Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information has been obtained from the books of Tom Limited for the year ended 31 December 2019: On extracting a list of balances

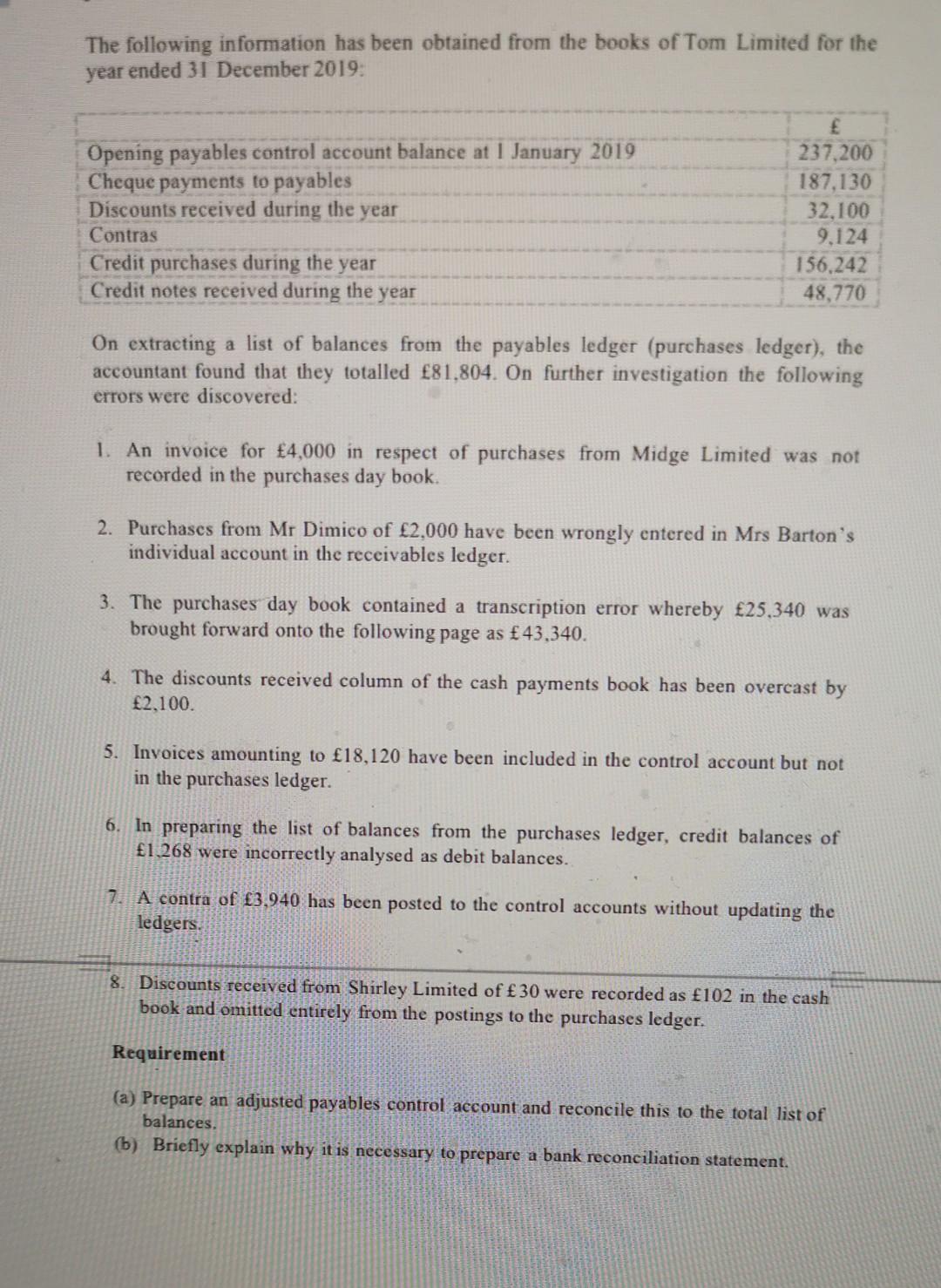

The following information has been obtained from the books of Tom Limited for the year ended 31 December 2019: On extracting a list of balances from the payables ledger (purchases ledger), the accountant found that they totalled 81,804. On further investigation the following errors were discovered: 1. An invoice for 4,000 in respect of purchases from Midge Limited was not recorded in the purchases day book. 2. Purchases from Mr Dimico of 2,000 have been wrongly entered in Mrs Barton's individual account in the receivables ledger. 3. The purchases day book contained a transcription error whereby 25,340 was brought forward onto the following page as 43,340. 4. The discounts received column of the cash payments book has been overcast by 2,100. 5. Invoices amounting to 18,120 have been included in the control account but not in the purchases ledger. 6. In preparing the list of balances from the purchases ledger, credit balances of 1,268 were incorrectly analysed as debit balances. 7. A contra of 3,940 has been posted to the control accounts without updating the ledgers. 8. Discounts received from Shirley Limited of 30 were recorded as 102 in the cash book and omitted entirely from the postings to the purchases ledger. Requirement (a) Prepare an adjusted payables control account and reconcile this to the total list of balances. (b) Briefly explain why it is necessary to prepare a bank reconciliation statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started