Answered step by step

Verified Expert Solution

Question

1 Approved Answer

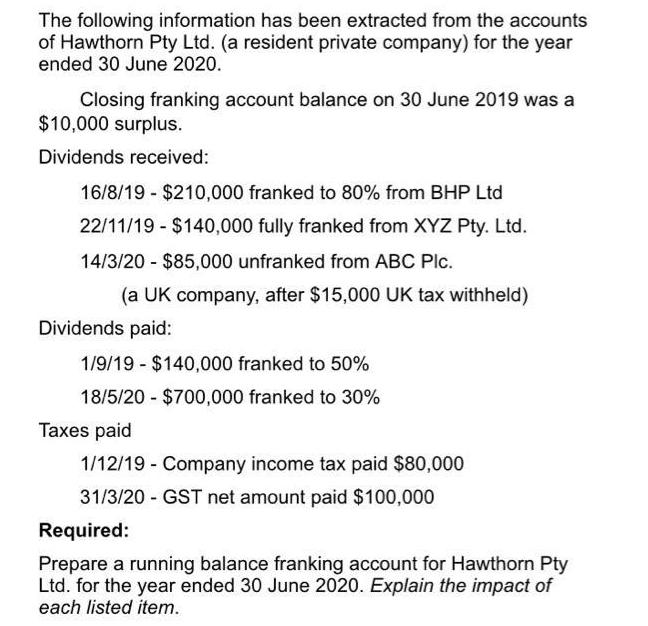

The following information has been extracted from the accounts of Hawthorn Pty Ltd. (a resident private company) for the year ended 30 June 2020.

The following information has been extracted from the accounts of Hawthorn Pty Ltd. (a resident private company) for the year ended 30 June 2020. Closing franking account balance on 30 June 2019 was a $10,000 surplus. Dividends received: 16/8/19 - $210,000 franked to 80% from BHP Ltd 22/11/19 - $140,000 fully franked from XYZ Pty. Ltd. 14/3/20 - $85,000 unfranked from ABC Plc. (a UK company, after $15,000 UK tax withheld) Dividends paid: 1/9/19 $140,000 franked to 50% 18/5/20 - $700,000 franked to 30% Taxes paid 1/12/19 - Company income tax paid $80,000 31/3/20 - GST net amount paid $100,000 Required: Prepare a running balance franking account for Hawthorn Pty Ltd. for the year ended 30 June 2020. Explain the impact of each listed item.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Franking account DATE AMOUNT 30619 10000 16819 210000 221119 140000 14320 85000 1919 140000 18520 70...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started