627,008 633,472 316,736 1,577,216 1,790,528 3,367,744 1,350,570 2,354,840 Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 1,350,570 1,745,686 3,096,256 $6,464,000 3,705,410 $6,926,000 Year Ended December 31, 2020 $5,255,000 2,653,775 2,601,225 Springfield Furniture Statement of Earnings Year Ended December 31, 2021 Net sales $5,579,000 Cost of goods sold 2,839,711 Gross margin 2,739,289 Operating expenses: Selling expenses 502,110 General and administrative expenses 831,271 Total operating expenses 1,333,381 Operating income 1,405,908 Interest expense 139,475 Income before taxes 1,266,433 Income taxes 253,287 Net income $1,013,146 635,855 793,505 1,429,360 1,171,865 157,650 1,014,215 202,843 $811,372 Perform a vertical analysis of the balance sheets for Springfield Furniture. (Round answers to 1 decimal place, e.g. 5.2%.) Vertical Analysis Springfield Furniture Balance Sheets December 31, 2021 December 31, 2020 Assets Current assets: Cash $41,556 % $51,712 % Accounts receivable 574,858 % 446,016 % Inventory 5,111,388 % 4,815,680 % Prepaid expenses 83,112 % 77,568 % Total current assets 5,810,914 % 5.390,976 % Building and equipment, net 1,115,086 % 1,073,024 % Total assets $6,926,000 % $6,464,000 % Liabilities and Stockholders' Equity Current liabilities: Accounts payable $602,562 % $627,008 % Bank loan payable 678,748 % 633,472 % 316,736 % Other accrued payables 214,706 % 1,577,216 % Total current liabilities 1,496,016 % % 1,724,574 1,790,528 Long-term debt % Total liabilities % 3,220,590 % 3,367,744 Stockholders' equity: Common stock 1,350,570 % % 1,350,570 Retained earnings 2,354,840 % 1,745,686 % Total stockholders' equity 3,705,410 % 3,096,256 % Total liabilities and stockholders' equity $6,926,000 % $6,464,000 % Perform a vertical analysis of the income statements for Springfield Furniture. (Round answers to 1 decimal place, e.g. 5.2%.) Springfield Furniture Statement of Earnings Year Ended December 31, 2021 Year Ended December 31, 2020 Net sales $5,579,000 % $5,255,000 % Cost of goods sold 2,839,711 % 2,653,775 % Gross margin 2,739,289 % 2,601,225 % Operating expenses: Selling expenses 502,110 % 635,855 % General and administrative expenses 831,271 % 793,505 % Total operating expenses 1,333,381 % 1,429,360 % Operating income 1,405,908 % 1,171,865 % Interest expense 139,475 % 157,650 % Income before taxes 1,266,433 % 1,014,215 % Income taxes 253,287 % 202,843 % Net income $1,013,146 % $811,372 %