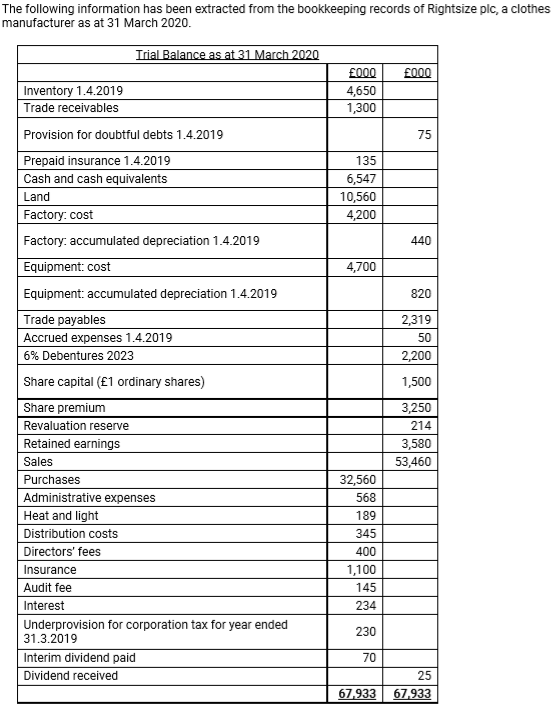

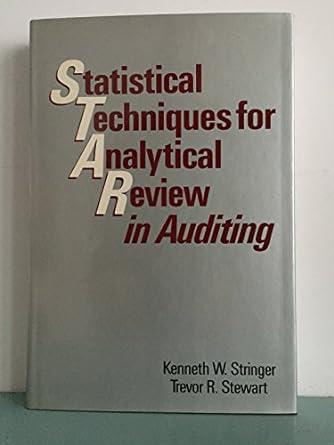

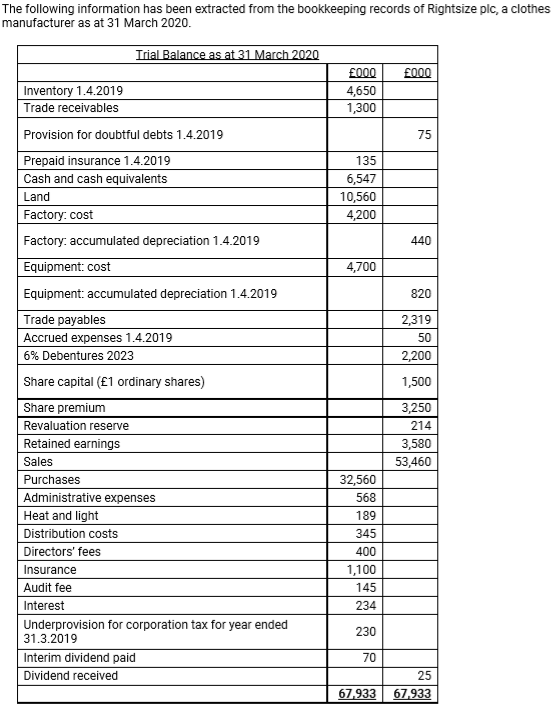

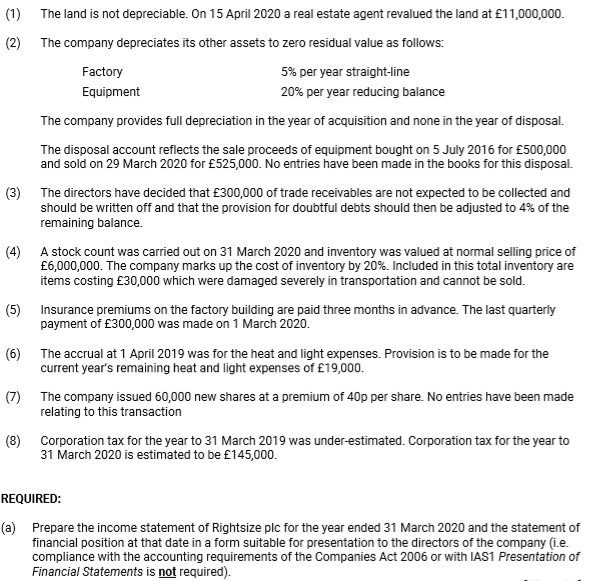

The following information has been extracted from the bookkeeping records of Rightsize plc, a clothes manufacturer as at 31 March 2020. Trial Balance as at 31 March 2020 0.00 Inventory 1.4.2019 Trade receivables 000 4,650 1,300 75 135 6,547 10,560 4,200 440 4,700 820 2,319 50 2,200 1,500 Provision for doubtful debts 1.4.2019 Prepaid insurance 1.4.2019 Cash and cash equivalents Land Factory: cost Factory: accumulated depreciation 1.4.2019 Equipment: cost Equipment: accumulated depreciation 1.4.2019 Trade payables Accrued expenses 1.4.2019 6% Debentures 2023 Share capital (1 ordinary shares) Share premium Revaluation reserve Retained earnings Sales Purchases Administrative expenses Heat and light Distribution costs Directors' fees Insurance Audit fee Interest Underprovision for corporation tax for year ended 31.3.2019 Interim dividend paid Dividend received 3,250 214 3,580 53,460 32,560 568 189 345 400 1,100 145 234 230 70 25 67.933 67,933 (1) The land is not depreciable. On 15 April 2020 a real estate agent revalued the land at 11,000,000. (2) The company depreciates its other assets to zero residual value as follows: Factory 5% per year straight-line Equipment 20% per year reducing balance The company provides full depreciation in the year of acquisition and none in the year of disposal. The disposal account reflects the sale proceeds of equipment bought on 5 July 2016 for 500,000 and sold on 29 March 2020 for 525,000. No entries have been made in the books for this disposal. (3) The directors have decided that 300,000 of trade receivables are not expected to be collected and should be written off and that the provision for doubtful debts should then be adjusted to 4% of the remaining balance. A stock count was carried out on 31 March 2020 and inventory was valued at normal selling price of 6,000,000. The company marks up the cost of inventory by 20%. Included in this total inventory are items costing 30,000 which were damaged severely in transportation and cannot be sold. (5) Insurance premiums on the factory building are paid three months in advance. The last quarterly payment of 300,000 was made on 1 March 2020. (6) The accrual at 1 April 2019 was for the heat and light expenses. Provision is to be made for the current year's remaining heat and light expenses of 19,000. (7) The company issued 60,000 new shares at a premium of 40p per share. No entries have been made relating to this transaction (8) Corporation tax for the year to 31 March 2019 was underestimated. Corporation tax for the year to 31 March 2020 is estimated to be 145,000 REQUIRED: (a) Prepare the income statement of Rightsize plc for the year ended 31 March 2020 and the statement of financial position at that date in a form suitable for presentation to the directors of the company (i.e. compliance with the accounting requirements of the