Answered step by step

Verified Expert Solution

Question

1 Approved Answer

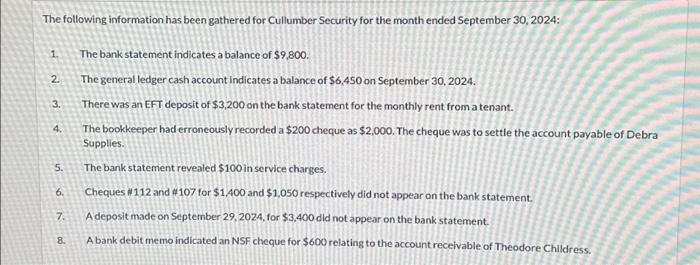

The following information has been gathered for Cullumber Security for the month ended September 30, 2024: 1. 2. 3. 5. 6. 7. 8. The bank

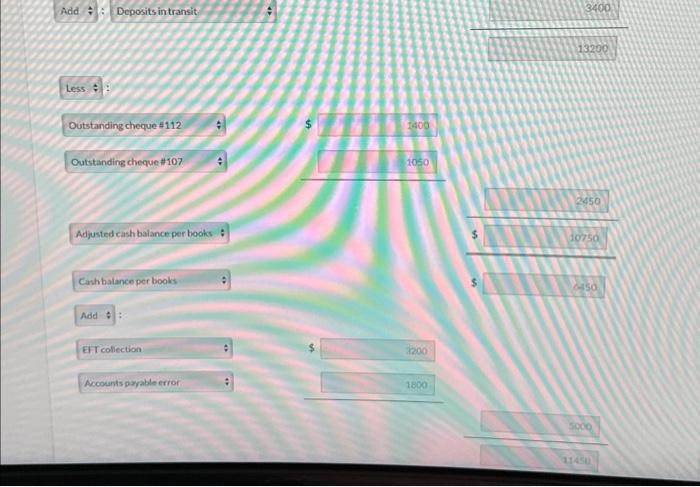

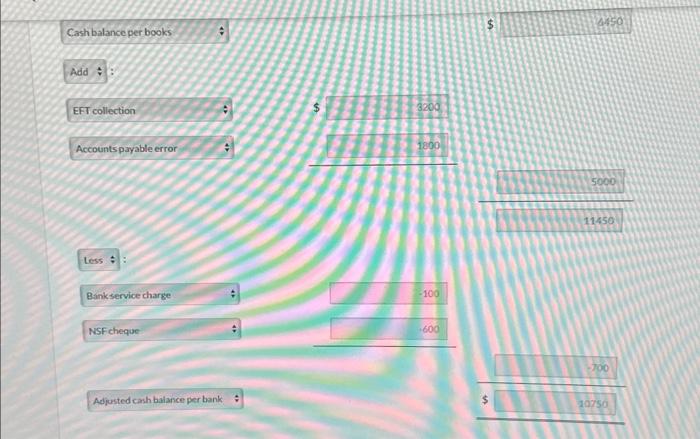

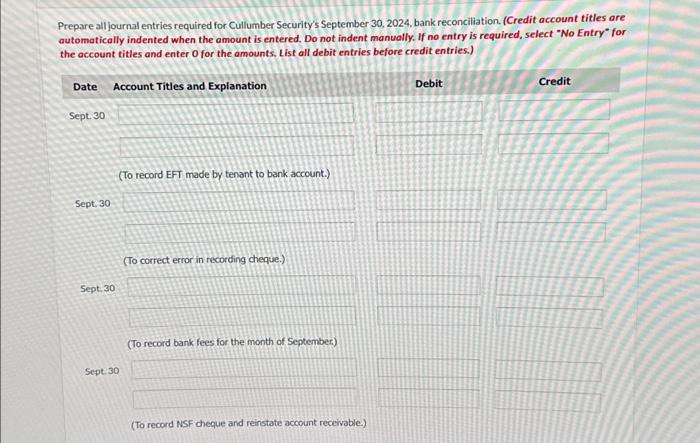

The following information has been gathered for Cullumber Security for the month ended September 30, 2024: 1. 2. 3. 5. 6. 7. 8. The bank statement indicates a balance of $9,800. The general ledger cash account indicates a balance of $6,450 on September 30, 2024. There was an EFT deposit of $3,200 on the bank statement for the monthly rent from a tenant. The bookkeeper had erroneously recorded a $200 cheque as $2,000. The cheque was to settle the account payable of Debra Supplies. The bank statement revealed $100 in service charges. Cheques # 112 and #107 for $1,400 and $1,050 respectively did not appear on the bank statement. A deposit made on September 29, 2024, for $3,400 did not appear on the bank statement. A bank debit memo indicated an NSF cheque for $600 relating to the account receivable of Theodore Childress. Prepare the joirnal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started