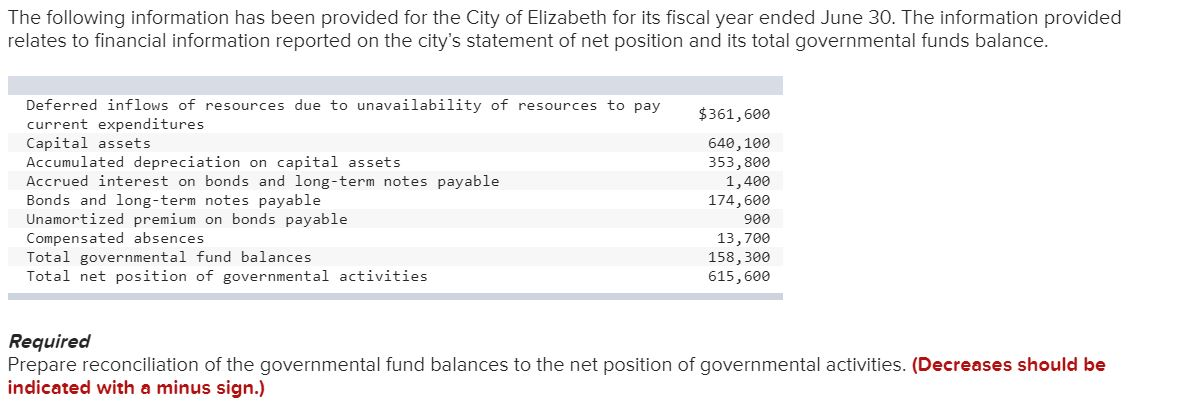

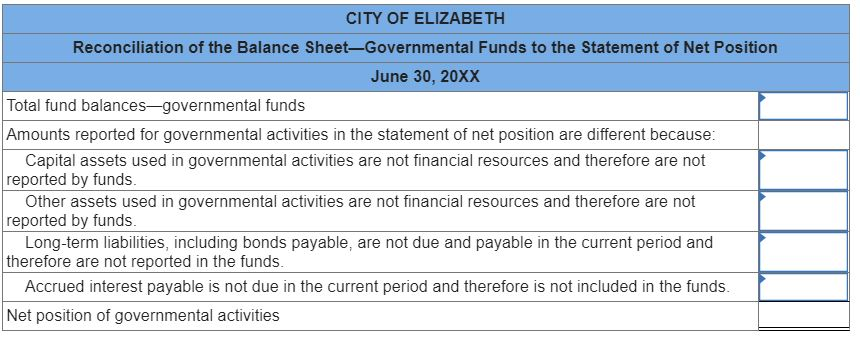

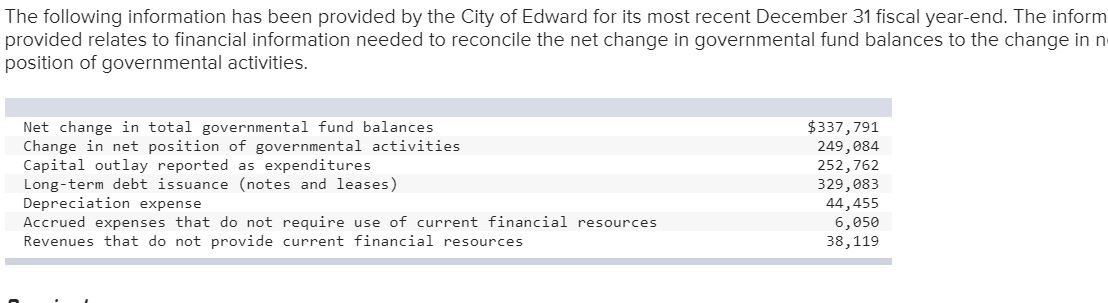

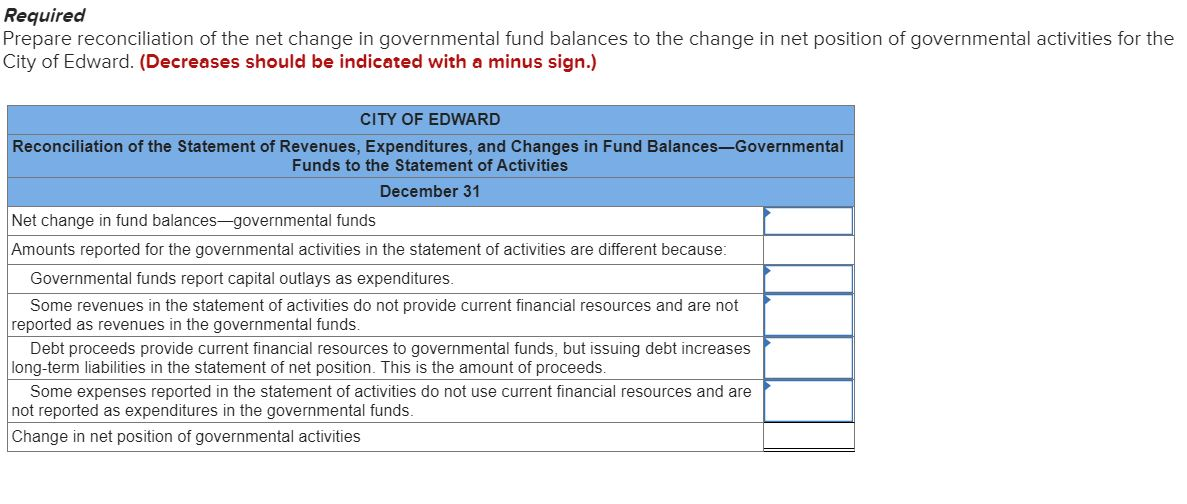

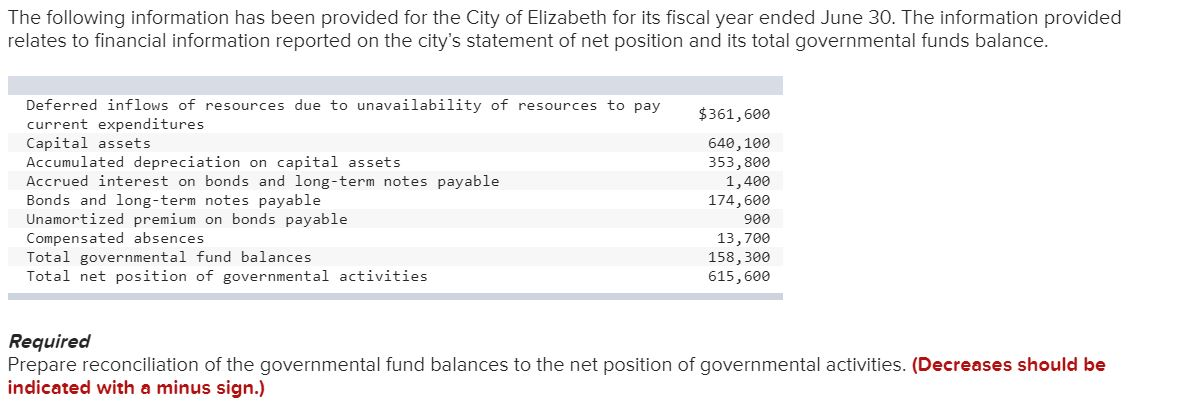

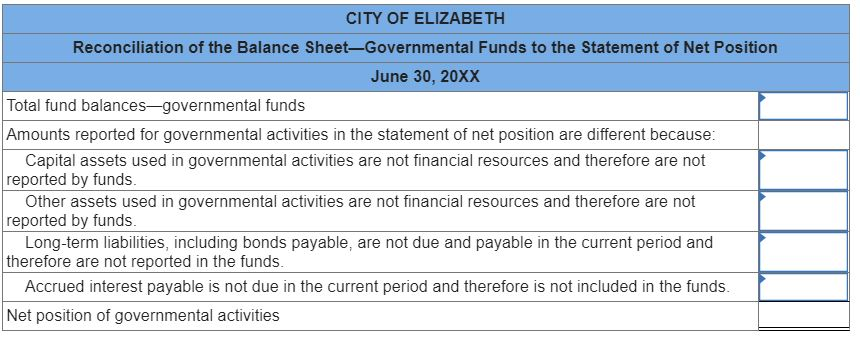

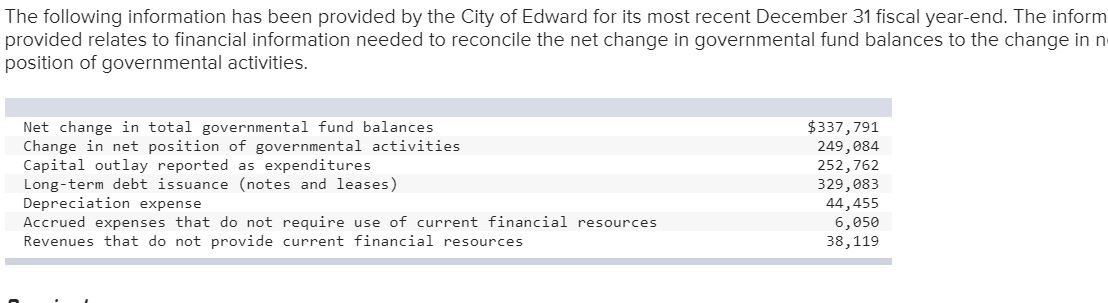

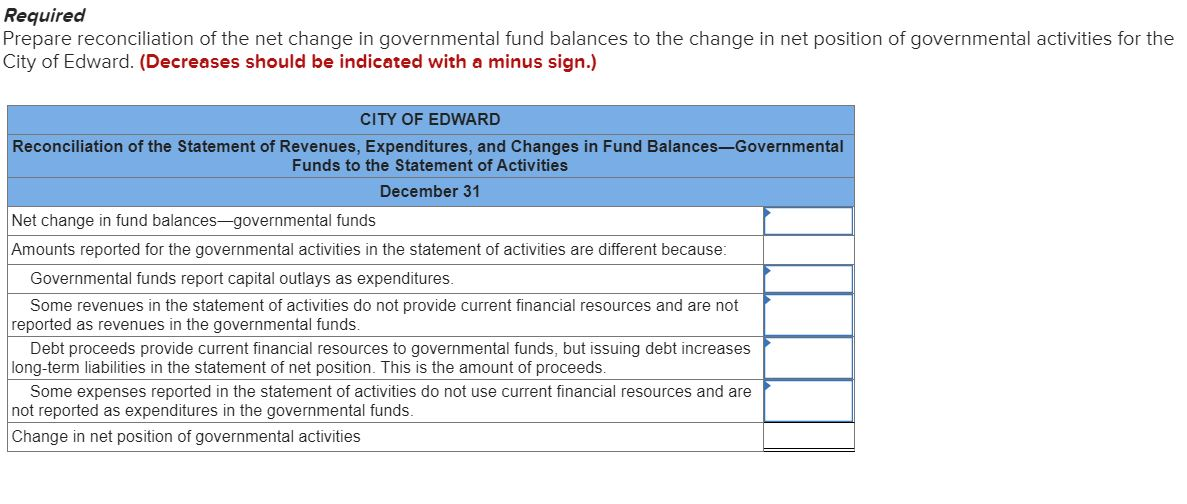

The following information has been provided for the City of Elizabeth for its fiscal year ended June 30. The information provided relates to financial information reported on the city's statement of net position and its total governmental funds balance. $361,600 Deferred inflows of resources due to unavailability of resources to pay current expenditures Capital assets Accumulated depreciation on capital assets Accrued interest on bonds and long-term notes payable Bonds and long-term notes payable Unamortized premium on bonds payable Compensated absences Total governmental fund balances Total net position of governmental activities 640,100 353,800 1,400 174,600 900 13,700 158,300 615,600 Required Prepare reconciliation of the governmental fund balances to the net position of governmental activities. (Decreases should be indicated with a minus sign.) CITY OF ELIZABETH Reconciliation of the Balance Sheet-Governmental