Companies Act 2006 or with IAS1 Presentation of Financial Statements is not required) The following information has been extracted from the bookkeeping records of Rightsize plc, a clothes manufacturer as at 31 March 2020. Trial Balance as at 31 March 2020 0.00 Inventory 1.4.2019 Trade receivables 000 4,650 1,300 75 135 6,547 10,560 4,200 440 4,700 820 2,319 50 2,200 1,500 Provision for doubtful debts 1.4.2019 Prepaid insurance 1.4.2019 Cash and cash equivalents Land Factory: cost Factory: accumulated depreciation 1.4.2019 Equipment: cost Equipment: accumulated depreciation 1.4.2019 Trade payables Accrued expenses 1.4.2019 6% Debentures 2023 Share capital (1 ordinary shares) Share premium Revaluation reserve Retained earnings Sales Purchases Administrative expenses Heat and light Distribution costs Directors' fees Insurance Audit fee Interest Underprovision for corporation tax for year ended 31.3.2019 Interim dividend paid Dividend received 3,250 214 3,580 53,460 32,560 568 189 345 400 1,100 145 234 230 70 25 67.933 67,933 (1) The land is not depreciable. On 15 April 2020 a real estate agent revalued the land at 11,000,000. (2) The company depreciates its other assets to zero residual value as follows: Factory 5% per year straight-line Equipment 20% per year reducing balance The company provides full depreciation in the year of acquisition and none in the year of disposal. The disposal account reflects the sale proceeds of equipment bought on 5 July 2016 for 500,000 and sold on 29 March 2020 for 525,000. No entries have been made in the books for this disposal. (3) The directors have decided that 300,000 of trade receivables are not expected to be collected and should be written off and that the provision for doubtful debts should then be adjusted to 4% of the remaining balance. A stock count was carried out on 31 March 2020 and inventory was valued at normal selling price of 6,000,000. The company marks up the cost of inventory by 20%. Included in this total inventory are items costing 30,000 which were damaged severely in transportation and cannot be sold. (5) Insurance premiums on the factory building are paid three months in advance. The last quarterly payment of 300,000 was made on 1 March 2020. (6) The accrual at 1 April 2019 was for the heat and light expenses. Provision is to be made for the current year's remaining heat and light expenses of 19,000. (7) The company issued 60,000 new shares at a premium of 40p per share. No entries have been made relating to this transaction (8) Corporation tax for the year to 31 March 2019 was underestimated. Corporation tax for the year to 31 March 2020 is estimated to be 145,000 REQUIRED: (a) Prepare the income statement of Rightsize plc for the year ended 31 March 2020 and the statement of financial position at that date in a form suitable for presentation to the directors of the company (i.e. compliance with the accounting requirements of the Companies Act 2006 or with IAS1 Presentation of Financial Statements is not required)