Answered step by step

Verified Expert Solution

Question

1 Approved Answer

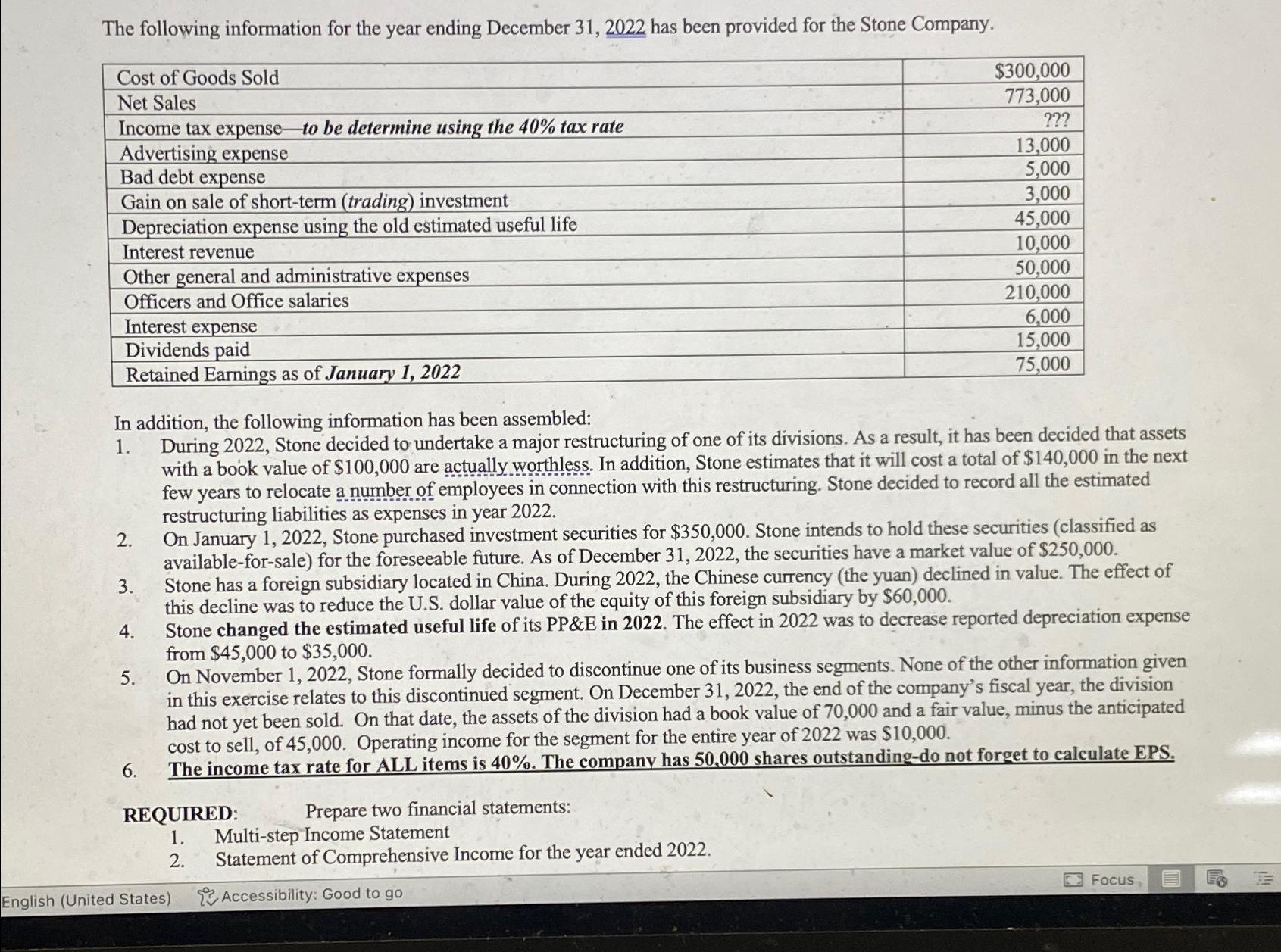

The following information for the year ending December 31, 2022 has been provided for the Stone Company. Cost of Goods Sold Net Sales Income

The following information for the year ending December 31, 2022 has been provided for the Stone Company. Cost of Goods Sold Net Sales Income tax expense to be determine using the 40% tax rate Advertising expense Bad debt expense Gain on sale of short-term (trading) investment Depreciation expense using the old estimated useful life Interest revenue Other general and administrative expenses Officers and Office salaries Interest expense Dividends paid Retained Earnings as of January 1, 2022 In addition, the following information has been assembled: 1. 2. 3. 4. 5. 6. $300,000 773,000 ??? 13,000 5,000 3,000 45,000 10,000 50,000 210,000 6,000 15,000 75,000 During 2022, Stone decided to undertake a major restructuring of one of its divisions. As a result, it has been decided that assets with a book value of $100,000 are actually worthless. In addition, Stone estimates that it will cost a total of $140,000 in the next few years to relocate a number of employees in connection with this restructuring. Stone decided to record all the estimated restructuring liabilities as expenses in year 2022. On January 1, 2022, Stone purchased investment securities for $350,000. Stone intends to hold these securities (classified as available-for-sale) for the foreseeable future. As of December 31, 2022, the securities have a market value of $250,000. Stone has a foreign subsidiary located in China. During 2022, the Chinese currency (the yuan) declined in value. The effect of this decline was to reduce the U.S. dollar value of the equity of this foreign subsidiary by $60,000. Stone changed the estimated useful life of its PP&E in 2022. The effect in 2022 was to decrease reported depreciation expense from $45,000 to $35,000. On November 1, 2022, Stone formally decided to discontinue one of its business segments. None of the other information given in this exercise relates to this discontinued segment. On December 31, 2022, the end of the company's fiscal year, the division had not yet been sold. On that date, the assets of the division had a book value of 70,000 and a fair value, minus the anticipated cost to sell, of 45,000. Operating income for the segment for the entire year of 2022 was $10,000. The income tax rate for ALL items is 40%. The company has 50,000 shares outstanding-do not forget to calculate EPS. REQUIRED: Prepare two financial statements: 1. Multi-step Income Statement 2. Statement of Comprehensive Income for the year ended 2022. English (United States) Accessibility: Good to go Focus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down Stone Companys financial statements and calculations step by step Multistep Income Statement for the Year Ended December 31 2022 1 Revenue Net Sales 773000 Interest Revenue 10000 Gain ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started