Funds to the Statement of Net Position June 30, 20XX Total fund balances-governmental funds Amounts reported for governmental activities in the statement of net position are different because: Capital assets used in governmental activities are not financial resources and therefore are not reported by funds. Other assets used in governmental activities are not financial resources and therefore are not reported by funds. Long-term liabilities, including bonds payable, are not due and payable in the current period and therefore are not reported in the funds. Accrued interest payable is not due in the current period and therefore is not included in the funds. Net position of governmental activities The following information has been provided by the City of Edward for its most recent December 31 fiscal year-end. The inform provided relates to financial information needed to reconcile the net change in governmental fund balances to the change in n position of governmental activities. Net change in total governmental fund balances Change in net position of governmental activities Capital outlay reported as expenditures Long-term debt issuance (notes and leases) Depreciation expense Accrued expenses that do not require use of current financial resources Revenues that do not provide current financial resources $337,791 249, 084 252,762 329,083 44,455 6,050 38,119 Required Prepare reconciliation of the net change in governmental fund balances to the change in net position of governmental activities for the City of Edward. (Decreases should be indicated with a minus sign.) CITY OF EDWARD Reconciliation of the Statement of Revenues, Expenditures, and Changes in Fund Balances-Governmental Funds to the Statement of Activities December 31 Net change in fund balances-governmental funds Amounts reported for the governmental activities in the statement of activities are different because: Governmental funds report capital outlays as expenditures. Some revenues in the statement of activities do not provide current financial resources and are not reported as revenues in the governmental funds. Debt proceeds provide current financial resources to governmental funds, but issuing debt increases long-term liabilities in the statement of net position. This is the amount of proceeds. Some expenses reported in the statement of activities do not use current financial resources and are not reported as expenditures in the governmental funds. Change in net position of governmental activities